Why you should invest with dividends in mind

Dividends are an important part of the investment process. Historically, dividends have been a substantial component of total equity returns. Companies that pay the most consistent dividends over time, popularly known as ‘Dividend Aristocrats’, can be invested broadly with exchange-traded funds.

When share prices are roaring ahead, few bother with unexciting elements like dividends. After all, most investors are in the market to make the most money in the shortest possible time. Dividends, on the other hand, are a waiting game.

Take Nvidia (NVDA) as a recent example. When this AI darling went ballistic during 2022-24 – rising a spectacular 1,100 percent, did dividends actually matter? Not exactly. Investors were only interested in its future accelerative earnings and not the dividend yield that these earnings may bring. Growth, in this case, was all that matters.

So why are dividends aristocrates still important?

One major reason for equity dividends is that not all public companies operate in fast-growing industries like AI. Many sectors move at a far slower tempo, such as mining. In this sector, minerals are generally dug out of the ground at a pace that must fulfil all the labour, environmental and safety concerns. Very few ‘revolutionary’ techniques exist that can accelerate this process. To attract investors to these shares, big mining companies therefore pay a reasonable dividend. Another is oil. Many oil companies pay good dividends year after year due to their relative stable earnings.

When companies cannot invest the retained earnings with profitable projects, the most sensible thing to do is to return the surplus capital to shareholders.

The other crucial characteristic of dividends is that equity markets are highly cyclical. Stock prices go up and come down. During a bear market, where equity prices keep falling, dividends help to provide some much-needed returns for shareholders. A form of ‘return stabiliser’, so to speak.

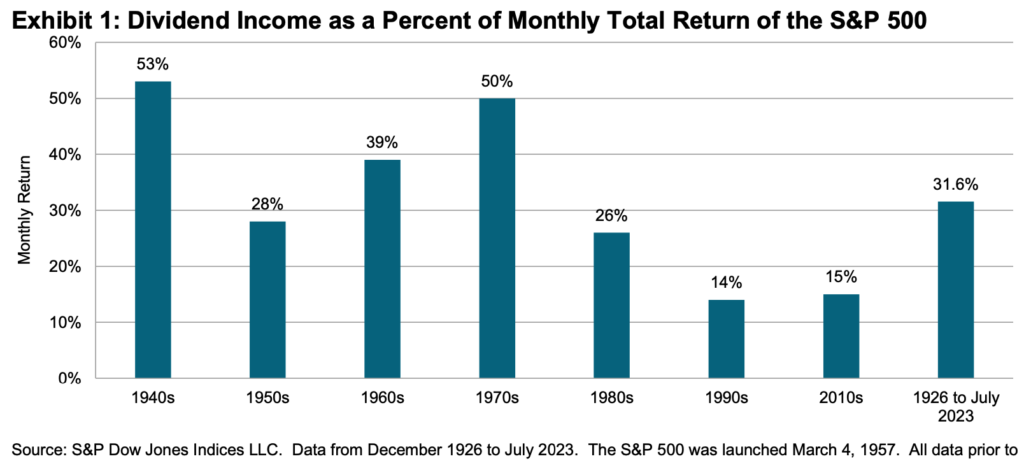

In fact, many academic studies have shown that dividends formed a substantial part of the total equity returns. Look at this chart below (from the Standard & Poor’s). The near-century data (1926-2023) shows that dividend income comprised 31.6 percent of the total monthly return of the S&P 500. This is a major contribution to the overall return for equity investors.

In other words, don’t overlook dividends when investing.

Source: www.spglobal.com

Companies that pay dividends regularly are thus favoured by many investors, like the older shareholders who are in need of dividend income in their later years. Dividend income also helped institutional investors in their asset-liability matching, or making future return assumptions to price asset risk.

And companies that pay dividends without fail for many years are especially prized. If these large enterprises (a member of S&P 500) maintain – and increase – the cash returns to shareholders for a number of years, they are called ‘dividend aristocrats‘.

Higher dividends over time is a sign that the underlying business is both stable and good. In the US, to become an elite member of this dividend aristocrat requires a lengthy 25-year dividend history. This criteria alone filters out much of corporate America. The final list is the crème de la crème of dividend payers.

Unsurprisingly, there are currently only 66 dividend aristocrats in the US. Within this group, the dividend yield can range from 2.3 percent (McDonald’s, MCD) to 4.3 percent (Chevron, CVX). All these businesses are large commercial entities that have been operating for a number of decades. A small sample of these Dividend Aristocrats are shown below.

Dividend investing also provides another critical aspect to investors: compounding returns. That is, you use the equity dividends to buy more shares of the company. Dividend re-investing. This way, slowly – but surely – you enlarge the size of your share of the business over time.

Dividend investing with funds

Given the widespread attractiveness of this dividend concept, financial instruments have attempted to capture a slice of this form of income investing. Many ETFs, for example, are structured around this idea. One such fund is the ProShares S&P 500 Dividend Aristocrats (NOBL) with $11.5 billion assets under management. This ETF (factsheet here) specifically tracks the group of 66 companies in the S&P 500 Dividend Aristocrat Index.

How did the fund do? Graphically, it seems pretty well. Prices are on an upward trajectory. The fund, after several quarters of sideways consolidation, hit new all-time highs just recently (see below).

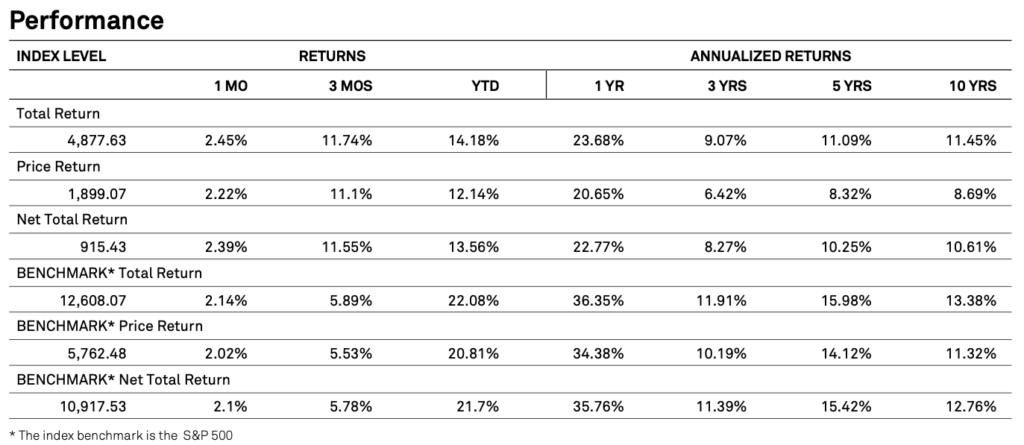

However, if we look closely and compare it against the main (benchmark) S&P 500 Index, some notable differences emerge. The first is that the S&P benchmark index outperforms the Dividend Aristocrats Index significantly.

At the index level (until 30 September 2024), for example, Dividend Aristocrat’s Net Total Return was a respectable 13.56 percent. The S&P 500’s Net Total Return, however, was 21.7 percent. The return difference this year is an amazing 8 percent (see table below).

This begs the question: Why are Dividend Aristocrats lagging the main index? One important market trend over the past 18 months was the emphasis on growth stocks, especially tech-related (and AI) companies.

In the spasm of excitement over new technologies, speculative capital chased the ‘next Google’ or ‘next Apple’. Nvidia was the chief beneficiary of this momentum play. In June this year, its market capitalisation shot up to a staggering $3 trillion – and was briefly the world’s largest company. This AI-focussed tech firm, plus a handful of other tech titans, pushed the S&P 500 Index into uncharted territory. In a word, the benchmark index became really ‘tech heavy’.

Source: Standard & Poor’s (www.spglobal.com, September 2024)

Most Divided Aristocrats, however, aren’t tech. In fact, the majority of tech firms are less than 30 years old. Many dividend yielders belong to the ‘value’ sector. Therefore, this disparity in performance is caused by the presence of mega-cap tech firms in the main benchmark index. These days, growth outperforms value.

You can also see this market effect in the UK, too. Take a look at the SPRD UK Dividend Aristocrat ETF (UKDV, factsheet here) below. Its price trend is showing low-to-moderate capital growth since 2019. As such, when buying consistent yielders, one has to pay attention to the current market momentum and the favoured sectors.

Still, a dividend is favoured by many conservative investors. One clear example of excellent dividend investing is Buffett’s Berkshire Hathaway (BRK), which in 2023 reaped nearly $5.3 billion in dividend income from just seven stocks.

Final Remarks

Should we, then, invest just using the dividend yield consideration alone? No! As you see from the discussion above, the stock market is continuing to pivot into growth stocks. While dividends are important, you shouldn’t miss out capital growth in other sectors. Diversification is important.

Another point to note is that the highest dividend yielders are not always sustainable. When a company’s share price drops sharply to yield at double digit, it signals something has gone awry in its business operations. The market anticipates troubles ahead.

In summary, even though dividends are important they should not be the only yardstick to measure a company. Pay attention to how the dividends are funded. Is it from profits or borrowings? And why is the firm paying dividends at all? Is it because there is not enough market opportunities to re-invest the earnings? All these question help to ascertain the prospects of a company.

If these questions are too complicated to be answered on an individual basis, perhaps sticking to an ETF of Dividend Aristocrats is most suitable since these companies are proven yielders over several business cycles. And you get the diversification benefit, too.

Current List of Dividend Aristocrats

| Dividend Aristocrat | Stock Code | Market Cap ($bn) | Dividend Yield |

| Walgreens Boots Alliance Inc | WBA | 7.5 | 11.5% |

| Franklin Resources Inc | BEN | 10.4 | 6.2% |

| Realty Income Corp | O | 54 | 5.1% |

| AT&T Inc | T | 157.1 | 5.1% |

| T Rowe Price Group Inc | TROW | 24.1 | 4.6% |

| Amcor PLC | AMCR | 16.2 | 4.5% |

| Chevron Corp | CVX | 275.7 | 4.3% |

| Federal Realty Investment Trust | FRT | 9.3 | 4.0% |

| Hormel Foods Corp | HRL | 17.1 | 3.6% |

| Kimberly-Clark Corp | KMB | 47.5 | 3.5% |

| Archer-Daniels-Midland Co | ADM | 28.3 | 3.4% |

| Essex Property Trust Inc | ESS | 18.6 | 3.4% |

| PepsiCo Inc | PEP | 230.7 | 3.2% |

| Consolidated Edison, Inc. | ED | 35.7 | 3.2% |

| AbbVie Inc | ABBV | 343.2 | 3.2% |

| Medtronic PLC | MDT | 113.2 | 3.2% |

| Johnson and Johnson | JNJ | 385.9 | 3.1% |

| Stanley Black and Decker Inc | SWK | 16.5 | 3.1% |

| Exxon Mobil Corp | XOM | 554.6 | 3.0% |

| Clorox Co | CLX | 20 | 3.0% |

| International Business Machines Corp. | IBM | 208.2 | 3.0% |

| Target Corp | TGT | 70.4 | 2.9% |

| Genuine Parts Co | GPC | 19 | 2.9% |

| Coca-Cola Co | KO | 302.4 | 2.8% |

| Sysco Corp | SYY | 37 | 2.7% |

| Air Products and Chemicals Inc | APD | 63.5 | 2.5% |

| NextEra Energy Inc | NEE | 172.3 | 2.5% |

| Procter and Gamble Co | PG | 396.8 | 2.4% |

| Cincinnati Financial Corporation | CINF | 21.7 | 2.3% |

| McDonald’s Corp | MCD | 217.9 | 2.3% |

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.