-

Jackson Wong PhD

Jackson Wong PhD

- Updated

In this guide, we will explain the best ways to send money to Europe using currency brokers for large amounts and money transfer apps for smaller amounts. Use our comparison of what we think are the best accounts for sending money to Europe to compare how many currencies they offer, what the minimum and maximum transfer sizes are, or if they offer currency forwards and currency options. You can also see how established a company is by comparing when they were founded, how many customers they have and how much money they transfer abroad.

Best ways to send money to Europe from the UK

- Use a currency broker like OFX for large EUR money transfers

- Use a money transfer app like Wise for smaller EUR money transfers

- Never use your bank for EUR money transfers as it is very expensive unless you are with a new fintech bank like Revolut that has discounted exchange rates

| Currency Broker | Number of Currencies | Min Transfer | Forward Contracts | Same Day | Customer Reviews | Get Quote |

|---|---|---|---|---|---|---|

| 40 | £100 | 24 months | ✔️ | 4.9

(Based on 2,604 reviews)

| Request Quote |

| 40 | £100 | 12 months | ✔️ | 4.8

(Based on 912 reviews)

| Request Quote |

| 55+ | £250 | 12 months | ✔️ | 4.4

(Based on 49 reviews)

| Request Quote |

| 30+ | £3,000 | 24 months | ✔️ | 4.7

(Based on 91 reviews)

| Request Quote |

Compare exchange rates for sending money to Europe

Use our Euro exchange rate comparison tool to request quotes from multiple providers and see how you could save up to 4% on large EUR currency transfers versus using your bank when you send money to Europe.

Please note: The rates displayed in this currency conversion quote tool are supplied to us directly from the currency brokers as a percentage mark-up. Please ensure you read our guide to getting the best exchange rates guide.

Pound To Euro Forecast – Is Now The Best Time To Buy Euros From Pounds?

The pound-to-euro forecast is an indication of where technical and fundamental analysts think the GBPEUR price may be in the future. You can use these exchange rate forecasts to help you decide if now is the right time to buy Euros, or if you should wait until the price improves.

GBPEUR Forecast Highlights

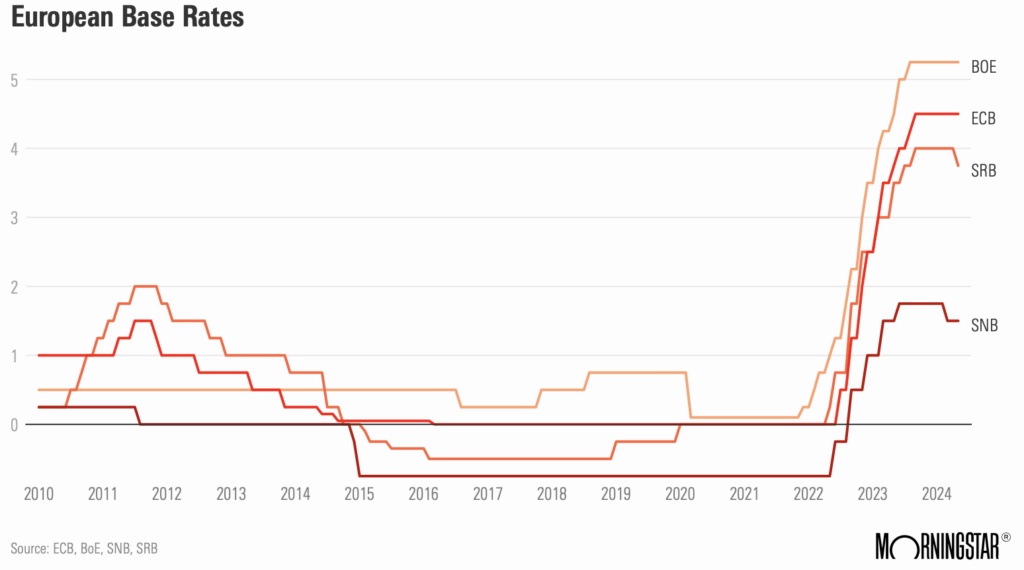

- ECB is eyeing to cut policy rate ahead of the Bank of England

- GBPEUR rebounds to the top of trading range on modest GBP strength

- Range trading is expected for now; an upside breakout at 1.18 is not to be ruled out

How has the Pound performed against the Euro recently?

Until recently, GBPEUR traded in a tight range. Watching the rate is like watching paint dry.

Fortunately, UK politics shook things up and injected a dose of excitement in the market. The Prime Minister, after some deliberation, pencilled in a date in July for a General Election. Sterling firmed up in anticipation of this momentous event.

Against the Euro, the rate bounced up and down the 1.16-1.17 range before settling above 1.170. In fact, the exchange rate edged up (intraday) to its highest level since late 2022 (see below). This is interesting. Is the market expecting some disequilibrium factors between the UK and EU?

The European Central Bank (ECB) is meeting this week (6 June) to decide on the broad monetary policy. According to market expectations, the Eurozone governing council is set to cut interest rate for the first time in years. Riksbank, the central bank of Sweden, already slashed interest rate in May. So ECB’s cut is following the lead of fellow European banks. The ECB policy rate, currently at 4.5 percent, is expected to fall by about 25 basis points.

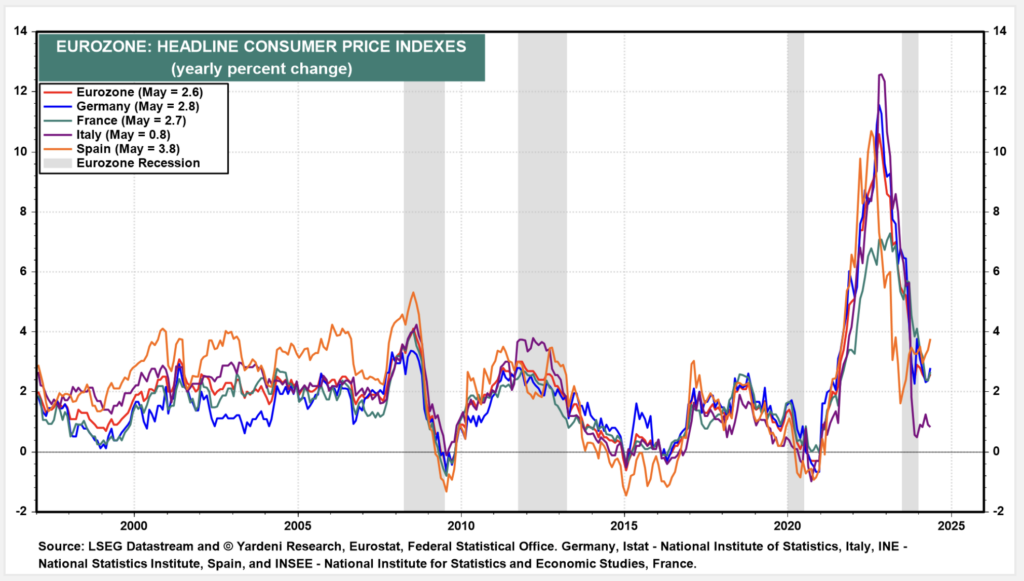

Two critical reasons are pushing the central bank to drop rates. One is falling inflation rates. The other is sluggish growth. The Eurozone suffered from a technical recession in the seance half of 2023.

The question is how far the ECB will drop the borrowing cost? For now, market participants are expecting no more than the 3 times in 2024. After all, we are already at half-way mark in 2024 and inflation rates are not really plunging into zones that inflation hawks feel comfortable.

Moreover, asset prices are generally holding up. The German DAX Index, for example, is trading near its all-time highs. As is the CAC 40. This signals to policymakers that the Eurozone economic conditions are not as bad as feared. At this point, there is no need for aggressive action in either direction.

As ECB is turning dovish first, GBPEUR may edge above the 1.175 range high.

Source: Morningstar.co.uk

Is it a good time to buy Euros with Pounds?

Based on the above analysis, it is a good time to buy Euros now?

Summer is starting and if you’re in need of some Euros for holidays in the continent, now may not be a bad time to secure these Euros with a currency forward. The fx rate GBPEUR is pretty stable and trades near the upper side of the range.

Of course, you may wish to wait further – betting on further GBP strength. This only works if you can afford to delay buying the Euros. The risk is that Sterling may weaken due to underperforming GBP day-to-day macro dataflow or concerning political trend. Buying on the spot when you need the Euros always carries some risks.

Will the pound get stronger against the Euro in 2024?

Earlier this year, Sterling got off to a good start and outperformed 90 percent of all other currencies in the first quarter.

This heady sentiment subsided somewhat in spring. Only in recent days did GBPEUR staged a modest rebound. But will this new-found Sterling strength persist for the rest of the year?

Two factors need to keep in mind. The first is politics. While Labour is set to win the general election, its economic policy is yet to be determined fully. Shocks and surprises may still hit (or boost) the currency later this year.

The second factor is the GBP-EUR interest rate differential. If a rate cut did materialise in Europe in the coming days, the ECB is widening the rate differential between the UK and the Euro. This may boost the GBP temporarily – until the Bank of England also start to cut interest rates. Remember, economic synchronicity between UK and Europe is high.

In sum, GBP may continue to exhibit strength against the Euro, but this strength could be fleeting. Unless, of course, Britain generates a string of GBP positive newsflow, like a sudden improvement in consumer spending, exports, et cetera. At this point, do not expect a massive disequilibrium trade in the GBPEUR.

Source: Yardeni.com (June 2024)

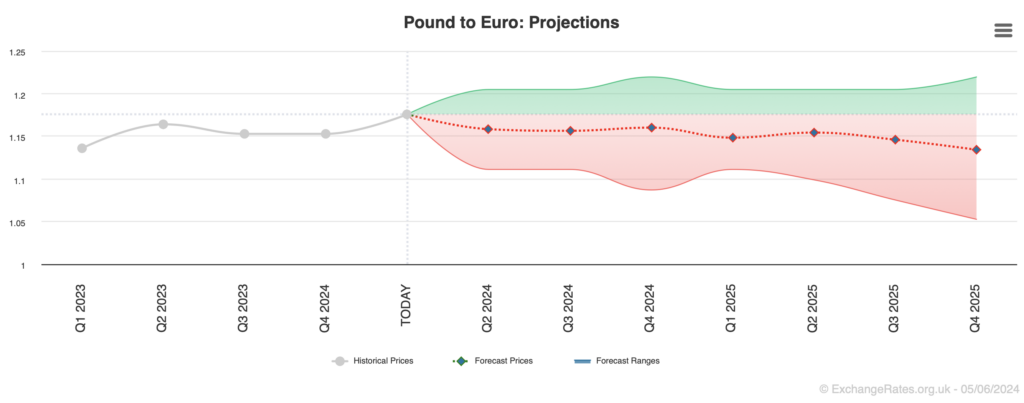

What is the GBPEUR forecast in weeks, months, years?

GBPEUR is slowly trading in the upper side side of horizontal range (1.15-1.17). Despite Sterling’s recent strength, the market is still feeling slightly downbeat on the GBP.

If we look at the aggregate forecasts for the rate, GPBEUR, the consensus is that we may see a modest decline of the exchange rate int 1.15 later this year. The projection chart below is taken from Exchangerateforecast.org.uk.

This shows that most analysts are not convinced that Sterling will continue to show strength from here. There is too much economic synchronicity between the two trading partners. Even monetary policies are quite similar these days.

But these exchange rate predictions should be viewed with some scepticism given how dynamic the macro situations are right now. If, for instance, the economic performance deteriorates more than expected in Europe, that may alter the expected path of the policy rate and the GBPEUR rates.

Chartwise, GBPEUR is ranging at the band 1.150-1.180.

Source: Exchangerates.org.uk (June 2024)

Where is the best place for buying large amounts of Euros from Pounds

There are two different ways people buy Euros from Pounds

- Through a currency broker like Currencies Direct, OFX or Corpay– when transferring money abroad

- Through a forex broker like CMC Markets, City Index or IG – when speculating on the price of currency

You can use our comparison table of currency brokers to see how many currencies they offer, what the minimum Euro transfer is and if they offer forwards and currency options as well as when they were established. You can either visit each currency broker individually or use our currency quote comparison tool to request multiple exchange rates.

Or, if you are more interested in trading GBPEUR, you can compare forex brokers here.

What is the live GBPEUR exchange rate?

The current GBPEUR exchange rate is 1.15446 which is a change of 0.06% from the previous days closing price. Over a week GBPEUR is 0.06%, compared to it’s change over a month of 0.7% and one year of -3.37%.

GBPEUR exchange rate data is updated every 15 minutes.

Methodology

We have chosen what we think are the best ways to send money to Europe based on:

- over 17,000 votes in our annual awards

- our own experiences testing the currency brokers

- an in-depth comparison of the money transfer app features that make them stand out compared to alternatives.

- interviews with the international payment company CEOs and senior management

History of the Euro (EUR)

The Euro exchange rate is the price you pay when you buy and sell Euros against other currencies. It is essentially the price of the Euro versus other currencies.

Exchange rates have been in existence for hundreds of years. A currency is measured against other currencies. Before 1971, most currencies were pegged to gold. For example, $35 US dollars exchanged for 1 ounce of gold. That fixed rate system (Bretton Woods) broke down in the early seventies. Most currencies are now free-floating, meaning the value of a currency fluctuates over time.

Compared to many other currencies, the Euro is a relatively young one. The transition to the Euro from old European currencies like the Italian Lira and Deutsche Mark was completed sometime in 2002. Whilst young, the Euro has become a very important currency. It is the official currency 19 countries within the Eurozone.

Did you know that the Euro was the second most traded currency in the world after the US dollar? In 2019, a Bank of International Settlement surveyed revealed that around $2.19 trillion of the currency was traded every day. This figure is almost 3 times the daily figure for Pound Sterling. Moreover, around 20 percent of the world’s foreign reserves are in the Euro.

Associated with the creation of the Euro is the presence of the European Central Bank (ECB). Not only does the central bank manage the monetary policy inside the Eurozone, it also controls the issuance of the Euro. Policies of the ECB significantly impact the movement of the Euro. The current ECB president is Christine Lagarde.

In the next few years, we may see the creation of the ‘digital Euro’.

Factors that move the Euro Exchange Rate

The Euro is subjected to multiple factors impacting its current and future movements. Broadly speaking, four factors are always in the calculus of investors and traders:

- Economic factors – such as balance of payments, economic policies of major Eurozone countries, inflation, growth rates etc

- Interest rates – monetary policies and the level of interest rates

- Political factors – such as elections of major Eurozone countries

- Market Sentiment – such as positioning of the trades, technicals of rates etc

The issue with these factors is that their importance are time varying. Sometimes the market places more attention on interest rates, sometimes debt policies of major governments are a concern.

These days, the most important policies – economic and monetary – are related to the pandemic.

For example, the ECB has drummed up €1.85 trillion of asset purchases via the Pandemic Emergency Purchase Programme to sustain the Eurozone economies during the past year.

But despite these bond buying programs, the Euro has strengthened, especially against the US Dollar. Why? Because the Fed is printing even more, thus suppressing the value of greenback against other currencies.

These days, it is safe to say that no country wants a strong currency. This makes their exports uncompetitive. The Swiss Franc, for instance, was hyper strong in 2011 but the Swiss National Bank devalued it that year. The Japanese Yen was strong until the BoJ enacted a multi-trillion QQE that devalued the currency massively during 2013-14. Central bank interventions are always possible when a currency appreciates.

Live Euro exchange rates

The current best Euro exchange rate versus other G10 currencies is the mid-market price which is:

| Australian Dollar (AUD) | 1.698355 |

| Canadian Dollar (CAD) | 1.611365 |

| Japanese Yen (JPY) | 183.3435 |

| New Zealand Dollar (NZD) | 1.9657 |

| Norwegian Krone (NOK) | 11.41368 |

| United Kingdom Pound Sterling (GBP) | 0.8662 |

| Swedish Krona (SEK) | 10.54258 |

| Swiss Franc (CHF) | 0.91607 |

| United States Dollar (USD) | 1.18859 |

Sending money to Europe FAQ:

The best way to send money to Europe is to use a currency broker.

As well as getting the best exchange rates, if you send money to Europe with a currency broker you also get:

- Expert help and advice to reduce your risk and exposure

- Dedicated account managers every step of the way

- Convert funds online and platform access 24/7

- Same day and forward currency exchange contracts

- Zero service charge, commission or transfer fees

- Transfer money direct to single or multiple beneficiary accounts

When you convert and transfer Euros (EUR) with a currency broker your fixed exchange should be a maximum of 0.5% from the mid-market for currency transfers. To put this in perspective, banks traditionally charge 3-5% which means that if you are sending £100,000 worth of Euros you could save up to £4,500 with a currency broker versus the banks.

Request a quote to see how much you can save – you’ll find a better Euro exchange rate than by using your bank.

Our comparison tables and Euro (EUR) exchange rate quote request forms will help you find the best EUR exchange rate. Our exchange rate comparison tables highlight the key features of currency transfer providers whereas Euro exchange rate quote request forms will make currency brokers compete for your business by offering the best exchange rate.

Here are a few tips on getting the best Euro (EUR) exchange rate:

- Always compare (read our guide to comparing exchange rates here)

- Never go with your bank

- Understand the fees

- Use a currency forward to lock in the current exchange rate

If you think the EUR exchange rate is going to go in your favour you should wait. Or, if you are worried the rate will move against you, it is possible to lock in the current rate for up to a year in advance with a currency forward.

Yes, you can send money using PayPal, but it is very expensive. If you are only planning on sending a small amount of money to Europe a money transfer app is much cheaper.

With a currency broker, you can send an unlimited amount of money to Europe. Money transfer apps are good for sending under £10,000. Banks are the worst way to send money to Europe because of the high fees.

The three main ways to send money to Europe are:

- Large amounts – currency brokers like Key Currency, Global Reach and OFX

- Medium amounts money transfer apps Like Wise and XE

- Small and cash amounts – wire transfer providers like Western Union (WU)

Yes, the best way to get the currency exchange rate if you want to send money to Europe is to use a currency forward where you buy the currency now by putting down a small deposit and pay the balance when you make the transfer.

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the EUR money transfer providers via a non-affiliate link, you can view them directly here: