PensionBee Customer Reviews

Tell us what you think of this provider.

Very good

Very good

Innovative and agile, great educational…

Innovative and agile, great educational tools, and I love their sustainable investment options.

Amazing customer service, fees and…

Amazing customer service, fees and content!

Easy to use and clear

Easy to use and clear

simple to use

simple to use

Simple and I’m invested in…

Simple and I’m invested in the Impact Plan.

easy to use, does one…

easy to use, does one thing very well

Exceptional product in its industry

Exceptional product in its industry

great platform for managing your…

great platform for managing your pensions

5/5

PensionBee Expert Review

In this review, we look at what PensionBee offers in terms of investments, the performance of its plans, its fees and charges, and more. We also look at how it stacks up against competitors in the pension space.

PensionBee Expert Review: Great For Combining Old Pension In One

Provider: PensionBee

Verdict: PensionBee is an online pensions company that has over 240,000 customers. Founded in 2014 by CEO Romi Savova, its aim is to make pensions simple so that everyone can enjoy a happy retirement. With PensionBee, you can set up a new pension from scratch. Or you can consolidate all your old pension accounts. Once you have an account set up, you can view your balance and make contributions to your account online or via the company’s app.

Is PensionBee a good pension provider?

PensionBee is a great way to track down all your old pensions and combine them into one easy-to-manage online pension in a range of different plans managed by established fund managers like State Street, Blackrock and Legal & General.

PensionBee is a good choice for those who want a hassle-free pension and are looking to consolidate old pensions into one account.

Market Access: What investments does PensionBee offer?

PensionBee offers customers a range of investment plans. These are managed by large-scale global money managers such as BlackRock, HSBC, and Legal & General and have different risk levels.

The plans on offer include:

- Tracker – This invests your money in a mix of global shares and bonds.

- Tailored – This is essentially a ‘target-date fund’ that invests your money differently as you go through life, moving your money into safer investments as you get older.

- Fossil Fuel Free – This is a sustainable investing plan.

- Impact – This plan invests in companies addressing the world’s greatest social and environmental needs.

- 4Plus – The aim of this plan is to achieve long-term growth of 4% per year above the cash rate.

- Shariah – With this plan, your money is invested in Shariah-compliant companies.

- Preserve – This is a lower-risk plan that makes short-term investments in creditworthy companies.

- Pre-annuity – This invests your money in bonds to provide you with returns that broadly correspond to the cost of purchasing an annuity.

| Plan | Fee | Risk level | Managed by |

| Tracker | 0.50% | Medium | State Street Global Advisors |

| Tailored | 0.70% | Varies | BlackRock |

| Fossil Fuel Free | 0.75% | Higher | Legal & General |

| Impact | 0.95% | Higher | BlackRock |

| 4Plus | 0.95% | Medium | State Street Global Advisors |

| Shariah | 0.95% | Higher | HSBC |

| Preserve | 0.50% | Lower | State Street Global Advisors |

| Pre-annuity | 0.70% | Higher | State Street Global Advisors |

Looking at this range of plans, PensionBee’s offering is a little limited compared to those of rivals. For example, competitors such as Moneybox and Nutmeg offer far more investment options.

How have PensionBee’s plans performed?

PensionBee display their pension plan returns on an average annual basis so you can see how much you would have made on average if you’d been invested with you. The best performing PensionBee pension fund is the Shariah managed by HSBC/State Street, which has seen average annual returns of over 16%, mainly because it contains 100% stocks and shares like Nvidia, Apple, Microsoft and Meta, which are higher risk than including bonds.

However, PensionBee also has pension plans for older investors, which take on less risk like the 4Plus, which only has annual returns of just over 5%. This is fine because the closer you get to the pension age, the less risk you should take.

| PensionBee Plan | Manager | 3-Year Annualised | 5-Year Annualised |

| 4Plus | State Street Global Advisors | 3.77% | 5.37% |

| Tailored LifePath Flexi | BlackRock | -1.05% | 2.46% |

| Shariah | HSBC / State Street | 11.48% | 16.82% |

| Tracker | State Street Global Advisors | 3.53% | 6.07% |

| Pre-Annuity | State Street Global Advisors | -11.09% | -5.38% |

| Preserve | State Street Global Advisors | 3.80% | 2.34% |

What is interesting about this is that even though some plans have performed very well, as a recent survey from PensionBee found that out of 1,000 UK adults, only 8% we prepared to take on a high amount of risk for their pension. 46% said they wanted moderate risk, and 26% opted for lower risk investments. Surprisingly, 5% said they didn’t care and wanted the professionals to make all the decisions for them.

Fees:

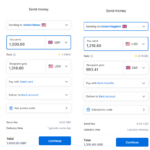

With PensionBee, you pay one simple annual fee of between 0.50% and 0.95% per year depending on the plan you choose. This fee is calculated daily and automatically deducted from your account each month (or when you switch or transfer your plan).

Note that if your pension is larger than £100,000, the company will halve the fee on the portion of your savings over this amount. So, for example, if you have £120,000 in the Tracker plan, the fee for £20,000 of the £120,000 will be reduced from 0.50% to 0.25%.

Now, some of PensionBee’s fees are pretty competitive (i.e. 0.50% for the Tracker plan). But they can be beaten. With Vanguard, for example, it’s possible to pay around 0.25% annually.

Is it worth consolidating your pensions with PensionBee?

There are several benefits of consolidating your old pensions into one account. For a start, bringing together your different accounts makes it much easier to manage your money. When your retirement savings are all in one place, monitoring your investments takes less time and it’s much easier to work out if you’re on track for retirement.

Combining pensions also allows for a better understanding of your asset allocation. If your money is spread out over many different pension providers, it can be difficult to keep track of your asset mix and know how much risk you’re taking on.

Additionally, consolidating your pensions can enable you to lower your costs. Today, many pension providers, including PensionBee, have tiered fee structures where annual charges are lower for higher account balances.

It’s worth pointing out that a pension consolidation is not always the best move. If you are a member of a defined benefit pension scheme, or you have a pension that comes with valuable benefits such as guaranteed annuity rates, you may be better off sticking with your current provider.

Is it easy to withdraw money from PensionBee?

With PensionBee, you have to follow standard UK pension rules. So, you cannot withdraw your money until age 55 (57 from 2028). When you reach the age of 55, you can either take your pension flexibly online through PensionBee drawdown, or you can buy a pension annuity through Legal & General. Note that at 55, you can only withdraw 25% of your pension tax-free.

What do you need to open a PensionBee pension?

Opening an account with PensionBee is a straightforward process. You can sign up either online or via the app. When signing up, you’ll need to provide some basic details such as your legal name, your current address, your date of birth, and your National Insurance number. If you wish to transfer old pensions to PensionBee, simply tell PensionBee the names of your old pension providers and some basic information and they will do the rest.

PensionBee Alternatives

If you’re looking for a pension or SIPP provider, some other options include:

- Hargreaves Lansdown – With a Hargreaves Lansdown SIPP, you have access to thousands of different investments.

- Moneybox – Moneybox offers access to investment funds, ETFs, and US stocks.

- Nutmeg – Nutmeg also offers a range of ready-made portfolios and has ESG options.

- Vanguard – Vanguard offers extremely low fees and a wide range of funds.

Pros

- The user-friendly platform

- Excellent customer service from ‘BeeKeepers’

- The tiered fee structure

Cons

- Limited investment strategies

- Limited investment options

- Lower peer-relative returns

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.2PensionBee FAQs

On average, pension transfers take around 12 weeks to complete.

PensionBee’s default plan is the Tailored plan. This is a ‘target-date fund’ that moves your money into safer investments as you get older.

No. With PensionBee you can’t invest in stocks or ETFs. You can only invest in its plans.

Yes. PensionBee offers several sustainable investing plans.

PensionBee is regulated by the UK’s Financial Conduct Authority (FCA). So, you should consider it to be safe.

Yes. If you’re eligible for tax relief, it will be applied to your account (only 20% tax relief is applied automatically).

No. It’s free to set up an account with PensionBee and also free to combine your old pensions.

PensionBee South East England Investors Lead as UK Pension Gaps Persist

The latest Pension Landscape 2025 report from online pension provider PensionBee reveals stark divides in how much Britons are saving for retirement, with gender, age and region all playing a decisive role. Based on more than 285,000 customers, the study shows the average UK pension pot has climbed 9% to £21,875, outpacing inflation. While women’s

PensionBee Report Uncovers 1,000-Day Pension Transfer Delays, Calls for Urgent Reform

Private pension provider PensionBee has launched a scathing attack on the UK’s pension transfer system, publishing a report that reveals shocking delays—some stretching over 1,000 days—and calling for the introduction of a legally enforced 10-day Pension Switch Guarantee. The report, A Switch In Time, produced with consultancy the lang cat, exposes widespread inefficiencies and rogue

Financial Wellbeing Takes Center Stage as PensionBee and ClearScore Join Forces

Private pension provider PensionBee has launched a new partnership that aims to unify retirement planning and credit management. Partners PensionBee and ClearScore have unveiled a venture aimed at transforming how individuals manage their financial futures. The collaboration inserts PensionBee’s retirement planning capabilities, directly into ClearScore’s Credit Health platform. What will this new service allow users

PensionBee ESG credentials bolstered by record EthiFinance score

The sustainability credentials of ESG-conscious retirement platform PensionBee have been given a boost in the latest EthiFinance ratings assessment. EthiFinance has give a record PensionBee ESG (environmental, social, governance) score, at an overall 86/100 in its 2023 assessment. This represents an overall rise of 10 points from the year before and 21 points from 2021,

PensionBee is buzzing about pension performance stinging savers

Analysis by PensionBee reveals that pension funds are delivering better returns than many British savers expect. PensionBee’s Pension Performance Benchmark analysis found that leading pension funds have delivered an average annual return of 7.72%, over the past five years for those who are 30 years from retirement. This figure is higher than the 5% to

PensionBee reaches £5bn in assets from over 250k customers

PensionBee recently announced that it has reached £5.0 billion in assets under administration (AUA) and 250,000 invested customers, demonstrating significant growth and a strong position in the UK pension market. PensionBee is a leading online pension provider in the UK that aims to simplify pension management by helping its customers combine old pensions, make new

PensionBee’s customer base tops 500,000 but losses increase

Online pension provider, PensionBee, has reported a big jump in losses for the first half of the year, so why do they still look so cheerful? It was good news and bad news for online private pension provider PensionBee. On the downside, there was a 145% leap in pre-tax losses and a drop in its

PensionBee offers Mini Harvard Course

PensionBee aims to develop its human resources by offering its employees mini MBAs run along similar lines to Harvard education. If you’re working for pension provider PensionBee, you’ll have a chance to complete a mini-MBA led by their own CEO. The 10 week program is led by CEO Romi Savova – who has an MBA

Romi Savova, PensionBee CEO on narrowing the pension advice gap

A recurring theme when I talk to CEOs and Fund Managers about long-term investing is that to make money most of the time you should do absolutely nothing. That, however, is in stark contrast to the fact that you must do something absolutely immediately, as soon as possible, this instant. Both are true, you should

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.