| Name | Logo | GMG Rating | Customer Reviews | Cryptocurrencies | Commission | CTA | Feature | Expand | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews 3.3

(Based on 3 reviews)

|

Cryptocurrencies 150 |

Commission 3.5% |

Features:

|

Coinbase Expert Review: Safety in numbers of a listed crypto exchange Provider: Coinbase Verdict: Coinbase is a cryptocurrency exchange that lets you buy and sell various cryptocurrencies like Bitcoin, Ethereum, Cardano and Solana. Coinbase was listed on the NASDAQ exchange in 2012 and claims to have over 273 billion assets on account in over 100 countries and process $185 billion in quarterly volume. Is Coinbase good for Crypto investing? Coinbase is one of the largest cryptocurrency exchanges with over 100 million users and is publically listed on the NASDAQ exchange (COIN). It offers access to large selection of cryptocurrencies that can be traded on it’s crypto exchange or withdrawn to a cryptocurrency wallet. Coinbase is a little more sophisticated than eToro. Yet it’s still easy to use thanks to its clean interface. And there is a wide range of crypto-assets available to investors. As with eToro, you can invest in Bitcoin, Ethereum, Cardano, and many other digital assets. On the downside, Coinbase has a slightly more complex fee structure. When buying or selling crypto, the cost of the trade is calculated at the time you place your order and is determined by several factors including your location, the size of the order, the selected form of payment, and market conditions such as volatility and liquidity. Overall though, the platform is quite well suited to beginners. It’s worth noting that earlier this month, Coinbase won approval from the UK’s FCA as a registered virtual asset service provider (VASP). Pricing: It’s expensive, when Iwas testing the app I bought some Bitcoin to test the app, I was charged over 3% in commission, that’s far more than eToro who at the moment only charge 1%. But having said that, I did double my money as Bitcoin had a bit of a rally after my original review, so it’s not all bad, if it goes up that is… Market Access: Coinbase offers the most cryptocurrencies compared to other exchanges, which makes them a great venue if you are interested in spreading your risk or looking for more volatile cryptos with a higher risk/reward ratio. App & Online Platform: No complaints here, just does what it’s supposed to. No stand out features or research though. Customer Service: Pretty good. I had a question, they answered it. Sorted. Research & Analysis: No research on the app, but then again, brokers only provide research to get people interested in markets and I don’t think I’ve had a conversion about money in the last 12 months that hasn’t included crypto in some way so no stimulus needed. One thing I do like about Coinbase though is that it’s a US company listed on the NASDAQ so in theory, if there are any problems with it that should be reflected in the share price.

The test: Why should investors be more cautious when investing in crypto assets with Coinbase I knew I should have sold when Bitcoin reached $100,000! When I reviewed Coinbase back in July last year, I some bought Bitcoin and Ethereum to test the app, and then forgot all about it. As Bitcoin has reached record highs, it jogged my memory and I was delighted to see when I logged back in that it’s now worth double. But I still think cryptocurrency is an imaginary asset and should be treated with extreme suspicion, here’s why. I don’t really like crypto as an investment, I think it’s daft. Yes, there is money to be made from crypto, but not necessarily if you are investing in it. Yes, some will make huge amounts from exchanges like Coinbase, and they will be the most vocal about the merits of digital currencies as an asset class. But no, not everyone or even the majority will make money. However, it it fairly undeniable that Bitcoin is now mainstream and that as major funds start buying it and it becomes easier to trade on regulated stock exchanges it does have a place in most people’s portfolios. But it’s the hype that is driving crypto prices, rather than the use case. The young though are taking massive risks and dangerously putting all their eggs in one baskets. And most worryingly being heavily influenced by people ramping crypto prices and coins on social media. The mentality of following the herd is not new, two decades ago when I first started out as a stockbroker it was mining and oil stocks. Companies would raise money on the stock market from people buying new shares to drill a hole in the ground. If they struck gold or “black gold” the share price would go through the roof, but if they didn’t it would be worthless. Then it was tech stocks, same story, The City filled their boots as it wasn’t really about what the company was worth or even if they made any money, it was about how many people were buying them, and what the perceived future value could be. Then carbon credits, which although a real thing, crooks in call-centres in Spain basically made up to cold-call and pressure sell investors into buying them on the basis they would be worth more in the future. All very Wolf of Wall Street, it wasn’t even stuffing people into an investment for high commissions it was just lying and stealing money.

Next came binary options, which I actually quite liked as they were a form of limited risk short-term bet on the movement of a market. In theory, the perfect way to day trade. The market is either going to do one of two things during the day, go up or go down, so you just placed a bet on what you thought was going to happen and your risk was capped based on your stake. This I felt was slightly safer than CFDs and spread betting because with those your potential losses are unlimited (or were at the time before negative balance protection and leverage caps). Plus one of the major mistakes that traders make is not cutting their losses (another is banking profits too soon). But the problem with binary options wasn’t the product it was the fact that they were not regulated by the FCA. Reputable firms in the UK did offer them in a regulated environment to their customers, but, then, the carbon credit scammers moved on to binary options, and set up basic platforms without hedging any underlying risk and stuffed punters full of welcome bonuses and “trade ideas”, again just lying and stealing. So, now that binary options have been banned, where have the scammers gone? Crypto, that’s right. But then, the FCA’s in their ultimate wisdom, decided to ban retail traders in the UK from trading through spread bets and CFDs. Now clearly in some respects, this was a good thing because trading a product on leverage which has price moves of 50% a day is clearly very high-risk and will almost definitely result in high financial losses for the majority of people that trade them. But what happened, was that because the FCA didn’t want to take responsibility for regulating crypto, it was binary options scams all over again. Honestly and with no hyperbole, I have just received a call on my mobile whilst writing this review from a Germany number asking me “how my investments are performing and if I’d heard of crypto”. I get these at least twice a day. I don’t even bother answering my phone anymore. But, if there is a market, people are going to want to trade it and you just have to look at any analytics to see that crypto is what people want to invest in and trade. As it becomes a more regulated financial asset, it will become safer to buy and hold, but not nesseicarly as an investement. The FCA is taking steps to regulate providers to ensure that customers are treated fairly, but you still don’t get FSCA protection. If you want to buy cryptocurrency you have two options really, you could go with a provider like eToro or Revolut, who are regulated by the FCA for other products or you can go with one of the massive VC backed crypto exchanges. I used Coinbase, but it isn’t the cheapest though as when I did some test trades the fees were 3.84% for buying Bitcoin and Ethereum compared to eToro’s 1% and Revolut’s 2.5%. Coinbase does offers the most cryptocurrencies to trade though, 150 versus 120 and 30 respectively. Coinbase is at least a public company so you can keep an eye on their finances to see how likely it is they are going to go bust. Coinbase is currently traded on the NASDAQ and at the time of writing worth $14bn, (although the share price is down 85% since they IPO’d in April 2012). eToro and Revolut are still private companies (not for the want of trying to IPO mind). I’ve traded crypto as a derivative before it was banned (although you can still trade crypto with a professional account), I’ve traded $50m clips of FX, worked £10m positions when trading stock CFDs, but oddly enough, I felt more nervous when depositing £500 into Coinbase to buy some Bitcoin for that review. I even used my secondary bank account, because I did’t want the transaction on my main personal account, just in-case when we came to re-mortgage “the computer says no” because they viewed me as some sort of crypto bro. I’m still not sure about crypto, but this shouldn’t really be about crypto it’s about Coinbase, after all they are just giving people what they want. They are not forcing anyone to buy crypto (Twitter, Youtube and Instagram do that), they are just making it easy. And it is easy, it’s an incredible piece of tech, like Betfair was to gambling and what the LSE was to share trading, if you want to trade it you can. But it’s still in it’s infancy as a regulated product and so as an “investor” you are not protected if anything goes wrong. Coinbase say they provide FDIC insurance if someone hacks them and nicks your crypto (up to $250k), but this doesn’t cover you if you get hacked, or Coinbase goes bust. Unlike buying stocks in the UK where you are covered by the FSCS and shares and investments are held in nominee accounts in a very well-established and highly-regulated banking infrastructure. In the immortal words of Mark Corrigan,

If you want to have a punt on crypto, you pays your money, you takes your chances, caveat emptor. Pros

Cons

Overall4.4 |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 4.5

(Based on 1,330 reviews)

|

Cryptocurrencies 8 |

Commission 0.12% to 0.18% |

Features:

|

Interactive Brokers Cryptocurrency Trading Expert Review Account: IBKR Crypto Trading Description: Interactive Brokers, offers cryptocurrency trading for its UK clients through Paxos that allows individuals, institutional investors, and financial advisers, to trade popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH). This is in addition to other more traditional investment products, such as stocks, options, futures, currencies, bonds, funds, and ETFs. All from a single unified platform. Is Interactive Brokers Good For Crypto Trading? Interactive Brokers has partnered with the Paxos Trust Company, a New York-based regulated trust company and custodian with expertise in digital assets, securities and payments, to provide cryptocurrency brokerage. Interactive Brokers’ UK clients will have a unified view of their IBKR securities brokerage account and their crypto account at PaxosTrust Company. This means clients will be able to manage their cash, trade cryptocurrencies, and invest in other asset classes, all from a single trading screen. Gerald Perez, Chief Executive Officer at Interactive Brokers (U.K.) Limited said of the new service: “Interactive Brokers offers a wide selection of global investment products, sophisticated technology and competitive pricing,” He added “Introducing cryptocurrency trading gives UK clients enhanced flexibility to invest across markets and asset classes while also adding exposure to digital assets.” Platforms for newbies and pros There are two types of crypto account for UK traders on Interactive Brokers Basic Crypto lets you trade and hold Bitcoin, Bitcoin Cash, Ethereum, and Litecoin through the IBKR platform. There are no additional or separate funding transactions are required and IBKR handles all required cashiering for you automatically, and unvested cash is always kept in your IBKR brokerage account. Crypto Plus lets you fund your crypto account, trade using non-marketable limit orders, and enjoy 24/7 trading. You will be able to hold USD in addition to cryptocurrencies in a dedicated Paxos account with access to 24/7 trading and place non-marketable buy limit orders. With Crypto Plus, all trading of crypto will require prefunding of your dedicated Paxos account and you will be responsible for managing all fund movement between your IBKR brokerage account and your Paxos crypto account. You can also trade crypto immediately when you transfer funds to your dedicated Paxos account during normal US banking hours. I opted for Basic Crypto so my cash would stay with IBKR rather than a third party, as I prefer to know who I’m dealing with. To enable crypto investing permissions on IBKR you have to complete a fairly basic questionnaire to prove that you understand the risks involved, which only takes a few minutes. You also have to prove that you are a sophisticated or professional investor. And then, just to be double careful, you’re not getting a severe case of FOMO, you have to wait 24 hours before you are able to buy cryptocurrencies on Interactive Broker (this is a regulatory requirement introduced by the FCA in 2023).

Overall, Interactive Brokers continues to be one of the cheapest places to trade anything. You can see in the below cost comparison below Coinbase and eToro execution costs are very low.

There are several benefits to trading crypto on IBKR: Consolidated platform: Clients can access a wide range of global investment products, including cryptocurrencies, on a single sophisticated trading platform, eliminating the need for multiple platforms. Competitive pricing: Cryptocurrency commissions are low at 0.12% – 0.18% of trade value, depending on monthly volume, with a minimum of $1.75 per order. There are no added spreads, markups, or custody fees. Currency conversion: Clients can convert GBP or other currencies to USD (the denomination for cryptocurrencies on the platform) at tight spreads as low as 1/10 of a PIP. Efficient portfolio management: Financial advisers can easily allocate a percentage of client assets to cryptocurrencies and manage their clients’ portfolios more efficiently. However, it’s important to note that cryptocurrency is still a very high-risk investment and even tough the costs of trading are lower, there is a high possibility that crypto could become worthless. Interactive Brokers (U.K.) Limited is registered with the Financial Conduct Authority as a crypto assets firm under the relevant regulations. Pros

Cons

Overall4.8 |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 3.3

(Based on 7 reviews)

|

Cryptocurrencies 400 |

Commission 0% |

Features:

|

Crypto.com UK Review 2025: Low Trading Fees and GBP Cryptocurrency Trading Provider: Crypto.com Verdict: Crypto.com offers a broad crypto trading experience with competitive maker-taker fees and a wide GBP market selection, avoiding FX charges. The app is easy to use with limit orders and curated baskets like Blue Chip Tokens for diversification. However, customer support is largely automated, research tools are limited, and fees rise quickly after free deposits. Summary Pricing – There is a 2.99% fee for using a credit or debit card to deposit funds which is quite steep. You can use Open Banking but only with ClearBank and BCB. There is also a withdrawal fee of £1.90 with a minimum amount of £70. A maker-taker model applies so if you are providing liquidity through limit orders your rates will be lower than if you are dealing at market. Crypto commission rates typically start from 0.25% to 0.08% for makers and 0.5% to 0.18% for takers. If you join the Level Up program, and pay a monthly subscription you can get these trading fees reduced and earn 1.5% cash on deposit too, but rates are higher than that in the bank. Market Access – You can trade around 150 cryptocurrencies in GBP, which is great because you don’t get stung with USD FX charges where you are required to convert GBP into USD. You can also trade crypto baskets, which is a collection of cryptocoins all lumped into one. For this review, I bought £100 worth of the Blue Chip ETF Tokens baskets, which is mainly Bitcoin with a few others added in like Ethereum, Solana, Cronos and Ripple. Mainly because I like diversification, and I’m only buying crypto for the sentiment value and that basket was the best performing over a year, and judging from the charts on Crypto.com seems to consistently outperform Bitcoin over 3 months, 6 months and a year. You can also set the basket to rebalance to keep the ratios right.

App & Platform – Crypto.com’s website is simple to use, almost too simple if I’m honest, I’d like to see more bid/offer spreads on the pricing pages. The Crypto.com app is better as you can work limit orders (as opposed to just market, so it’s cheaper). Customer Service – As far as I found the support is mainly a bot, which did answer my questions quickly. When I asked the customer service bot about this it couldn’t quite understand the question. There is no telephone number, which is not surprising for a crypto exchange. Research & Analysis – On the crypto.com app there is an “Insights” tab, which is not available on the website, which gives you crypto news as well as signals. Where you can trade from the feed, however, I’d take those with a pinch of salt and do your own research before deciding what to buy and sell. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Pros

Cons

Overall4.2 |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 0.0

(Based on 0 reviews)

|

Cryptocurrencies 600+ |

Commission 0.00% – 2.49% |

Features:

|

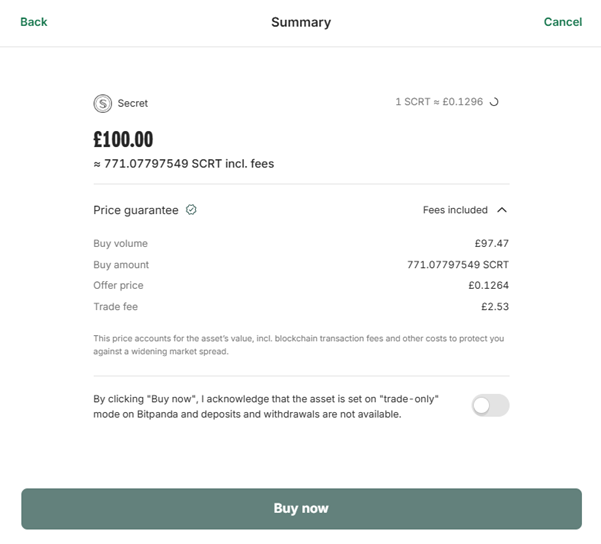

Bitpanda Review 2026: Is It Safe and Worth Using in the UK? Provider: Bitpanda Verdict: Bitpanda is a European investment platform founded in 2014 in Vienna, Austria. Originally built as a simple way to buy Bitcoin, in Europe it has expanded to offer trading in cryptocurrencies, ETFs, stocks, precious metals, and commodities. The company is privately owned, with founders Eric Demuth, Paul Klanschek, and Christian Trummer still actively involved. Bitpanda now claims several million users across Europe. Is Bitpanda any good? In this expert review we put Bitpanda to the test with real money and buy some crypto from the UK to find out if Bitpanda is any good. Pricing I was able to deposit GBP free via debit card which makes it cheap to get started (compared to other UK crypto platforms that are currently charging 2.9% on debit card deposit). When buying actually cryptocurrency, I was charged £2.52 when I bought £100 worth of crypto for this review so you can assume the commission rates are 2.53%, but Bitpanda say their fees range from 0.99% to 2.49% – so assume the smaller (less liquid) the cryptocurrency the higher the fees will be. Bitcoin for example should be 0.99%.

Market Access Bitpanda offer one of the widest ranges of cryptocurrencies with over 600 assets available on the platform. There is also a good selection of digital assets for staking and earning rewards of up to 29.82%, but when I checked the highest paying one, Coreum, it was unavailable for staking. The second highest was Secret, paying 13.28% so I bought £100 worth and staked all of it. As with all crypto, I fully accept that I may lose all my money, but it might, just might pay off in the future so I’m always happy to risk some fun money on it. App & Online Platform Simple to use for beginners, but for larger traders not having access to level-2 pricing from a crypto exchanges means you can’t check liquidity. But if you are just buying some crypto to tuck it away and see what happens, it’s straightforward. However, it did take a few moments for my funds to be allocated to my account before I could buy some crypto. It kept saying “Fiat wallet could not be found”. Customer Service When I went to the my account tab to try to find my Fiat Wallet, the Contact Support link was greyed out. But when I managed to copy and paste “Fiat wallet could not be found” there was an article, but it didn’t really help. It just told me the steps I’d been through. No phone support, but I was able to submit a ticket to help resolve the issue. The system had auto resolved it before I got a response though. Research & Analysis There are some educational guides on the main website. But, Bitpanda does not have any news flow or analysis on the site, and for altcoins like Secret, there are no descriptions of what it does other than the risk warning. I’d like to see more information in the “About” section. Can Bitpanda Be Trusted? Bitpanda is generally considered a trustworthy and reputable platform within Europe. You can cash out to your bank easily (withdrawals to SEPA accounts typically take 1-3 business days), although some UK users report longer times due to banking friction. Bitpanda offers zero deposit and withdrawal fees on all payment methods. Bitpanda is not a “get-rich-quick” crypto app, rather, it’s a balanced investing platform offering crypto, stocks, ETFs, and commodities within a regulated environment. Is Bitpanda Available in the UK? Yes, Bitpanda is available in the UK, but with some limitations. You can open an account, deposit GBP, and buy assets. However, some crypto-related services (like derivatives) are unavailable.. Bitpanda supports GBP and EUR deposits via bank transfer, debit card, and SEPA. UK users can also pay with Visa or Mastercard, though fees vary depending on method. While most UK banks now allow crypto transactions, some (e.g. HSBC and Nationwide) still block payments to certain platforms. Bitpanda, however, usually works fine with major banks like Barclays and Monzo. I had no problems depositing funds from the Natwest Mastercard (debit card). Bitpanda is a legitimate alternative for UK users who want a wide range of digital assets. Is Bitpanda Regulated in the UK? No, in the UK Bitpanda is registered (not Regulated) by the FCA to provide cryptoasset services. Ffunds are not protected by the FSCS and you will not have access to the financial ombudsman service if anything goes wrong. You can check on Bitpanda’s status in the UK here: https://register.fca.org.uk/s/firm?id=0014G00002UyCuqQAF Bitcoin and crypto are not illegal in the UK, and holding or trading them on Bitpanda is perfectly lawful, though users should understand that cryptoassets remain largely unregulated and high-risk. Who Owns Bitpanda? Bitpanda remains a privately held company co-founded by Eric Demuth (CEO), Paul Klanschek, and Christian Trummer. It has raised significant funding from investors including Valar Ventures (backed by Peter Thiel), positioning it among Europe’s fintech unicorns. In the UK, Bitpanda makes money through trading spreads and fees and its savings plans and staking services. Pros

Cons

Overall4.2 |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 1.0

(Based on 2 reviews)

|

Cryptocurrencies 395 |

Commission 0.02% – 0.04% |

Features:

|

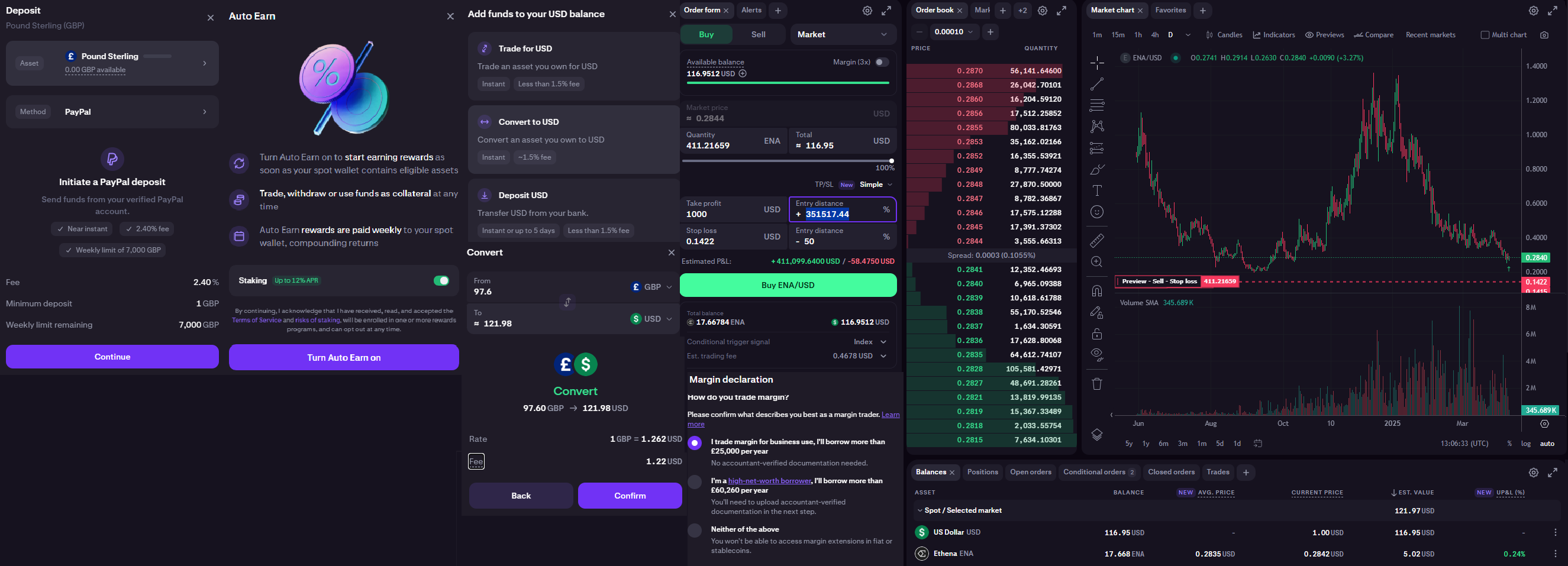

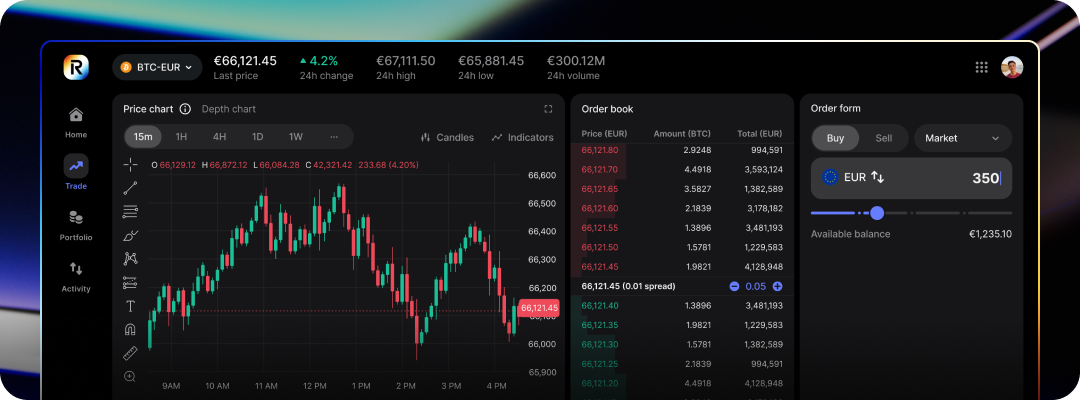

Kraken Pro Expert Review: TikTok Testing & Trading Provider: Kraken Verdict: Kraken is one of the world’s largest cryptocurrency firms and recently launched a “Kraken Pro” platform. When you’ve signed up to Kraken, you can access Kraken Pro with no extra charges. The new Kraken Pro trading platform brings all of the firm’s services together in one place. It is designed to be accessible to all traders, be they retail, professional or even institutional clients. Is Kraken Good for Cryptocurrency? The Test: For now, this is a quickfire test of just the Kraken Pro platform because I have spent all day testing crypto platforms and I’m knackered.. I think my bank would be a little concerned if I used my account for any more crypto deposits today, so I’m funding my Kraken Pro account via PayPal, which comes with a 2.4% fee, but that’s OK because I’m only putting in £100. You’ll see why in a minute. If you are depositing more, it would be sensible to use Plaid Open Banking, because it’s cheaper. I opened my Kraken account years ago, so I didn’t have to wait for the 24-hour cooling off period. Whilst I waited for my funds to be processed, I turned on the Auto Earn options. This means that whatever eligible crypto I own, I can stake it automatically (and also use it as collateral) and earn rewards of up to 12%, which are paid weekly. If I’m honest, I’m unconvinced by the whole “crypto as an investable asset class” idea because I think crypto is mainly driven by sentiment. But that doesn’t mean there is opportunity. So when deciding what cryptocurrency to buy on Kraken (there are over 300 of them) I turned to the most rampant ramping source possible, TikTok. I Googled how to search for the most popular cryptos on TikTok and the first video was of a teenager very convincingly talking about the best cryptos to buy during a market crash. I decided to follow his first tip – Ethena. He was going through his “top picks” with “massive discounts right now” but didn’t say what discount it was or even what the fiat value should be. But as he has 1.2 million followers I assumed that some other people may be listening to him and also buying the same coins. Which would mean that sentiment may drive them up. The first one he mentioned was Ethena at an apparent 73% discount. Which looked like it had been ramped towards the end of 2024 but was now trading on what technical analysts would call “support” although I don’t think that is necessarily relevant here. But first I’d have to convert my GBP into USD, which is instant, but comes with a 1.5% ($1.22) fee. So my £100 is now $121.98 which at the GBP-USD mid-rate of 1.2804 is £78.10. So I’m already down 22%, and I haven’t even lost any money on crypto yet! This is because of the conversion rate that Kraken applies, as crypto is generally priced in USD. There are quite a few order options when you buy, which is great if you’ve got size but I don’t so it’s pointless working an iceberg, which pecks away at the market bit by bit of setting a limit below, so I just went balls in at the market. But not that deep because I put a stop loss in 50% below. I have zero expectations of this growing gradually, but rather hoping for some sort of social media pump and dump to drive it higher so put my take profit in 350,000% higher, hoping to nick $1,000 profit if that happened. Either way it meant I didn’t have to add Ethena to any watch list to keep track of it. 🤞 You can actually trade that coin on 3x margin, but I’m not daft enough for that. T-20 trading AIM stocks was fun enough and at least they had fundamental value, well some of them at least. I think when it comes to crypto, you pays your money, you takes your chance. What Does Kraken Pro Look Like?

What is Kraken Pro Like to Use? You can configure Kraken Pro, customising the layout to suit your trading style, using the platform’s trading and data modules as required, inside the drag-and-drop desktop interface. Kraken Pro’s functionality is more suited to experienced users. You can also switch seamlessly between trading and staking products and services. You can track and monitor all of your positions and performance from one clear and consolidated portfolio view. All of which is powered by real-time data. The platform allows you to search for the top gainers and losers and the most actively traded and newly listed cryptocurrencies. That comes alongside a dedicated charting package that lets you compare four markets simultaneously and apply a range of indicators to those instruments. At the same time, you can monitor live order books and stream time and sales data to keep up to speed with market trades. Kraken Pro’s user interface is intuitive to navigate around and use. You can drill down to surface a token or coin from the platform’s markets view, which displays a heat map of the available asset classes. So, for example, clicking on the heatmap icon for layer 1 protocols brings up tokens such as NEAR. Clicking on that icon brings up a chart and an order entry box, alongside the order book in the NEAR/USD pair. There is a series of how-to guides and walk-through videos. As well as information on order types and dedicated API documentation. Kraken also prides itself on answering and attempting to resolve support queries quickly. Who is Kraken? Kraken was founded in San Francisco back in 2011. The firm operates in more than 190 countries and is regulated in various jurisdictions, including the US, UK, Canada, Australia and Europe. Kraken is one of a select group of businesses authorised by the UK Financial Conduct Authority (FCA) to offer cryptoasset services in the UK. Kraken offers trading in more than 300 individual cryptocurrencies and crypto pairs. Kraken’s trading volume in 2024 was more than $207 billion and it has more than 9 million unique clients. Despite recent market volatility, cryptocurrencies seem to be enjoying a new lease of life, and there is growing interest among both professional and retail traders. That is perhaps driven in part by a change of heart among US regulators and moves by the White House to establish a US national cryptocurrency reserve. It may take some time for that thaw to spread across the Atlantic, but dedicated cryptocurrency enthusiasts haven’t ever paid much attention to national borders. Kraken UK FCA-Authorised as an Electronic Money Institution Kraken was one of the first crypto exchanges in the UK to offer GBP-BTC trading, in 2014, and has been authorised as an e-money institution by the UK’s FCA. Whilst this doesn’t mean you get the same protections as if you were buying shares on a stock exchange, it does mean that Kraken is one of a handful of Bitcoin brokers that the regulator has deemed responsible enough for UK crypto investors. It’s worth noting, though, that crypto is largely unregulated in the UK. Kraken currently offers 300+ cryptocurrencies in the UK and hopes to make it easier than ever for the 7 million crypto traders in the UK to invest in digital assets. In early 2025, Kraken received a MiFID regulatory licence to buy and sell crypto derivatives within the European Union (EU). The cryptocurrency exchange gained the licence through buying a Cypriot investment firm which had recently received the licence from the Cyprus Securities and Exchange Commission (CySEC). The move allows Kraken to offer crypto derivatives products to traders resident in the 27 EU countries, aiding its plans to expand across the continent. The buyout came after Kraken had acquired Crypto Facilities, a UK FCA-registered crypto futures platform, in 2019. The acquisition of the new licence follows the firm’s launch of Kraken Pay in January 2025. This service allows users to send payments internationally using more than 300 cryptocurrencies and fiat currencies. In December 2024, rival exchange Coinbase enabled Apple Pay, allowing for immediate conversions between fiat currencies, such as dollars and pounds, and cryptocurrencies. FCA data shows the percentage of people in the UK who own some crypto rose to 12% in 2023 from 10% in 2022. The average value held rose from £1,595 to £1,842 over the same period. In 2024, the financial watchdog reiterated its rules against selling cryptocurrency derivatives such as exchange-traded funds (ETFs) to retail investors in the UK. Pros

Cons

Overall4.5 |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 4.6

(Based on 511 reviews)

|

Cryptocurrencies 30 |

Commission 1.49% |

Features:

|

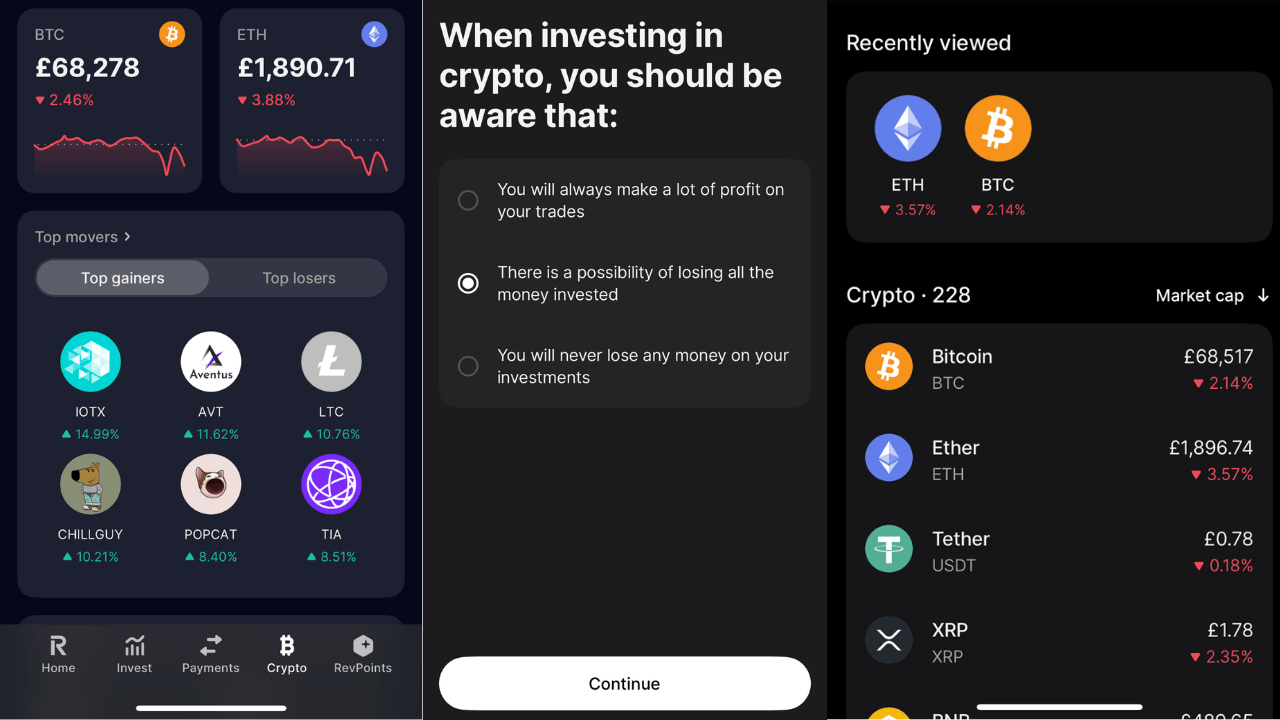

Revolut Cryptocurrency Review: Banking and digital assets all in one Account: Revolut Cryptocurrency Investing Description: Revolut X lets you trade crypto on a stand alone app. As Revolut is now a bank more than a crypto exchange, its app is a good way to dabble in the crypto markets if you just want to buy a small amount of the most popular cryptocurrencies. Capital at risk Is Revolut good for cryptocurrency investing? Revolut is a good choice if you are just dabbling in cryptocurrency and don’t need anything too complicated. Market Access: Revolut X lets you trade 400+ pairs to trade in real-time with USD, EUR, or GBP with instant visibility of how your portfolio is performing and decide your next trade with token details and a live order book. On the baking app you can buy, sell, and send over 228 digital currencies at the touch of a button, with no hidden fees. But, Revolut’s cryptocurrency service is not regulated by the FCA in the same way as investing in the stock market. As you will find out when you take the “how well do you understand crypto” quiz when you try to buy cryptocurrencies on the app. App & Online Platform: It’s pretty easy to buy crypto on Revolut, it took me about 3 minutes to login, acept the terms and conditions that I may lose all my money and buy some Bitcoin and Ethereum. If you want to know which is best, we’ve just written a guide on Bitcoin versus Ethereum. However, it’s a bit annoying that it’s app only and you can’t use it on a laptop or desktop. If you are trading crypto on Revolut X it is also available on desktop if you want to see more detailed market analysis. You’ll find technical indicators, TradingView charts, and top-traded, top-gaining, and top market cap coins.

Revolut Fees: Versuse eToro & Coinbase For Crypto Revolut X does not charge if you are a (taker) selling, but there is a 0.09% charge if you are buying (making). The difference is based on if you are making or taking liquidity from the exchange. Revolut has recently reduced it’s commission for buying and selling cryptocurrency for trades above £20,000 from 1.49% to 1.29%. From 24 March 2025, Revolut has also removed the minimum trading limit, so you can now make trades below £1.49. In real-terms that means if you bought £100k worth of Bitcoin it would save you £180 compared to the previous pricing structure. It’s a decent saving. but won’t really make a difference, especially as if you buy £100k of one of the most volatile digital assets in the world the price will probably have changed by that much before you have read your confirmation notification. Fees are pretty high, if you are just buying a small amount. To test the app, I bought £200 worth of each I was charged a whopping £2.98, which is 1.49%. That’s very high compared to buying share,s which are largely commission-free these days. However, Revolut has recently reduced their crypto commission for trades above £20,000. It’s not as cheap as eToro’s 1%, but it’s certainly a lot cheaper than Coinbase.

Customer Service: Obviously, there is no phone number (Revolut has far too many customers for a call centre to handle), and no in-app live chat feature, but there are direct links if you need to report any fraud or banking issues. Research & Analysis: You get access to some fairly standard articles and news feeds on crypto but nothing unique. There are links to the cryptocurrencies official websites and the white papers, so you can do your own more thorough research.

Pros

Cons

Overall4.3 |

We have chosen what we think are the best cryptocurrency exchanges based on:

- over 30,000 votes in our annual awards

- our own experiences testing the crypto exchange accounts with real money

- an in-depth comparison of the features that make them stand out compared to alternative cryptocurrency exchanges.

- interviews with the crypto exchange CEOs and senior management

What is a cryptocurrency exchange?

There are many different cryptocurrency exchanges in operation today and there’s no one exchange that’s best for everyone. When choosing a crypto exchange, there are a number of things to consider including the range of cryptoassets offered by each platform, fees, security features, educational features, and regulation. The best crypto exchanges make it easy to buy and sell the cryptocurrencies you’re interested in with low fees and a high level of security.

How does a cryptocurrency exchange work?

Cryptocurrency exchanges operate in a similar way to stock brokerage platforms, however, instead of matching buyers and sellers of stocks, they match buyers and sellers of cryptoassets.

The process of buying cryptocurrency on an exchange may seem daunting but it’s actually quite simple. Here are the steps you need to follow:

- Check that the crypto exchange is regulated by the FCA – we only feature FCA-regulated exchanges on Good Money Guide.

- Open an account – you can do this online or by downloading the app.

- Deposit funds – decide how much you want to invest – keep in mind crypto is a high-risk investment and you can lose all your money.

- Search for the right crypto – BTC for Bitcoin or ETH for Ether/Etherium.

- Set your price limit – you can choose to buy at the market (the current price) or set a limit if you want to get it cheaper.

- Decide where you want to keep your crypto – you can either leave it on the exchange or download it to a crypto wallet.

Most crypto exchanges like Coinbase use an order book to match buy and sell orders. An order book is a list of all outstanding buy and sell orders, organised by price level. When a buyer is matched with a seller, the exchange executes the trade.

Some crypto exchanges like Kranken, allow you to trade one cryptoasset for another. These are known as crypto-to-crypto exchanges.

Others, like Revolut, only allow you to trade fiat currencies such as the US dollar or the British pound for cryptoassets. These are known as fiat-to-crypto exchanges.

Pros

- 24/7 global market access

- High liquidity for major coins

- Easy entry for beginners

- Low trading fees (some)

- Instant execution and settlement

Cons

- Price volatility and risk

- Security breaches and hacks

- Limited regulation or protection

- Withdrawal delays possible

- Complex fees and spreads

Cryptocurrency Exchange Fees

Before trading with a cryptocurrency exchange, it’s important to understand the exchange’s fees. Crypto exchanges charge many different types of fees including:

-

Trading fees

These are typically charged on both fiat-to-crypto trades as well as crypto-to-crypto trades. They vary from exchange to exchange and can be based on a combination of factors including the size of the trade, the selected payment method, and market conditions such as volatility and liquidity.

-

Spreads

A spread is the difference between the cost to buy an asset and the cost to sell the same asset. Trading platforms often use spreads to generate extra fees. At present, Coinbase charges a spread of about 0.5% for cryptocurrency sales and purchases, however, this spread can change depending on market fluctuations.

-

Withdrawal fees

Some crypto exchanges charge a fee to withdraw your money. In most cases, the fee is on a per withdrawal basis and not a percentage of the withdrawal amount. eToro, for example, currently charges a withdrawal fee of $5.

-

Borrowing fees

Some crypto exchanges offer margin trading. This is where you can borrow money to increase the size of your position – a process known as using ‘leverage.’ Crypto exchanges that offer margin trading typically charge fees based on the amount borrowed. They often also charge an additional fee if a margin position is liquidated.

-

Custody fees

These are fees that exchanges charge to hold customers’ assets. They vary from exchange to exchange. Coinbase currently charges a 0.5% p.a. fee on a monthly basis.

While fees are important to consider when choosing a crypto exchange, don’t automatically rule out a platform just because it has higher fees. Higher fees can be a worthwhile trade-off for a higher level of security and extra features such as educational content and investment tools.

Cryptocurrency Exchange Currencies

The fiat currencies you can use to buy cryptocurrency vary by exchange. Some exchanges, such as Coinbase and Binance, support a range of different fiat currencies including the British pound, the US dollar, and the Euro.

Others, such as eToro, only let you buy crypto in US dollars. This means that if you are based in the UK and the pound is your home currency, you will need to convert your pounds to US dollars on the platform before you trade.

Cryptocurrency Exchange Order Types

Most crypto exchanges allow you to place several different types of orders. The main types of orders are:

Market orders

When you place a market order, the exchange executes your trade at the best available market price in the order book. An advantage of market orders is that they are usually executed quite quickly. A disadvantage is that they are sometimes executed at unfavourable prices.

Limit orders

When you place a limit order, you instruct the exchange to execute your trade at a certain price (or better). An advantage of limit orders is that you always receive the price you want for your trades. A disadvantage is that they can take time to execute. If there is no matching buyer/seller to accept your price, your limit order will not be executed.

Stop loss orders.

When you place a stop loss order, you instruct the exchange to sell your cryptoasset when it reaches a certain price. Stop loss orders are designed to help traders minimise losses.

Crypto Exchange Transaction Limits

Most crypto exchanges have limits in place in terms of how much you can deposit, withdraw, and trade at once. These limits vary from exchange to exchange. They can also vary depending on where you are based and the type of account you have with the exchange.

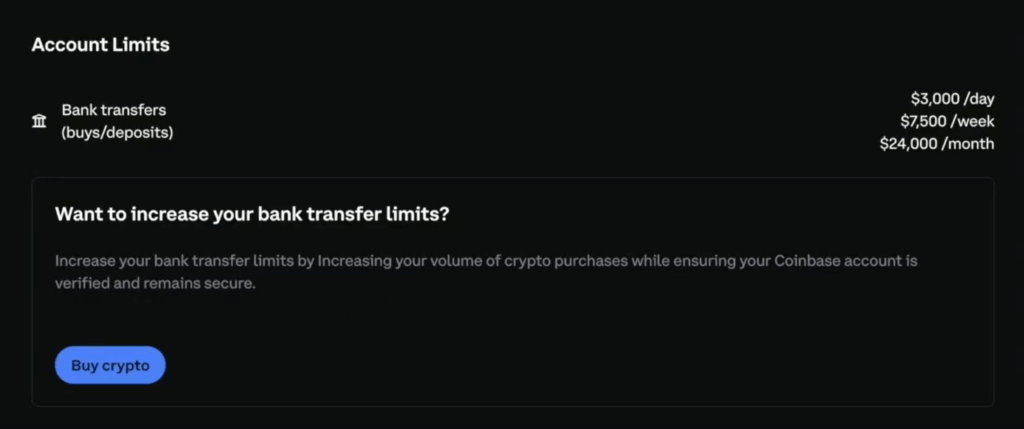

With Coinbase for example, limits depend on your account level. For example, when you have a ‘Level 1’ account, the maximum trade size with 3D Secure (credit/debit card) purchases is £3,000.

To increase your buy / sell limits, you may need to complete several verification steps and enable additional account features.

Crypto Exchange Deposits

There are several ways to fund purchases on crypto exchanges

The first way is via bank transfer. This will involve entering your bank details into the system. Bank transfer deposits generally take 1-3 days to go through so you usually can’t trade instantly.

The second way is via credit/debit card. This process tends to be instant meaning you can trade straight away. It’s worth noting, however, that some credit card companies do not allow you to buy crypto on their cards.

Usually, you have to provide some form of identification before you can fund your account or make a trade. These identification checks are for money laundering reasons.

| Provider \ Method | Bank transfer | Debit / Credit Card | E-wallets (PayPal / Skrill / Neteller etc) | Wire / International bank transfer | Crypto deposit |

|---|---|---|---|---|---|

| IBKR | ✔️ | ❌ | ❌ | ✔️ | ✔️ (asset / position transfers) |

| Kraken | ✔️ | ✔️ | ❌ / limited | ✔️ | ✔️ |

| Coinbase (UK) | ✔️ | ✔️ | ❌ / limited | ✔️ | ✔️ |

| eToro (UK) | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ (via eToro crypto wallet) |

What are the different types of crypto exchanges?

There are two main types of cryptocurrency exchanges – centralised exchanges and decentralised exchanges.

Centralised Exchanges

A centralised exchange is managed by a corporate authority and is custodial in nature. Most popular crypto exchanges such as Coinbase, are centralised.

By contrast, a decentralised exchange distributes verification powers to anyone willing to join a network and certify transactions. These exchanges allow users to execute peer-to-peer transactions without the need for a third party.

Both centralised and decentralised exchanges have their advantages and disadvantages.

One major advantage of centralised exchanges is that they tend to be quite user-friendly. Most centralised exchanges provide easy-to-use websites and apps that make crypto trading quite straightforward. Another advantage is that they tend to be quite reliable.

On the downside, centralised crypto exchanges tend to charge relatively high transaction fees. Coinbase, for example, charges transaction fees of around 0.50% to buy cryptoassets such as Bitcoin and Ethereum (3.99% for credit card purchases). Centralised crypto exchanges are also often targeted by hackers and cybercriminals due to the fact they hold a lot of crypto on behalf of their customers. In 2014, one of the largest centralised crypto exchanges, Mt. Gox, suffered a major hack in which $460 million in customer funds was stolen.

Decentralised Exchanges

One advantage of decentralised exchanges is that they offer anonymity. Unlike centralised exchanges, which require users to complete know-your-customer (KYC) checks when opening an account, decentralised exchanges are anonymous and offer complete privacy. Another advantage is that there’s no hacking risk as these exchanges are not custodial in nature.

On the downside, decentralised exchanges do not facilitate the trading of fiat currencies for cryptoassets. This means they are not convenient for those looking to buy crypto with fiat currencies such as the British pound or the Euro. Decentralised exchanges also tend to lack liquidity. Only around 1% of crypto users transact through decentralised exchanges. This means that it can take some time for a trade to be executed.

Are Crypto Exchanges Safe?

If you buy crypto on an exchange, you do not have access to the Financial Ombudsman Service (FOS) or the Financial Services Compensation Scheme (FSCS) if something goes wrong. If your cryptoassets are stolen or your platform goes bust, for example, no one is responsible for helping you get your money back.

Cryptocurrency exchanges are increasingly being targeted by cybercriminals, so it pays to do your research into security when choosing a platform. In 2020, there were nearly 30 attacks on crypto exchanges, the largest of which resulted in more than $200 million worth of crypto being stolen from Singapore-based exchange KuCoin.

Most of the major cryptocurrency exchanges such as Coinbase and Binance now have advanced security features in place. One example of a security feature that is very common is two-factor authentication (2FA). With two-factor authentication, you need to provide additional information whenever you log in, such as a code sent to you by text message.

Many platforms also have crime insurance in place to protect themselves against losses from theft or cybersecurity breaches. This can protect you if the platform is hacked. This insurance will not protect you, however, from any losses resulting from unauthorised access to your personal account due to a breach or loss of your login details.

One way to reduce your risk when investing in crypto is to spread your investments across multiple exchanges. This could protect you if one exchange is hacked.

Another way to reduce risk is to move your cryptoassets off the exchange’s platform and onto your own secure ‘cold’ crypto wallet that’s not connected to the internet. Cold crypto wallets are much harder to hack, although you’ll need to remember your passcode or you could lose access to your cryptoassets forever.

FCA Registered Cryptoasset Firms

In the UK, only firms on the FCA’s Cryptoasset Firms register are allowed to offer crypto investing and trading services to UK customers. There are only around 44 firms on this list (as 11/9/24) and we have sumamrised what each one does and who they do it for below:

| Registered Cryptoasset Firm | What do they do? | FCA Reference Number | Regulated Since |

|---|---|---|---|

| eToro (UK) Ltd | eToro is one of the largest crypto investing and social trading platforms in the world. | 583263 | 14-Jan-22 |

| Interactive Brokers (U.K.) Limited | IBKR lets you trade and invest in crypto, stocks, options, ETFs, futures, bonds, and more from a single unified platform for as little as 0.12% – 0.18% | 208159 | 12-Jun-23 |

| Revolut Ltd | Revolut lets you buy and sell 175 cryptocurrencies with 0% fees and hold them in a cryptocurrency wallet. | 900562 | 26-Sep-22 |

| Hidden Road Partners CIV UK Ltd | Hidden Road is a global credit network for institutions offering prime brokerage, clearing and financing across traditional and digital assets. | 828692 | 20-Dec-22 |

| Archax Ltd | Archax was the first registered crypto exchange in the UK united-kingdom and provides institutional services to the cryptocurrency industry including Coinbase. | 838656 | 18-Aug-20 |

| Ziglu Limited | Ziglu offers a fast, simple way to buy and sell crypto, with no hidden fees. | 900977 | 01-Sep-20 |

| Gemini Payments UK, LTD | Gemini make crypto simple where you can find, trade and buy Bitcoin over 80 coins including Ethereum their cryptocurrency platform. | 900988 | 19-Aug-20 |

| Zumo Financial Services Limited | Zumo enables banks, asset managers, fintechs and brands to let their customers to buy, hold and sell cryptocurrencies through their existing platform. | 901033 | 10-Dec-21 |

| Regulated Decentralised Finance Ltd | The ReDeFi project is trying to solve the problem of financial exclusion. It is a new financial system that is built on top of blockchain technology. | 849446 | 01-Dec-21 |

| OANDA Coinpass Limited | Coinpass is an all-in-one crypto investing platform for UK businesses and corporate investors. | 921481 | 26-Aug-21 |

| GEMINI INTERGALACTIC UK, LTD | A rather vague product that sites within the Gemini user agreement. | 921817 | 19-Aug-20 |

| COMMERCIAL RAPID PAYMENT TECHNOLOGIES LIMITED | This firm traded as Crypterium but recently rebranded to Choise.com is a gateway crypto platform that combines CeFi and DeFi solutions. | 925234 | 11-Oct-21 |

| Baanx.com Ltd | Baanx Group bridges the gap between fiat and digital asset technology to provide you with an API-driven platform. | 927401 | 16-Dec-21 |

| ICONOMI LTD | ICONOMI offer crypto copy investing platform with more than 3000+ cryptocurrency investing strategies. | 927859 | 21-Oct-21 |

| Zodia Custody Limited | Zodia Custody offers a comprehensive selection of cryptocurrencies that they say meet rigorous criteria for quality, safety, and regulatory compliance. | 928347 | 15-Jul-21 |

| Fidelity Digital Assets, LTD. | Fidelity Digital Assets build enterprise-grade cryptocurrency custody and crypto trading services for institutional investors. | 928554 | 18-Nov-21 |

| Bitpanda Custody Ltd | Bitpanda is currently unable to open new accounts for Retail Customers based in the UK, but they plan to onboard users soon. | 928556 | 04-Oct-21 |

| Wintermute Trading LTD | Wintermute is an algorithmic trading firm in digital assets who create liquid and efficient markets on centralized and decentralized crypto trading platforms and off-exchange. | 928764 | 25-Feb-22 |

| CoinJar UK Limited | CoinJar allows you to buy, sell, store and send Bitcoin and 60 more cryptocurrencies with as little as £10. | 928767 | 27-Sep-21 |

| PAYWARD LTD. | Payward is the legal name for Kraken, who let you invest in over 200 cryptocurrencies in 190 countries. | 928768 | 23-Nov-21 |

| Ramp Swaps Limited | Ramp provide a powerful fiat to crypto toolkit that enables anyone, from established brands to blockchain pioneers, to easily onboard crypto customers users into web3. | 928783 | 20-Jul-21 |

| Fibermode Limited | Fibermode’s FCA entry points to the Mode App websites, but it does not work so they must not be in business any more? | 928786 | 23-Jun-21 |

| BCP TECHNOLOGIES LTD | BitcoinPoint is an app that lets users buy Bitcoin and other cryptocurrencies directly from their phone by linking a UK bank account. | 928840 | 03-Dec-21 |

| Solidi Ltd | Solidi is a crypto exchange, although by the state of their website and social accounts it looks like they a bit behind the times. | 928852 | 23-Jul-21 |

| Galaxy Digital UK Limited | Galaxy is a digital asset and blockchain leader helping institutions, startups, and individuals build bespoke solutions for a digitally native ecosystem. | 928891 | 25-Nov-21 |

| Transak Limited | Transak offers an integration platform that companies can use to allows their users to buy more than 170 cryptocurrencies with credit/debit cards, or bank transfers in more than 169 countries. | 928910 | 04-Jan-22 |

| X Capital Group Limited | X Capital Group looks like it’s out of business, best avoid. | 929098 | 22-Dec-21 |

| Enigma Securities Ltd | Enigma Securities offer technology for institutional digital-asset liquidity and say they power the largest players globally. | 930442 | 24-Dec-21 |

| ABEX Capital UK Limited | ABEX provides cutting-edge agency cryptocurrency execution technology and tools. | 933825 | 07-Apr-22 |

| Uphold Europe Limited | Uphold lets you buy, sell, and invest in digital currencies, cryptos, national currencies, and stablecoins as well as transfer and send/receive over 260 cryptocurrencies. | 938277 | 17-Feb-22 |

| FORIS DAX UK LIMITED | FORIS DAX operates crypto.com in the UK and lets you buy Bitcoin, Ethereum, and 350+ Cryptocurrencies with GBP. | 941745 | 16-Aug-22 |

| MoonPay (UK) Limited | MoonPay offers a fast and simple way to buy and sell cryptocurrencies with a credit card, bank transfers or Apple Pay. | 944716 | 09-Dec-22 |

| Zodia Markets (UK) Limited | Zodia Markets is a institutional digital asset trading business that enable global corporations and institutions to realise the full potential of the digital asset future. | 954558 | 27-Jul-22 |

| Bitstamp UK Limited | Bitstamp (now owned by Robinhood) lets institutions and private clients buy and sell cryptocurrency. | 978690 | 13-Jun-23 |

| Komainu UK Limited | Komainu offers clients a regulated digital asset custody solution that is secure, segregated, and verifiable on the blockchain. | 985974 | 06-Oct-23 |

| Portofino Technologies UK Ltd | Portofino Technologies is building financial infrastructure technology to power digital asset adoption | 990940 | 27-Feb-24 |

| BNXA UK VASP Limited | BNXA powers embedded crypto solutions for businesses so that their users can buy and sell crypto directly from their app using a variety of local and global payment options. | 999863 | 09-Feb-24 |

| Paypal UK Ltd | PayPal supports buying, selling and holding of Cryptocurrency using your PayPal account. | 1000741 | 31-Oct-23 |

| TP ICAP E&C Limited | TC ICAP provide broking, execution, and trading venue services to wholesale market participants for cryptoassets. | 146880 | 21-Nov-22 |

| Skrill Limited | Skrill lets you buy and sell over 40 cryptocurrencies with as little as £1 | 900001 | 12-Nov-21 |

| Paysafe Financial Services Limited | Paysafe let businesses through a single integration accept cryptocurrency, cards, cash, digital wallets, and bank transfers. | 900015 | 12-Nov-21 |

| DRW GLOBAL MARKETS LTD | DRW through Cumberland, provide institutional cryptocurrency liquidity in the cryptoasset space. | 746273 | 07-Jun-22 |

| Crypto Facilities Ltd | Crypto Facilities is a regulated trading venue for institutions to trade Futures on Bitcoin, ETH and other cryptocurrencies. | 757895 | 17-Nov-21 |

| Clear Junction Digital Limited | Clear Junction helps crypto businesses provide customers with a means of buying and selling cryptocurrency using fiat. | 900696 | 20-Dec-21 |

Crypto Exchange FAQs

No, most crypto exchanges charge users fees. Fees including transaction fees, trading spreads, custody fees, withdrawal fees, and margin fees.

You can store your crypto on an exchange if it is centralised. However, storing crypto on an exchange is usually not recommended. Transferring your crypto to a crypto wallet is generally much safer.

Yes, since 2020, cryptocurrency exchanges are primarily regulated by the Financial Conduct Authority (FCA) via their Registered Cryptoasset Firms register. The FCA provide a searchable database of cryptocurrency exchanges they have checked and supervise.