-

Reviews By

Richard Berry

Reviews By

Richard Berry

- Updated

Short selling is a type of trading where you try to profit from the price of a stock, index, commodity or ETF going down rather than up. You can either short stocks through financial spread betting, CFDs, inverse ETFs of single stock futures. In this guide, we explain what short selling is and review some of the best trading platforms for “going short”.

| Name | Logo | Markets | Overnight Fees | GMG Rating | Customer Reviews | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

Markets 13,500 |

Overnight Fees 2.5% – SONIA |

GMG Rating |

Customer Reviews 3.8

(Based on 124 reviews)

|

Visit Platform 69% of retail investor accounts lose money |

Short Selling Account Types:

|

City Index: Best for short selling trading signals and analysis.

City Index was one of the original CFD and spread betting brokers to enable retail investors to short the market. You can go short on around 4,700 global shares, 84 currency pairs, 40 indices and 20+ commodities. Spreads and pricing is competive, but the main benefit of City Index is their trading signals and post trade analytics. City Index have their own Performance Analytics which tells you whether you are better at going long or short the market based on your trading history. |

||

|

Markets 7,000 |

Overnight Fees 2.5% – SONIA |

GMG Rating |

Customer Reviews 4.2

(Based on 19 reviews)

|

Visit Platform 74% of retail CFD accounts lose money. |

Short Selling Account Types:

|

Despite being primarily a forex brokers you can also short indices, commodities and over 5,500 UK shares and US stocks. |

||

|

Markets 4,500+ |

Overnight Fees n/a |

GMG Rating |

Customer Reviews 4.8

(Based on 1,812 reviews)

|

Visit Platform 62% of retail investor accounts lose money |

Short Selling Account Types:

|

Capital.com Voted Best Trading Account In 2025 Provider: Capital.com Verdict: Capital.com won the People’s Choice vote for “Best Trading Account” in the 2025 Good Money Guide Awards and “Best Trading App” in our 2023 awards as they have one of the most intuitive apps for trading the most popular markets globally. Capital.com was founded in 2016 and is a CFD trading platform broker with offices in the UK and around the world. Since then, they have grown to offer over 3,000 tradable assets to 100,000 monthly active clients. Is Capital.com any good for trading? Capital.com has a user friendly and intuitive trading platform and app, that gives access to the most popular financial markets with competitive spreads with the ability to reduce risk by decreasing your leverage. Trading via the app has always been capital.com’s forte, and in 202, it won our award for “best trading app” not in part due to the fact that the company CTO has extensive experience in building engaging apps like Candy Crush. What makes Capital.com different? Thumbs up, literally Do you know what one of the most impressive thing about Capital.com is? They put the buy and sell buttons at the bottom of the app. I don’t mean that in a facetious way, it’s genuinely a brilliant feature. This may not sound like much but it’s a good example of how Capital.com has integrated decades of analytics, experience, feedback and customer data into creating a very easy-to-use intuitive trading app from scratch. When Capital.com first became authorised by the FCA back in 2018, I visited their offices in London to have a chat about what they offer. The two main things we discussed were button placement and AI. Trading App But anyway, if you’ve updated your iPhone to the latest iOS you’ll notice that Apple has started moving things to the bottom of the screen, the search bar for instance. This is because, phones are getting bigger, and your thumb can’t reach the top of the screen if you are holding it with one hand. This is something that Capital.com figured out would make trading easier 5 years ago. I’ve just been through a bunch of other trading apps on my phone and still, amazingly enough, none of the other brokers have done this yet.

Capital.com was also the first to integrate artificial intelligence to help you improve your trading, they say, based on the Martingale theory. When I spoke to Chris Demetriou, the head of sales in the UK, he said that the system should give you prompts based on your previous trades. So for example, if you are about to do a trade that is similar to ones you have constantly lost on before, you should get a “are you sure you want to do this” notification. Leverage Control Everybody knows, that one of the main reasons people lose money when trading is overleverage. This could be either from not having enough free cash on account to give your position breathing space, or simply putting on trades that are too risky. One really good feature is that you can change your leverage based on asset class. The default leverage is the max that retail traders in the UK are permitted, but you can change this to 1:1 so you need to fully pay up for positions. A sensible thing to do if you are just getting started, which can help reduce excessive losses. As your experience grows you can increase your leverage accordingly. Hedging You can also set the platform to put on hedging positions, so you can be long and short the same thing at the same time. Why you ask? Well, it can help you run longer-term positions and short-term hedges. This in fact is the very point of CFDs. They were originally hedging tools, and still a good way to protect your long-term investment portfolio against short-term market corrections without having to close off your positions. Customer Support Customer support is pretty good too, you can get in touch via the chat widget on the platform, whatsapp or telegram. When I tested it I got a response within a minute and the issue I had was dealt with quickly (uploading ID to verify my account if you must know). TradingView You can’t trade from the charts, but when you have open positions they are overlayed along with your stops and limits, which you can move by dragging and dropping. But, if charting is your thing, you can join the other 78,000 Capital.com customers using and trading from TradingView. Proprietory Tech One thing I quite like though is that instead of relying on third-party software, the Capital.com trading platform is built in-house, and if you want something you can ask for it. For example, previously on the app you could see where an asset is as a percentage relative to the daily range. But, a customer asked, if you could see it in points too. So, that was quickly integrated so that you can now toggle between percentages and points. A small thing, but indicative of a broker that can do things and does do things, rather than just logging a helpdesk ticket. Refinitiv There are no trading signals on the platform or app, but you do get access to Refinitiv reports on US stocks, which give you a good overview of historic and potential future financial health. A good feature for those looking at slightly longer-term positions. Overnight funding Talking of long positions, or longer long positions, Capital.com also display quite clearly what your overnight financing rates are going to be on a daily basis. I’m sure this is a regulatory obligation anyway, but it’s done in a way that you can actually see what the price is, rather than an opaque formula. It gives a bit more transparency about how much a position is going to cost you. Investmate If you are new to trading, they have a stand-alone app called Investmate, which puts you through a series of bitesize courses that explain the financial markets. Capital.com also own currency.com if you fancy a punt on crypto, and shares.com so we can expect to see more comprehensive physical investing options soon. Pros

Cons

Overall4.5 |

||

|

Markets 2,000+ |

Overnight Fees n/a |

GMG Rating |

Customer Reviews 3.7

(Based on 146 reviews)

|

Visit Platform 76% of retail investor accounts lose money |

Short Selling Account Types:

|

Plus500 Expert Review 2026: A user-friendly platform with access to global markets Provider: Plus500 Verdict: Plus500 is one of the largest online trading platforms and operates in more than 50 countries worldwide. Founded in 2008, it has more than 26 million customers today.

Plus500 is headquartered in Israel, however, it’s listed in the UK on the London Stock Exchange (it’s a member of the FTSE 250 index). Here in Britain, its platform is operated by Plus500UK Ltd, which has offices in London.

In the UK, you can only trade CFDs with Plus500. CFDs are financial instruments that allow you to profit from the price movements of a security without owning the underlying security itself. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Is Plus500 a good broker? Yes, Plus500’s trading platform has evolved nicely over the years from a simple interface to an intuitive execution venue for CFDs on the major markets and stocks. Opening a Plus500 account is really simple:

Pricing: It’s dynamic so moves with the market for minimum spreads. Plus500 does not charge any trading commissions when you place a CFD trade. However, there are some fees you need to be aware of including:

Withdrawals are free of charge no matter how many you make per month. Deposits are also free of charge. Market Access: Very good, Plus500 are always first to try new asset classes With Plus500, you can trade CFDs on a range of assets and instruments including:

Overall, there are over 2,800 assets you can trade with CFDs. The maximum amount of leverage you can use with Plus500 varies depending on the asset class as shown in the table below. If you are trading forex, you can potentially borrow up to 30 times your own money. For shares, you can only borrow up to five times your own capital. Plus500 margin rates:

Platform & Apps: Basic execution, but it does the job well Plus500 trading apps and platform also offers several tools to help traders manage risk including:

Customer Service: Plus500 doesn’t have a phone option, but its live chat is sufficient Plus500’s customer service options are limited to online chat, email and WhatsApp. So, you can’t contact the company by telephone. However, don’t let that put you off. We contacted the company via online chat and were very impressed with the service and support offered. It’s worth noting that support is available 24/7. This is a big plus – some other CFD providers only provide support during the week. If you are a larger or professional trader you can get access to Plus500’s Premium Service Package which includes:

The premium service is invitation only. To become a premium customer, you must have a real-money trading account. However, if you want better margin rates but are not interested in the premium package you can upgrade to a professional account. The Plus500 professional account is an account designed for professional traders. With this account, you have access to higher levels of leverage (e.g. 1:20 for shares). To be eligible for a professional account, you must meet two of the following three criteria:

Research & Analysis: Some sentiment, but limited education and analysis. Plus500 offers a range of additional features designed to help traders make money, including:

Pros

Cons

Overall4.6 |

||

|

Markets 1,200 |

Overnight Fees 2.5% – SONIA |

GMG Rating |

Customer Reviews 4.6

(Based on 86 reviews)

|

Visit Platform 71.9% of retail investor accounts lose money |

Short Selling Account Types:

|

Pepperstone: Best for short selling stocks on MT4 & MT5.

Pepperstone has one of the largest ranges of stocks to short through their MT4, MT5 and cTrader trading platforms. Pepperstone’s strength is tight pricing in liquid markets and is a good option for those that also want to automate their short trading on major indices. |

||

|

Markets 10,000 |

Overnight Fees 3% – SONIA |

GMG Rating |

Customer Reviews 4.3

(Based on 257 reviews)

|

Visit Platform 61% of retail investor accounts lose money |

Short Selling Account Types:

|

Spreadex: Best for customer service when shorting.

Spreadex offers short selling on thousands of large and small cap stocks, via financial spread betting or Contracts For Difference on the world’s major stock indices – with low commission on stocks and tight spreads on the most popular markets from 1pt on UK 100, 1pt on Germany 40 & 1.7pts on Wall Street. |

||

|

Markets 17,000 |

Overnight Fees 2.5% – SONIA |

GMG Rating |

Customer Reviews 3.9

(Based on 695 reviews)

|

Visit Platform 68% of retail investor accounts lose money |

Short Selling Account Types:

|

IG: Best liquidity for large short sellers.

IG has some of the best liquidity due to it’s size and customer base which means it is especially good for large traders who want to short stocks in size. They can often provide better liquidity than the underlying exchanges. Plus they offer smaller-caps stocks for shorting, not just the main market shares. |

||

|

Markets 12,000 |

Overnight Fees 2.9% – SONIA |

GMG Rating |

Customer Reviews 3.7

(Based on 149 reviews)

|

Visit Platform 64% of retail investor accounts lose money |

Short Selling Account Types:

|

CMC Markets: Best for low-cost short selling.

With CMC Markets you can short thousands of markets, but also see what their most profitable traders are bearish on. You can go short via CFDs or spread bet with tight spreads, lightning-fast execution and the highest-rated customer service in the industry.* |

||

|

Markets 2,100 |

Overnight Fees -5.8% |

GMG Rating |

Customer Reviews 4.6

(Based on 136 reviews)

|

Visit Platform 72% of retail investor accounts lose money |

Short Selling Account Types:

|

One of good things about XTB, is that as well as being able to hold physical shares for investing. You can also hedge those positions with separate CFD positions, if you think the price will come down and you do not want to realise capital gains. |

||

|

Markets 9,000 |

Overnight Fees 2.5% – SAXO RATE |

GMG Rating |

Customer Reviews 4.1

(Based on 125 reviews)

|

Visit Platform 62% of retail investor accounts lose money |

Short Selling Account Types:

|

Saxo: Best for DMA short selling.

Saxo Markets has offered short selling facilities to larger individual and institutional traders for decades. They cater slightly more towards more professional short sellers and can help with larger borrow requests and access to on exchange liquidity and options strategies. |

||

|

Markets 7,000 |

Overnight Fees 1.5% – SONIA |

GMG Rating |

Customer Reviews 4.5

(Based on 1,347 reviews)

|

Visit Platform 59.7% of retail investor accounts lose money |

Short Selling Account Types:

|

Interactive Brokers: Best for on-exchange short trading.

Interactive Brokers offers on exchange DMA trading so you can short stocks and markets with direct market accounts. They also have transparent, low commissions and financing rates for short positions. |

❓ Methodology: We have chosen what we think are the best brokers for going short based on:

- over 30,000 votes and reviews in our annual awards

- our own experiences testing the short selling on the platforms with real money

- an in-depth comparison of the features that make them stand out compared to alternatives.

- interviews with the CFD short-selling platform CEOs and senior management

How to short sell stocks – everything you need to know!

It was recently reported that short interest in FTSE 250 stocks is at it’s highest level since the mini budget. What this means is that people (hedge funds in particular) think the stock market is going to go down. Which for some people is good news, those people are short sellers. Going short means that you profit when stocks or a market goes down instead of up and whilst it may sound complicated it’s actually quite easy. In this guide, we’ll go through how to short stocks, and the risks and potential rewards of shorting the market.

Related short selling guides:

How does short-selling work?

Short selling is speculating that the price of a financial asset will go down rather than up. Short selling is mainly used for trying to profit from falling shares prices, protecting investment portfolios in bear markets and derivatives trading like CFDs, spread betting and futures trading.

When you go short you are selling a stock that you do not own in the hope that it will reduce in value before you buy it back. The principle of shorting stocks is not new, professional traders and hedge funds have been shorting stocks it for years. It works like this:

- Fund A thinks the share price of Vodafone will go down and they want to bet on a drop in the short term (a few months).

- Fund A knows that Fund B has a long term (a few years) position in Vodafone shares.

- Fund A asks to borrow Fund B’s Vodafone shares so they can sell them to someone else.

- Fund B lends Fund A the Vodafone shares and charges 5% of the value as a fee.

- Funds A sells the Vodafone shares on the London Stock Exchange

- A month later Vodafone shares have dropped in price and Fund A buys them back.

- Fund A then gives the shares back to Fund B.

Different ways to “go short”

The main ways to short-sell the market are:

- Financial spread betting – take a bet on a stock

- CFDs – a contract based on the difference between the opening and closing price of your trade

- Inverse ETFs – these are exchange-traded funds that go up when the asset they track goes down

- Options – you can either buy puts or sell calls to speculate on the market going down

Short selling with financial spread betting

For the private spread betting investor, going short it is much simpler as you do not have to go through the process of borrowing stock to sell it. You can just bet a certain amount per point that the shares will go down. Plus, with a financial spread betting profits are tax-free as trades are structured as bets.

To do this, you will need an account with a spread betting broker that will either net the position off against one of their clients that is long or will borrow the stock just like Fund A did in the example above. Then give it back when you close your position.

This example is based on a single trade and the intricacies of a brokers stock lending and borrowing team are much more complex than this.

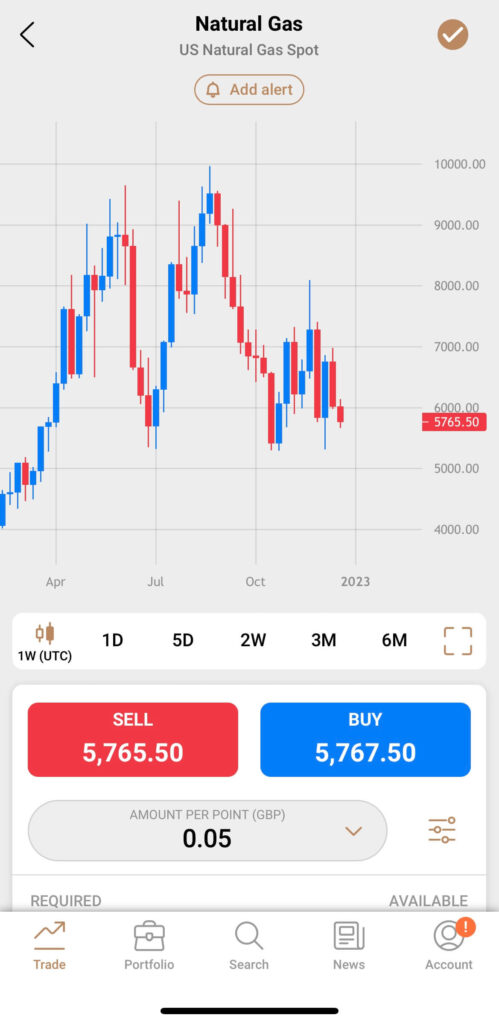

So for example, if you bet £10 a point (cent) that Deutsche Bank stock (priced at 7.72) moves then you could potentially make £7,720 if it goes to zero. In order to execute the trade you would have to deposit £1,500 in initial margin and make sure you have enough money on your account for daily P&L margin.

Another benefit of shorting as a spread bet is that even though Deutsche Bank trade in Euros you can have a GBP position.

- Further reading – compare the best spread betting brokers here or read our guide to how financial spread betting works

Short selling with CFDs (contracts for difference)

Short selling with a CFD is similar to spread betting in that you trade on margin but instead of betting a £ per point you buy and sell an equivalent amount of CFD instead of selling the shares. Be mindful that you always trade in the currency of the underlying asset so using our DB example, your P&L will be in Euros.

- Further reading: compare the best CFD brokers in the UK here

Short selling by buying a put option

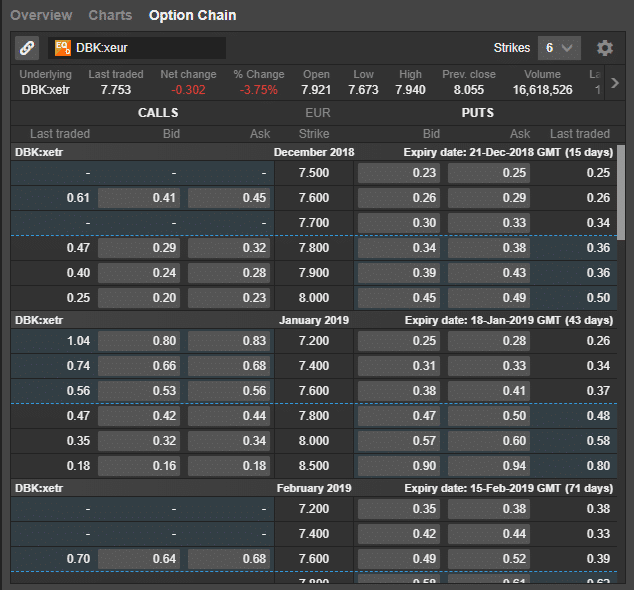

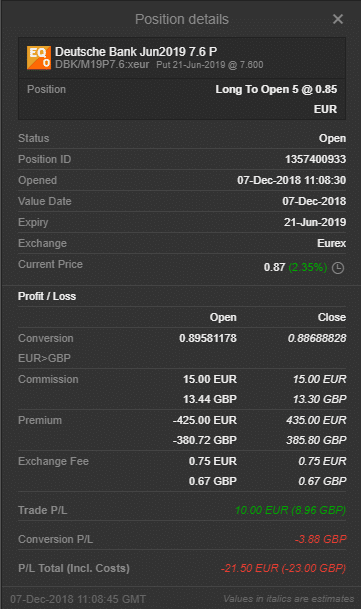

Buying a put option will give you the right to sell a certain amount of stock in Deutsche Bank at set price.

So taking an example from the below options chain on Deutsche Bank shares. If you buy some 7.6 January 2019 put options you will have the right to sell your Deutsche Bank at 7.6 even if the price is trading on the market at 6. Of course, you don’t have to wait till the option expires, you can sell your option position. If the price has moved lower the intrinsic value of the option will have increased from 0.41. However, the closer the option gets to expiry the lower the time value will get.

You can read more about calculating the time value of an option for options trading here.

The risk with options is that you lose the premium that you paid and the option expires out of the money worthless. The benefits of shorting via options are that your risk is limited, but they can expire worthless.

An example of a put options order execution ticket below:

Short selling buy selling a call option

This is a very high-risk form of short selling because your losses are unlimited. Unlike buying a call options where your losses are limited to the premium you paid for the options and your potential profits are unlimited. When selling call options (or writing call options) your profit is limited to the price you receive for the call option but your losses are unlimited.

- Further reading: compare the best options trading platforms in the UK here.

Pros & cons of short selling

Advantages of short selling | Disadvantages of short selling |

| 👍Make money when the market goes down | 👎Unlimited losses if the market rises |

| 👍Can be used to hedge long term investments | 👎Can be hard to borrow stocks |

| 👍Simpler alternative to trading options | 👎Short positions can be called in and automatically closed |

Bull and bear markets are the yin and yang of financial cycles. Learning to short-sell may prove to be lucrative when the markets head south.

When people think of short selling, they associate it with financial vultures, unscrupulous hedge funds, and doom merchants. Even regulators are not too kind towards this activity. Banning short-selling activities is the first thing they do during market panics. But is short selling really that negative?

In a modern, sophisticated and complex financial market, short selling is an invaluable activity. It helps to burst the unfounded optimism of a sector, prevent irrational buying of assets, and uncover frauds. It is a vital part of an efficient market and price discovery.

The risks of short selling

Short selling is taking a punt on the downside of a stock. To short sell a stock, you borrow shares from someone who already owned them, and sell these shares on the market hoping to back them back cheaper in the future. For example, you borrow XYZ plc shares and sell them at 120p now. If prices go down to 100p next week, you make a 20p gain.

After you buy back the stock, you return these shares back to the original owners.

Unlike buying shares, short selling is not cheap. On top of the usual CFD or spread betting brokerage fees, short sellers may have to pay a fee to the owners of the shares and whatever dividends accrued to them during the period shares out on loan.

Moreover, short selling is fairly high risk. This is because a stock’s upside is limitless. The most XYZ plc can only go down is 100% (bankrupt). But it can double or triple over a short period of time. Thus brokers who arranged the shares often require counterparts to post large collateral to guard against this risk.

But this is not the most crucial factor. The most dangerous risk for CFD traders short selling is a short squeeze. This describe a manic scramble to buy back shares previous shorted. The catalyst could be better-than-expected results, a takeover approach, or a new product discovery. Suddenly, every short seller rush to cover their short positions by buying back the shares they previously shorted. When everyone buys a stock, it creates an immense upward pressure on prices which hurt short sellers even more.

One example is Tesla (TSLA), which was heavily shorted in 2018-’19. But when its financial position was not as dire as predicted, Tesla began to surge – and prompted a massive wave of short covering. The spike to near $1,000 indicates this panic buying. Once this wave passes, prices collapsed back to $400. That’s why naked short selling is often limited to experienced and sophisticated investors with deep pockets.

Benefits of short selling

- Short selling could be suitable for experienced investors who enjoy going against the grain. It is a lucrative activity for successful investigative traders who know what they are doing. There are professional funds that are dedicated to this activity alone.

- Short selling pays off just when you need it. For example, your short-selling activities may net you a fortune during severe bear markets. This gives you a layer of protection on your long-only portfolios.

- Short selling allows you to take more aggressive long activities because you have some downside hedge.

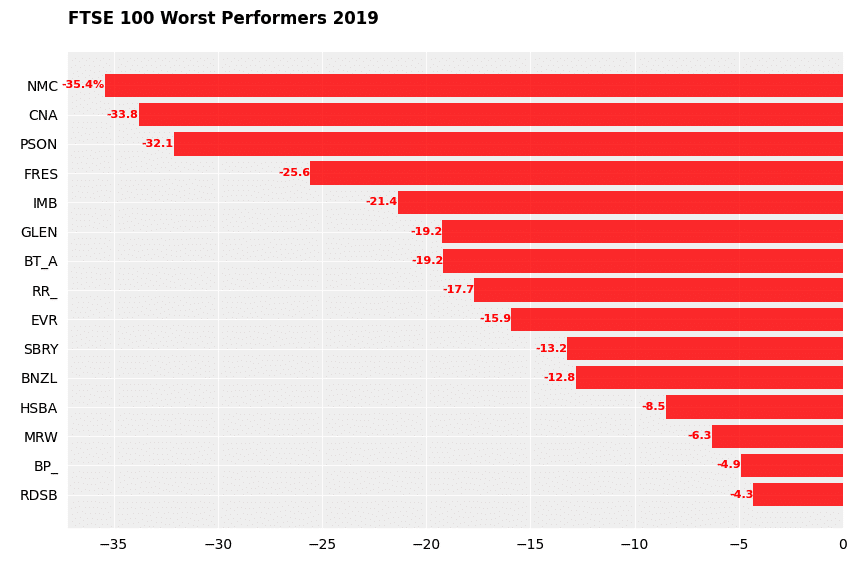

- There are plenty of opportunities for short sellers in the UK. During a relatively steady year (2019), there are many blue-chip FTSE stocks that plummeted in value. For example, Centrica (CNA), Fresnillo (FRES), Glencore (GLEN) all drop by double digits (see below). This created opportunities for short sellers.

When to consider short selling

There are three scenarios where short selling can be considered, speculation, fraud and portfolio protection.

- Related guide: 50 rules for successful trading

Speculative Mania

When stock markets have been rising to stratospheric levels and incredibly expensive valuation, it is ripe for short selling. One instance that comes to mind is the dot-com boom. Many stocks slumped by 99% in the crash that followed. Not to forget is that during the Global Financial Crisis in 2008 many short sellers made a fortune because they bet against the credit bubble. One key thing to bear in mind is that selling a mania requires a near-perfect timing. An expensive stock can become even more expensive before prices turn down.

Undiscovered Fraud

This means that investors are generally unaware of the underlying ill financial health of a company. One recent example in the UK is NMC Health (NMC), a former darling of the stock market. In December of 2019, the company was accused by Muddy Waters – a specialised research outfit that targets financial frauds – for concealing its true debt levels. Initially, the firm rejected these accusations. Then the true picture emerged weeks later and NMC was suspended, but not before its share prices collapsed by 75% from its peak (see below). If you smell something fishy about a stock, stay away. Better still, short sell it.

Bear Markets

During a bear market, most stocks will depreciate. Prices decline as profit outlook turn negative. Valuation of a stock shrinks. This means that the path of least resistance is to the downside, create trends that are favourable to short sellers.

Short selling in summary

Short selling stocks is speculating that the price of a stock with go down and trying to profit from that move by selling a stock before you own it and buying it back later.

If you think that a share price is going down then you can put on short position to profit from a falling market. Here’s a quick guide to shorting stocks, the risks, the potential rewards, the types of trading and the brokers that offer short selling.

There are three main ways to of short selling stocks, spread betting, CFDs and options.

- Spread betting – take a $ per cent bet on the stock. Spread betting is one of the most popular ways for private investors to short US stocks. Commissions are worked into the spread, so you just see one price. Profits are also tax free.

- CFDs – are a contract for difference between the opening and closing prices of a trade. Spread betting tax benefits are unique to the UK so Europeans trade CFDs instead. CFDs are also useful for larger more tax efficient traders who want DMA (Direct Market Access) to get better pricing.

- Options– this gives you the right to sell a certain amount of stock at a certain level in the future. You don’t have to which is why it’s called an option. If you think a share price is going down, you would buy a “put” which gives you the right to sell stock at a certain price. The price of a put will increase the further down the stock goes, allowing you to sell the put at a higher price and therefore making a profit on the options.

How to short sell stocks

To short sell stocks you need a broker that offers short selling. But before actually place your trades, given that short selling is risky, you should consider these factors that may increase your success:

- Know the company inside out, especially if you are short selling individual stocks. You need to be able to ascertain a company’s true financial picture better than the market. Not easy to do, given markets are relatively efficient. Seek discrepancies in the firm’s debt, cash flow, product sales, etc – and compare it with its peers. Does it make sense? Is high valuation a reason to short sell it?

- Look for triggers. Shorting a stock on its way up is highly dangerous because you may not have the financial power to sustain margin calls. Better to wait until prices peak and start to come down. During the dot-com, one trigger to short a stock was the expiration of lock-up periods. When these lock-up expired, management, early investors, and founders all dump their stock holdings to turn their paper wealth into cash. This created massive downward pressure on prices.

- Start small. Only add when prices are starting to move favourably in your direction. Stoplosses are essential.

- Analyse short activities. Find out what other funds are shorting – because this may create herding behaviour

Risks of short-selling stocks

- Unlimited potential losses: The main risk is that share prices can go up indefinitely, but only down to 0. So in theory, if you are shorting Facebook stock you potential losses are infinite. Also, if the company is bid for or a takeover rumour emerges the share price will surge.

- Over leverage: Shorting shares is generally done on margin. Using leverage to trade means that you get exposure to more stock than funds on account. So for example, if the margin rate for Facebook is 10% you can short $10,000 worth of stock with only $1,000 on account. If the stock drops 50% you make $5k, but if it rallies, just 10% you’ve lost all your money.

- Currency Risk: Facebook is an American stock so there is a currency exposure. If the GBPUSD rate changes significantly, this can wipe out all your profits. You can avoid this through by trading a GBP position in a USD stock with a spread betting or CFD broker.

Rewards of short-selling stocks

- You can profit when the stock goes down. Shorting stocks, is not a new principle for UK investors. Spread betting and CFD trading have been around for years. Spread betting and CFD traders have been speculating on currencies, indices and stocks going up and down for decades. Shorting is of course an excellent tool for protecting long term investments against short term downtrends. But also provides a trade for short term speculation. It is risky though, so always make sure you understand the risks involved.

- Receiving income from overnight financing. When you trade on leverage there is an overnight financing charge for long positions. Most accounts are set to charge 2.5% over/under 1 month LIBOR (or thereabouts). What this means is that if you are long, you have to pay 2.5% plus the 1 month LIBOR rate to hold the position. But, if you are short you should receive the interest. In practice though (at the moment) interest rates are so low the short credit ends up negative so you check with your broker if you actually pay interest on short positions.

⚠️ FCA Regulation

All short-selling trading platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK brokers that offer short-selling are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature short-selling platforms that are regulated by the FCA, where your funds are protected by the FSCS.

Short Selling Broker FAQs:

If you are a professional trader Interactive Brokers Workstation is the best platform for shorting stock,s as you can drip-feed orders into the market, as well as execute pairs trades with their “pairs trader” feature. Short selling on Interactive Broker can also be done through buying put options, or selling call options for advanced traders.

For beginners, one of the best platforms for shorting stocks is City Index as they offer spread betting which is tax-free on indices, major stocks and options. Plus City Index have some excellent trading signal tools, which will give an indication of if a market is overbought.

You can also short stocks on the app versions of these trading platforms, however, functionality may be limited. For instance, the IBKR Workstation platform offers far more order execution types than the Interactive Brokers Global App.

In our awards, Saxo and IBKR consistently win “best options brokers” as they offer direct access to equity options on listed stock exchanges.

IG is also one of the best stock brokers for short selling, as it offers investment products alongside options trading through TastyTrade, CFDs, and financial spread betting. This means you can hedge your long portfolio and generate income with covered calls.

Spreadex is an excellent broker for shorting penny stocks as they are one of the few CFD and financial spread betting brokers that offer access to trading AIM and small-cap stocks.

You can also short penny stocks on IG, but their phone service is not as good as Spreadex as with many penny stocks you have to do the trade over the phone with an expert dealer as there is often limited liquidity in stocks with low market caps and a price will be required from a market maker.

You can trade stocks in the UK through financial spread betting platforms like IG, CFD brokers like City Index and options brokers like Interactive Brokers. You can also buy inverse ETFs like 3x Tesla (TSLA) Short ETP from Leveraged Shares, which goes up, when Tesla shares go down.

You make money shorting when you sell a stock or asset before you own it and buying it back cheaper. It is also possible to make money by receiving interest on overnight positions.

No, in the UK you cannot short Bitcoin on Coinbase, as they are not permitted by the FCA to offer derivatives products to retail investors. However, if you want to short BTC in the UK, you can if you qualify as a professional investor.

However, if you are based in the US, you can short BTC on Coinbase with perpetual futures.

If you are a US investor, you can short on Fidelity Investments using margin trading or options on Fidelity Trader +.

However, in the UK, Fidelity International does not let retail investors short stocks, as they only offer ISA, GIA and SIPP accounts.

Some brokers will credit your account with overnight interest if their rate is less than the local rate. For example, if a broker charges =/-2.5% SONIA and interest rates are 5%, you should receive 2.5% from overnight funding?

Yes, if an exchange “calls in short” positions a broker will be obliged to buy back your position in the market or close off if you have traded OTC.

If you have a short position in a stock that gets suspended you will not be able to trade out of it until it comes back to market or you broker agrees to close the position. You will also have to put up efecetilvey 100% margin for the position as you cannot have leverage positions in suspended securities.