InvestEngine Customer Reviews

Tell us what you think of this provider.

Great value, great app

It’s been really easy to get started with InvestEngine and the app is very easy and simply to use with enough information tucked away.

ISA

I’ve been using InvestEngine since the middle of last year and I have been happy with their service and performance. I have discussed the company with many of my friends and family, actively encouraging them to consider investing with them.

Really easy to deal with

Set up an account and easily stepped through account management

Investment hub simplified

I recently came across InvestEngine to open a SIPP without paying extortionate fees that I was witnessing from other providers who were raising their Management Fees. I liked the easy account opening and the options available to either invest from my own choices, invest from a managed fund for a small fee or leave as Cash at no charge whilst attaining tax relief from HMRC. I also opened a DIY ETF investment portfolio and took advantage of the offer of gaining anywhere between £20 and £100 for doing so. I referred a friend and once they had invested we both received a bonus which is now invested in our DIY ETF. All of this was completed with ease and without complication. First rate service and excellent platform. Would thoroughly recommend InvestEngine. I am currently in profit but keeping a wary eye on the US AI tech and US political situation for future returns.

Clean and simple

I use their stocks and shares ISA. The app is functions great, is simple to use and viewing portfolio performance is straightforward. Very affordable and clearly ahead of the rest of the competition right now.

Low cost self managed SIPP

Low cost self managed SIPP. Easy to use app, control your own portfolio balance with , percentages and auto invest to that level

Easy to invest

I fid it very easy to use and invest /

confusing cash balances

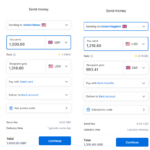

Generally good and low cost. Minor niggles include it lacks inverse ETFs so you cant hedge and of course doesnt have daily liquidity which is one main attraction of direct ETFs if you are punting. Also lacks the US ETF universe. Bigger niggle is the way the platform handles cash balances is very odd … it seems to put each ETF in a box and you assign cash to that box …. rather than having a total portfolio cash balance; and then you have to press extra buttons to get the cash you put in that box to invest in the corresponding ETF … so on numerous occasions it turned out i hadnt invested when i thought i had. Finally, just like many banks and financial platforms .. their know your client process is tedious and largely pointless beyond appearing to tick some BoE type KYC boxes…. IE feel free to call me if you want to know why.

So easy to manage

Having never invested before i now have a Cash ISA with Invest Engine. They manage the account for me, for a very small fee, and rebalance my portfolio on a regular basis. As a novice investor i have been so happy with their service.

Great Value Low Cost Platform

User friendly platform and zero fees! Very simple to use and a wide range of ETFs to suit most long term investors.

InvestEngine Expert Review

InvestEngine is one of the best investment platforms for buying ETFs

Provider: InvestEngine

Verdict: InvestEngine is one of the cheapest ways to buy ETFs as they offer zero account fees for DIY investors as well as low-cost simple managed ETF portfolios. They also have a managed ETF investment service, for those that want help with what to invest in.

Is InvestEngine any good?

Yes, InvestEngine won “Best ETF Platform” in the 2025 Good Money Guide Awards.

InvestEngine makes it really simple to get started by investing in ETFs with zero commission, although the market range is a bit limited if you are looking for more complex asset classes. Plus, they also have a managed service for those who want an expert to build a diverse portfolio of ETFs for them.

Pricing: Top marks as it is actually free to buy and hold ETFs in a GIA and ISA (although keep in mind you have to pay ETF charges to the exchange). Plus, the InvestEngine SIPP is free and managed accounts are very low cost too

Market Access: InvestEngine only offer about 763 ETFs on their platform so are marked down a bit here. However, they do offer enough to build a diverse portfolio of exchange-traded funds.

Platform & App: Both are well built and easy to use, intuitive and cross-device

Customer Service: InvestEngine are easy to contact through chat (even on weekends) plus an active community board. There is no published phone number on the site though.

Research & Analysis: There are some good insights on their blog, with fairly active social channels (mainly investing tips or product highlights).

Pros

- Fractional ETF investing

- Zero commission ETFs

- Managed ETF portfolio service

- Free ETF SIPP account

Cons

- Limited to ETFs

- Cannot buy individual shares

-

Pricing

(5)

-

Market Access

(4)

-

Platform & App

(5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.5Capital at risk.

InvestEngine Facts & Figures

| ⬜ Public Company | ✔️ |

| 👉 Number Active Clients | 38,000 |

| 💰 Minimum Deposit | £100 |

| 💸 Client Funds | £390m |

| 📅 Founded | 2019 |

Account Costs | |

| 👉 Investment Account | 0% |

| 👉 SIPP | 0.15% |

| 👉 Stocks & Shares ISA | 0% |

| 👉 Junior ISA | ❌ |

| 👉 Lifetime ISA | ❌ |

Dealing Costs | |

| 👉 UK Shares | ❌ |

| 👉 US Stocks | ❌ |

| 👉 ETFs | £0 |

| 👉 Bonds | ❌ |

| 👉 Funds | ❌ |

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.