So you want to buy cannabis stocks? Buying cannabis stocks is a hot topic at the moment. Not quite as much as crypto trading – but at least with cannabis there is an underlying asset. So, if you want to get involved in the wacky world of baccy stocks here is our guide on where to trade and invest in cannabis stocks

Marijuana stock plays aren’t a new thing, they’ve been around for a while but mainly in the form of spivvy penny shares. You know, the type of stocks where you “pays your money and takes your chance” and more often than not (just as with some smaller mining stocks) can be prone to being manipulated by “pump and dump” schemes. So when you invest or trade cannabis stocks, you buy some and may either lose all your money or make a bucket load.

I’ll resist the temptation to use puns like, “could these stocks go sky high?” because quite frankly they’ve all been used by everyone else already.

However, we are guilty of lit puns too, cough-cough…

Here is a quick rundown of the best brokers to buy cannabis stocks.

Obviously, we’re not recommending these stocks or providing investment advice here. Just highlighting where you can buy cannabis stocks. If you wanted…

Cannabis stocks are becoming more readily available on platforms like IG, Saxo and eToro. Read our reviews to find out more or read on for screenshots and the risks and opportunities involved in trading marijuana.

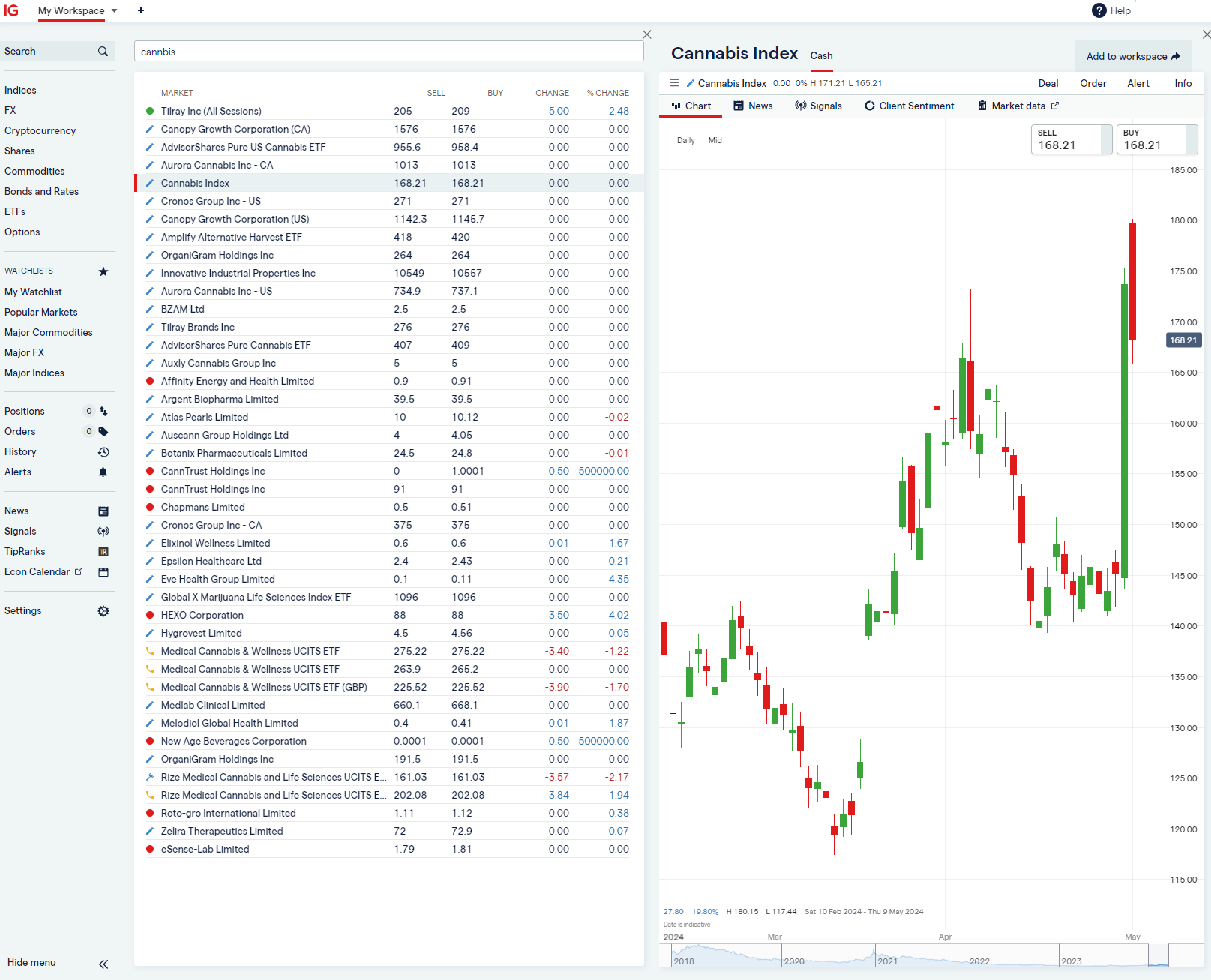

IG: Spread Betting on Cannabis Stocks

If you want to trade cannabis with tax-free profits and are based in the UK take a look at IG. A quick search on their platforms shows around 30 cannabis stocks that you can trade as a spread bet. You can also trade cannabis as a CFD or invest in ETFs.

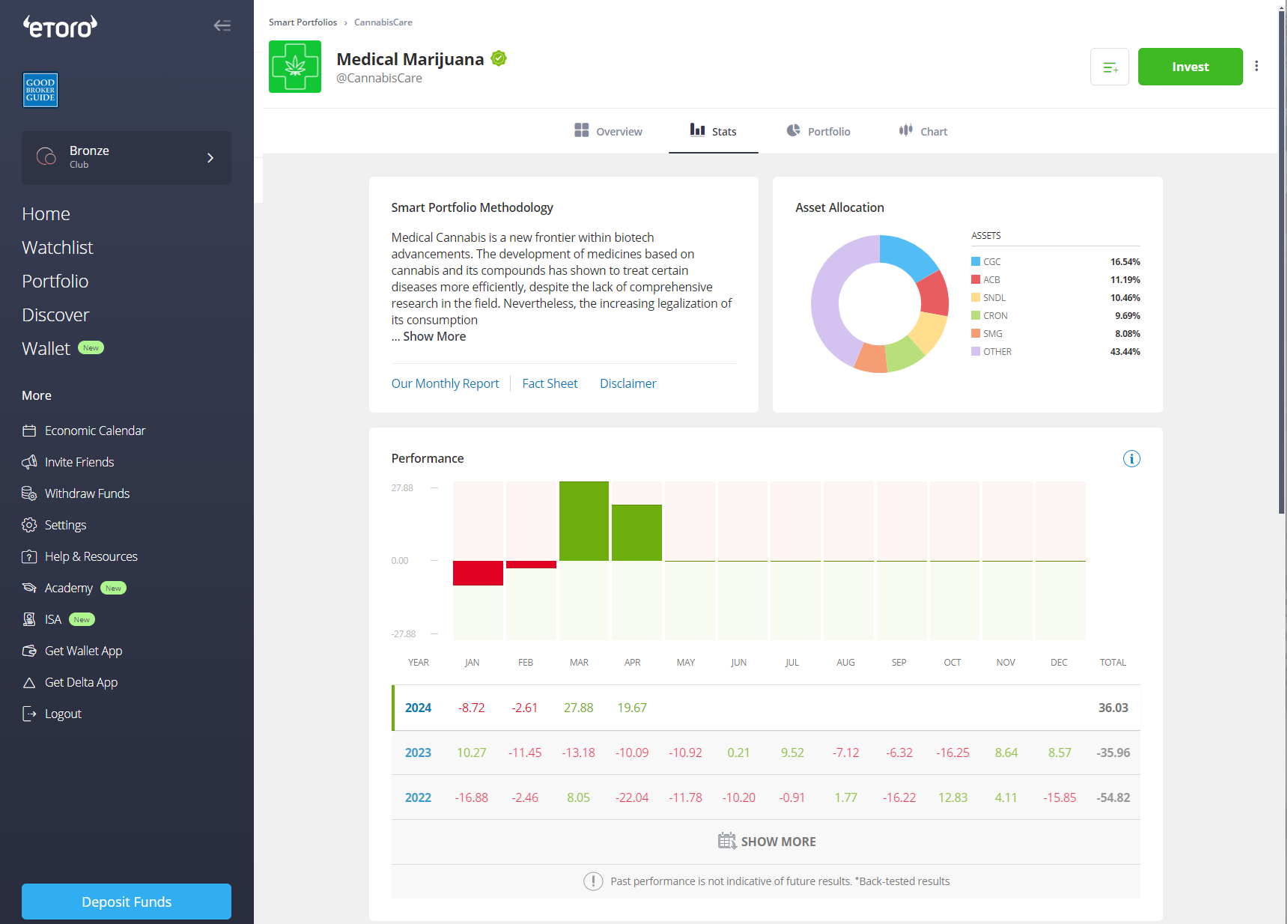

eToro: Cannabis CopyPortfolios

If you are of the social trading persuasion eToro gives investors the chance to bet on the rapidly growing medical marijuana market via it’s CannabisCare CopyPortfolio.

eToro has set its sights on what it believes is one of the most ‘intriguing markets’ around – medical marijuana. It might be controversial, but the market is booming and the platform clearly believes this is an area with enormous potential.

etoro’s CannabisCare CopyPortfolio invests in a range of different companies which are getting involved with the medical marijuana space. The portfolio spreads across all these different companies giving investors a balanced exposure to the various sectors of the industry. It includes those which are already selling legal cannabis-based medications as well as those which are developing new treatments or legally growing the marijuana plant.

It’s understandable to see why eToro introduced their CannabisCare Copy Portfolio in 2018 as a study from Grand View Research suggests the global legal marijuana market could be worth almost $150 by 2025 growing at 34.% annually.

It is helped by an increasingly benign environment in which public opinion is shifting. Roughly 85% of Americans support the legalisation of cannabis for medical purposes. Research is building a body of evidence and legislators are paving the way for growth. Canada and the US have been particularly active with the rest of the world following in their footsteps.

Cannabis will always be a politically sensitive drug, but opposition is slowly crumbling as people gain a wider understanding of how it can be used in medicine. Donald Trump – to the surprise of many – has signalled a willingness to support legislation which could legalise medical marijuana, although he has also threatened to change his mind.

Even so the stage is set for rapid growth. This is a sector in which there is a huge amount of research underway, but which remains in the early stages of development. As such, the rewards, as well as the risks, could be substantial.

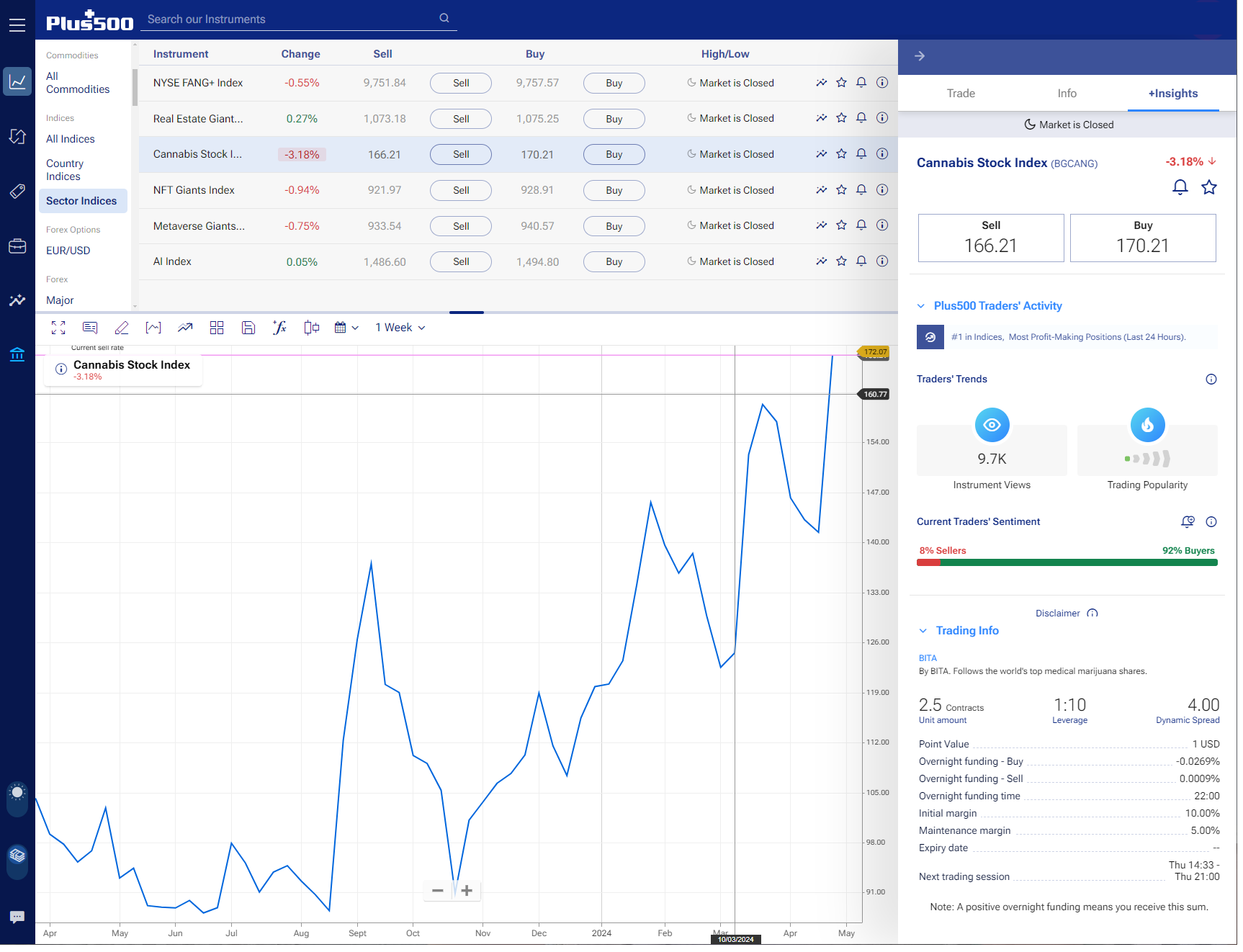

Plus500: Cannabis CFD Index Trading

Plus500 has launched a Cannabis index tradable via their platform which is a CFD based on the price of the BGCANG BITA GLOBAL CANNABIS GIANTS.

The cannabis index includes large Cannabis companies like Tilray, Aurora Cannabis and GW Pharmaceuticals. however, on neither the BITA website and Plus500’s website we couldn’t find a full constituents list.

If you are thinking of trading Cannabis as a CFD here is a quick rundown of the pros and cons of trading a Cannabis Index rather than the individual stocks.

You diversify your risk with a Cannabis Index

Cannabis companies are very high-risk investments because they are in a volatile sector. Bioscience stocks are choppy enough without the added morality and legal issues that the medical marijuana industry faces.

So, expect big moves in individual stocks are they fight for regulatory approval of their products.

By buying or selling an index you are not quite so exposed to these individual stock movements.

However, you are still susceptible to the volatility of the index. So if there is an overall legal or regulatory change in medical marijuana, then expect big moves in the index.

You can get leverage trading through cannabis CFD Indices

This isn’t necessarily a good thing as the current Plus 500 margin rates allow you to get $500 exposure with $100 on deposit (1:5).

The benefit is of course if you call the market right you multiply your profits, but if you lose, you’re losses are also increased.

You’ll pay overnight financing charges – If you buy a Cannabis ETF of ETN you are buying a listed basket of stocks that is actively managed by the provider. There will be charges from the provider and your broker for holding the ETF, but they won’t be as large as the financing charges for holding a cannabis CFD index position.

For example, you’ll pay interest on long and short positions with Plus 500 at the moment (2/5/24). Daily rates are:

- Overnight Funding On Longs: -0.0269% (9.8185% per year)

- Overnight Funding On Shorts: 0.0009% (0.3285% per year)

Marijuana ETF investing through Saxo

If you want access to a cannabis ETF, Saxo offer Horizons Marijuana Life Sciences Index ETF which is a basket of stocks with exposure to cannabis. Although, Saxo classifies this as a very high-risk product so you will need to upgrade to a professional trading account to invest in it.

Is it safe to invest and trade cannabis?

The platforms we have highlighted in this article are regulated by the FCA and deemed by us to be safe for trading cannabis stocks. however, it’s important to note that cannabis as an asset class is high risk.

What to watch out for when trading cannabis stocks

- Firstly, most cannabis stocks are listed abroad so make sure you either hedge your currency exposure or trade in your local currency. Which you can do with spread betting for example.

- Secondly, regulation is a major factor and changes will have a significant impact on cannabis stock prices.

- Thirdly, it’s just like any other pharma stock – they are subject to high volatility

Opportunities & risks in the cannabis sector

Once in a while, a hot new sector bursts into life and captures investors’ imagination. Remember those internet stocks twenty years ago? Or those raging crypto-currencies a year ago, particularly Bitcoin? More recently, a new such sector has emerged: Cannabis stocks.

What are cannabis stocks? Mainly, these are listed companies engaging in producing or selling cannabis, a type of drug that is used for medicinal and recreational purpose. It is popularly known as marijuana or weed.

‘Drug?!’ you may wonder. Yes, the drug that Elon Musk was reportedly smoking during his podcast interview recently, which caused a huge drop in Tesla’s share price overnight (see picture below).

In many countries, cannabis is still illegal. Many governments around the world – including the UK – assume these drugs are addictive and dangerous. Just this week, a front-page headline in The Times (September 12, 2018) read: ‘Policy catch 11-year-olds being used to sell (cannabis) drugs.’

Winds of Change Lifting the Cannabis Sector

If cannabis is so controversial, why are cannabis stocks popular these days? Because legalising cannabis is becoming a trend. Uruguay, Canada and some US states are now opening public access to cannabis. With this change, people are expected to spend more money buying the drug. Some estimated that legal cannabis market will triple from the current US$10 billion to $30 billion in five years time*. Very good prospects indeed.

The question now, at least for new investor/traders unfamiliar with cannabis stocks: Should you join the party?

To answer this question, we have devised a small flexible framework for analysing ‘Hot Sectors’.

Framework For Analysing ‘Hot Sectors’

Before you consider buying these weed stocks, ask yourself three questions:

- Do you know a lot about the sector? Meaning, do you have some form of ‘knowledge edge’?

- Why do you need to buy the sector? In other words, do you really need to participate now?

- What is the sector priced at now? Depressed, normal, or high?

To see this more clearly, you should place the sector in the Sector Cycle below and assess the risk-reward prospect.

Sector Cycle – Five Stages Of Cannabis Investing

Stage 1: Dormant – Few know about the sector. It is virtually non-existent. Public knowledge is low. Alternatively, it is a ‘sleeper’ sector. Boring, few exciting prospect. A sector could stay here for many years.

Stage 2: Catalyst – New technology, changed laws, or shifting political landscape becomes the market catalyst that incite changes. Prospect becomes better.

Stage 3: Smart Money/Insiders move in – Astute investors start to place bets in the sector, via venture backing, loans, or new companies. This stage can occur over some years.

Stage 4: Public Participation – Once the trend persists for a while, media starts to take note. Also, early investors reaped huge gains. Articles, books, videos, internet, and interviews amplify these juicy returns – and investor greed. Public Joe became a ‘convert’ and buy.

Stage 5: Hysteria, Bubble, and Collapse – Hysteria sets in. Prices go ballistic. The sector becomes a bubble that lasts for a few months (even a couple of years). When the last buyer is in, the sector implodes.

Where do you the cannabis sector is right now? I suspect between 4 and 5. Why? Because when a stock goes up by 30x in two years, you know that many investors would be looking to cash out. At these high valuation levels, the sector is ‘priced for perfection’. In other words, any negative factor – such as lower-than-expected revenue growth – could cause a massive drop in share prices.

Moreover, many cannabis firms are investing heavily to position themselves strategically in the sector. You can expect equity dilution, higher balance sheet leverage, and low dividends. Also, who will survive in the long term? Nobody knows right now.

Conclusion

Cannabis is a new hot sector. Its prospect is driven by a growing market (due to a changing legal landscape). But note this, higher cannabis demand brings about higher cannabis supply. At some point, a tipping point will cause street prices to plummet as the sector becomes saturated. Are we there yet? Perhaps not. Thus, it is quite likely that the sector may remain popular for the time being.

Turning to risk-reward prospect of buying the sector at the moment. If you know next-to-nothing about the sector but still want to trade NOW when the sector is trading at high valuation levels – better set clear rules and follow them. It is a volatile sector. Huge gains and severe drawdowns are equally possible. After all, it is a novel sector filled with uncertainties.

*Investor Chronicle (September 7, 2018)

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.