UnitedHealth (UNH) is the largest healthcare provider in the US. The company provides health and administration services to an astounding 152.0 million people. Those services include health insurance, medical coverage and access to high-quality care and treatments. UnitedHealth has a market cap of almost $470.0 billion and annual sales of $371.60 billion, it employs some 400,000 staff.

A broad-based sector

The S&P 500 Healthcare sector has had a tough time over the last couple of years, with the sector index appreciating by just +7.70% in that time. And by just +6.80% in the last year, that compares to a +22.50% gain in the S&P 500.

Healthcare is a very broad-based sector in the US, and it contains pharmaceuticals and biotech companies, medical equipment and instrument makers, insurers, care providers and pharmacies, as well as suppliers and support service providers.

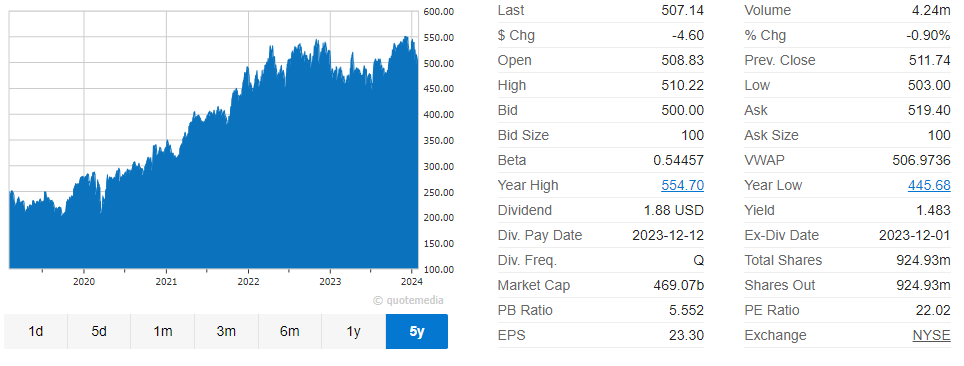

However, UnitedHealth stock price continues to climb.

A narrower focus

So when we are comparing companies within the sector it’s best to try and compare apples with apples, and not oranges.

And that means looking at UNH in the context of the Hospital and Medical Service plan, industry segment.

Within this group, UnitedHealth is by far the biggest, it’s larger than the other 8 stocks combined.

Making it what’s known as a category killer and its valuation reflects that.

Premium rating

UNH trades on a forward PE ratio of 18.0 times, the second highest in the sector and is only eclipsed by Humana (HUM), more on that later.

UNH has the highest price-to-sales ratio in the group, at 1.25 times. Its price-to-book ratio of 4.93 times puts it third from the top on that metric.

And it has the highest price-to-cash flow ratio among its peers. Those multiples can perhaps be justified by UnitedHealth’s returns.

Over the last 5 years UnitedHealth’s revenues have grown by +64.25%, its earnings by just over +95.0%, and its dividend by +111.0%.

UnitedHealth also has the highest profit margins among its immediate peers.

A muted share price performance

However, its share price performance has been muted of late with the stock price barely moving above the gain line over the last 6 months and falling by almost -5.0% in the last quarter.

The reason for that lacklustre performance can be laid at the door of rival Humana Inc., which issued two consecutive profit warnings in the space of a fortnight.

In both instances, Humana stock plunged by -12.0%, over the last three months Humana’s shares have lost -27.0%.

Humana warned about higher than anticipated costs in implementing Medicare Advantage, a government-subsidised healthcare package for US senior citizens.

A higher take-up, and utilisation of these plans in Q4, severely dented Humana’s bottom line and forward guidance.

UnitedHealth has acknowledged the higher costs associated with implementing Medicare Advantage, but so far it’s been able to contain them.

The question is can that continue? If it can then the share price can probably rally from here.

However, if can’t contain those costs then the stock price could come under pressure once more.

Wall Street’s view and target price

Wall Street seems happy to give UNH the benefit of the doubt and rates the stock as a strong buy, with a consensus price target of $597.0.

That’s +18.0% above the current price of $503.60.

It’s also important to note that this is a US election year and healthcare, and the funding for it, are never far from the headlines in these circumstances.

Joe Biden has made a point of increasing access to and lowering the cost of healthcare in the U.S.

In his most recent budget, he pledged $150.0 billion over 10 years, to further that goal. However, a Republican president might not look favourably on these plans.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

To contact Darren, please ask a question in our financial discussion forum.