Freetrade Customer Reviews

Pros: no fees on buying stocks and easy to use mobile app Cons: open up to new european and asian stock markets Pros: User friendly and continuos development of new features Cons: Add more features Pros: Ease of use and communication Pros: Nothing Cons: Everything the platform looks like it’s been designed by my 3 year old cousin! Nothing makes sense even the prices are wrong. Pros: its good for new investors but Trading212 is better Cons: A lot, the plus account just weird that you have to pay for something you can get for free at trading212 Pros: Low fees Cons: LISA Pros: very good but not all round the shares to buy + no ipo+not enough information on stocks Cons: more stocks and ipo and more info on stocks Pros: The user experience is second to none Cons: More data and information provisionTell us what you think of this provider.

5/5

5/5

5/5

1/5

5/5

1/5

2/5

5/5

5/5

5/5

Freetrade Expert Review

Freetrade Won Best Investing App In The Good Money Guide Awards

Is Freetrade a good investing app?

Yes, Freetrade is a great investing app for those with a small amount of money who want a very low-cost way to start investing in UK and US shares and ETFs. As your portfolio grows you can upgrade for better execution and data. It’s most suited to medium and long-term investing.

Yes, Freetrade is a great investing app for those with a small amount of money who want a very low-cost way to start investing in UK and US shares and ETFs. As your portfolio grows you can upgrade for better execution and data. It’s most suited to medium and long-term investing.

Freetrade is one of the original and biggest commission-free investing apps in the UK. It now offers, GIAs, ISAs and SIPPs to over 1.5 million UK & European investors. It is possible to have a free account with end-of-day orders and limited stock data. Or you can upgrade to either a “standard” or “Plus” account for tax-efficient accounts, web access, reduced FX charges and most stock data.

Freetrade also won “Best Investing App” in the 2025 Good Money Guide Awards.

Freetrade offers a ‘freemium’ share dealing service and it’s mission is to get everyone investing by making it simpler and more affordable.

Founded in 2016, Freetrade launched its iOS app in the UK in October 2018, and since then it has grown at an impressive pace.

Freetrade’s popularity stems from two key features: commission-free trading for shares and exchange-traded funds (ETFs), and the ability to buy fractional US shares. These features have made investing more accessible and cost-effective, especially for beginners.

It’s worth noting that Freetrade won the 2021 Good Money Guide award for ‘Best Commission-Free Stockbroker’. It also won the 2019 Good Money Guide ‘People’s Choice’ award.

Pricing:

With Freetrade you can buy stocks with zero commissions.

However, if you’re buying US or European stocks, you’ll need to pay foreign exchange (FX) fees. These fees vary depending on the ongoing plan you choose.

There are three options when it comes to plans. These are:

Freetrade Basic – Free

Freetrade Standard – £4.99 per month billed annually or £5.99 per month billed monthly

Freetrade Plus – £9.99 per month billed annually or £11.99 per month billed monthly

As for how Freetrade’s fees compare to other platforms, they are pretty competitive. But there are lots of variables to consider here including the type of plan you have, the type of stocks you invest in (i.e. UK vs US stocks), and how many trades you make per month.

If you just wanted to buy a few blue-chip UK shares within a General Investment Account, you could potentially pay no fees at all (you would have to pay Stamp Duty on trades).

However, if you wanted to buy and hold UK shares in a stocks and shares ISA, you would be looking at annual charges of at least £59.88.

That’s not particularly high but it can be beaten. AJ Bell, for example, offers an annual charge of 0.25% for ISAs and this is capped at just £42 per year (this doesn’t include any trades).

Market Access: In terms of accounts, Freetrade offers three options, a General Investment Account, a Stocks and Shares ISA and a SIPP (Self-Invested Personal Pension). But, to open a stocks and shares ISA or SIPP you need to sign up for a premium plan.

Pros

- Zero commission

- No fees for a basic account

- Fractional shares

- UK Treasury Bills

Cons

- App only on the basic plan (no desktop)

- 0.99% FX fee for the basic account

- Relatively early stage company

-

Pricing

(5)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(3.5)

Overall

4.1Freetrade Facts & Figures

| ⬜ Public Company | ❌ |

| 👉 Number Active Clients | 1,600,000 |

| 💰 Minimum Deposit | £1 |

| 💸 Client Funds | n/a |

| 📅 Founded | 2018 |

| Account Costs | |

| Investment Account | £0 |

| SIPP | £11.99 per month |

| Stocks & Shares ISA | £5.99 per month |

| Junior ISA | ❌ |

| Lifetime ISA | ❌ |

| Dealing Costs | |

| UK Shares | £0 |

| US Stocks | £0 + 0.99% FX (basic) |

| ETFs | £0 |

| Bonds | ❌ |

| Funds | ❌ |

Freetrade News

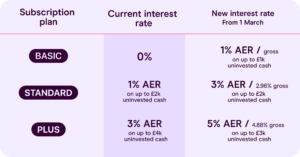

Freetrade Plus Accounts Can Earn Up To 5% Interest On Uninvested Cash

Commission-free share trading and investing app Freetrade’s new cash investment facility which offers easy access and attractive interest rates now

Can you buy fractional shares on Freetrade?

Yes, you can buy Fractional shares on Freetrade. With fractional shares, you can buy a fraction of one US stock.

Is Freetrade Safe?

Yes, you can consider Freetrade to be trustworthy. Freetrade is authorised and regulated by the Financial Conduct Authority (FCA) in

Can you short on Freetrade?

No, you cannot short stocks on Freetrade, but you can still earn money from other people going short as the

Freetrade Investment ISA comes with a free share worth between £100 and £2,100

In this review, we look at Freetrade’s stocks and shares ISA offering, account options, fees and more. Whether you’re a

Freetrade launches Gilt investing in 9 UK Government bonds

You can now buy Gilts on Freetrade, the investing app recently acquired by established stock broker IG. The great thing

Investing in UK Treasury Bills on Freetrade with Adam Dodds, CEO

Freetrade has just launched UK Treasury Bills for their customers, which have previously only been available to UK investors in

Freetrade’s valuation is cut by more than 60% from £650m to £225m

Freetrade the commission-free share investing app has undergone a dramatic cut in its valuation as it seeks to raise new

Freetrade to start lending out customer shares to increase revenue

Commission-free share dealing platform, Freetrade, is venturing into the world of stock lending, a move that it says will help

Freetrade ticked off for Tiktok…

Freetrade, one of the fast-growing commission-free stock brokers claims to change the way we trade stocks and shares has been

Freetrade FAQ

Overall, Freetrade is a good platform that offers a broad selection of investments and very competitive fees and charges. But it’s not perfect. And it’s not going to be the right platform for everybody. As always, the best platform for you will depend on factors such as the size of your portfolio, the investments you like to own, and the extra features you are looking for.

Freetrade is an independent, privately-owned company.

No. While Freetrade offers zero commissions on trades, you still need to pay Stamp Duty, FX fees, and annual charges (if you choose a premium plan).

When you buy UK stocks with Freetrade, the company deducts Stamp Duty at a rate of 0.5%. This does not apply to investment trusts or shares listed on AIM.

The minimum investment with Freetrade is currently £2.

Yes, it does. But you can only access this with a ‘Plus’ account.

There is always investment risk when you buy shares or ETFs. So, if you trade through Freetrade, it’s possible that you could lose money. However, the platform itself should be regarded as safe. It is regulated by the FCA, and accounts are covered by the Financial Services Compensation Scheme (FSCS).

With Freetrade, customer assets are held in ring-fenced accounts. So, if the company goes bust, your assets will be returned to you or transferred to another broker. If you hold cash with Freetrade, you will be covered by the Financial Services Compensation Scheme (FSCS) up to £85,000.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.