The natural Gas forecast is an indication of where technical and fundamental analysts think the nat gas price may be in the future. You can use these gas forecasts to help you decide if now is the right time to buy Natural Gas futures, CFDs, options or derivatives or if you should wait until the price is lower.

Natural Gas Forecast Highlights

- Natural Gas corrected persistently during the summer

- Technical floors are slowly being established (eg $2 at HH Gas); the downtrend still weighs on the commodity

- Seasonality effects may impact gas prices into the year-end

How has Natural Gas performed recently?

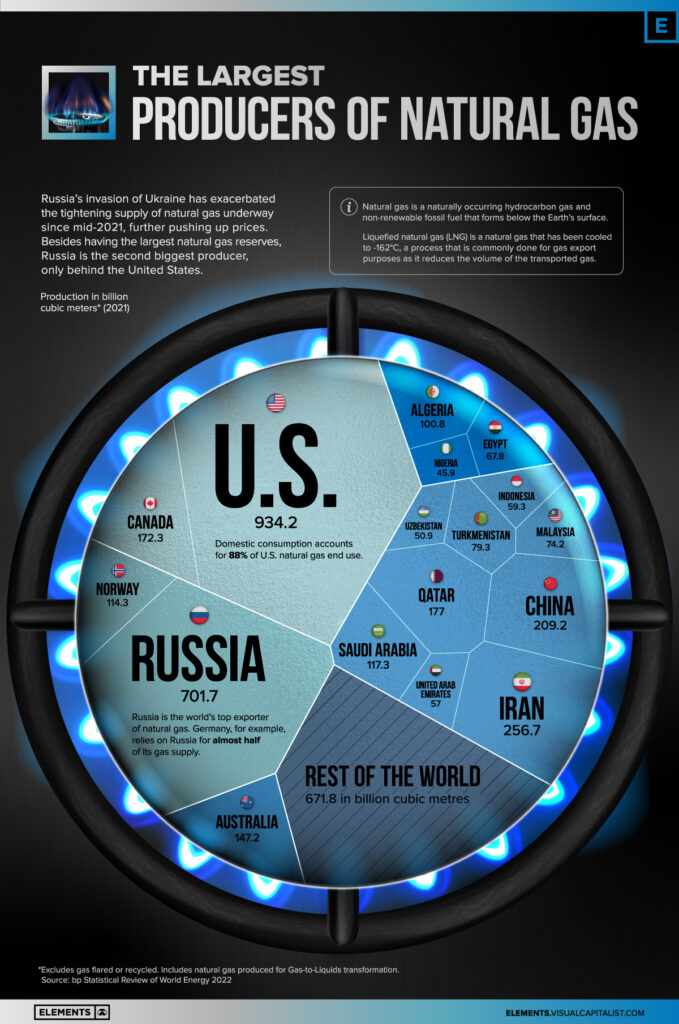

Natural Gas is an abundant natural resource used to power residential, transport and commercial entities. Odorless and colourless, natural gas is mostly produced in the US and Russia (see bel0w). Henry Hub, located in Erath, Louisiana (next to Texas), is the most well-known gas distribution hub in America. As Texas is the most prolific gas producing state (almost a quarter of US’s total), Henry Hub serves as a strategic and crucial distribution hub. Given this backdrop, gas futures traded in the CME are named Henry Hub Gas contracts with the ticker ‘NG’ (overview of NG futures contracts).

In Europe, the Intercontinental Exchange or ICE also commercialised gas trading in the UK. The gas futures contracts called ‘UK NBP Natural Gas Futures’ (link to contract specifications). However, a more frequently traded gas derivative contract is the Dutch TTF Natural Gas Futures, which is also on the ICE platform (see contract specification here).

Due to the Russo-Ukraine conflict, natural gas prices had experienced extremely wild swings over the past four years, especially in Europe. From the pandemic lows in early 2020, prices surged hundreds of percent in just 24 months (see below). Sky-high energy prices naturally heaped enormous financial pain on industrials and residential users. Inflation rates skyrocketed.

But societies adjust. Switching energy supplies, building more storage capacity and exhorting household to use less gas all help to deal with the gas crisis back in 2022/23. These tactics, and slowing demand, pulled prices significantly down from the 2022 peaks. Natural gas prices are currently range trading with their historical norms. There was a 50 percent rally back in spring and early summer. But this advance, like crude prices, has regressed back to range support. Prices are finding temporary support around $2.0.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please ask a question in our financial discussion forum.