Yes, stocks and shares ISA are definitely worth investing in. You can become an ISA millionaire with tax-free profits and you can make much more money than you can with a cash ISA.

- Investment ISAs let you invest £20,000 per year with tax-free profits

- They are worth it for those who want to be invested for more than 5 years as the stock market can potentially outperform interest rates and inflation

- For those who may need the money sooner a Cash ISA is a better option as there is no risk of losing money if the stock market goes down

Stocks and shares ISAs are a powerful tool for average investors to increase their portfolio returns. Crucially, investment gains and dividends up to a certain point are free from the taxmen. As the past decade saw higher returns from the stock market over cash ISAs, investors should consider maxing out allocation to stock ISAs every year to reap the benefit of compounding returns over time.

Ever since the creation of Individual Savings Accounts (ISAs) back in 1999, they have been a popular financial tool for households and individuals to save and invest.

The main attraction of ISAs is that interest, dividends and capital gains are all sheltered from the government. Capital withdrawals are permitted ‘without losing any tax benefits‘ as the HMRC writes. The drawback of the ISA financial scheme is that individuals can only put a limited amount of savings into them. For 2024/25, the limit is £20,000 per tax year (running from 6 April to 5 April).

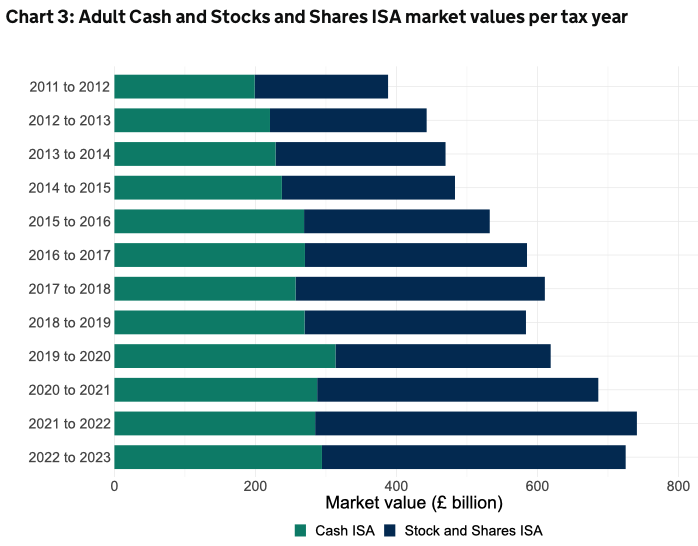

Do not, however, underestimate the power of tiny gains. Over time, these annual ISA savings – aided firmly by compounding returns – propelled many ISAs into seven-figure pots. Last year, ISAs millionaires surpassed 4,000. In the most recent set of data, Stocks & Shares ISAs account for more than 59 percent of the total market value of all ISA accounts (a percentage worth £430 billion!). You can see the total breakdown of cash/stock ISAs below.

Over the past decade, the market value of stock and shares ISAs has clearly grown faster than cash ISAs.

Source: HMRC (Sep 2024)

Two important and sustained macroeconomic factors help to shape this trend. One is the prolonged bull market in equities. Higher stock prices propelled many shares into uncharted territories, which helped stock and shares ISAs immeasurably. At the same time, interest rates were suppressed by the Bank of England. As a result, capital growth on cash savings were minuscule. Near-zero interest rates did not help savers. Only in late 2021 did the central bank embark on a cycle of rate hikes.

Within a stock and share ISA, holders can deploy capital capital into a few major investments classes, including:

- shares of a company

- unit trusts or investment funds

- company and government bonds

For the average investor, these investment choices are more than enough to choose from.

Historically, stock ISAs tended to generate modestly higher investment returns than cash ISAs, as the above chart depicts. But this is not always the case. There are times when economic conditions invert this investment relationship.

According to MoneyFacts (www.moneyfacts.co.uk), in 2023/4, the average stock ISA saw a return of just 2.8 percent. In comparison cash ISAs returned almost a percentage point higher (at 3.73 percent, see below). Another scenario where a stock ISA underperforms a cash ISA is during an equity bear market. Stock prices decline due to poor economic outlook and lower corporate profits. This happened during 2022/23 – when skyrocketing interest rates and tumbling profit margins caused a sharp correction in global stock markets.

On rare occasions, stocks and bonds may even decline simultaneously, thus removing the benefits of diversification of having both in a portfolio.

| 1 Feb 2023 to 1 Feb 2024 | % growth |

| Average stocks & shares ISA | 2.80% |

| Best-performing stocks & shares ISA fund sector | 34.14% (Technology & Telecoms) |

| Worst-performing stocks & shares ISA fund sector | -32.46% (China/Greater China) |

| 1 Feb 2022 to 1 Feb 2023 | % growth |

| Average stocks & shares ISA | -3.27% |

| Best-performing stocks & shares ISA fund sector | 24.64% (Commodities and Natural Resources) |

| Worst-performing stocks & shares ISA fund sector | -32.81% (UK Index Linked Gilts) |

| 1 Feb 2021 to 1 Feb 2022 | % growth |

| Average stocks & shares ISA | 6.92% |

| Best-performing stocks & shares ISA fund sector | 27.69% (Commodities and Natural Resources) |

| Worst-performing stocks & shares ISA fund sector | -21.98% (China/Greater China) |

| Average cash ISA rate | |

| Feb 2023 to Feb 2024 | 3.73% |

| Feb 2022 to Feb 2023 | 1.71% |

| Feb 2021 to Feb 2022 | 0.51% |

Source: Moneyfacts.co.uk (2024)

Of course, the above stock ISA returns are just averaged figures proxied by gains and losses obtained from a basket of funds. Many astute investors generated substantially higher returns than the figures quoted in the table, especially if they focussed on US stocks. Since 2009, the continuing rise of American tech companies is nothing short of spectacular. Apple (APPL), Tesla (TSLA), Microsoft (MSFT), and the latest darling, Nvidia (NVDA), all surged to trillion-dollar capitalisations. More importantly, these American technology leaders can be bought with stock ISAs.

Investment funds that rode this mega-trend reaped riches for their shareholders.

The most famous of these tech-focussed funds in the UK is the Scottish Mortgage Trust (SMT), previously led by James Anderson. Within a decade (2011-2021) the fund grew by more than 1,000 percent as the post-pandemic boom vaulted the US tech-heavy fund to £15 (see its current portfolio here). In 2010, the trust traded near 100p. While prices have regressed substantially from this 2021 peak, the fund is still trading far ahead from its 2009 lows.

Another technology-related fund that are delivering excellent returns for shareholder is the HG Capital Trust (HGT, factsheet here). In the past twenty years, HGT’s returns have topped 2,000 percent! How did it achieve such a stellar result? The company sticked to a niche area that is booming: Software. The fund is the largest investor in the software industry and is extremely adept in discovering fast-growing, high-margin software businesses. Look at its share price performance below; prices soared to new all-high times this year.

There are also other trusts and funds that have scored big gains for shareholders, including Polar Capital Technology Trust (PCT), JP Morgan America Trust (JAM), Scottish Oriental (SST) or JP Morgan India (JII). These companies invest in specific regions (such as US or some emerging markets) or industry (eg, technology or mining).

These funds are mostly active, meaning fund managers pick the best stocks based on rigorous research. There are funds that track specific market indices, such as the FTSE 100 ETF (ISF, factsheet). In a bull run, these indices are excellent choices to hold over time.

The thing is, investors need to stay invested over the long term to reap the reward. Even a strong fund like HG Capital moved sideways for years (2011-2016) before prices took off.

Patience aside, there is also the question of allocation. How much should we allocate to developed equities (ie, shares in developed stock markets), emerging markets, gilts and bonds, and cash? There is no specific rule to this. The whole investment process is more of an art than a science. Perhaps invest in areas you know something about, rather than going into stock markets blindly.

The last element to think about is losers. Not all investments appreciate in value. Losses are part of the investment game. The question is what to do when a stock is struggling. Letting go is one option; add more (averaging down) is another. Deciding which depends on your risk profile and confidence in the asset. Will it ‘bounce back’? Adding to a falling asset will drag the overall portfolio returns.

To become an ISA millionaire, the age-old investment rule still counts: Sell losers and ride winners.

- Interested in setting up a stocks and shares ISA? Compare top-rated stocks and shares ISAs here.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.