Bond Scams: One of the interesting things about running a website is that you can see via the analytics how people end up on it.

It’s part of the way we run the business, we make money by referring users to financial service providers so it’s in our interest to check that when people are searching for things like “best bond broker” our comparison table of bond brokers shows up in the Google search results.

Another technique is to add a link on bond brokers, and by some sort of SEO magic, Google ranks the bond broker comparison page better.

But I digress, the point of Good Money Guide is to highlight providers that are regulated by the FCA and offer a decent service to clients. That’s why we run an awards ceremony and also write reviews as well as just data comparison. It’s hard enough to make money investing sometimes, so you really don’t want your broker to be ripping you off too!

It’s also why we are constantly pontificating about the market. Especially with bond yields at zero and write things like “three ways to recession-proof your portfolio“.

And it seems that people are looking for high-paying bonds at the moment because interest rates are so low. If you want a low-risk investment that provides a fixed income on your money, bonds could be the answer.

We are seeing loads of searches in our analytics for bond comparison sites, bond brokers, offers and providers we have never heard of. These searches are for providers that are not regulated by the FCA, do not show contact details and promise returns of up to 13%.

Which I suppose in a way is good news because it means that some people are doing their homework and researching providers and bond scams after coming across them.

But the bad news is that we don’t feature any of these sites or brands on our Good Money Guide. So for Google users to end up here, there is a clear rise in the popularity of bond scams, dodgy bond and fixed income investment schemes.

So how can you spot a fixed income or bond scam and avoid being ripped off?

- Always check the FCA register to see if the provider is regulated

- Even if they are double check they are not a clone of another real firm – the FCA publishes a list of warnings and clones here.

- Always Google the name followed by “reviews”, but actually read them – often scammers post a lot of fake reviews.

- Keep an eye out for stock images used for supposed employees like “The Real Guy Waltzer” as exposed in the Sunday Times this weekend. You can easily check an image by clicking on it and dragging it to the images tab search bar.

- Always check for contact details. They should be prominent and obvious. If you can’t see them then check the terms and conditions page or the privacy policy page. If the pages do not clearly display what company owns the website alarm bells should be ringing that you have stumbled onto a bond scam.

- Never put your details into an enquiry form as you’ll end up on a list that gets passed around and forever be spammed or cold-called. If you are really curious gmail has a feature where you can set up a temporary email address by adding a + then something before the @. So if you’re email is joebloggs@gmail.com use joebloggs+bond@gmail.com which you can delete later.

- Is there a risk warning? All investing comes with risk, no matter how safe it may seem. If there is no risk warning, that’s a warning!

- Finally, always look for a management or team page, with links to Linkedin profiles and entries on the FCA register. Anyone offering investment advice needs to be regulated by the FCA. After all, as Tom Macura, COO of WiseAlpha says:

“Behind every great product is a team of experienced professionals working tireless to build it. That’s why I recommend reviewing the backgrounds of the people who run a company before investing.”

If people are hiding, they are hiding for a reason…

How do people come across these unregulated bond investment sites?

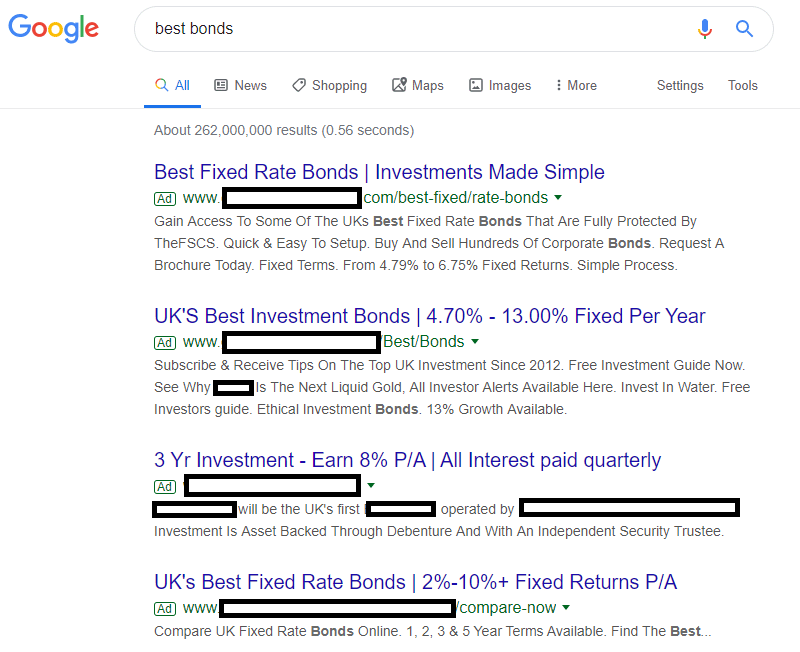

What is probably happening is someone is search google for “best bonds” in which case you’ll get a load of bond scam spammy Google Adwords ads that target keyword searches and put sponsored listings above the actual results.

You can see the results below of such a search, I’ve blanked out any identifiable links, but these results are perfect examples of lead generation sites, harvesting data to pass on to marketing companies so a call center can phone you up and try and separate you from your money.

A prime example of a bond scam was the recent London Capital & Finance scandal after they promised returns of 8% per year to investors, whilst paying their marketing agents a 25% commission on any funds deposited. I think the objective there, was quite clear. They went bust owing £236m to investors.

So how should you find bonds to invest in?

Firstly, there is an excellent site called Fixedincomeinvestor.co.uk which was founded by Mark Glowrey when he was at Stockcube Research and Investors Intelligence. He’s now at City & Continental dealing with institutional bond placings and so one. But he did also write an excellent book called The Sterling Bonds and Fixed Income Handbook: A practical guide for investors and advisers. Note, that’s an affiliate link to Amazon so if you click on it and buy the book we get a little commission. Another way the site makes money.

But anyway, after I took over the running of it when Mark left I installed a forum, which is now populated with some really great chat about bonds. Join in or just see what people have to say about bonds.

I remember an occasion when one such slippery bond scam promoter tried to get people to invest in their unregulated bond via the forum and the community of bond enthusiasts absolutely blasted it. The thread is still there, despite them begging us to take it down.

You can also rank bonds on fixedincomeinvestor.co.uk by yield, time to maturity and so on. However, these are generally, corporate bonds and gilts, so you will need a stockbroking account with someone like Hargreaves Lansdown. You can read reviews of Hargreaves Lansdown here, or our interview with Chris Hill their CEO, or our chat with Peter Hargreaves the original founder here.

But if you just want a fixed rate bond that you can buy, you can have a look on the comparison pages of a respected site like Money Saving Expert but the bonds all offer pretty low-interest rates.

Another option if you want to invest in big brand name bonds that offer higher rates of interest you can take a look at WiseAlpha. They basically buy institutional bonds and then write notes around them so you can earn an income on bonds that you wouldn’t otherwise have access to.

What is the downside of investing in bonds?

There is a downside though. As opposed to bonds where you just earn interest issued by a bank like Lloyds Online Fixed bond that pays 0.55% fixed for 2 years. With those sorts of bonds, you put your money in, you get your interest and then you get your money back at the end.

When you are buying listed bonds like on fixedincomeinvestor.co.uk, or WiseAlpha you have to contend with the price of the bond changing too. If the underlying company is not doing so well, the price of the bond will go down. Which means the yield will go up. FOr example, you can buy £100,000 worth of the bond for £80,000. So you earn interest on a £100,000 investment, instead of the £80,000 you invested.

The advantage, of course, is that you can get some capital appreciation too, in this case, another £20k at maturity.

But, the bond price could drop further and the company go bust and you get nothing.

If you suspect a website of being a bond scam please report it to the FCA here.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com