Multi-asset investment platform eToro has launched a new recurring investments feature, allowing users in the UK, Europe, and UAE investors to automatically buy stocks, ETFs, and cryptoassets at regular intervals.

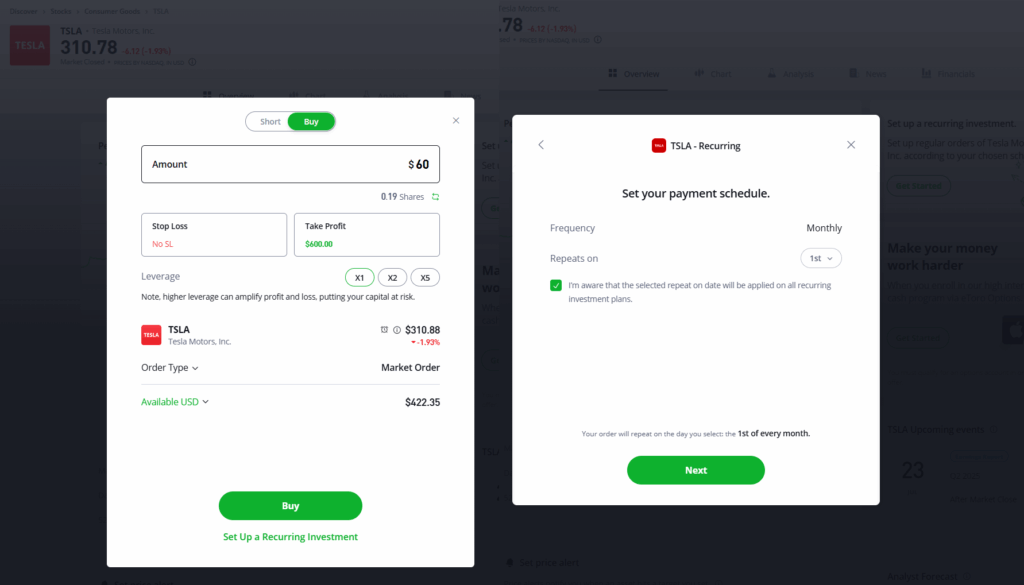

The new functionality is designed to support long-term investing habits, enabling users to set up automatic buy orders on a weekly, bi-weekly, or monthly basis. With minimum investments starting from just $25, the feature allows up to $5,000 per transaction and a total monthly limit of $25,000.

According to eToro’s Retail Investor Beat survey, 45% of respondents said they use recurring investments to stick to a consistent investment plan that fits their budget. Others cited time savings (41%), avoiding the stress of market timing (29%), and the benefits of dollar-cost averaging (25%) as key motivations.

Tuval Chomut, Chief Solutions Officer at eToro, said: “The launch of recurring investments is part of our mission to empower long-term investors and reduce the emotional impact of market volatility. By automating contributions, investors can remain consistent and focused on their goals.”

Recurring investments are available in a phased rollout across 20 European countries, including the UK, France, Germany, and Sweden. Users in the Netherlands can currently only access recurring plans for stocks and ETFs, with crypto support to follow. The feature excludes CFDs, SmartPortfolios, and CopyTrading products. ETF investments are not currently supported in Switzerland, while crypto is unavailable for recurring purchases in Belgium and the UAE.

This release follows other recent updates to eToro’s platform, including new portfolio tools and local currency accounts for UK and EU users, aimed at reducing foreign exchange fees when investing in domestic stocks.

With over 40 million users across 75 countries, eToro continues to evolve from a trading platform into a comprehensive investment ecosystem. The addition of recurring investments strengthens its appeal to passive and long-term investors seeking a simple, automated way to build wealth over time.

There are a couple of things to watch out for, though, when you set up a regular investment for small amounts, if you do not have enough funds in your account balance, this will trigger payments from your card, which will incur deposit fees, that could quickly eat into your investments.

Plus, at the moment, you can only set up weekly regular investments, which is a little more limiting compared to other brokers that let you set up regular investments like InvestEngine and Lightyear.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.