InvestEngine SIPP/Pension Expert Review: Zero-fee SIPP lays down gauntlet to big platforms

Account: InvestEngine Pension/SIPP

Description: InvestEngine has dropped the platform charges on its pensions service, with its now zero-fee SIPP (Self-invested Personal Pension) it is among the very lowest cost DIY pensions available on the market. The ETF-specialist investment platform’s SIPP previously carried an annual management charge of 0.15% on assets.

Is InvestEngine's Pension/SIPP Any Good?

InvestEngine has an excellent pension offering in line with its free general investment account (GIA) and Individual Savings Account (ISA), which also carry no platform charges. ETFs bought through the platform still carry their own charges, though trading them is free.

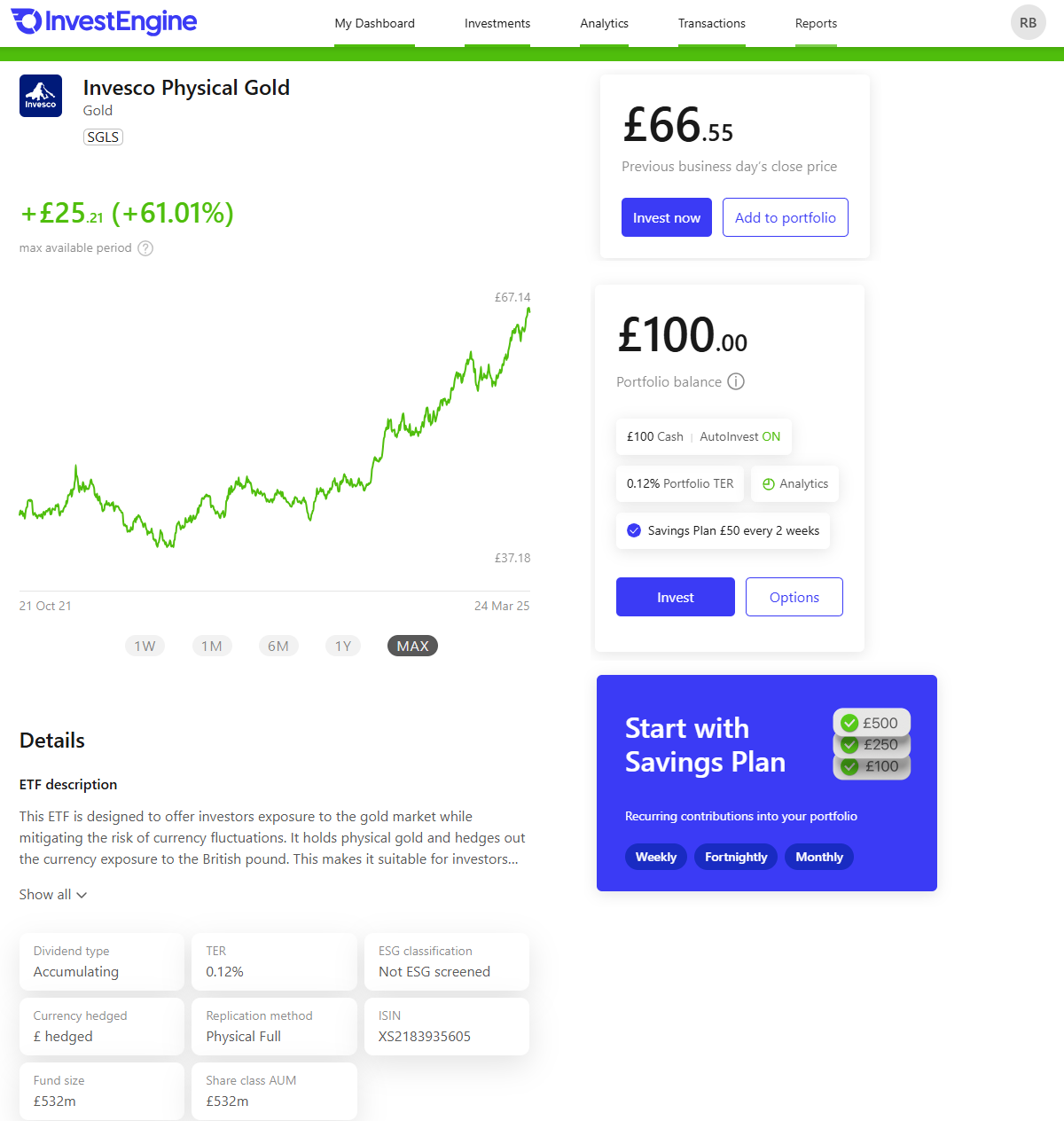

To test the SIPP, I set up some regular investments in an Invesco Physical Gold ETF. I chose to invest in Gold for my InvestEngine SIPP as the stock markets are in absolute turmoil at the moment and investors always flee to the safety of Gold. Plus, it’s done rather well recently and even though you don’t get dividends, there is scope for a lot of capital growth.

Pricing: InvestEngine’s SIPP account is free as long as you make your own decisions about what ETFs to invest in. There is a 0.25% charge for their managed accounts (where they take you through a questionnaire and allocate a selection of ETFs to your portfolio) or InvestEngine’s LifePlans which are fairly similar to Vanguard’s LifeStrategy ETFs.

InvestEngine is able to offer such low fees on its services as it takes the interest earned on customers’ uninvested cash, which most other platforms at least partially pay out.

If you compare its zero-fee SIPP offering favourably with those of rival investment platforms, which carry charges they can add up significantly over time. For example, it noted Hargraves Lansdown carries a 0.45% platform fee on a £80,000 portfolio of ETFs. This is in addition to a starting £11.95 fee per trade for between 0 to 9 transactions a month.

Assuming a customer makes 12 ETF trades a year for 20 years alongside making £10,000 annual contributions to their pension and 5% annual investment growth, this would amount to a cost of £6,868 over that timeframe.

InvestEngine makes similar comparisons for providers such as AJ Bell, Interactive Investor and Vanguard which also all carry platform fees. Again these platforms also all offer varying amounts of interest on uninvested cash (you can view a comprehensive table through this link) and access to a broader range of securities.

Market Access: You can only invest in 600 UK-listed ETFs from asset managers such as Vanguard, iShares, Invesco, and JP Morgan. with InvestEngine, so you don’t get access to some more exotic US ETFs. However, it is also worth noting that Hargreaves Lansdown’s platform offers access to a much wider range of securities, including individual stocks and actively-managed funds. Its SIPP also offers interest on uninvested cash (4.02% AER, as of December), which InvestEngine does not.

This may balance things out depending on how customers choose to allocate their assets, though InvestEngine does still offer access to money market ETFs that offer exposure to interest rates, while not receiving the Financial Services Compensation Scheme (FSCS) £85,000 guarantee on losses to bank deposits.

In November last year InvestEngine also launched a range of fully managed investment portfolios named Lifeplans, in a challenge to robo-advisers such as Nutmeg, Moneyfarm and Wealthify.

App & Platform: InvestEngine has really great apps, super simple to use, which hosts around £1 billion in assets for around 75,000 clients, which we consistantly found it to be a good way to buy ETFs but the range of instruments it offers is a bit limited if you are looking for more complex asset classes.

Customer Service: A real team of people in the UK, who you can email for any issues, but no phone number for emergencies.

Research & Analysis: Some good blogs and research notes for pension investors, I’ve interviewed their head of investments, Andrew Prosser, if you want to hear directly from the horse’s mouth how they treat customers.

Pros

- Zero commission and fee pension investing

- Diverse range of UK globally focussed ETFs

- DIY and managed SIPP accounts

Cons

- No US listed ETFs

- No interest on uninvested cash

- No individual shares

-

Pricing

(5)

-

Market Access

(4.5)

-

App & Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(4.5)

Overall

4.8

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.