Yes, you can buy Bitcoin and crypto ETFs if you are classified as a professional investor in the UK. Retail investors are not allowed to buy cryptocurrency or Bitcoin in the UK, as the FCA has banned them due to the lack of key information documents.

Personally, I think that is idiotic and a prime example of how the UK is lagging in innovation and drive. Significant change is required to inspire investors to engage with financial markets.

What are spot Bitcoin ETFs?

ETFs are Exchange Traded Funds which are open-ended funds, that are listed and traded on a stock exchange, in the same way as stocks and shares.

After much prevarication, and somewhat begrudgingly, the SEC finally gave the go-ahead for the listing of Spot Bitcoin ETFs last year and since then the underlying asset BTC has been on a bit of a run, especially since the new US government is seen as crypto-friendly.

- Further reading: How to invest in ETFs

An ETF typically tracks the performance of an index, sector or commodity. Movements in the price of an ETF reflect the changes in the value of the underlying instruments it tracks.

Spot Bitcoin ETFs, authorised by the SEC, track the spot or cash price of Bitcoin in US dollars, and the value of the funds will be supported by, and hedged with, physical holdings of Bitcoin, rather than derivatives exposure.

The SEC had previously authorised ETFs that track Bitcoin futures prices, but not the coins themselves.

However, the new funds will hold Bitcoins, probably offline, in so-called cold storage, and away from would-be hackers and thieves.

Spot Bitcoin ETFs have been launched by a tranche of well-known money managers, including iShares, Invesco, Fidelity, Franklin Templeton, Vaneck and Wisdom Tree.

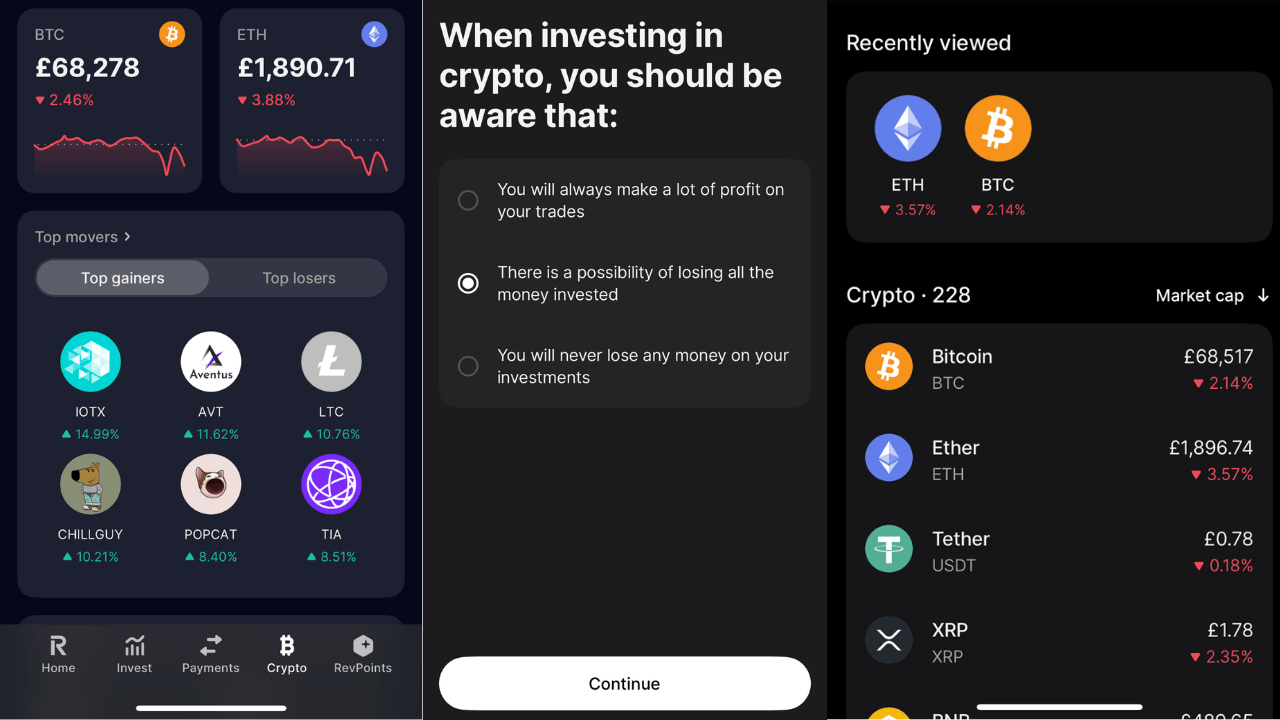

Bitcoin & Cryptocurrency ETFs Alternatives

From 8 October 2025, the FCA will allow UK retail investors to buy regulated crypto ETNs listed on recognised UK exchanges. These products track the price of cryptocurrencies and offer a regulated route to gain exposure without holding the assets directly. True spot crypto ETFs remain unavailable under current UCITS rules, and crypto ETNs will not be covered by the Financial Services Compensation Scheme (FSCS), meaning there’s no protection if the provider fails. Retail investors should therefore check which platforms will offer these products and be aware of the risks involved.

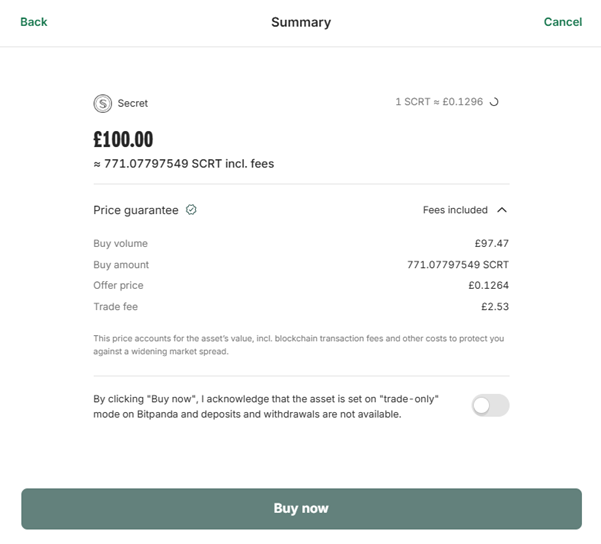

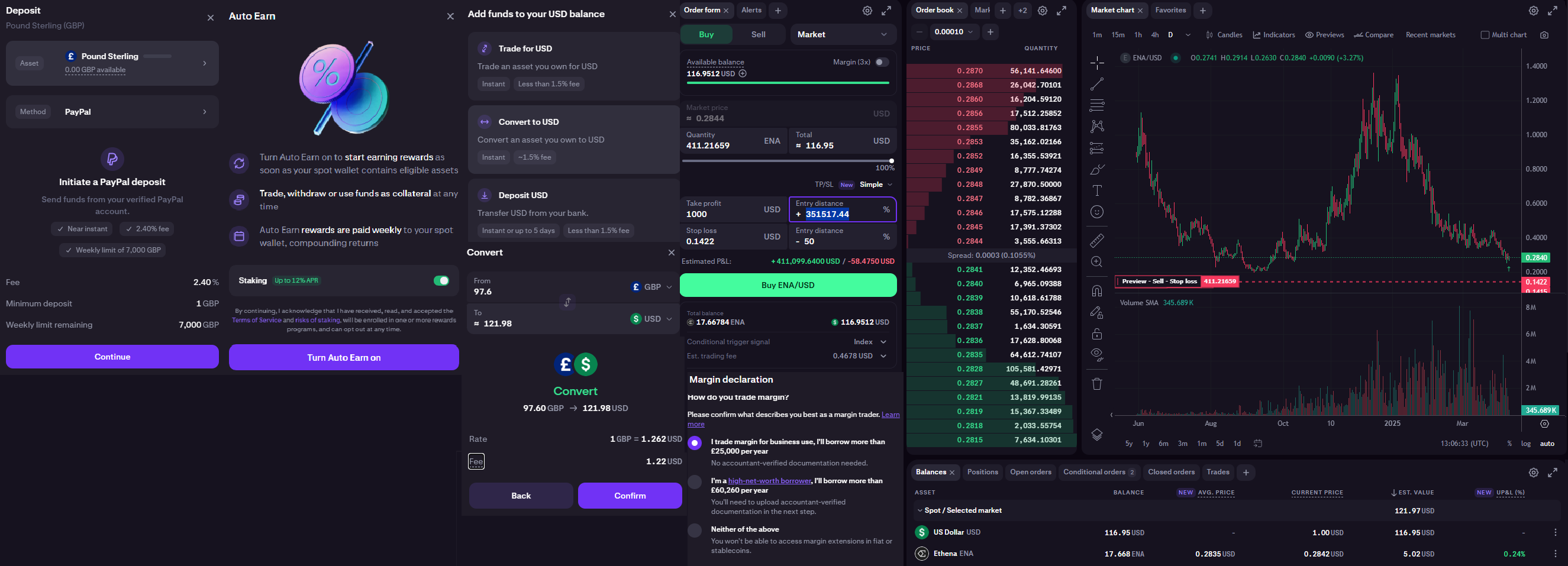

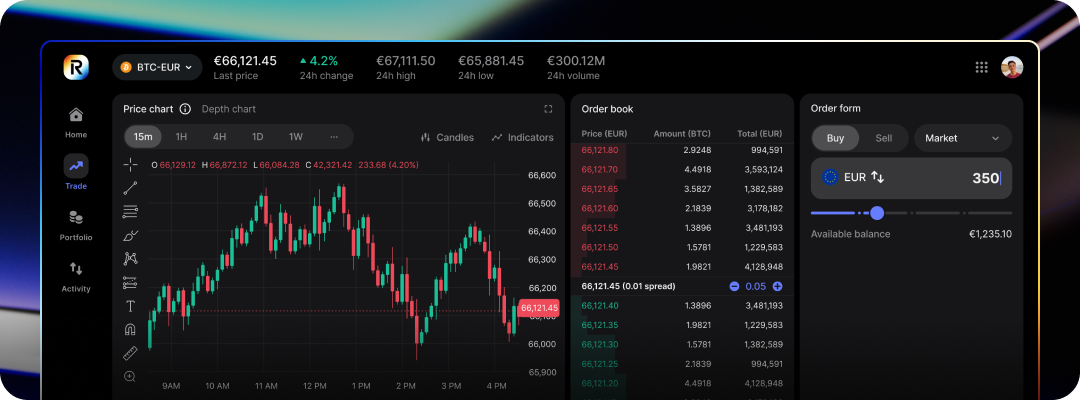

You can buy Bitcoin and Ether ETNs with Saxo, our you can buy cryptocurrency directly on a crypto exchange like Coinbase or through a broker like IG or Interactive Brokers.

| Name | Logo | GMG Rating | Customer Reviews | Cryptocurrencies | Commission | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews |

Cryptocurrencies 150 |

Commission 3.5% |

Features:

|

|

|||

|

GMG Rating |

Customer Reviews |

Cryptocurrencies 8 |

Commission 0.12% to 0.18% |

Features:

|

|

|||

|

GMG Rating |

Customer Reviews |

Cryptocurrencies 400 |

Commission 0% |

Features:

|

|

|||

|

GMG Rating |

Customer Reviews |

Cryptocurrencies 600+ |

Commission 0.00% - 2.49% |

Features:

|

|

|||

|

GMG Rating |

Customer Reviews |

Cryptocurrencies 395 |

Commission 0.02% – 0.04% |

Features:

|

|

|||

|

GMG Rating |

Customer Reviews |

Cryptocurrencies 30 |

Commission 1.49% |

Features:

|

|

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.