interactive investor Customer Reviews

Tell us what you think of this provider.

efficient transfer. helpful customer service

efficient transfer. helpful customer service

Good range

Great range of different accounts and a decent fee structure, especially if you make a lot of trades, and will definitely save money against some of the traditional investment providers/brokers.

Excellent.

Straight forward and easy to work with. Helpful people.

Reliable service and easy to use platform

Have been with Interactive Investor for many years and have found the service to be very reliable. The online platform is straigtforward to use and the customer support team has always been helpful.

average

Commission for UK stocks when added to the monthly fee is not as cheap as first appears. For overseas transactions the fx fees are large and frankly a rip off.

Customer service is painful as they often ask for NI number which not many would know. Some customer representatives seem to think they are quiz masters rather than customer service reps, so I try to avoid the phone.

Great platform

Interactive Investor stands out as a reliable platform for serious investors who value a flat-fee structure and a wealth of investment options. While it may not be the best fit for beginners or those with smaller portfolios, its robust tools and transparency make it a compelling choice for experienced investors.

STABLE PLATFORM WITH A GOOD INTERFACE AND GREAT CUSTOMER SERVICE

I have been with Interactive Investor for over a decade and highly recommend the service. The fixed fee pricing for high volume trading is excellent value.

Opening an account

Opening an account is very easy and the interface is easy to navigate

Excellent functionality, good value

I’ve been a very satisfied ii customer for many years now. They have a great range of accounts (trading, ISA, SIPP and JISA’s) all for a single monthly fee. Communication with the company is excellent when needed.

Lots of simple features, easy to use

Lots of simple features, easy to get the handle on and use ongoing. Access instant quotes and get a simple to understand historical record of transtions. Very good phone support.

interactive investor Expert Review

interactive investor offers fixed fee investing on a wide range of investments

Provider: Interactive Investor

Verdict: Interactive Investor’s fixed fee account structure make them one of the most cost effective ways for people with large portfolios to manage their investments, ISAs and pensions. ii are expecially good for high value portfolios and those wanting access to small cap stocks.

What does interactive investor do?

Interactive Investor or II as its known is one of the UK’s largest self-determined investor platforms. II can trace its roots back to 1995 and the startup floated on the London stock exchange back in the year 2000 before being bought by the Australian business Ample in 2002. Today, Interactive Investor is a owned by abrdn with assets under administration of more than £50 billion and 400,000 customers to whom II offers share trading and investment services including, ISAs SIPPs and share dealing, alongside research and analysis. Including model portfolios, selected funds and thematic investments.

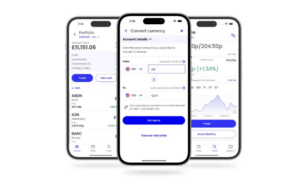

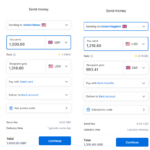

Interactive Investor differs from other investment platforms as it charges a fixed account fee, rather than a percentage of the funds you have on account. Which, over time, could save you thousands in costs.

As a low-cost provider ii competes directly with the likes of Hargreaves Lansdown and AJ Bell offering general investment accounts, ISAs and pensions.

Pricing: Brilliant for medium and large investors, expensive for small accounts.

Market Access: You’ll be hard-pressed to find something you can’t invest in.

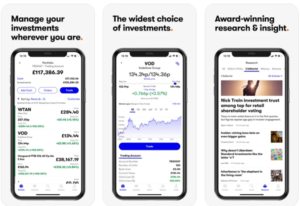

Platform & Apps: Very good, excellent data and usability.

Customer Service: They are massive and mostly online, but you can call them directly, generally good.

Research & Analysis: Loads, daily and weekly updates across all the asset classes they cover, with lots of analysts and opinions. No advice service though.

Does interactive investor pay interest on cash?

Yes, but only 2% for under £10k and you need at least £100k in your account to get their best rate of 3.25%. There are other brokers that offer better rates on uninvested cash, though.

interactive investor versus Interactive Brokers

interactive broker and interactive investor may sound similar but cater to different investor profiles and operate under different jurisdictions and cater for different types of investors.

interactive brokers is a US‑based global brokerage offering a wide spectrum of asset classes and advanced trading tools, often targeting active traders and professionals. interactive investor, by contrast, is a UK‑focused subscription‑based platform offering a fixed‑fee structure suited to medium‑to‑long‑term investors primarily in equities, funds, bonds, Gilts, ISAs, and SIPPs.

interactive investor employs simpler platforms with relatively basic charting tools, while interactive brokers features a more complex interface and lower per-trade costs but with more variable fees. interactive investor is better for large longer term investment accounts because of its simplicity, flat monthly fee and broad UK offerings, whereas Interactive Brokers suits users seeking global market access and sophisticated execution tools.

Can you buy Gilts on interactive investor?

Yes, ii supports investment in government bonds, including UK Gilts, via its platform. This is confirmed on the site, which lists bonds and Gilts as available investments .

Pros

- Fixed account fees

- Easy to use

- Good research

Cons

- No Lifetime ISA

- Expensive for very small accounts

- No derivatives for hedging

-

Pricing

(5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(5)

Overall

5

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.