In this guide, you can compare the best accounts for setting up regular investments. We also take a look at the pros and cons of drip-feeding versus lump-sum investing.

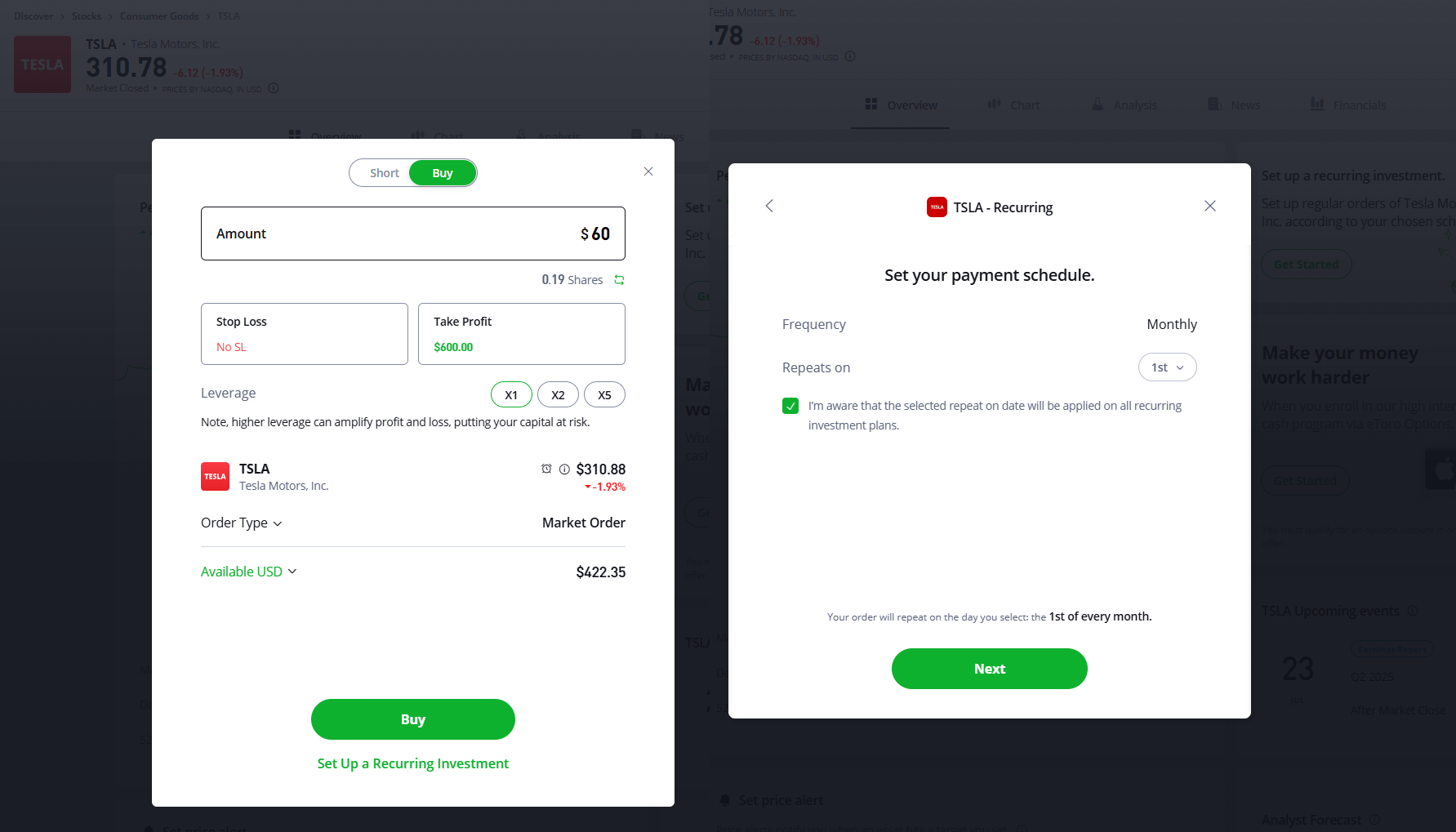

eToro – great for buying regular US stocks

I tested eToro’s new regular investing service, with two orders in Lloyds and Tesla, because well, everyone is buying those two stocks, so why shouldn’t I…

eToro’s recurring investment feature allows users to automatically invest in stocks, ETFs, and cryptoassets on a regular schedule—weekly, bi-weekly, or monthly. Available to users in the UK, Europe, and the UAE, the feature is designed to support long-term investing by helping users stay consistent and reduce the impact of market volatility.

Investors simply choose an asset, set the amount they want to invest (starting from $25), and select a frequency. eToro then places automatic buy orders at the chosen intervals, eliminating the need for manual trading. This approach enables users to benefit from dollar-cost averaging, where investing smaller amounts regularly helps smooth out price fluctuations over time.

Recurring investments are free from commission fees and are ideal for those looking to build their portfolio gradually. The feature is part of eToro’s broader push to make investing more accessible, consistent, and aligned with long-term financial goals.

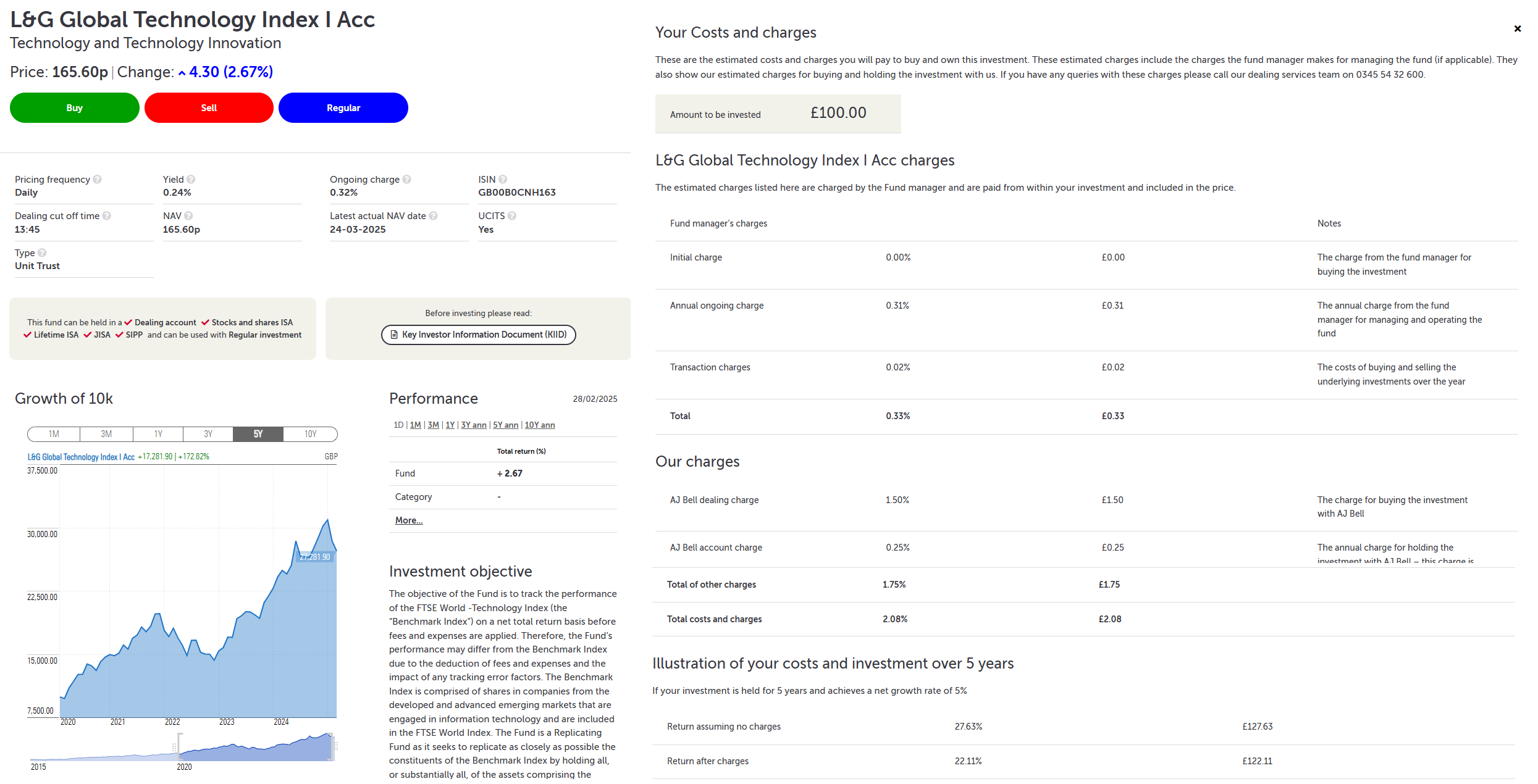

AJ Bell: Great for low-cost DIY recurring investments,

The platform fee is only 0.25% for an ISA. Unlike other platforms, it lets you buy investment trusts and other managed funds. As we featured Ed Monk from Fidelity in this article, I thought it would be interesting to see what his customers were buying.

As luck would have it the most bought Investment Trust amongst Fidelity ISA Millionaires is the Legal & General Global Technology Index Trust, which is great because it contains all the top US tech stocks like Apple, Microsoft, Nvidia, Meta and Alphabet.

A high growth, higher risk type of Investment Trust that would be good for an ISA as profits are tax free. I’ve bought £100 worth a month in my AJ Bell ISA, hoping it will tick up nicely over the next few years as the tech boom continues. In case it crashes, but then I’ll probably just keep calm and carry on whilst averaging down…

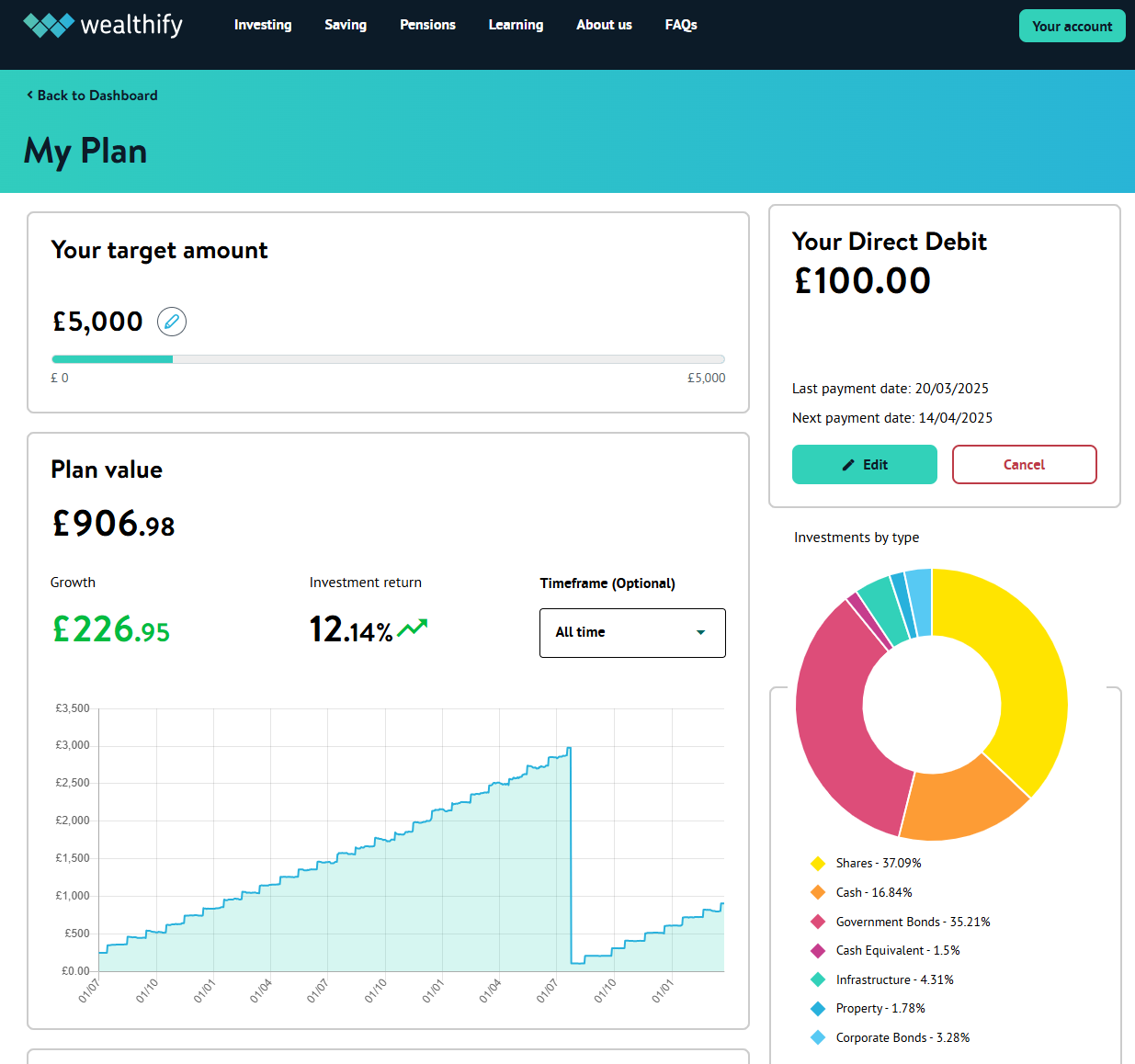

Wealthify: Set up monthly investments into low-cost pre-built portfolios.

I’ve been making £100 regular payments every since my first Wealthify review. It’s quite handy to have for a rainy day. The great thing about Wealthify is that you don’t really have to think about what you are investing in.

You just answer a quick questionnaire and are given a portfolio choice based on your time scale and how much risk you want to take. If you invest in a general investing account, you can access the money pretty much straight away if you need it.

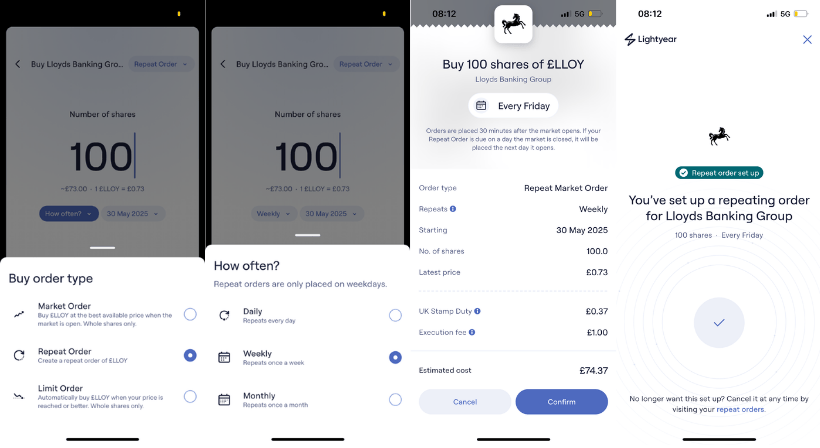

Lightyear: Buy individual stocks on a daily, weekly or monthly basis.

I tested it with a weekly LLoyds purchase, as I think LLOY is on their way to £1. It’s so cheap to invest with Lightyear, there are no account fees and if you fancy buying US stocks instead of homegrown shares, the FX fee for converting GBP to USD is one of the lowest, around at 0.35%.

Lightyear was founded by some of the key players at Wise so the app is super slick and almost propels you on to the next step. Plus, the usual pain point, paying money into your account is one of the quickest I tested with open banking.

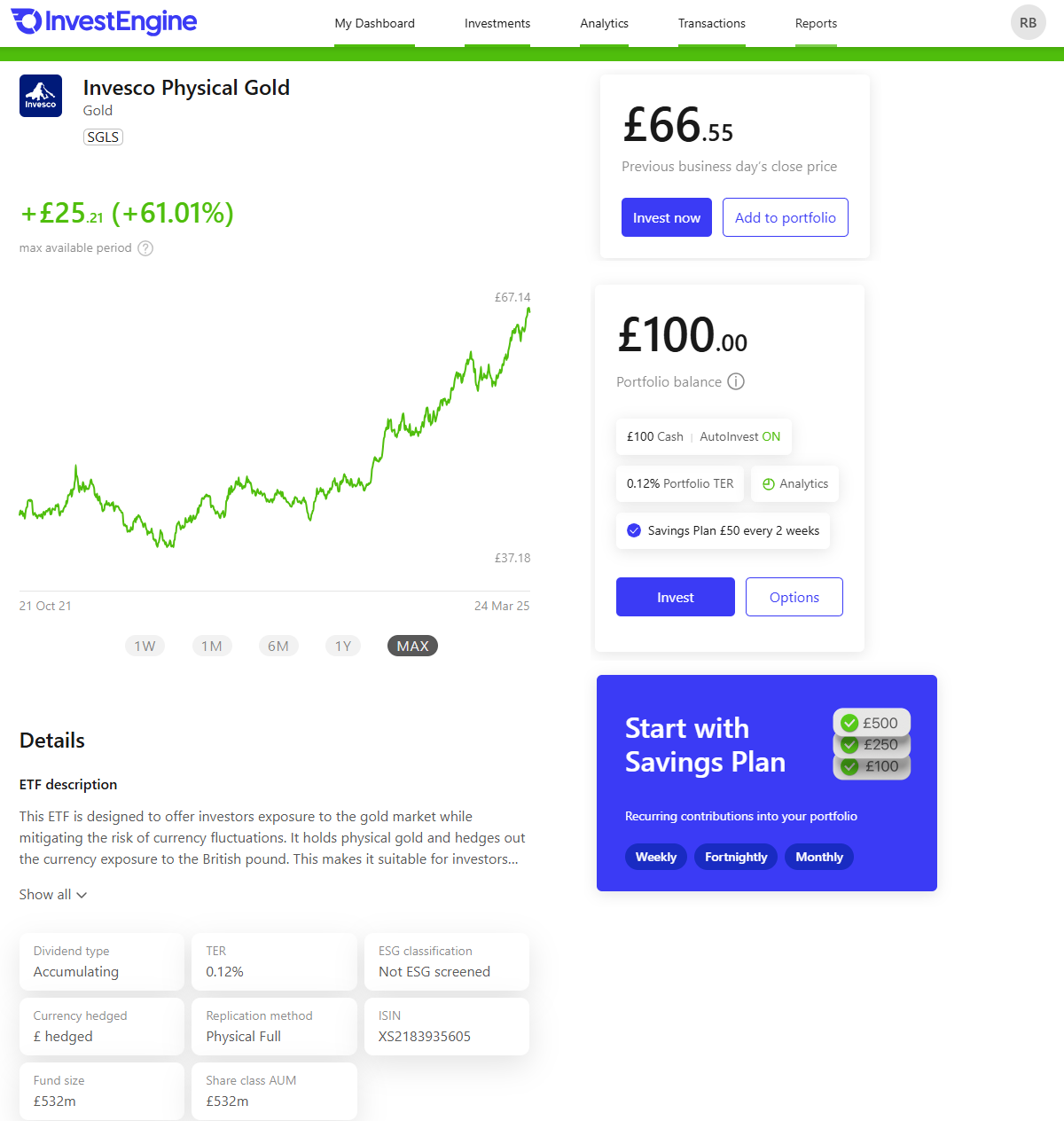

InvestEngine: Commission-Free ETF Pension Investing

It’s free to buy and hold ETFs with InvestEngine in a SIPP and as Gold has just broken through $3,000 and our analysis shows that it doesn’t look like it’s going to stop anytime soon, I set up a regular fortnightly £50 purchase for my pension with £100 to get started.

You can’t actually buy real gold; you have to buy a Gold ETF, which tracks the price of gold. There are some charges levied by the ETF, which are deducted from your account, but no account fee or dealing commission.

Plus, I bought this Gold ETF for my InvestEngine SIPP, which is a pension where you get to choose exactly what you put in it. You can’t buy individual shares or US-listed ETFs, with InvestEngine, but if you are building a diverse portfolio for your retirement (which you should be), it’s a great way to get exposure to sectors, currencies and commodities.

One thing to be aware of is fees. Most platforms charge a fee per deal, although regular investment dealing charges are usually £1.50 versus around £10 for a standard investment. The minimum amount you can invest is typically £25 or £50, but it’s worth bearing in mind that investing very small amounts can be inefficient because of the charges involved.

Regular Investing Versus Lump Sum Buying

Buy low and sell high is said to be the secret to successful investing, but with even the most experienced of investors struggling to predict market movements, it’s a strategy that is fraught with risks.

The difficulty is there is no real way of figuring out how low is low and how high is high. All too often, investors buy investments only to see them plummet in value; or sell them just before they bounce back.

One way of removing the anxiety around market timing is to use a strategy called drip-feed investing. Instead of investing a lump sum of money all at once, you commit to investing a set amount each month.

“By adopting this approach you remove your built-in biases and assumptions automatically and dispassionately, and so are less likely to try and predict how markets will behave,”

Says Ed Monk, associate director for Personal Investing at Fidelity International. We’ve already mentioned Ed, as I bought one of the most popular investments at Fidelity to demonstrate how easy regular investing is.

In addition to taking the emotion out of investing, drip-feeding enables you to average out the price you pay for your investments – a concept called pound-cost averaging. When prices are down you buy more units in your investments and when prices are up you buy fewer.

“History clearly shows that the over long term, markets steadily increase but with down periods in between,” says Andy Parsons, head of investments and product proposition at The Share Centre. “Providing you’re investing for the medium to long term, ideally more than five to seven years, then such an approach should provide a financial reward.”

Regular Investing Is Less Risky

The main benefit of lump sum investing is if share prices are going up you can take full advantage of market growth.

On the flipside, your entire lump sum is exposed to a potential drop in the market, whereas with drip-feed investing only a small proportion of your money falls in value.

Deciding between the two strategies will usually come down to your tolerance for risk.

Lump Sum Investing Wins In A Bull Market

Several pieces of research suggest lump sum investing wins in a bull market, whereas drip-feeding is likely to be the better option in uncertain times. A research paper by Michael S. Rozeff at the University at Buffalo asserts that investors who hesitate lose. His study reveals that a lump sum investment in the S&P 500 made at the beginning of each of the years 1926 to 1990 had an annual return that was higher than a monthly drip-feeding strategy in 40 of the 65 years.

Likewise, a column by Tim Harford in the FT argues that since drip-feeding has only done better than lump sum investing when the market subsequently fell, lump sum investing is a better bet because markets rise more often than they fall. However, he concedes that markets fluctuate a lot, which can result in lump sum investors making simple errors like selling at the bottom.

The beauty of drip-feeding is there is no need to try to time the market – and this removes the potential for costly mistakes.

Recurring Investments Can Produce Better Returns

Analysis from Fidelity suggests impartial investing is more likely to beat a market timing strategy over the long run.

Its research shows if an investor invested regularly in the FTSE All Share between 1990 and 2020 – putting away £1,000 a year in the first decade and then increasing this by £1,000 in each subsequent decade – their original £60,000 would increase to £166,776.

In contrast, if an investor set aside the same amount each year but only invested when the market hit a cyclical peak they would end up with £114,767. Even if an investor managed to invest these same amounts when the market was at its lowest, they would grow their pot to just £144,215.

How To Set Up Regular Drip Feed Investments

Setting up a regular investment through a platform like Hargreaves Lansdown or AJ Bell is fairly straightforward. It’s just a matter of opening an account, choosing an investment and selecting the regular investment option. You can compare stockbrokers for regular or lump sum investments here.

It’s so easy to set up regular investing that it should be part of Freshers week at university and everyone forced to set up a recurring investment at 18, even if it’s jsut for £1. The earlier you start investing the more you will end up with in the long run, as the market usually always goes up. As you can see from our stock market crash statistics, the market normally always goes back up in the end.

I’ve demonstrated how simple it is to set up different types of recurring and regular investments in different markets and accounts below.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.