Moneybox offers a simple app to help you start investing and saving where you can try and turn your money into something greater when buying your first home, investing for the future or saving in general.

Moneybox expert review

Review by Richard Berry

Over the last decade, we’ve seen the arrival of a lot of new investment platforms designed to make investing easier. Moneybox is one such platform.

Is Moneybox a good choice for your money? Is it safe? You can find answers to these questions, and more, in our review of the robo-advisor here.

Moneybox Good Money Guide Review

Provider: Moneybox

Verdict: Moneybox offers a simple app to help you start investing and saving where you can try and turn your money into something greater when buying your first home, investing for the future or saving in general.

Is Moneybox good for investing and saving?

Yes, Moneybox is good for investing and saving, especially for beginners, offering a variety of investment accounts and options. It provides robust performance but comes with relatively high fees.

Given its range of investments, Moneybox could be suited to a range of investors. However, it is probably best suited to someone relatively new to investing with a small amount of money to invest. Those with larger amounts to invest may be better off going for a platform with lower fees and more investment options.

Pros

- Variety of Investment

- Good Performance

- User-Friendly

Cons

- Relatively High Fees

- Investment and Platform Risk

- Better Alternatives for Large Investments

-

Pricing

(3.5)

-

Market Access

(4)

-

App & Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.1

What can you invest in with Moneybox?

For a robo-advisor, Moneybox offers a lot of options for investors.

For starters, it offers a full range of investment accounts including:

- Stocks and Shares ISAs

- Lifetime ISAs

- General investment accounts

- Personal pensions

- Cash ISAs

- Junior ISAs

- Easy-access savings accounts

- Fixed-term savings accounts

Additionally, it offers a wide range of investment choices. With Moneybox, you can put your money into:

- Ready-made portfolios – Moneybox offers three options when it comes to ready-made portfolios (more information on the performance of these below).

- Investment funds and ETFs – Investors have access to a vast selection of funds including index trackers, thematic funds, and ESG funds.

- US stocks – With Moneybox, you can buy shares in 20 individual US-listed companies including Apple, Tesla, and Coca-Cola. You can buy fractional shares too.

Overall, Moneybox’s offering is impressive. With the ability to choose what kind of account you want to invest in, and customise your portfolio with different types of products, you have a lot of flexibility.

What ready-made portfolios does Moneybox offer?

Moneybox offers three ready-made portfolios with different risk levels – Cautious, Balanced, and Adventurous. These contain a mix of shares, bonds, property, and cash that include funds run by Fidelity, iShares, Legal & General, Blackrock, and Royal London.

How have Moneybox portfolios performed?

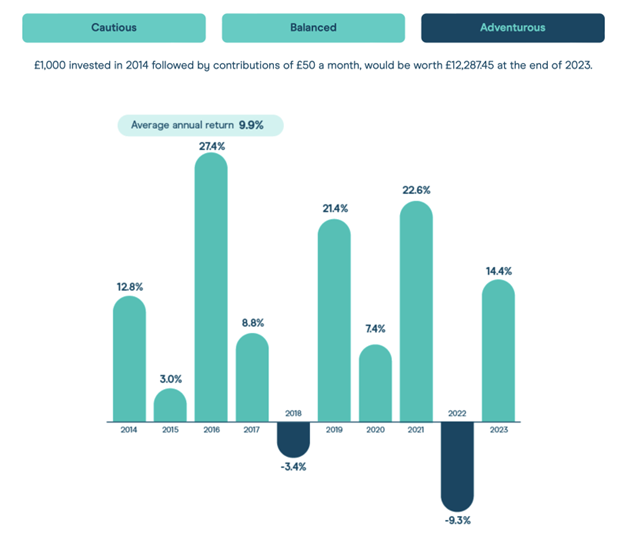

Of the three ready-made portfolios, the Adventurous option has generated the highest returns over the long term. For the 10-year period to the end of 2023, it delivered a return of 9.9% per year (net of fees), which is decent.

What are you actually investing in when you invest with Moneybox?

It’s no secret that Moneybox portfolios, in particular the ISA has performed very well. Investinginsiders.co.uk consistently ranks them as one of the best-performing stocks and shares ISA accounts over the past five years. But how has a seemingly mass-market savings app managed to beat the best investors in the business? Are they investment wizards or are they taking higher risks seeking better returns? The answer I’m afraid is not very interesting, it’s just that the stock market has done quite well recently and the allocation of their portfolios gears more towards equities.

You see, there are three different types of investment strategies, not just with Moneybox, but worldwide.

Cautious: This is where you mainly invest in bonds and interest-paying products. The returns are geared to the level of interest rates and only slightly depend on how the stock market performs.

Adventurous: Here you are taking on more risk in the hope of better returns, this is done by having more exposure to stocks rather than bonds. Stocks make people money by going up in price, you buy low, then sell high to make money. But, you can also lose money if they go down. However, overall the stock market is a mechanism that is designed to go up, as profitable companies survive and remain listed on stock exchanges, where as companies that lose money are kicked out of the main indices like the FTSE 100 or Dow 30.

Then there is also balance, which is somewhere in the middle.

But how do Moneybox decide what to invest in? They must be great stock pickers right to have called the market right? Wrong. Well sort of. Moneybox have picked a few things to invest in. In that they have sort of picked everything to invest in, but just in different amounts.

For instance, all three of their portfolios contain these funds:

| Investment Type (Fund Name) | Cautious | Balanced | Adventurous |

| Global Shares (Fidelity Index World Fund) | 15% | 65% | 80% |

| Global Property Shares ESG (iShares Environment and Low Carbon Tilt Real Estate Index Fund (UK)) | 5% | 10% | 15% |

| Corporate Bonds ESG (iShares ESG Overseas Corporate Bond Index Fund (UK) A sub-fund of BlackR) | 20% | 25% | – |

| Government Bonds (iShares Overseas Government Bond Index Fund (UK)) |

20% | – | – |

| Cash Fund (Legal & General Cash Trust Unit Class I GBP Accumulation – ISIN: GB00B0CNHB64) | 40% | – | – |

So, what you are doing when you invest with MoneyBox is investing in a range of funds that invest in lots of different things. Which then invests in a load of other things. But actually, what has made the difference to the stunning growth of Moneybox portfolios over the past five years is that what you have the most exposure to is US tech stocks.

If you are invested in the MoneyBox Adventueorus fund, 80% of your money is in the Fidelity Index World Fund, and the top ten holdings of that fund are, drum roll please, you guessed it… Apple, Microsoft, NVIDIA, Amazon, Facebook and Meta. About a quarter of the fund is in it’s top ten holdings and the fund contain a whoping 1,429 stocks. You can see what percentage the fund holds below:

| Holding Rank | US Stock | % of assets |

| 1 | Apple Inc | 4.75 |

| 2 | Microsoft Corp | 4.41 |

| 3 | NVIDIA Corp | 4.04 |

| 4 | Amazon.com Inc | 2.52 |

| 5 | Meta Platforms Inc Class A | 1.5 |

| 6 | Alphabet Inc Class A | 1.48 |

| 7 | Alphabet Inc Class C | 1.3 |

| 8 | E-mini S&P 500 Future Sept 24 | 1.19 |

| 9 | Eli Lilly and Co | 0.94 |

| 10 | Tesla Inc | 0.94 |

Even the ESG Bond fund’s top ten holdings are not what you think they’d be. Being an ESG fund you’d expect a range of “companies that make the world a better place IOUs” but instead the holdings consist of Japanese Government Bonds, debt from Anheuser-Busch (that makes beer (ok fine that does make the world a better place), Pfizer (medcine is good but is it ESG?), Bank of America (even the hardest pro ESGs can’t claim bank are green (well not that sort of Green), CVS Health and WarnerMedia (which makes TV shows, which have to be the worst things in the world for the planet).

Is it cheaper to replicate MoneyBox portfolios yourself?

Now, the big question is, can you do this yourself for less? Well, yes you can. You can go to AJ Bell and buy these funds individually and pay 0.25% instead of the 0.45% that Moneybox charges. But would that really make a difference to your returns? Yes, it will, but it will take time and you will have to monitor the portoflios monthly for any changes if you want to continue to replicate then. But is it worth the time? Well, yes if you have lots in your stocks and shares ISA account.

If you max out your ISA and put in £20k for one year the difference will be £50. So that’s quite a lot of work to save yourself £50.

But what about the long term difference, if you invest £20k every year for 10 years and got 7% returns, your pot with Moneybox would be worth at least £1,897 less than with AJ Bell.

So really the question is, how much is £1,800 worth to you if you have nearly £300,000 in your ISA. If it’s a lot, do it yourself, if not, let Moneybox do the hard work for you.

Moneybox versus Nutmeg and other robo-advisors

We recently compared the performance of a few other robo-advisors including Nutmeg, IG, Moneyfarm, and Wealthify. Of the platforms we compared, we found that between 2019 and 2023, Nutmeg had the highest returns. With this robo-advisor, £1,000 in the most aggressive portfolio at the start of 2019 would have grown to £1,549 by the end of 2023.

Had one invested £1,000 in Moneybox’s Adventurous portfolio at the start of 2019, their money would have been worth £1,659 by the end of 2023. So, Moneybox outperformed Nutmeg over this period. Past performance is not an indicator of future performance though.

It’s worth pointing out here that a £1,000 investment in a basic global tracker fund would have most likely produced even higher returns. We calculated that a £1,000 investment in the iShares Core MSCI World UCITs fund over the same period would have grown to £1,834 (before fees).

| Robo Advisor | Account Fees | Average Fund Fees | Plans | Customer Reviews | More Info |

|---|---|---|---|---|---|

| 0.5% - 0% | 0.09% | 3 | (Based on 1,330 reviews)

| See Portfolios Capital at Risk |

| 0.6% - 0.3% | 0.16 - 0.7% | 10 | (Based on 2,564 reviews)

| See Portfolios Capital at Risk |

| 0.75% - 0.35% | 0.1% - 0.21% | 14 | (Based on 235 reviews)

| See Portfolios Capital at Risk |

| 0.25% | 0.07% | 5 | (Based on 1,616 reviews)

| See Portfolios Capital at Risk |

What are Moneybox’s fees?

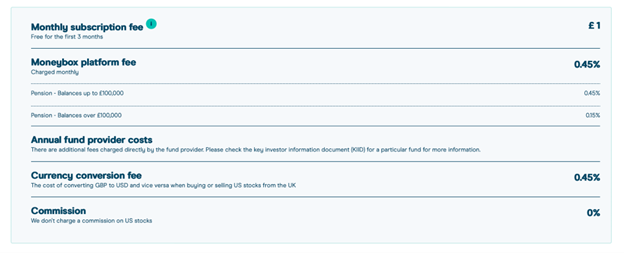

For investment accounts, Moneybox charges three different fees:

- A fixed subscription fee – This is £1 per month, free for the first three months and charged per Moneybox account.

- A platform fee – This is 0.45% of the value of your investments per year (plus an extra 0.15% fee for pensions over £100k).

- Fund provider fees – These vary depending on the funds you’re invested in.

While the platform fees here are on par with those of other robo-advisors, they are relatively high. There are definitely cheaper options out there. With Vanguard, for example, account fees are just 0.15% per year.

There are no commissions when buying US stocks (there are 0.45% FX fees though). This is a good deal. However, annual charges with stocks are 0.45% and there doesn’t appear to be a fee cap. So, charges could be high if you had a large portfolio of stocks.

As for the fund fees, some look quite high too. For example, the Legal & General Global Technology fund has an annual fee of 0.34% on Moneybox. With Hargreaves Lansdown, the fee for this fund is 0.20%.

Is Moneybox safe?

With Moneybox, there are two main risks you need to be aware of.

One is investment risk. When you invest in stocks and funds, there is always a chance that you could lose money. So, you should not invest money that you can’t afford to lose.

The other risk is platform risk. This is the risk of the platform going under. Now, Moneybox is covered by the FSCS, so if it failed you would be eligible to claim up to £85,000 if there was any shortfall in the assets it held for you. Note that Moneybox has appointed UK broker Winterflood Securities to hold investments as a custodian.

In Summary

- Moneybox offers a broad range of accounts for investors

- Moneybox offers a wide range of investments including ready-made portfolios, investment funds, ETFs, and stocks

- Moneybox’s ready-made portfolios have performed well

- Moneybox’s fees are a little on the high side

Last updated 12/9/24