I’d say the best thing about Bestinvest’s GIA is the added value. Market access is a bit limited, but you can get advice on what to invest in as and when you need it (at a cost).

Bestinvest’s GIA has recently launched a series of low-cost ready-made portfolios. You can also buy individual shares, funds and trusts. Bestinvest’s investment platform has combined low-cost online investing and share dealing with personalised expert advice to help clients choose suitable investments for their portfolios. A good choice for investors who want to talk to an actual human when investing, rather than doing everything online themselves.

- Investments: Shares, ETFs, funds

- Minimum deposit: £1

- Account types: GIA, ISA, SIPP, JISA, JSIPP

- Account charge: 0.2% to 0.4%

- Dealing fee: Shares £4.95, funds £0

Fees:

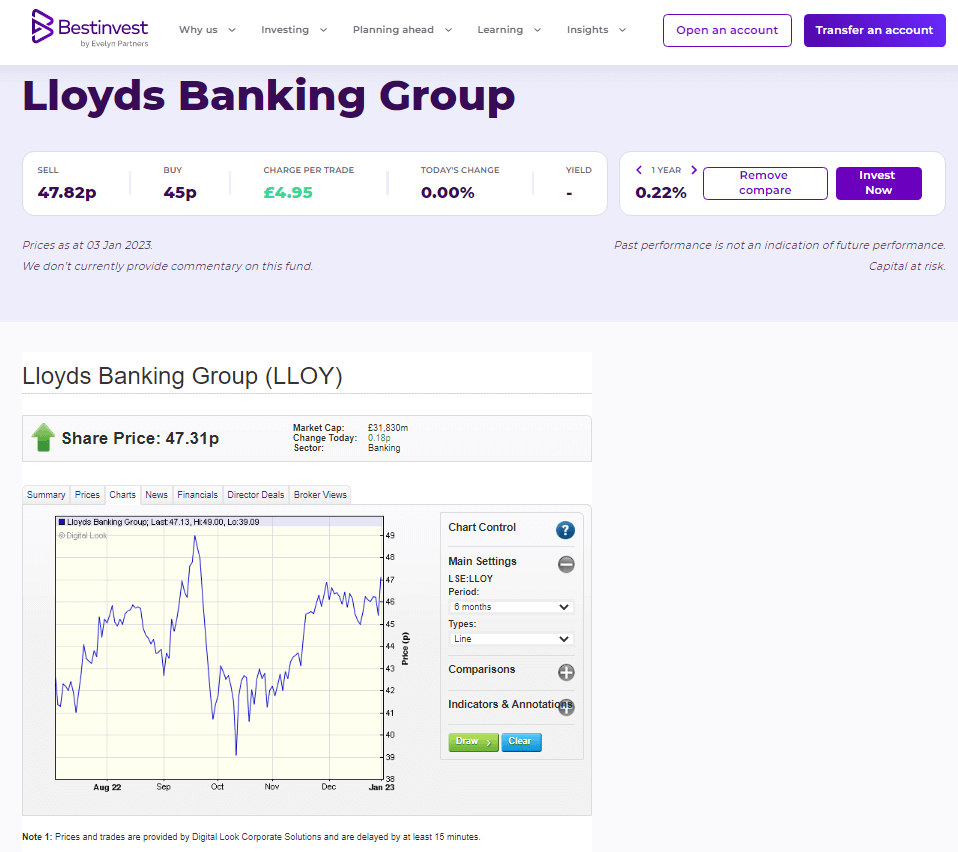

Bestinvest general account fees start at 0.2% a year for smart ready-made portoflios, which makes them one of the cheapest managed investment accounts. If you have more than £500,000 in your account, it reduces to 0.1%. For other investments, like bonds, shares and expert-managed portfolios, the account fee is 0.4% up to £250k. Dealing commissions £4.95 per online share trade, fund dealing is free.

For investment advice, Bestinvest will give you a full portfolio health check for £495, which includes advice on your individual holdings, and suggestions for new or alternative investments. There is also a more basic investment advice package priced at £295 where you speak to an advise who will send a report advising on a ready-made portfolio and some suggestions for creating your own portfolio.

Investing Platform:

Bestinvest’s investment platform is very simple to use and lets you connect with an investment advisor via video chat.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.