CFD trading platform Capital.com has resumed onboarding new clients in the UK, more than a year after it paused account openings under its UK-regulated entity. The move marks a return to one of its original core markets, as the fast-growing fintech seeks to re-establish its presence with UK retail traders and high-risk investors.

Capital.com, which is authorised and regulated by the Financial Conduct Authority (FCA), originally launched in the UK in 2018. However, in March 2024 the Capital.com halted the onboarding of new UK customers, citing the need to strengthen its systems, controls, and compliance processes to match its rapid global expansion. Existing UK clients were unaffected, and the firm’s licence remained active.

While the UK was once a significant growth engine for the platform, Capital.com’s business has increasingly shifted overseas. According to its latest figures, the online trading platform reported $1.5 trillion in trading volumes during the first half of 2025, with growth led by the United Arab Emirates (UAE), which accounted for over 70% of MENA region volumes. The group also operates under other regulated entities across Europe, Asia, and Australia, serving a growing global client base.

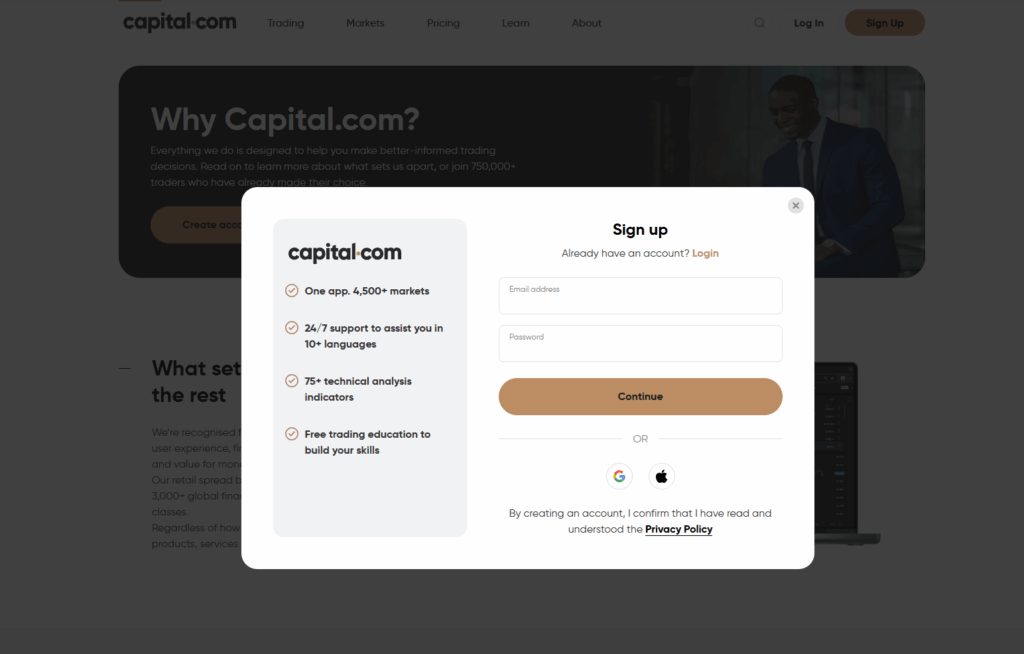

On its UK website, Capital.com positions itself as a transparent and technology-driven trading platform, highlighting its FCA regulation, investor protection measures, and tools designed to help retail traders learn and manage risk. The company says it aims to offer a safer and more educational trading experience compared to many competitors.

Capital.com’s return to the UK market signals confidence that its infrastructure and oversight can once again meet the FCA’s expectations, following a period of rapid international expansion. It also comes as competition intensifies among retail brokers for market share in the UK, where regulatory scrutiny and compliance costs are high.

It remains to be seen how aggressively Capital.com will seek to rebuild its UK customer base, and whether it will adapt its product offering to suit the market’s evolving regulatory landscape or as many other brokers are doing, seeking scale elsewhere.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.