Stockopedia is a brilliant stock market data platform. But it’s not cheap.

Are there any free alternatives? Absolutely. Here’s a look at a few companies and websites that provide free stock market data today.

Koyfin

Koyfin is quite similar to Stockopedia in that it’s a financial data platform designed for retail investors. One key difference, however, is that it offers a free plan.

Now, functionality is limited with Koyfin’s free plan. But there are plenty of features available on this plan including:

- 2-year financials and 1-year estimates for stocks

- 2 watchlists and portfolios

- 2 screens

- Market and macro dashboards

- Fundamental charting

- An economic and earnings calendar

- Web-based news

Ultimately, it could be a good place to start if you are looking for a free alternative to Stockopedia.

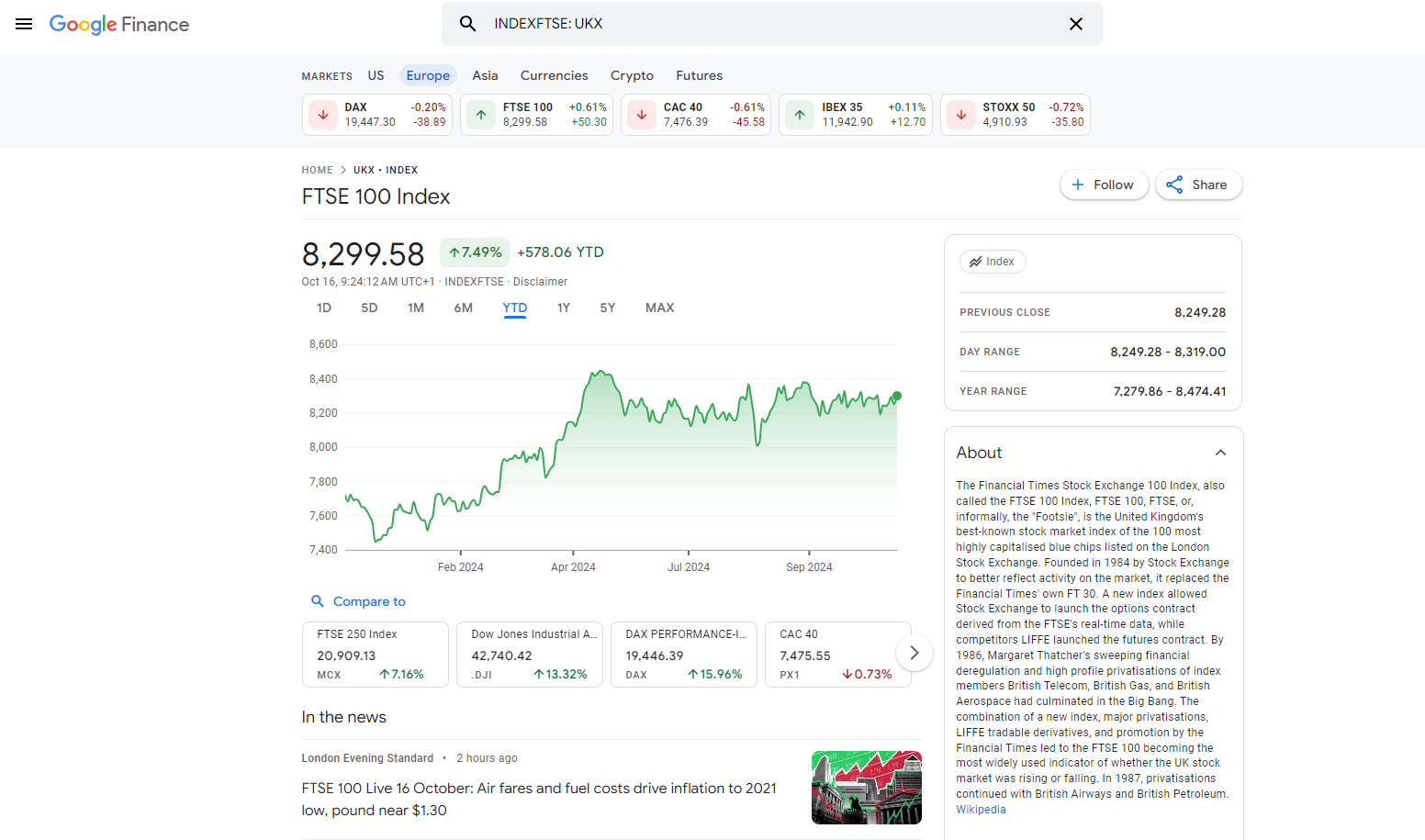

Google Finance

Google Finance is popular with those looking for free stock market data and it’s easy to see why. Not only is the platform easy to use but it’s also very fast.

On Google Finance, you can find:

- Key stats for each stock (P/E ratio, market cap, yield, etc.)

- Companies’ income statements, balance sheets, and cash flow statements

- Charts (you can compare stocks which is useful)

You can also setup watchlists and portfolios, which is handy.

One great feature of Google Finance is that you can use its data to build your own stock market spreadsheets. This can be a valuable tool if you’re running your own portfolio.

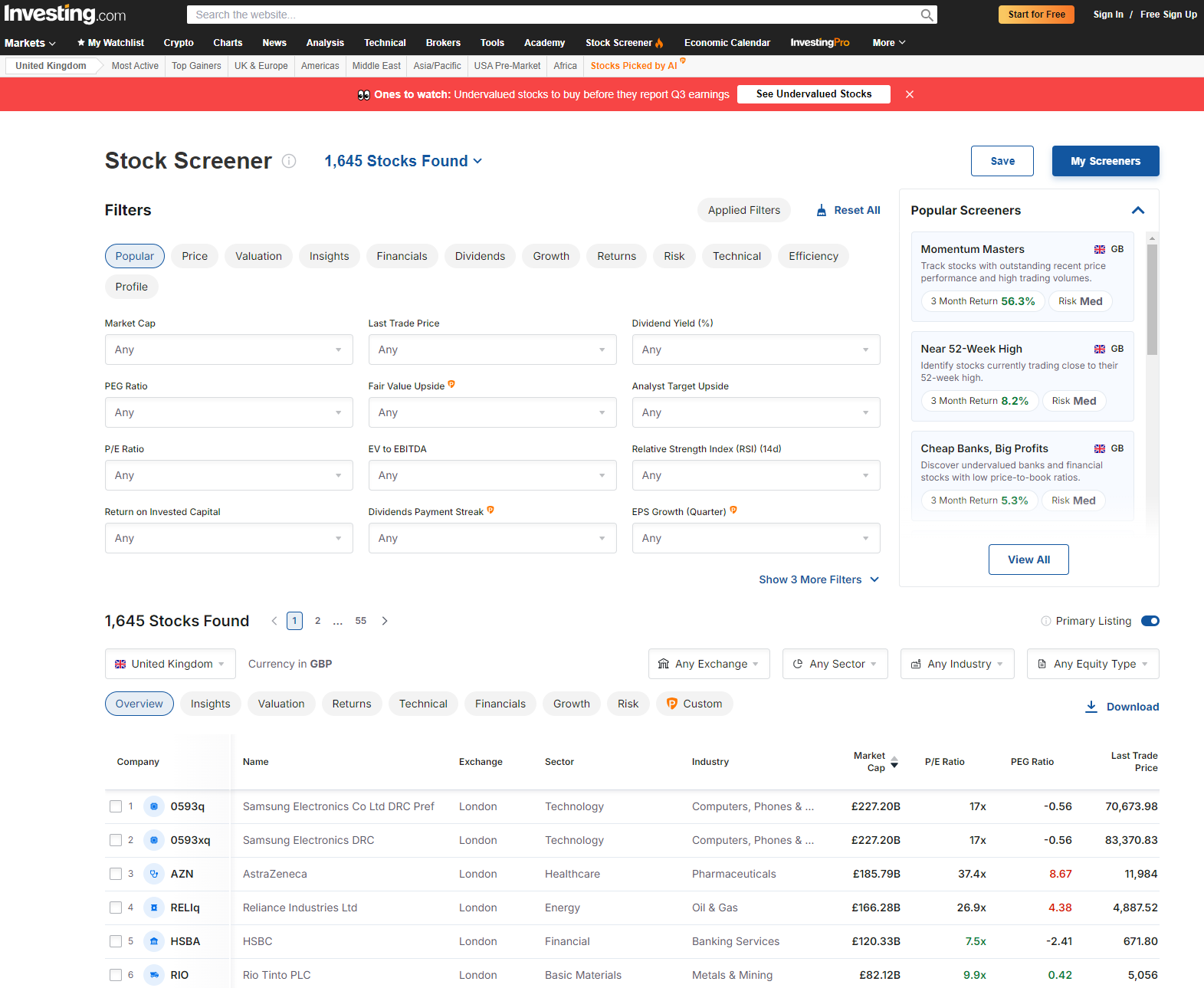

Investing.com

Another popular platform for free financial data is investing.com. With more than 46 million monthly users, it’s one of the top three global financial websites.

On this platform, you can find:

- Key stats for each stock

- 5 years of financials

- Financial ratios

- Analysts’ price targets

- News & analysis

- A stock screener

- Charts

Overall, it’s a very solid investment data platform.

Yahoo Finance

Yahoo Finance has been around for ages now. And while the site can be a bit slow and clunky (mainly due to ads), it’s not bad for a free resource.

At Yahoo Finance, you can find:

- A summary page for every stock

- Income statements, balance sheets, and cash flow statements

- Analysts’ forecasts

- Financial ratios

- A stock screener

- Chart functions

Data comes from multiple sources including LSEG and Morningstar.

Financial Times

If you’re not a fan of the Yahoo Finance user experience, you may want to check out the Financial Times’ data section. It has fewer ads than Yahoo Finance and is therefore a bit more user-friendly.

Here, you can find:

- Key stats for each stock

- Income statements, balance sheets, and cash flow statements

- Earnings and dividend forecasts

- Director information and director dealings

- Charts

Data comes from a range of sources including LSEG and S&P Global Market Intelligence.

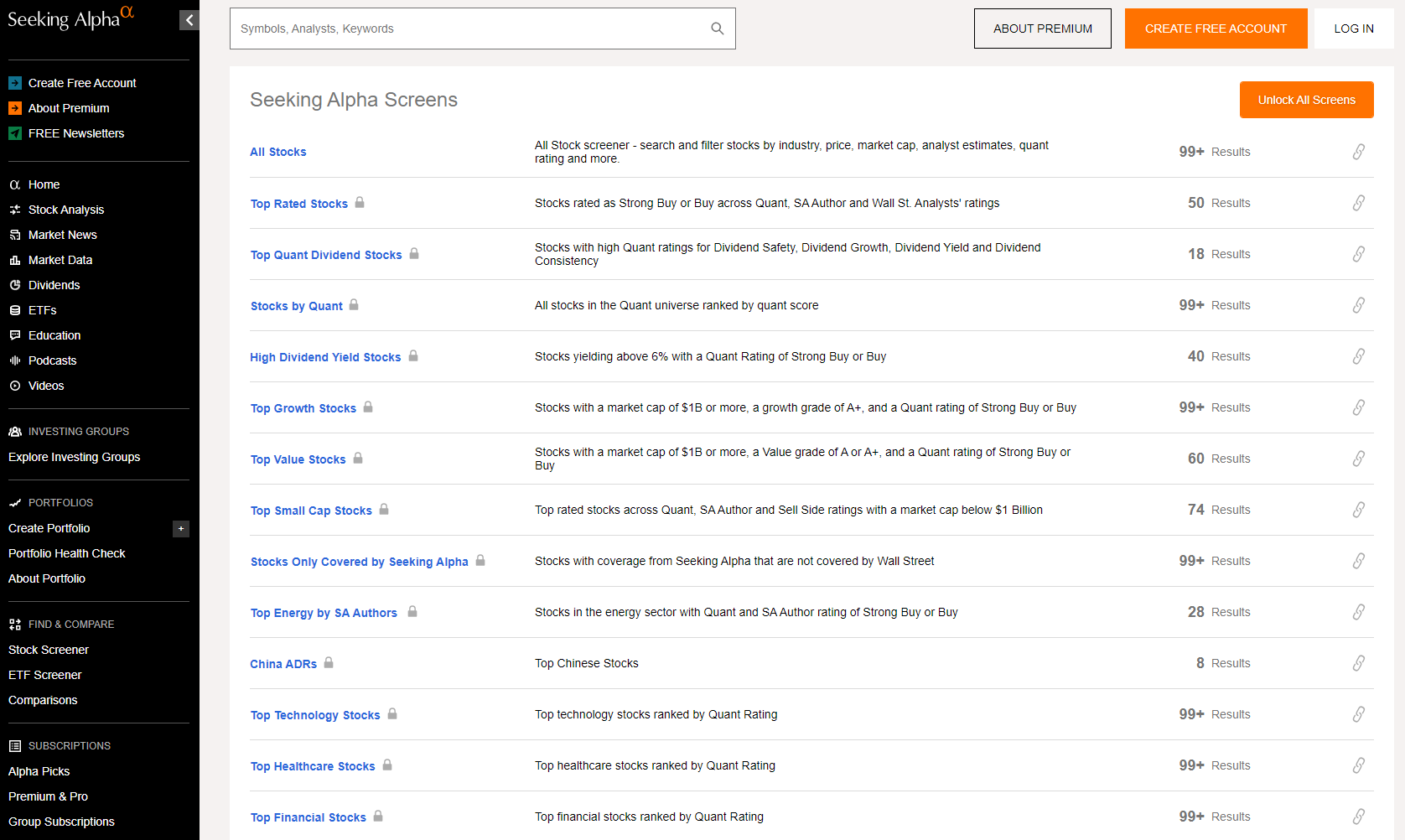

Seeking Alpha

Seeking Alpha is one of the most popular stock market research websites in the world. On its website, there are hundreds of thousands of articles on individual stocks and funds.

With a free Seeking Alpha account, you can get access to:

- Financial ratios

- Income statements, balance sheets, and cash flow statements

- Earnings forecasts

- Sector comparisons

- Charts

- Two research articles per month

Seeking Alpha also has a ‘Premium’ subscription service. With this service, you get access to its Quant ratings, which are based on data and ‘quantamental’ analysis (and similar to Stockopedia’s stock rankings), as well as stock screeners and stock rankings. Additionally, you can read any article on the platform with a subscription.

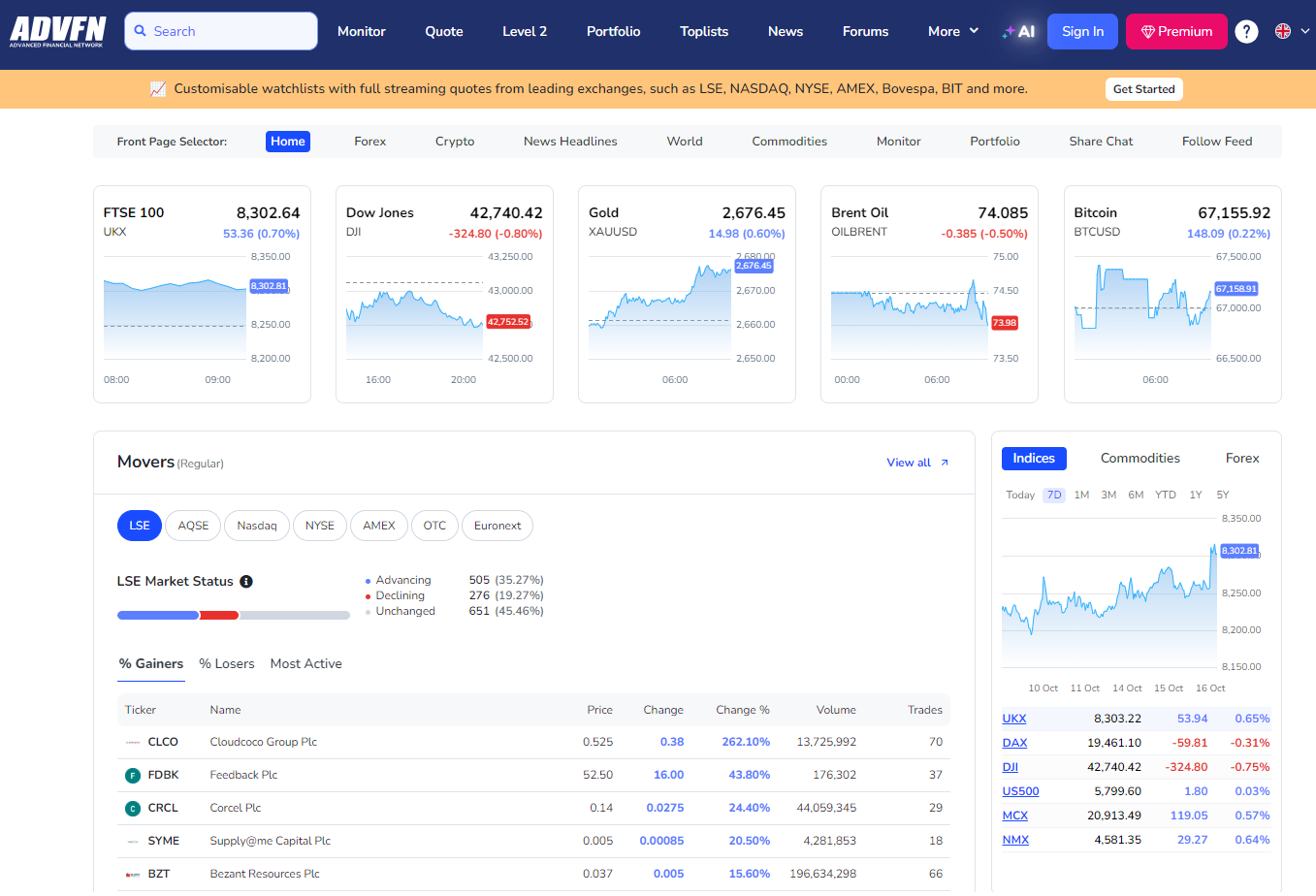

ADVFN

Finally, another option to consider for free stock market data is ADVFN. It’s a UK company that was originally set up as a financial forum in 1999.

With ADVFN, you get:

- Realtime UK quotes

- Financial ratios

- Income statements, balance sheets, and cash flow statements

- Watchlists

- News and research

- Charts

Overall, there’s plenty of data available on ADVFN. The site can be a bit slow due to ads though.

Based in London, Edward is a distinguished investment writer with an extensive client portfolio comprising a diverse array of prominent financial services firms across the globe. With over 15 years of hands-on experience in private wealth management and institutional asset management, both in the UK and Australia, he possesses a profound understanding of the finance industry.

Before establishing himself as a writer, Edward earned a Commerce degree from the prestigious University of Melbourne. Complementing his academic background, he holds the esteemed Investment Management Certificate (IMC) and is a proud holder of the Chartered Financial Analyst (CFA) qualification.

Widely recognized as a sought-after investment expert, Edward’s insightful perspectives and analyses have been featured on sites such as BlackRock, Credit Suisse, WisdomTree, Motley Fool, eToro, and CMC Markets, among others.

To contact Ed, please ask a question in our financial discussion forum.