XTB Customer Reviews

Tell us what you think of this provider.

Generally ok

Generally ok

Bad

Bad

the best investment platform, one-stop…

the best investment platform, one-stop shop, good for all types of instruments and all types of investments

Waw

Waw

outstanding, user friendly platform…

outstanding, user friendly platform

Great customer support, cheap and…

Great customer support, cheap and easy to use

easy, intuitive, fast , execution…

easy, intuitive, fast , execution time on point

0% commission on stocks is…

0% commission on stocks is great

the best

the best

3/5

72% of retail investor accounts lose money when trading CFDs with this provider

XTB – Good Money Guide’s Expert Review

XTB Review: A Great All Round Trading & Investing Platform

Provider: XTB

Verdict: XTB is a CFD and forex broker headquartered in Poland and listed on the Warsaw Stock Exchange (WSE:XTB) valued at over $1bn. XTB was founded in 2003 and offers forex, indices, commodities, ETF and stock CFD trading. XTB has historically used celebrity endorsements to promote it’s brand including Jose Mourinho, Conor McGregor, Joanna Jędrzejczyk and Jiří Procházka.

72% of retail investor accounts lose money when trading CFDs with this provider

Is XTB a good broker?

XTB, are a decent all-round trading platform and a good choice for most small-to-medium sized CFD traders. They are publically listed in Poland and offer, competitive spreads on a fairly wide range of markets.

The key things to focus on when considering trading with XTB are:

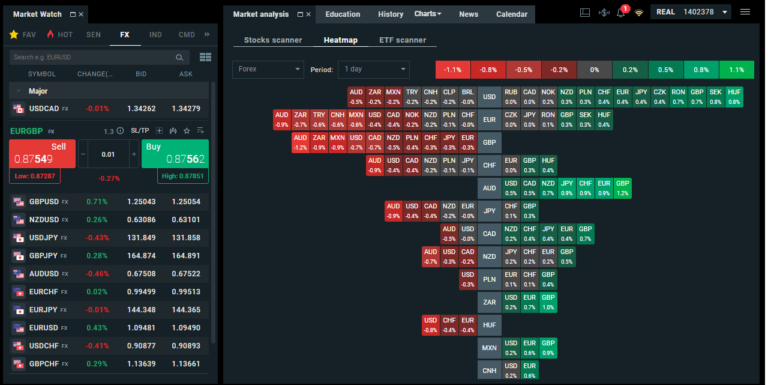

- They have their own proprietary trading platform. When I interviewed Omar Arnaout, the XTB CEO Omar Arnout, he said “I’m really proud of our platform and honestly believe it’s one of the best in the market.” Rightly so.

- They really push client education, XTB won “Best Trading Platform Education” in our 2023 awards (although they didn’t show up to collect the trophy, they never do). You can read their Q&A on forex education here.

- Customer service is paramount. Omar said that “first and foremost is the customer service”. I really agree with this as I think it’s important to have a few different trading accounts (diversify, diversify, diversify) and you’ll trade more with the broker that treats you best.

Pros

- Publically listed

- Mulitple platform choices

- Innovative order types

Cons

- Not UK based

- No DMA

-

Pricing

(4)

-

Market Access

(4)

-

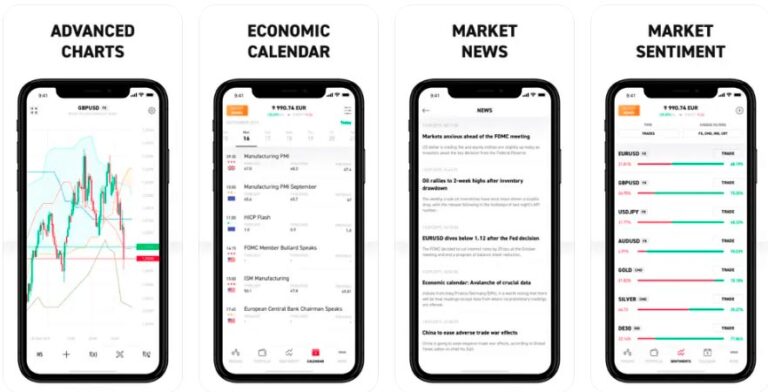

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4

Our XTB Ratings Explained

- Pricing: Industry standard and inline with tight spreads

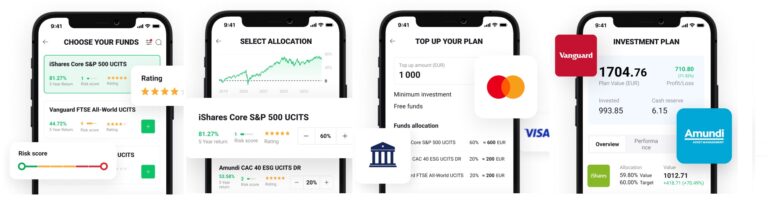

- Market Access: Getting better all the time as XTB embrace long-term investing

- Platform & Apps: Very good, with some really innovative features and integrations

- Customer Service: Industry standard.

- Research & Analysis: Lots of educational ‘masterclasses’ built-in.

72% of retail investor accounts lose money when trading CFDs with this provider

XTB Facts & Figures

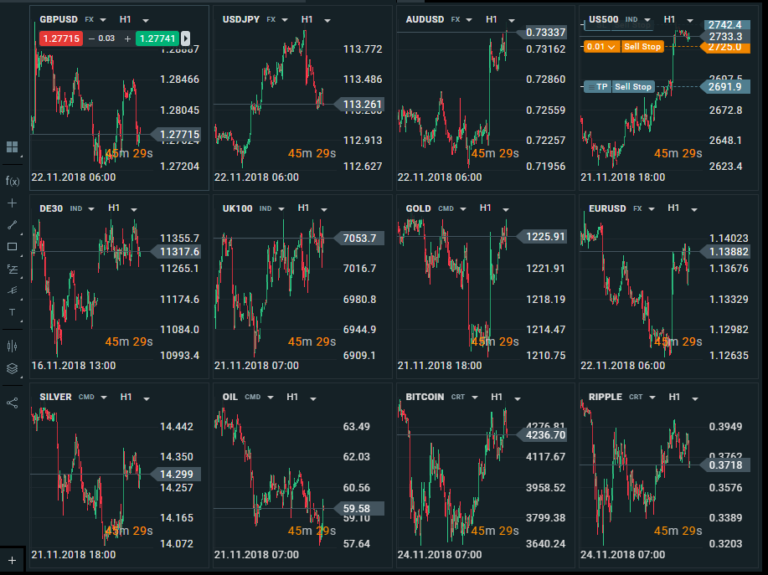

| Total Markets | 2,100 |

| ➡️Forex Pairs | 57 |

| ➡️Commodities | 22 |

| ➡️Indices | 25 |

| ➡️UK Stocks | 230 |

| ➡️US Stocks | 1080 |

| ➡️ETFs | 138 |

| Broker specifics | |

| 👉Active Clients | Over 447,000 |

| 💰Minimum Deposit | 0 |

| ❔Inactivity Fee | 10EUR per month |

| 📅Founded | 2002 |

| ℹ️Public Company | ✔️ |

| Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ❌ |

| ➡️DMA (Direct Market Access) | ❌ |

| ➡️Futures Trading | ❌ |

| ➡️Options Trading | ❌ |

| ➡️Investing Account | ❌ |

| Average Costs | |

| ➡️FTSE 100 | 1.7 |

| ➡️DAX 30 | 1 |

| ➡️DJIA | 3 |

| ➡️NASDAQ | 1 |

| ➡️S&P 500 | 0.5 |

| ➡️EURUSD | 0.9 |

| ➡️GBPUSD | 1.4 |

| ➡️USDJPY | 1.4 |

| ➡️Gold | 0.35 |

| ➡️Crude Oil | 3 |

| ➡️UK Stocks | 0.08% |

| ➡️US Stocks | 0.08% |

XTB News

Is XTB on MT4 or MT5?

Expert opinion: XTB reviewed & rated Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide),

Is XTB any good for forex trading?

In this guide, we review XTB’s forex trading platform for pricing, market access, platform features, customer service and research and

XTB Trading App Review

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison

XTB’s Boost Uninvested Cash Interest Rates For Stocks & Shares ISA

XTB has raised interest rates for UK clients on uninvested cash, offering 4.2% on US Dollars and 2.3% on Euros

What is XTB’s trading platform?

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison

Shift to investing boosts XTB client numbers by 50% to 1.4 million

XTB onboarded nearly 500,000 more clients last year, bringing its total customer base to more than 1 million. In its

XTB CFD Trading Review

XTB CFD Trading Review Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of

XTB’s demo trading account is a breath of fresh air

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison

XTB ETF coverage rivals HL and AJ Bell with new additions

XTB ETF (exchange-traded fund) coverage has expanded with the recent addition of new products to its platform, bringing the broker

Are Xtrade and XTB connected?

No – XTB & Xtrade are two completely separate trading companies. XTB is a popular forex and CFD broker. Through

XTB retirement account launched as it grows multi-currency card

XTB has introduced individual retirement accounts for investors in Poland as it seeks to grow its share of the European

XTB signs Zlatan Ibrahimović

Polish multi-asset brokerage XTB announced a partnership with a sporting legend as it welcomed Zlatan Ibrahimović onto its team. Zlatan,

Is an XTB ISA on the cards?

XTB the Polish multi-asset broker becomes the latest firm to expand into UK retail investment products. XTB ISA The ISA

XTB aims to add ISAs to it’s Investing Plans

Investment Plans allow users to build a personalised portfolio of ETFs that are specifically aligned with their attitudes towards risk

XTB adds auto ETF investing plans for UK clients

XTB investment plans allows UK clients to save and invest regular amounts via a range of ETF-based strategies. Using the

Can you trade commodity futures on XTB?

Can you trade commodity futures on XTB? No, XTB does not offer DMA futures trading, but you can trade commodities

Is it legal to use XTB for indices trading?

Yes, XTB is regulated by the FCA (Financial Conduct Authority) in the UK, so it is safe to trade indices

XTB adds fractional share trading to its offering

XTB has introduced fractional share trading where clients cane to trade in fractions of a wide range of stocks and

XTB eXtends To Be a real stock broker by offering physical equities

XTB UK customers can now trade physical stocks alongside CFDs and margin FX products. As of today, UK clients can

XTB, kicking and punching it’s way to $1bn

XTB, with a little help from major sponsorship and partnership deals with fighters like Conor McGregor, and football manager Jose

XTB is the latest broker to jump on the zero commission CFDs bandwagon

CFD broker XTB has introduced commission-free CFDs on more than 2000 stocks from around the world. XTB zero commission CFDs

XTB posts impressive growth in its Q4 earnings release

Warsaw-based Forex platform and CFD broker XTB updated investors with its Q4 earnings this week. Positive news in XTB’s Q4

Forex Education – Q&A with Joshua Raymond from XTB

A while ago, we spoke to Joshua Raymond about putting effective trading strategies in place. Now, as XTB seeks to

xStation 5 – XTB Launches an Upgraded Mobile Trading App

XTB has recently released an upgraded mobile trading app, with a raft of powerful new features, driven by both client

Joshua Raymond from XTB talks to us about traders upgrading to professional status and putting effective trading strategies in place

Thanks for talking to us Josh. First and foremost, why the switch to XTB? To be perfectly honest, I had

Omar Arnaout, XTB CEO give us his views on ESMA and progression from CFDs to multi-asset investment brokerage

How long have you been CEO of XTB and what did you do beforehand? I’ve been CEO and President of

XTB FAQs:

Yes, we rate XTB as a good broker and can recommend it based on their pricing, reputation, customer service, regulator status and platform features.

Yes. If you are trading through the FCA regulated entity of XTB your funds are protected by the FSCS. However, it’s important to note that XTB offers CFDs which are a high-risk and volatile way to invest and trade the market.

There is no minimum deposit required to open an account. However, you will need enough funds on account to cover the initial and variation margin of the positions you open.

XTB say it takes one business day to withdraw funds from your account. However, this process may be delayed if you use a different withdrawal/deposit method due to AML regulations.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.