Investors heaved a collective sigh of relief when they learned of a Sino-US trade deal in Switzerland. ‘The Art of a Deal” article series was prominently displayed on the White House website (www.whitehouse.gov), describing the details of this initial agreement with China.

Source: Whitehouse.gov (12 May)

Specifically, import duties on goods entering US and China are slashed to 30 percent and 10 percent, respectively. This is a steep drop (-115 percent) from previously announced tariffs maintained just days ago. Obviously the economic pain suffered by both economies are squeezing officials into a deal. While this initial trade deal last for only 90 days, that’s enough to get the ball rolling. Better this than nothing at all.

Slowly but surely, the world is wrested back from the brink of a global trade war. The US administration, facing global opposition to its tariff policies, has decided to adopt a more accommodative stance. The recent UK-US trade agreement shows this intention. Hopes of more trade deals are coaxing investors back into the market.

Ever the high-beta trade, the Nasdaq 100 Index spiked as China-US inked initial agreement. Nvidia (NVDA), Tesla (TSLA), Broadcom (BRCM) – all rallied sharply. These companies have significant revenue from China.

For investors who have stayed on the sidelines, the temptation to rush back into risk assets grows. When they finally succumb, this will push equity prices higher.

But is the tariff war really over? To the pessimists, the whole issue is far from over. The conclusion of Chapter One, perhaps. The devils, as they say, will be in the details. Economist Joseph Stiglitz already voiced his concern about the UK-US trade agreement, commenting that it “isn’t worth the paper it’s written on.“

Moreover, all these trade deals failed to bring tariff rates to back to the levels before the ‘Liberation Day’. The Budget Lab at Yale shows that, as of 12 May 2025, the US Average Effective Tariff Rate still stands at the highest level since 1930 (see below). The dark economic days of those times ought to tell leaders not to repeat the same mistake.

This tariff chart raises another important point – are markets too bullish about prospects of ‘trade deals’? Many stocks have rebounded 30-50 percent from their April lows. These rallies may have priced a lot of the ‘good news’ already. The fact that long-term US interest rates have continued to rise despite the initial sino-US trade deals is concerning. Lastly, the impact of tariffs on corporate profitability may only emerge throughout the year.

Source: Budget Lab at Yale

Equity Breakouts

Still, for investors they have to act on price signals. Current equity prices suggest that fears of an all-out global trade war have subsided substantially. And despite the gloom and doom headlines, some stock indices have even rebounded to new all-time highs, eg German Dax index. In dollar terms, the iShares Germany (US:EWG) just broke out of the massive resistance at 37.50. A long-term breakout like this normally last for some time (see below).

Interestingly, iShares UK (US:EWU) also rose to its highest level since 2015. This means that due to the recent depreciation of the US dollar, foreign stocks are showing better performances than before.

Back to question: Should we chase the rally? For overbought stocks, perhaps not. Wait for a market wobble – when all the doubt of these trade deals returns – for better entry points.

Next, I turn my attention to some interesting UK stocks below. Specifically, financials, defence and house builders.

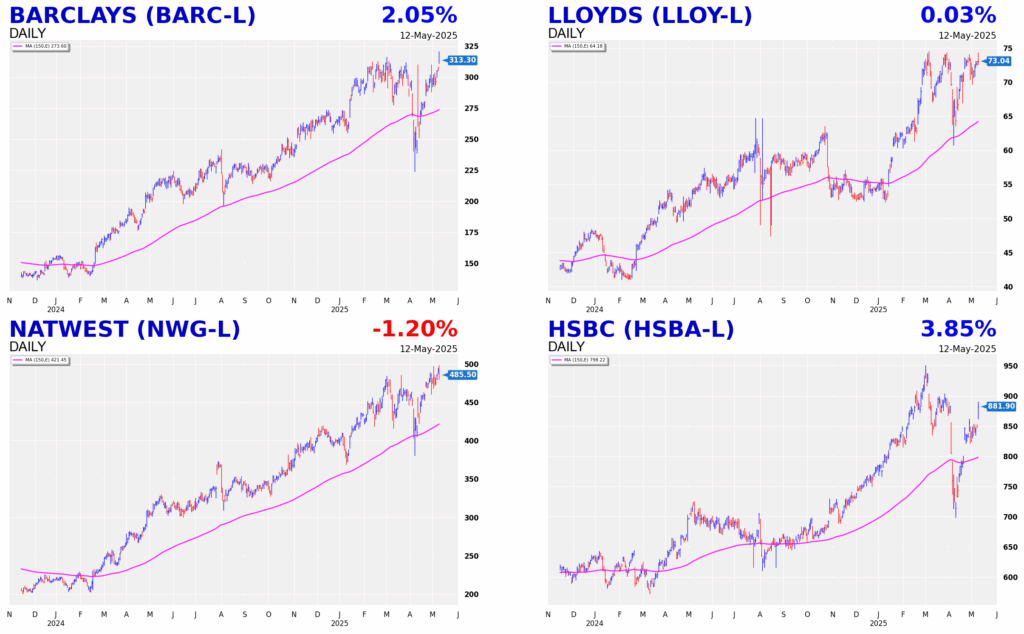

UK Banks are leading the British stock market higher

For years the UK banking sector lagged the general market. In the post-GFC, post-Brexit world, British banks struggled to revive its mojo. Just 18 months ago, Barclays (BARC) was worth a paltry £25 billion. Compared this to JP Morgan’s (US:JPM) mammoth market cap of $500 billion.

But fears about a credit event here were overdone. The profitability of these big banks outperformed expectations. So rich are some of these UK banks that billions was spent on buyback.

Barclays, for example, splashed out two buyback programs in 2024 (worth £1.75 billion), and announced another £1 billion earlier this year. Cumulatively, since 2020 Barclays bought £5.7 billion of its own shares. Lloyds (LLOY) completed a £2 billion buyback last year and aims to buy up to £1.7 billion worth of shares in 2025.

Enlarging banks’ earnings per share have enticed investors. No wonder banks’ share prices have been rising non-stop since February 2024. More impressively, they staged excellent recovery rallies last month. Fading trade war concerns immediately sent bank shares to their 52-week highs, evident of strong underlying demand here. Further medium-term upside expected.

Other large financials, such as Prudential (LSE:PRU) and Standard Chartered (LSE:STAN), also looked technically bullish. The former is reversing its long-term downtrend decisively and could propel higher in the months to come.

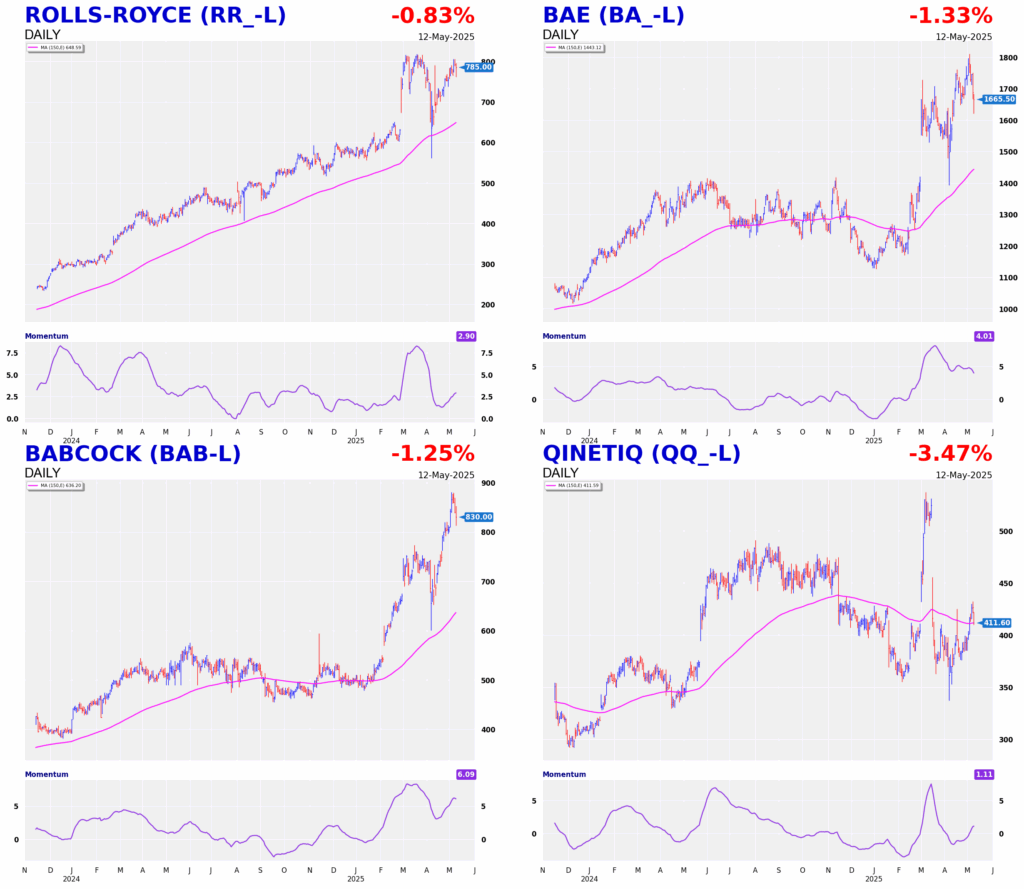

Should we chase Defence stocks?

Defence is another UK industry that has outperformed the general market.

Two factors are transforming this sector. The first is the pullback in America’s support for Ukraine. The gap would have to be filled in by Europe, including the UK. The second is the general increase in defence commitments across Europe. For years the defence sector was mired in a doldrum due to austerity and a lack of ‘growth catalysts’. But the possibility of more geopolitical conflicts around Europe – and waivering US support – are wake-up calls. This seismic change has pulled investors into the sector.

Look at BAE’s (BA.) share price since February. Its share prices rocketed through multiple resistance levels to new all-time highs. Similarly, Babcock (BAB) soared to long-term highs just days after the market meltdown on April 2. A similar picture is noted for Rolls Royce (RR.)

These speedy recoveries point to a renewal of their long-term uptrends. But overbought and in need to a pullback, the sector may need a rest before reasserting their bull trends.

Recovery in UK Housebuilders

The swift recovery in UK house builders started a month ago, at the nadir of the Trump tariff tantrums.

Major UK property developers like Berkeley (BKG) bottomed out near their long-term lows and then, out of the blue, surged through multiple technical ceilings. Their rallies decisively overturned the ongoing bear trends. What happened? What caused investors to bet heavily on this sector?

One reason is perhaps the anticipated fall in interest rates. Indeed, just last week the Bank of England lowered the policy rate by 25bps. Volatility in economic trends may increase due to the rise in global tariffs. In turn, this may lead to a more accommodative monetary stance. Coupled with a steady housing price trend, speculators gamble that these house builders are oversold and present some ‘value’.

Chart-wise, large house builders have broken their base patterns to the upside. But the advances from April lows are overbought and could be due for a partial retracement. The near-term retracement targets are their long-term means (ie, 150-day moving average). Tactically these pullbacks could be a buying opportunity.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.