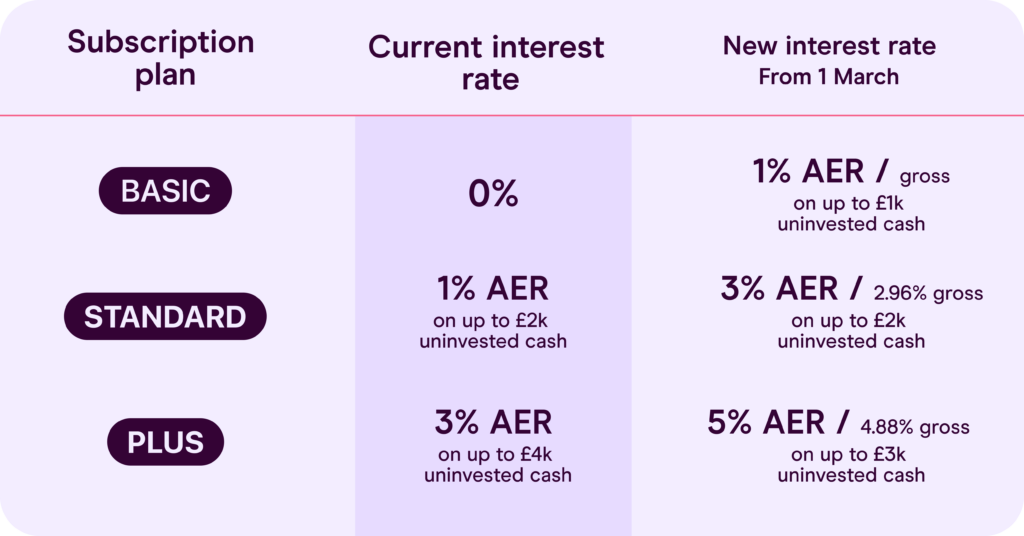

Commission-free share trading and investing app Freetrade’s new cash investment facility which offers easy access and attractive interest rates now pay up to 5% for Plus account holders. This is 0.5% more than the 4.5% current Bank of England Interest Rates.

However, there are limitations:

- The high rate of interest only applies up to £4,000

- You need to pay a £9.99 account fee for a Plus account

- Free account holders on get 1% interest up to £1k

Freetrade cash investments

Freetrade clients will now be able to invest in a range of ETFs that track the overnight interest rate markets in both GBP and USD.

According to the fractional shares broker, these funds offer better rates than are available from the average easy-access savings account.

There are no lock-in periods or fixed terms, and the ETFs are SIPP and ISA eligible, allowing Freetrade customers to benefit from these higher interest rates within a tax-free wrapper.

Cash is back

Rising interest rates have turned cash back into an asset class and with UK inflation now running at 4.60% pa and thus below Bank of England base rates, investors can once again receive a positive real return on uninvested cash.

Freetrade is offering a minimum of five funds from ETF providers that include Lyxor and Xtracker.

Speaking about the new cash investment offering Freetrade’s Head of Communications, Alex Campbell said:

“With rising rates and volatile stock markets, cash or cash-like investments are increasingly looking like a sensible place for investors to park their cash. If a very low-risk fund can be expected to generate a return of over 5% over that period, investors can sit back and offset inflationary headwinds while they wait for investment opportunities to emerge. “

He added

“These funds offer investors greater flexibility than savings accounts and returns that track overnight lending rates, not the whims of banks. Unlike savings accounts, these ETFs can be bought and sold during market opening hours, their returns track the latest benchmark rates set by central banks, and they can be held with cash already inside a tax wrapper.”

Who are Freetrade?

Freetrade was founded by its CEO Adam Dodds back in 2016 and the firm now has more than 1.4 million customers.

It offers clients access to commission-free dealing in more than 6,000 stocks and ETFs via its app.

The firm is independently owned and has attracted 19,000 individual shareholders through crowdfunding.

Freetrade has also received funding from venture capital funds, most notably Molten, and Left Lane Capital.

Investing in cash

Cash is often overlooked as an asset class.

True many portfolios won’t always have large cash balances.

However, as traders and investors sell out of positions or top up their portfolios, they will have uninvested cash balances to manage.

The ETFs that Freetrade are offering could provide an efficient way to get the best returns on that money, particularly when high street banks are in no rush to pass on higher interest rates to savers and investors.

- Related Guide: Best brokers for getting interest on cash balances

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.