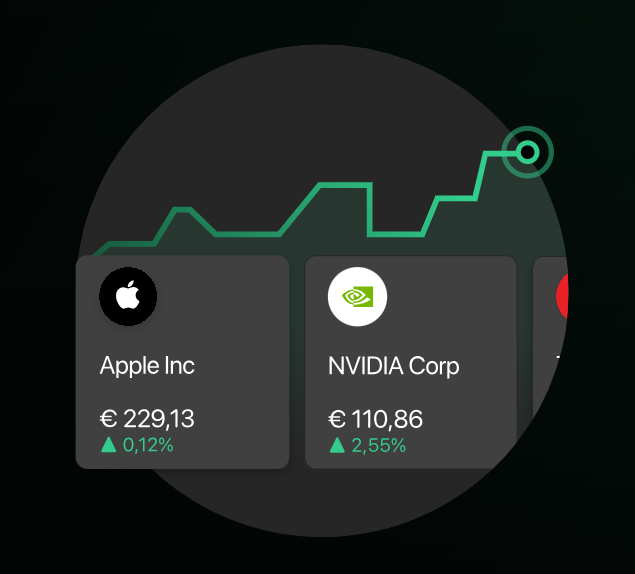

bunq, Europe’s second-largest neobank, which is based in Amsterdam, has just announced the launch of its new stock trading feature bunk Stocks

bunq Stocks is a new investment account designed with “digital nomads” in mind. It allows users to invest in a curated list of popular US and EU public companies and global multi-asset ETFs through bunq’s partner Ginmon. A German fintech with expertise in Robo-investing and online wealth management.

bunq Stocks makes investing more accessible by allowing users to open an investment account within seconds, and by offering fractional share trading with a minimum investment of just €10.

bunk Stocks has a curated list of popular stocks and ETFs, for its clients to trade. Thereby reducing the “complexity of choice” inherent in investing.

Yes, bunq is offering free trades for the first three months to new users of its app.

Can UK clients use bunq Stocks? Well, not yet (and maybe not ever), initially, bunq Stocks is available in the Netherlands and France, though the company does plan to launch the service throughout the rest of Europe over time.

bunq has reached a milestone of 14.5 million users across Europe, cementing its position as the second-largest European neobank, behind Revolut

In addition to Stocks, bunq has announced several updates including An AI money assistant named Finn, which can provide personalised budgeting tips and recommend bars and restaurants in the area.

It also offers an eSIM for frequent travellers, activated via the bunq app, the eSIM provides internet access in over 160 countries allowing users to save up to 90% on their data roaming costs.

bunq was founded in 2012 by serial entrepreneur Ali Niknam, a Dutch entrepreneur of Iranian descent with a background in web hosting and data centres. Mr Niknam invested just under €99.0 million in the bunq start-up.

At its last funding round, of $111.0 million, which was completed in July 2024. The neobank was valued at $1.80 billion.

The latest funding round was supported by existing investors such as Pollen Street Capital. bunq has been pioneering change in the European banking industry, with a focus on serving digital nomads across Europe.

What differentiates bunq within the banking industry?

bunq stands out for several reasons:

It was the first bank to receive a European banking permit in over 35 years, It raised the largest series A round ever secured by a European fintech at €193 million.

It was the first EU neobank to achieve structural profitability which it hit at the end of 2022. The company is now aiming to become the premier global neobank for digital nomads.

bunq’s current valuation is significantly below that of its much larger rival Revolut that valaution gap may have to close in the near future though in which direction is unclear

What are bunq’s plans?

bunq has announced its bid to enter the US market by applying for a banking licence, as part of its mission to build a global neobank for digital nomads in particular expats working and living in the US who need access to banking services

bunq has launched its new Stocks service just days after its larger rival, UK based Revolut, launched a CFD trading service in Europe.

Neither Fintech has chosen to launch their respective services in the UK. That, despite the fact that Revolut was granted a banking licence by the PRA back in July.

Does that reluctance to launch in Britain say something about the regulatory climate in the UK?

Industry sources suggest that Revolut will offer margin trading in the UK in the not too distant future.

However, bunk, which does not have a UK presence, will have to weigh up whether a UK offering would be commercially viable, given the regulatory complexities of operating here.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

To contact Darren, please see his Invesdaq profile.