This Investing Returns Calculator is an easy and effective way to explore how your money could grow through investing. Whether you’re saving for a long-term goal, comparing potential outcomes for an ISA or SIPP, or simply curious about the power of compounding, it’s a great starting point for understanding how small, regular investments can add up over time.

What is a investment returns calculator?

The Good Money Guide Investing Returns Calculator is designed to help you estimate how much your money could grow over time through investing.

By entering a few key details such as your starting amount, how much you plan to invest regularly, your expected rate of return, and how long you’ll invest for, the calculator gives you an instant projection of your potential portfolio value.

It’s a simple way to visualise how compounding returns work and how regular investing can help you build wealth over time.

How to calculate your returns on investment?

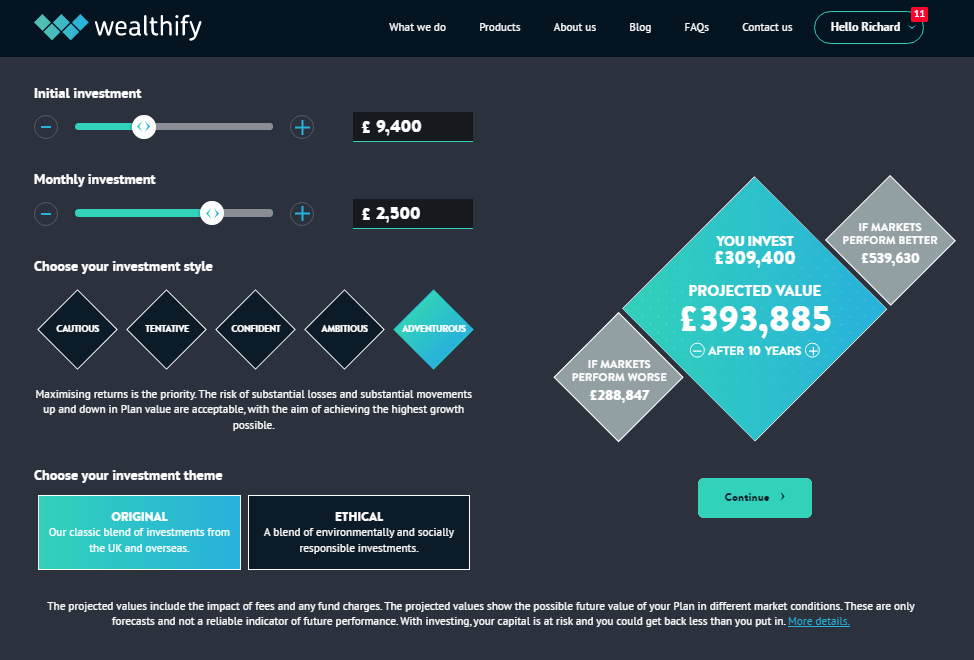

To get started, fill in the fields provided. Begin with your initial investment, which is the lump sum you plan to invest at the start. Next, enter the expected annual return, which is the percentage growth you hope to achieve each year. Be realistic here — long-term market returns are often between 4% and 8% depending on risk and asset mix. You can then add a monthly investment amount if you intend to make regular contributions. Finally, set the duration in years to see how your investment might perform over time.

How much money can you make investing?

Once you’ve entered the information, the investing returns calculator will display three main figures: your final portfolio value, your total investments, and your total returns. The final portfolio value shows what your money could be worth at the end of the chosen period, combining your contributions and growth. The total investments figure represents how much you’ve personally paid in (your initial amount plus any monthly payments), and the total returns show how much growth your portfolio could generate over the period.

The results are best used as a guide rather than a guarantee. The calculator assumes a steady, fixed rate of return and doesn’t account for investment fees, taxes, or inflation — all of which can affect your real-world returns. For a more accurate picture, try testing a few different scenarios, such as optimistic, conservative, and middle-of-the-road return rates, to see how changes in performance could affect your outcome.

For example, if you start with £2,000, invest £100 each month, and achieve a 5% annual return over 10 years, your portfolio might grow to around £18,000. Of that, about £14,000 would be your own contributions, and roughly £4,000 would come from investment growth. This demonstrates how compounding works — your money earns returns, and then those returns go on to earn more.

Ready to start investing?

| Name | Logo | GMG Rating | Customer Reviews | GIA Annual Fees | Dealing Commission | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews |

GIA Annual Fees £59.88 |

Dealing Commission £3.99 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees 0% |

Dealing Commission £1 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees 0.6% |

Dealing Commission £0 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees £0 |

Dealing Commission 0.05% |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees 0% - 0.75% |

Dealing Commission £3.95 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees 0% - 0.25% |

Dealing Commission £3.50 - £5 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees 0% - 0.45% |

Dealing Commission £5.95 - £11.95 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees 0.12% |

Dealing Commission 0.08% |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees 0.15% |

Dealing Commission £0 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees £120 |

Dealing Commission £0 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees £96 |

Dealing Commission £0 |

See Offer Capital at risk |

Features:

|

|