In this volatile investment climate, very few stocks are establishing new all-time price highs. American Express (AXP), surprisingly, is one of these wonder shares. The Amex stock price climbed to record highs this year despite the ongoing Ukraine War, high-interest rates and tight consumer spending.

Is American Express a buy, hold or sell?

Amex, the credit-card company you shouldn’t leave home without, has been reporting record revenues and profits in the past few quarters. In 2022, for example, American Express’s yearly revenue hit almost $53 billion. This figure rose above $60 billion the very next year. Net income in 2023 surpassed $8.3 billion. No wonder investors are flocking to buy shares of the company.

Just recently, Amex’s share price briefly touched the psychological $200 level after gaining 35 percent in the last three months. Based on Amex’s bullish share price momentum, it would be hard for me to think this is anything else apart from ‘buy’.

That said, Amex’s rally is – technically speaking – short-term overbought. This means that its rally could be vulnerable to a correction from that $200 level. This level has acted as resistance in the past; it may do so again.

Moreover, investors are now digesting the possibility that the Fed may not cut interest rates in March, as previously assumed. This could dent market optimism and pull most US stocks lower. Not to forget are those potential credit losses due to the weakening household income.

And fundamentally, Amex is priced on the rosy side of the scale. It’s dividend yield now fetches just 1.20 percent. The price-earnings ratio is above 17.

Over the long term, is American Express still a buy? My answer is a clear yes. Just look at its long-term monthly price chart. The stock grew nearly twenty times in the past two decades. The stock even managed to hold onto its post-pandemic price gains despite the sharp rise in interest rates and weakening consumer spending.

Yes, there were a few deep setbacks and bear trends along the way. Each time, however, the company grew stronger, and its share price bounced to new all-time highs as soon as the economic upswing gathered pace.

Furthermore, this company has a strategic cornerstone investor: Warren Buffett. Through the conglomerate Berkshire Hathaway, Warren Buffett currently owns more than 151 million shares of American Express.

This 20 percent stake was acquired back in the early nineties for a meagre $1.3 billion. This equates to a cost price of just $8. Until now, the legendary investor has not sold this extraordinarily profitable position. Dividends from this stake alone amount to more than $300 million.

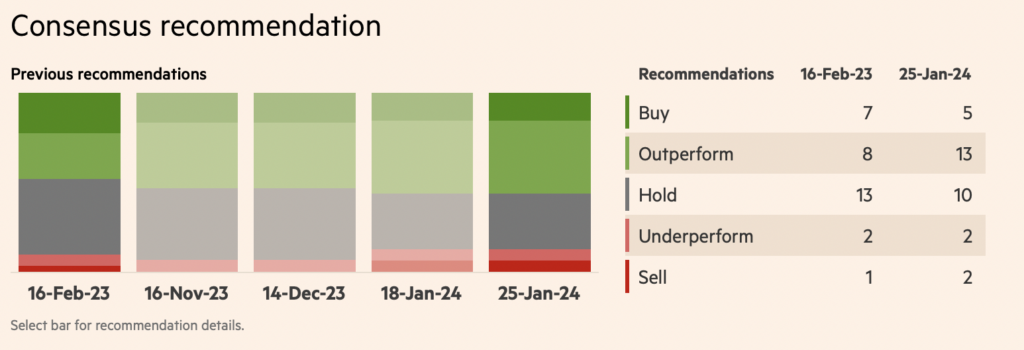

Based on the above discussion, the stock forecast for Amex is unsurprisingly positive. But investors are not uniformly bullish. More than a third of the current broker forecasts are in the neutral zone of ‘Hold’.

The median 12-month stock price forecast is aggregated at $205 – where prices are trading right now. Slim upside.

Perhaps the recent rally has proved stronger than expected and analysts aren’t sure if this rally can be supported by Amex’s fundamentals.

To sum things up, American Express is a solid company with a great brand value and solid client base. The CEO Steve Squeri has navigated the company very well in the past five years, and churned out record profits for shareholders. Its market cap of $145 billion is still far behind Visa, valued at $548 billion, and Mastercard , at $421 billion.

Timing wise, waiting for better entry points may not be a bad idea since the market is still highly volatile.

Source: Financial Times (paywall)

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.