Xe Money Transfers Expert Review

Provider: Xe

Verdict: Xe started off life as an online currency conversion calculator, then started flogging the data to currency transfer providers, then in 2002 decided to compete with all it's customers and offer online money transfers (which it provides through HiFX in the UK. At the time, HiFX was one of the largest money transfer providers in the UK, but as Xe.com is one of the largest currency conversion calculators in the world (in the top 500 websites by traffic) HiFX decided to rebrand to Xe.

Is Xe a good international money transfer app?

Xe is a good option if you are looking for cheap no no-frills, small to medium-sized currency transfers from a trusted and well-established brand. However, if you have a large amount of currency to transfer and need personal service, you are better off with a currency broker.

I’ve always liked Xe.com, the website has always been an excellent resource for currency information. But ever since they were bought by Euronet under their HiFX brand in 2017 you can now use them for international currency transfers. They offer loads of currencies, a slick app, and the ability to send money by debit, credit card and bank transfer to other bank accounts, to be picked up as cash or to a mobile wallet. As international payments have grown in popularity you can also use them for business international payments.

Is Xe cheap for international money transfers?

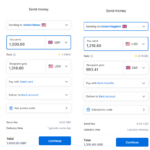

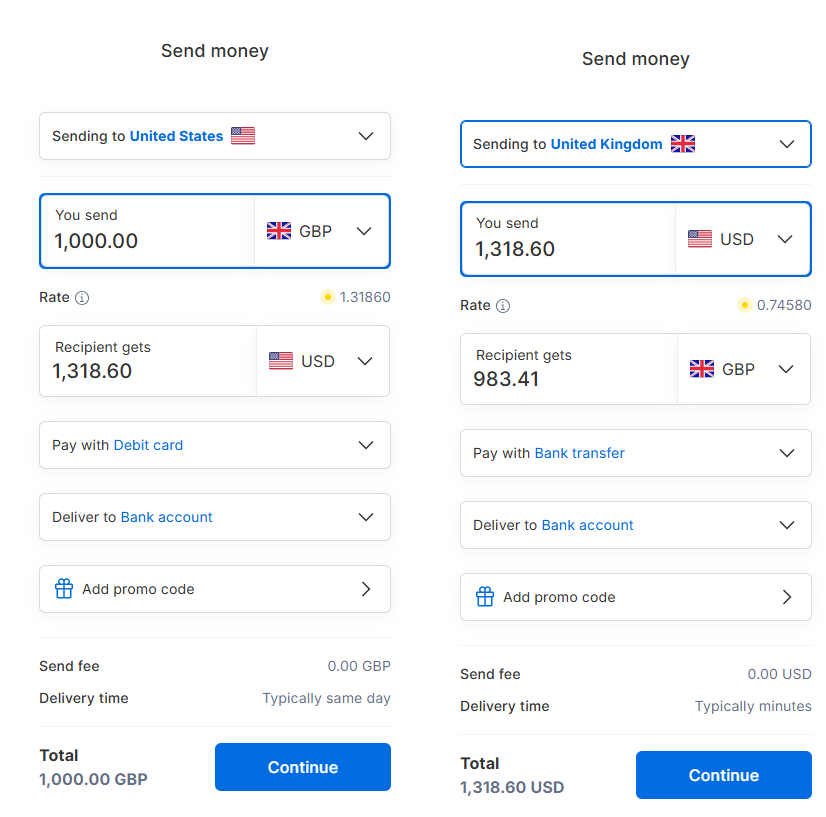

I’m not sure Xe is as cheap as it used to be. When I was testing the app it looks like Xe exchange rates are around 1% from the midmarket. When I requested some quotes, the midmarket was 1.3294 for GBPUSD, and Xe quoted me 1.3186. Doing it the other way round, the USDGBP rate was 0.7522 and Xe quoted 0.7458 (about 0.85%) away from the mid-market.

It’s a bit frustrating that money transfer apps are still hiding fees in the exchange rate market up (read my guide on how to compare exchange rates here). Especially when it says there is no send fee. Granted, “Send Fee” and “Exchange Rate Market Up” are two different things, but it still stinks.

Is Xe safe for money transfers?

Yes, we rate Xe.com as a safe way to send money abroad as they have been established since 1995, owned by a larger parent company and are authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration 462444, for the provision of payment services.

Who owns Xe.com money transfers?

Xe.com is ultimately owned by Euronet Worldwide Inc, which is a public company listed on the NASDAQ with the ticker code EEFT. Xe.com is managed by HiFX, which acquired XE.com in 2017. Prior to this HiFX only offered money transfer services for business, but the acquisition enabled them to offer individual currency transfers. You can see thier share price and how much they are worth below.

Pros

- Discounted exchange rates

- Good data and charting

- Good currency calculator

Cons

- Not suitable for large transfers

- No forwards or hedging

-

Exchange Rates

(4)

-

Available Currencies

(4)

-

App & Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(3)

Overall

3.8Xe Customer Reviews

Xe Facts & Figures

| 💱 Total Currencies | 98+ offered |

|---|---|

| 💵 Min Transfer | £1 |

| 💰 Max Transfer | $500,000 |

| 🛒 Customers | 500,000 |

| 🏛️ Founded | 1993 |

| 🏢 HQ | Newmarket, Canada |

| ⚖️ Regulated | Yes - by the FCA |

| Account Options | |

| 🧍 Personal Transfers | ✔️ |

| 👔 Business Transfers | ✔️ |

| 📅 Currency Forwards | ❌ |

| 💸 Currency Options | ❌ |

| 🤝 Personal Service | ❌ |

| 📱 Phone Dealing | ❌ |

| ⌨️ Online Platform | Yes - very easy to use |

| ⭐ TrustPilot Rating | 4.3/5 |

| 🌐 Website | Visit Xe |

Xe Alternatives

Xe’s closest competitors are Wise and Remitly for small transfers, you can compare them against other money transfer apps below:

| Money Transfer App | Currencies | Min | Max | Bank Transfer | Credit Card | Debit Card | Cash | Customer Reviews | More Info |

|---|---|---|---|---|---|---|---|---|---|

| 50 | £1 | £1m | ✔️ | ✔️ | ✔️ | ❌ | (Based on 217 reviews)

| See Rates |

| 130 | £1 | £50k | ✔️ | ✔️ | ✔️ | ✔️ | (Based on 122 reviews)

| See Rates |

| 75 | £1 | £5k | ✔️ | ✔️ | ✔️ | ❌ | (Based on 25,913 reviews)

| See Rates |

| 98 | £1 | £500k | ✔️ | ✔️ | ✔️ | ❌ | (Based on 117 reviews)

| See Rates |

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.