Scottish Mortgage Investment Trust Plc (SMT) share price analysis and market data includes key financials, earnings estimates, peer performance, dividends, news and a company profile that will give you an indication as to whether this stock is a buy, sell or hold.

You can buy these shares in either a general investment account, stocks & shares ISA or SIPP for your pension with one of the brokers below.

| Name | Logo | GMG Rating | Customer Reviews | Annual Fees | Dealing Commission | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews 4.2

(Based on 1,094 reviews)

|

Annual Fees 0% – 0.25% |

Dealing Commission £3.50 – £5 |

See Offers Capital at risk

AJ Bell Reviews |

Features:

|

AJ Bell Share Dealing Review Provider: AJ Bell Share Dealing Verdict: AJ Bell is a low-cost online investing platform and is the cheapest share dealing platform for buying and selling shares for the UK do-it-yourself (DIY) investor. They also offer plenty of investment ideas, including investment guides and equity research. Summary A great choice to deal shares with low costs in a variety of investment accounts.

Fees: AJ Bell share dealing account fees are capped at £3.50 a month. Dealing costs are £1.50 for funds and £5 for shares but drop to £3.50 when there were 10 or more online share deals in the previous month. Special Offers:

Pros

Cons

Overall4.2 |

||

|

GMG Rating |

Customer Reviews 3.8

(Based on 1,763 reviews)

|

Annual Fees 0% – 0.45% |

Dealing Commission £5.95 – £11.95 |

See Offers Capital at risk

Hargreaves Lansdown Reviews |

Features:

|

Expert Review Account: Hargreaves Lansdown Share Dealing Description: Hargreaves Lansdown offers access to the widest selection of stocks for share dealing accounts in the UK. The platform also has one of the best research portals for analysing stocks. Is it expensive to buy and sell shares on Hargreaves Lansdown? Hargreaves Lansdown is not as expensive as it used to be as there is no account charge for holding shares in a general investment account and a max of £3.75 in a stocks and shares ISA. HL does still cost more than competitors like AJ Bell and Interactive Brokers to buy and sell shares, but the account running costs can be lower because of the monthly cap. HL won the Best Stock Broker in our 2024, 2022 awards, and in 2021, it won Best Full-service Stockbroker for their all-round approach to customer service.. Another added bonus of dealing shares through HL is that their clients benefit from price improvements for best execution. HL say they reach out to multiple brokers to get the best prices for a trade and clients can make a saving of £18 per trade on average. This is particularly relevant if you are dealing with cap UK shares, which is where Hargreaves Lansdown excels. Overall, Hargreaves Lansdown is an excellent choice for most types of share dealing on UK and international markets. Pros

Cons

Overall4.9 |

||

|

GMG Rating |

Customer Reviews 3.6

(Based on 74 reviews)

|

Annual Fees 0.4% – 0.08% |

Dealing Commission £1 – 0.08% |

See Offers Capital at risk

Saxo Reviews |

Features:

|

Saxo Share Dealing Review: Lower fees and professional grade tech Account: Saxo Share Dealing Description: Saxo’s platform has share dealing on more than 50 stock exchanges around the world with 22,000 shares available for investors. Making it one of the most diverse investment platforms for share dealing in the UK. Its forte is on the trading side for traders that need direct market access and are more price-sensitive to bid/offer spreads. Is Saxo any good for share dealing? Yes, you can deal shares directly on exchange with Saxo. In fact, Saxo is one of the best DMA brokers for trading shares inside the bid/offer price as you can place your orders directly on the order book. Saxo’s platform has share dealing on more than 50 stock exchanges around the world with 22,000 shares available for investors. Making it one of the most diverse investment platforms for share dealing in the UK. Its forte is on the trading side for traders that need direct market access and are more price-sensitive to bid/offer spreads. Saxo is a good share dealing platform for sophisticated and advanced investors who also need direct access to capital markets. Fees: Saxo Markets charges a share dealing commission based on a percentage of transaction size. They are very competitive though, and UK share dealing commission starts at 0.1% (£100 if you buy £100,000 worth of stock) and drops to 0.05% for more active traders. As Saxo is a prime broker with a retail and institutional client base, they are one of the best share dealing platforms for larger customers. However, there are some downsides. Firstly they do not offer acesss to smaller cap shares on their trading platform like brokers Spreadex and IG, who have a much braoder range of shares to trade online. Secondly, you cannot trade shares as financial spread bets (where profits are free of capital gains tax). Finally, the cost of dealing shares with Saxo is higher than with a broker like Interactive Brokers. But Saxo wins hands down when it comes to customer services, research and analysis. Pros

Cons

Overall4.3 |

||

|

GMG Rating |

Customer Reviews 4.5

(Based on 1,330 reviews)

|

Annual Fees £0 |

Dealing Commission £3 |

See Offers Capital at risk

Interactive Brokers Reviews |

Features:

|

Interactive Brokers Share Dealing Review Provider: Interactive Brokers Share Dealing Verdict: Interactive Brokers is an excellent account for sophisticated share dealers who want to manage their own portfolio with complex order types actively and need access to a wider range of investment products like derivatives, options, and futures. They also offer fractional share dealing if you only want to start trading a small amount. Summary One of the most advanced share dealing platforms for beginners and professional investors.

Fees: Interactive Brokers does not charge share dealing custody fees and minimum share dealing commissions are £1 in the UK or 0.05% of the deal size. Pros

Cons

Overall4.3 |

||

|

GMG Rating |

Customer Reviews 3.9

(Based on 678 reviews)

|

Annual Fees £0 – £96 |

Dealing Commission £0 |

See Offers Capital at risk

IG Reviews |

Features:

|

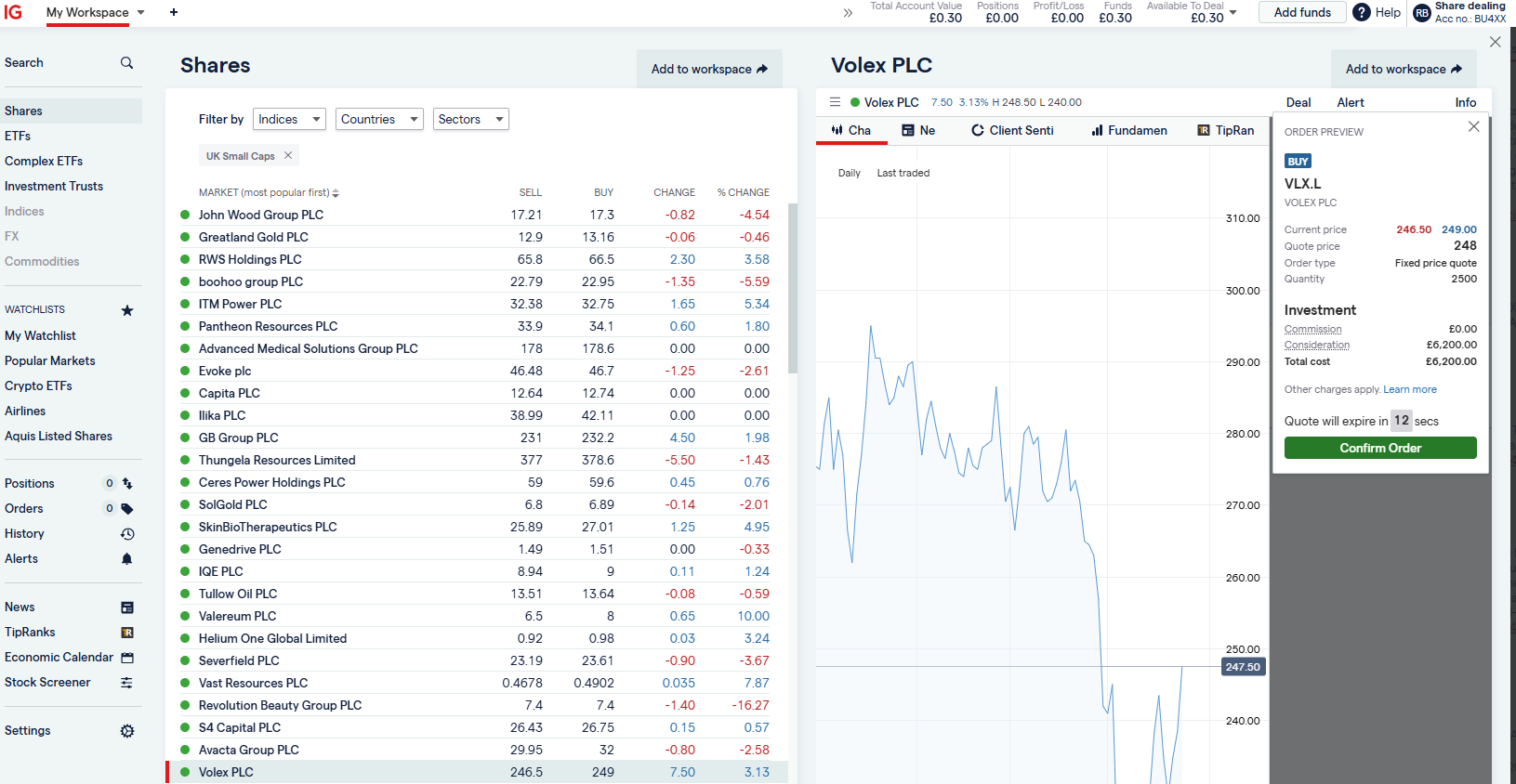

IG Share Dealing Expert Review Account: IG Share Dealing Description: With IG you can deal in over 13,000+ shares, funds and investment trusts with zero commission on US stocks and UK shares, with a foreign exchange fee of just 0.5%. You can also deal on a limited amount US shares while the market is closed. Is an IG share dealing account any good? An excellent share-dealing platform for those who want to deal shares regularly in the short and long term. You also get access to a huge range of UK small-cap shares, where you can request quotes from marketmakers via RSPs. This is something that is not available from other trading/investing platforms like CMC or Trading 212. An IG share dealing account is different from a spread betting or CFD trading account in that you actually own physical shares as opposed to trading derivatives. The ability to deal in shares with IG means that you can invest in companies for the long term alongside your short-term higher-risk speculation. An excellent share-dealing platform for those who want to deal in shares regularly in the short and long term.

Pros

Cons

Overall4.4 |

||

|

GMG Rating |

Customer Reviews 4.3

(Based on 1,123 reviews)

|

Annual Fees £59.88 |

Dealing Commission £3.99 |

See Offers Capital at risk

interactive investor Reviews |

Features:

|

Interactive Investor Share Dealing Review Provider: Interactive Investor Share Dealing Verdict: Interactive Investor is a low-cost share dealing platform that offers investors access to over 40,000 shares. II won the 2021 and 2023 Good Money Guide award for Best Investment Account. Summary Interactive Investor is a great choice for anyone who wants to buy and sell shares on a regular basis and has a large portfolio.

Dealing Fees: Interactive Investor share dealing commissions are a free trade every month, then UK Shares and Funds, US Shares charged £7.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free. Special Offers:

Pros

Cons Fixed-fee expensive for very small share dealing accounts below £1,000

Overall4.3 |

What does the Scottish Mortgage Investment Trust Invest In?

Before you invest in the Scottish Mortgage Trust, perhaps it would be good to take a look at some of SMT’s top holdings. The top 10 holdings of SMT comprise more than 46% of its total assets. We take a look at each below.

1. ASML (ASML)

ASML is a European tech firm that could be unfamiliar to many. But its machines are essential to modern computer chip making. ASML is one of the leaders in photolithography, particularly in the niche extreme ultraviolet lithography (EUV). In fact, ASML is perhaps the only supplier of the latest EUV machines in the world. When a company has a stranglehold like this (a ‘wide moat’, so to speak), investors are bound to be pleased (think: Microsoft’s windows). Gross margin is an impressive 49%. And, the company isn’t small – its market cap is worth a staggering $233 billion. The company is also listed in the States.

2. Moderna (MRNA)

Moderna, the biotech firm using mRNA (messenger RNA), was one of the pandemic winners. During 2020/21, the firm raced to invent a new vaccine that protect millions against coronavirus. It succeeded. Now, Moderna is employing the same mRNA technology, of which two early inventors were awarded 2023 Nobel prizes, to create new medicines (to cure rare diseases, flu, among others). This is an exciting area. But Moderna’s share prices are on the slow drift south. How long will it take for MRNA’s share price surpass its pandemic peak is difficult to guess.

3. Nvidia (NVDA)

Nvidia is currently the sector leader in the booming Artificial Intelligence (AI) industry. Its products are heavily subscribed in the world of accelerated computing, data centres, gaming, and AI platforms. So powerful is its future growth rate that the market recently awarded Nvidia the coveted $1 trillion market capitalisation in the summer. However NVDA’s share price is overbought after a massive surge; its price trend is vulnerable to a consolidation. Watch for a break below $400 support.

4. Tesla (TSLA)

This EV car company needs no further introduction. Tesla is spearheading the EV revolution. In 2023, the Elon Musk-led firm is racking up record global sales. Ergo, the market anticipates Tesla to continue enlarging its market share in the competitive world of consumer car market. Its nearest pure EV competitor is China-based BYD (BYDDF). Tesla’s share price is highly volatile, which will filter through to impact SMT’s asset values.

5. Mercadolibre (US:MELI)

Mercadolibre was one of the first Latin American tech stocks to list in Nasdaq. The $63 billion company operates the largest online platform in South America. Formed in 1999, the Uraguay-based company has been expanding throughout the years and now has more than 150 million customers on its system in 18 Latin America nations. MELI’s latest 10Q report shows revenues in the first-half at $6.45 billion and net income of $463 million. Scottish Mortgage first invested in Mercadolibre back in 2020 before the massive price surge to $2,000 (see below).

6. Amazon (US:AMZN)

Amazon is one of original giants of internet retailing. While its founder Jeff Bezos had stepped down from the company back in 2021, the $1.3 trillion company remains as financially strong as ever. Its cloud system (AWS) is a major contributor to Amazon’s underlying profit (quarterly operating income totalled $5.4 billion). The company has a massive locked in on internet spending and this is possibly why SMT is continuing to invest in AMZN shares.

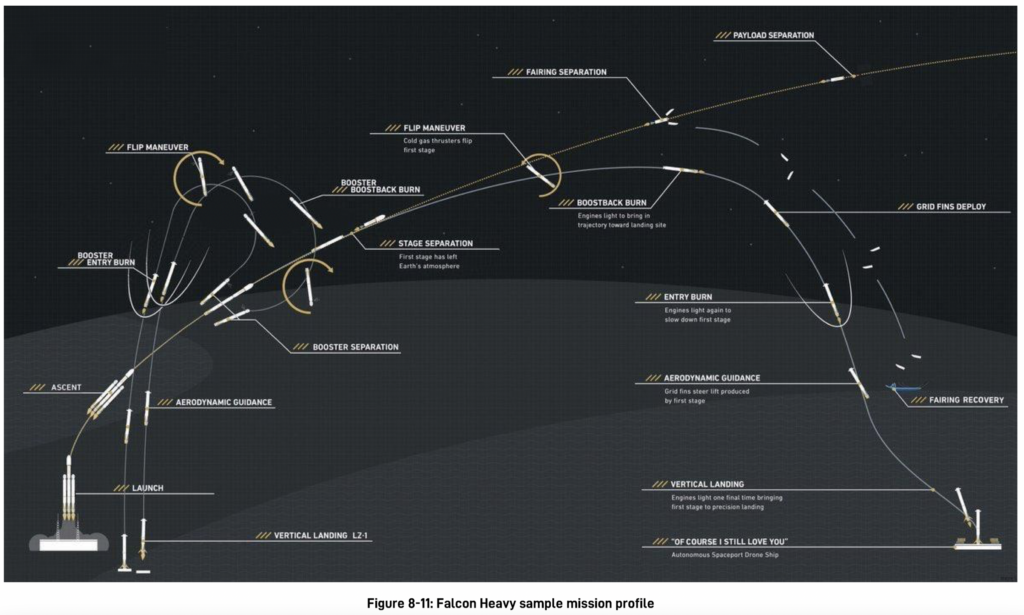

7. Space X

Space X is another Elon Musk-led company. Scottish Mortgage first bought into Space X in December 2018 – at a valuation far lower then. In early 2023, a $750 million funding round saw Space X’s valuation reach $137 billion; and in July ’23, valuation jumped further to $150 billion. So far, Space X has launched 5,000 satellites in low Earth orbit to solidify its Starlink network. This space-based internet connection has 1 million customers. Few private companies have a lead in space-based broadband as wide as this. Reusable rockets (Falcon 9, showed below) is another ‘edge’ that Space X possesses. Right now, SpaceX is ploughing billions into its commercial system. Payday will come later, perhaps via IPO. When this happens, excitement will grow significantly on SpaceX.

Source: SpaceX.com, Falcon User Guide

8. Northvolt

Northvolt (www.northvolt.com) is a Swedish battery company founded by former Tesla executives. Its main business is to serve the EV revolution and the booming energy storage requirements. Just recently, Northvolt raised $1.2 billion convertible note to expand its factory in Poland. It is also setting up the first battery plant in Canada, which will cost $7 billion in the first phase alone, to supply high-performance lithium-ion battery cells to electric automobiles. Total Northvolt customer orders are as high as $55 billion. Scottish Mortgage first invested in Northvolt in 2020. But public valuation data for Northvolt is hard to come by. Perhaps only when the IPO happens will we know for sure how much SMT’s stake is worth.

9. PDD (PDD)

PDD is the abbreviation for the Chinese retailer PinDuoDuo (PDD). Founded only in 2015, the Nasdaq 100 company reported sales of US$12.4 billion in the 1H of 2023 (operating income totalled $2.9 billion). Not bad for an 8-year old retailer! Growth was extremely high in its early years and surprised many big players like Alibaba (BABA). No wonder PDD’s share price rebounded significantly from its 2022 lows. The market likes PDD because it also owns Temu, a fast-growing internet-based retailer which ships products directly from China (www.temu.com) and competes with Shein.

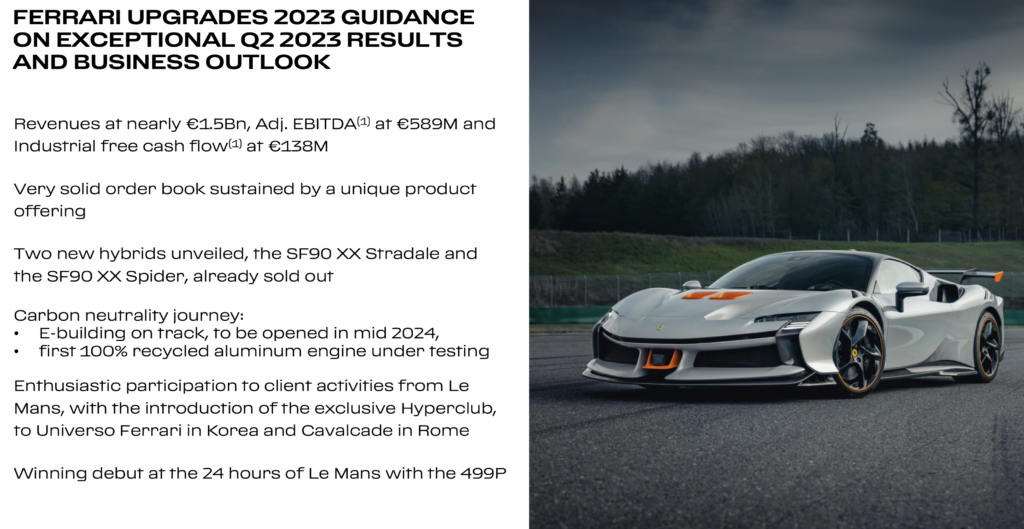

10. Ferrari (RACE)

The company certainly needs to further introduction. Ferrari is the ultimate luxury car that most people dream of owning. The car company’s clientele are extremely wealthy; and they have no trouble waiting for a new Ferrari (some say up to three years for certain models). According to its latest quarter report, Ferrari’s revenue came in at E1.5 billion and its order book appears strong. Many models are sold out. The prancing-horse’s business moat is therefore extremely wide and durable – a business that is likely to prosper in the years ahead. That said, Ferrari’s share price is consolidating its recent rally.

Source: Ferrari

Read next:

What is the Scottish Mortgage Trust (SMT)?

Scottish Mortgage Trust is a century-old investment trust listed on the London Stock Exchange. As of September 2023, the fund has assets of more than £13 billion, of which nearly £12 billion are shareholders funds (latest annual report here). Edinburgh-headquartered Baillie Gifford (www.bailliegifford.com) managed this flagship investment trust.

Scottish Mortgage Trust is famed for its early bets on promising companies that subsequently turned into giants. Under the stewardship of James Anderson, who retired in 2021 after spending twenty years as SMT’s manager, he parlayed small tech bets into multi-billion gains for SMT shareholders.

SMT famously invested in Tesla (US:TSLA) in 2013 when its share price was still in the single digit. By 2021, SMT’s investment gains in the EV carmaker soared to a staggering $29 billion. Other early investments in Alibaba (BABA) and Amazon (AMZN) also reaped massive profits for the fund. Unsurprisingly the covid-stock boom saw Scottish’s share price surged from £5 to nearly £16 – the final culmination of a long bull run (see below).

According to the Financial Times , during 2001-2021 when James Anderson was managing the SMT, the fund’s total returns reached a stunning 1,300 percent. Investors who sticked with the fund through the Global Financial Crisis and pandemic made a fortune. So big is the Trust now that it is a member of the blue-chip FTSE 100.

Read next:

Should you buy the Scottish Mortgage Trust now?

Scottish Mortgage Trust is well-known for riding the long bull market in leading US Nasdaq stocks. It was one of the first to invest Tesla. While that bet has been pared back somewhat (5.3% of portfolio still owns Tesla), other companies are slowly replacing it. After such a long bull market SMT can be vulnerable to a further decline.

What are the pros and cons of investing in the Scottish Mortgage Trust?

On the upside:

- SMT is managed by an experienced team who had researched their investment thoroughly

- Globally positioned, SMT invests in many parts of the world as long as the business systems are competitive

- Portfolio includes many privately listed companies that average investors couldn’t buy (see below)

- A well-diversified equity portfolio geared towards businesses with strong ‘moats’ or excellent long-term growth

But you should be aware that:

- SMT’s share price trend is fairly violent these days; swings in share prices may be higher than expected since the trust is still mired in a bear trend; technical support is observed at 600p

- Tech shares may decline or underperform the market

- Privately-listed companies valuation are unknown – since they’re not “marked to market” regularly

Here are the (latest) top 16 holdings of the Scottish Mortgage Trust:

Source: Scottish Mortgage Trust (Aug 2023)

Over the past year or so, they have relinquished older bets and acquired newer (and hotter) tech stocks like Nvidia (NVDA) – the leader in the AI boom.

Perhaps a thematic grouping of SMT’s portfolio may help you to understand the the fund’s structured. Broadly, SMT’s holdings are concentrated among:

- Technology – ASML, Nvidia, Tesla,

- Healthcare – Moderna, Illumina

- China – PDD, Meituan, ByteDance, Tencent

- Consumer – Amazon, Mercadolibre, Kering, Ferrari,

- Private – Space Technologies, Northvolt

Of course, there are other bets like Wise (WISE), or Spotify (unlisted) that are geared towards ‘fintech’ (financial technology).

In sum, Scottish Mortgage is about pivoting into the next-gen sector leaders that can bring sustained growth over many years.

Source: Scottish Mortgage Trust

Read next:

Featured Brokers For Buying Scottish Mortgage Investment Trust Plc Shares

You can buy these shares in either a general investment account, stocks & shares ISA or SIPP for your pension with one of the brokers below.

| Name | Logo | GMG Rating | Customer Reviews | Annual Fees | Dealing Commission | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews 4.2

(Based on 1,094 reviews)

|

Annual Fees 0% – 0.25% |

Dealing Commission £3.50 – £5 |

See Offers Capital at risk

AJ Bell Reviews |

Features:

|

AJ Bell Share Dealing Review Provider: AJ Bell Share Dealing Verdict: AJ Bell is a low-cost online investing platform and is the cheapest share dealing platform for buying and selling shares for the UK do-it-yourself (DIY) investor. They also offer plenty of investment ideas, including investment guides and equity research. Summary A great choice to deal shares with low costs in a variety of investment accounts.

Fees: AJ Bell share dealing account fees are capped at £3.50 a month. Dealing costs are £1.50 for funds and £5 for shares but drop to £3.50 when there were 10 or more online share deals in the previous month. Special Offers:

Pros

Cons

Overall4.2 |

||

|

GMG Rating |

Customer Reviews 3.8

(Based on 1,763 reviews)

|

Annual Fees 0% – 0.45% |

Dealing Commission £5.95 – £11.95 |

See Offers Capital at risk

Hargreaves Lansdown Reviews |

Features:

|

Expert Review Account: Hargreaves Lansdown Share Dealing Description: Hargreaves Lansdown offers access to the widest selection of stocks for share dealing accounts in the UK. The platform also has one of the best research portals for analysing stocks. Is it expensive to buy and sell shares on Hargreaves Lansdown? Hargreaves Lansdown is not as expensive as it used to be as there is no account charge for holding shares in a general investment account and a max of £3.75 in a stocks and shares ISA. HL does still cost more than competitors like AJ Bell and Interactive Brokers to buy and sell shares, but the account running costs can be lower because of the monthly cap. HL won the Best Stock Broker in our 2024, 2022 awards, and in 2021, it won Best Full-service Stockbroker for their all-round approach to customer service.. Another added bonus of dealing shares through HL is that their clients benefit from price improvements for best execution. HL say they reach out to multiple brokers to get the best prices for a trade and clients can make a saving of £18 per trade on average. This is particularly relevant if you are dealing with cap UK shares, which is where Hargreaves Lansdown excels. Overall, Hargreaves Lansdown is an excellent choice for most types of share dealing on UK and international markets. Pros

Cons

Overall4.9 |

||

|

GMG Rating |

Customer Reviews 3.6

(Based on 74 reviews)

|

Annual Fees 0.4% – 0.08% |

Dealing Commission £1 – 0.08% |

See Offers Capital at risk

Saxo Reviews |

Features:

|

Saxo Share Dealing Review: Lower fees and professional grade tech Account: Saxo Share Dealing Description: Saxo’s platform has share dealing on more than 50 stock exchanges around the world with 22,000 shares available for investors. Making it one of the most diverse investment platforms for share dealing in the UK. Its forte is on the trading side for traders that need direct market access and are more price-sensitive to bid/offer spreads. Is Saxo any good for share dealing? Yes, you can deal shares directly on exchange with Saxo. In fact, Saxo is one of the best DMA brokers for trading shares inside the bid/offer price as you can place your orders directly on the order book. Saxo’s platform has share dealing on more than 50 stock exchanges around the world with 22,000 shares available for investors. Making it one of the most diverse investment platforms for share dealing in the UK. Its forte is on the trading side for traders that need direct market access and are more price-sensitive to bid/offer spreads. Saxo is a good share dealing platform for sophisticated and advanced investors who also need direct access to capital markets. Fees: Saxo Markets charges a share dealing commission based on a percentage of transaction size. They are very competitive though, and UK share dealing commission starts at 0.1% (£100 if you buy £100,000 worth of stock) and drops to 0.05% for more active traders. As Saxo is a prime broker with a retail and institutional client base, they are one of the best share dealing platforms for larger customers. However, there are some downsides. Firstly they do not offer acesss to smaller cap shares on their trading platform like brokers Spreadex and IG, who have a much braoder range of shares to trade online. Secondly, you cannot trade shares as financial spread bets (where profits are free of capital gains tax). Finally, the cost of dealing shares with Saxo is higher than with a broker like Interactive Brokers. But Saxo wins hands down when it comes to customer services, research and analysis. Pros

Cons

Overall4.3 |

||

|

GMG Rating |

Customer Reviews 4.5

(Based on 1,330 reviews)

|

Annual Fees £0 |

Dealing Commission £3 |

See Offers Capital at risk

Interactive Brokers Reviews |

Features:

|

Interactive Brokers Share Dealing Review Provider: Interactive Brokers Share Dealing Verdict: Interactive Brokers is an excellent account for sophisticated share dealers who want to manage their own portfolio with complex order types actively and need access to a wider range of investment products like derivatives, options, and futures. They also offer fractional share dealing if you only want to start trading a small amount. Summary One of the most advanced share dealing platforms for beginners and professional investors.

Fees: Interactive Brokers does not charge share dealing custody fees and minimum share dealing commissions are £1 in the UK or 0.05% of the deal size. Pros

Cons

Overall4.3 |

||

|

GMG Rating |

Customer Reviews 3.9

(Based on 678 reviews)

|

Annual Fees £0 – £96 |

Dealing Commission £0 |

See Offers Capital at risk

IG Reviews |

Features:

|

IG Share Dealing Expert Review Account: IG Share Dealing Description: With IG you can deal in over 13,000+ shares, funds and investment trusts with zero commission on US stocks and UK shares, with a foreign exchange fee of just 0.5%. You can also deal on a limited amount US shares while the market is closed. Is an IG share dealing account any good? An excellent share-dealing platform for those who want to deal shares regularly in the short and long term. You also get access to a huge range of UK small-cap shares, where you can request quotes from marketmakers via RSPs. This is something that is not available from other trading/investing platforms like CMC or Trading 212. An IG share dealing account is different from a spread betting or CFD trading account in that you actually own physical shares as opposed to trading derivatives. The ability to deal in shares with IG means that you can invest in companies for the long term alongside your short-term higher-risk speculation. An excellent share-dealing platform for those who want to deal in shares regularly in the short and long term.

Pros

Cons

Overall4.4 |

||

|

GMG Rating |

Customer Reviews 4.3

(Based on 1,123 reviews)

|

Annual Fees £59.88 |

Dealing Commission £3.99 |

See Offers Capital at risk

interactive investor Reviews |

Features:

|

Interactive Investor Share Dealing Review Provider: Interactive Investor Share Dealing Verdict: Interactive Investor is a low-cost share dealing platform that offers investors access to over 40,000 shares. II won the 2021 and 2023 Good Money Guide award for Best Investment Account. Summary Interactive Investor is a great choice for anyone who wants to buy and sell shares on a regular basis and has a large portfolio.

Dealing Fees: Interactive Investor share dealing commissions are a free trade every month, then UK Shares and Funds, US Shares charged £7.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free. Special Offers:

Pros

Cons Fixed-fee expensive for very small share dealing accounts below £1,000

Overall4.3 |