Forum Replies Created

-

AuthorPosts

-

Richard BerryKeymaster

Richard BerryKeymasterPeople searching for how to buy Gilts is one of the most popular pages on Good Money Guide at the moment. We have a full guide where you can compare the best investment platforms for buying Gilts in the UK here: https://goodmoneyguide.com/investing/where-can-i-buy-uk-government-gilts/

However, to answer your question well we sourced an expert comment from Mark Glowery from Allia C&C, and author of The Sterling Bonds and Fixed Income Handbook: A practical guide for investors and advisers, who had this to say:

With higher rates on the table (currently up to 5.3% in long-dated gilts) investing in gilts and bills has become much more popular with investors. Higher-rate tax payers are also attracted by the tax-free gains offered by low-coupon gilts.

Most of the wealth management and execution-only platforms will be able to offer dealing and custody in gilts, but it is important to choose a reliable provider that can provide the service at a reasonable price.

The three major private investor platforms in the UK are Hargreaves Lansdown, ii and AJB, all of whom provide a gilt execution service across a variety of investment account types (ISA/SIPP etc.) Online execution is possible with all three with Hl and ii offering instant online dealing on live prices.

Commissions and custody rates will vary across the platforms and I would recommend modelling such charges (both dealing and custody) against your likely activity over the next few years to identify the best value provider.

Richard BerryKeymaster

Richard BerryKeymasterIf you’re looking at Fisher Investments for a £600k pension, the main things to benchmark are fees and performance.

Fisher usually charges around 1% a year (declining at higher levels) which is fairly inline compared with other discretionary wealth managers like 7IM & Saltus most are in the 0.75%–1% range, often with extra fund costs on top.

You might also want to look at lower-cost alternatives such as Vanguard Personal Financial Planning or Wealthify discretionary portfolios, which can be closer to 0.25%–0.75%.

On performance, don’t just take Fisher’s marketing at face value. In the short term (1–3 years), compare them with peer group benchmarks like the ARC Private Client Indices or the Investment Association’s Mixed Investment 40–85% Shares sector. For the long term (5–10+ years), compare them against a global equity index such as MSCI World or FTSE All-World, since Fisher typically runs equity-heavy, globally diversified portfolios.

23rd September 2025 at 11:22 am in reply to: I am looking for a safe platform to be able to trade crypto futures in the uk #154794 Richard BerryKeymaster

Richard BerryKeymasterAt the moment, crypto futures are not allowed in the UK, so any crypto exchange offering it to UK investors you should avoid.

It is possible to trade on exchange crypto futures like Bitcoin and Bitcoin micro contracts if you are classified as a professional investor, but you will have to prove that you can answer yes to two of the three of the below questions:

1. Has your trading averaged 10 significantly sized leverage transactions per quarter over the last 4 quarters?

2. Do you have a financial instrument portfolio, including cash deposits, exceeding €500,000?

3. Have you worked in the financial sector in a professional position, requiring knowledge of derivatives trading, for at least a year?

Even then, any FCA-regulated futures brokers in the UK will ask you to prove this by sending in documentation before providing market access.

Crypto futures are banned in the UK because they are traded on margin with leverage, meaning your losses are amplified and as Crypto is a volatile asset, it can mean you can lose all your money quickly.

However, you can still buy and invest in crypto in the UK through an FCA-regulated cryptocurrency exchange. When you buy crypto, your losses are limited to what you deposited, but you should still be prepared to lose your entire investment.

You mentioned – PTPY – which does not look legit to me – it says it has 7.3m users, but the website profile does not match this. PTPY also says it has an APP on the Apple Store and Google Play, which do not exist. When you enter a phone number, it asks you to sign in and enter a password. To me, it looks like a classic lead generation tool for scams, whereby if you enter your phone number, you will be cold-called afterwards. There are also no reviews for PTPY online that would suggest.

So avoid PTPY.

Safetyvalve, which you also mention, is a scam – avoid.

You also asked about how to vet a platform before depositing funds – always follow these steps.

- Check they are regulated by the FCA – you can do this on the FCA register.

- Double check that you are looking at the right provider website (clone scams are commonplace)

- Always search the internet for reviews – most reputable brands will have a page on TrustPilot, but be suspicious of lots of overly positive reviews

- If you feel under any pressure, walk away. If you are contacted by a salesperson from a financial platform and they give you the hard sell ,that is a big red flag – you should block their number and ignore them.

- And finally, ASK – ask your friends, ask your family, ask the internet, you can even ask us directly in the forum if you think something specific is a scam.

Richard BerryKeymaster

Richard BerryKeymasterThis is a great question as an inheritance can help set children up for life, if invested wisely. We put this question to Charlene Young, a senior pensions and savings expert at AJ Bell, who has given these suggestions:

“Although a child can be named as a beneficiary in a will, this doesn’t always mean they can automatically take ownership of the money when the person who made the will dies. The minimum age is usually 18, although can be 16 in Scotland, where the age someone reaches full legal capacity is lower.

“You’ve mentioned that your granddaughter is 16 and has received the money, so it might be that she lives in Scotland and there are no extra restrictions placed on her by the will, such as the money must be held in trust for her benefit until a later age, or that it must be used for a specific purpose. If a trust is involved then her options will be limited by what the trustees decide, as managing the money for her will be their responsibility.

“Some people worry about young people suddenly taking control of a large sum of money, but this isn’t a view I share. Young people face tough financial conditions, particularly when it comes to paying for higher education, or getting onto the property ladder. A kick start from an inheritance could take a huge weight off their mind and open many different doors to opportunities they might have felt were closed off to them. Inheriting money can come with mixed emotions, but it’s likely that being left a monetary gift will also ensure it is used wisely.

“The main things to consider for your granddaughter are what she’d like to use the money towards, and what that future timeline looks like. That might be university education. While students who are resident in Scotland will generally be eligible for free tuition, there are still living costs to consider which could begin in just two years’ time.

“Even if university isn’t on the cards, anything she’d like to use in the next five years should really stay in cash. Although investing gives money the best chance of growing over and above inflation in the long term, the ups and down of markets don’t make it a good choice for shorter time frames.

“It’s worth pointing out that your granddaughter will have her own personal allowance, meaning she can earn up to £12,570 tax-free a year, plus an extra £1,000 in tax-free interest on any non-ISA savings.

“As interest rates are falling, it’s crucial to shop around for the best rates on cash. Comparison sites can help filter accounts for under 18s, from easy access to fixed term or savings bonds. These might pay higher rates of interest, but this will be in exchange for not having access to the cash for the time frame specified. Most government-backed accounts from NS&I are also available to over 16s, including Guaranteed Growth Bonds and Premium Bonds. Just a word of warning on Premium Bonds – while many people like the thrill of the chance of winning a prize, over two thirds of premium bond holders have never won anything and would have been better off in a general savings account.

“A Junior ISA is often a popular choice, although the allowance for these is £9,000 per tax year. Junior ISAs are tax-free accounts for under 18s, where the money is locked up until their 18th birthday. At age 18, the account converts to an adult ISA.

“There are cash and investment versions available – and while they must be set up and managed by a parent or guardian, banks will support 16- and 17-year-olds with setting up and managing the cash version.

“If the goal is to get on the property ladder in five years or more, then investing might help her get there more quickly than cash, but returns are not guaranteed. Unfortunately, the investment options are quite limited until your granddaughter turns 18, other than stocks and shares Junior ISAs, which I’ve mentioned. From age 18, she’d be eligible for adult ISAs, including the Lifetime ISA, which comes with a 25% government bonus on the money you pay in. The Lifetime ISA allowance is £4,000 with up to £1,000 to come from the government. They do come with some tight eligibility rules though, especially when it comes to using them for a first UK home purchase, so if a property is not the priority, a standard ISA might be a preferred option.”

Richard BerryKeymaster

Richard BerryKeymasterHighly likely it is a scam – I can see no website for it, Station One is not on the FCA register as being able to offer financial services in the UK and users in our forum has reported it as being associated with Whatsapp investing scams.

Avoid: https://goodmoneyguide.com/review/station-one-dma-trading-platform/

You can find out how to report financial scams here.

Richard BerryKeymaster

Richard BerryKeymasterThanks for flagging – I would avoid all of these, as they stink of illegitimacy.

They also do not appear on the FCA register of regulated financial service providers.

I would suggest you report any contact you have had with them as per our guide on reporting financial scams.

4th August 2025 at 11:49 am in reply to: InvestEngine’s ‘temporary’ long term block on managed pensions #153990 Richard BerryKeymaster

Richard BerryKeymasterIt’s a real shame that InvestEngine have paused its managed ETF portfolio service, especially as I’ve been looking forward to reviewing it ever since I interviewed Andrew Prosser about it.

After your question, I did ask InvestEngine why they have paused it, and after a few unanswered emails, Adam Lees, Head of marketing, eventually told me:

“We expect the relaunch to be in the new year and are taking the time to get this right. Our priority product since their launch has been our DIY portfolios and subsequently our pension product, so most of our resource has been focused on these areas hence our recent launch of Hargreaves transfers with more providers to follow. We now service nearly £1.4bn across 120,000 DIY portfolios, 7x our Managed business. We appreciate the interest in our Managed portfolios but we want to make sure we get it right and provide the long-term investing platform that will serve users needs for many years ahead and rival our DIY proposition.”

I’m not overly surprised by this because InvestEngine has been on a massive customer grab at the moment. They have done well onboarding a huge amount of customers from Vanguard after they introduced fees for smaller accounts, as it’s now cheaper to own a small amount of Vanguard ETFs on InvestEngine rather than direct with Vanguard.

InvestEngine are also in the process of signing up lots of new customers from Hargreaves Lansdown, where it is quite expensive to buy and sell ETFs (currently £11.95 – £5.95 per trade).

However, it does seem odd that the managed account service has been paused for so long, particularly when it is one of the only ways InvestEngine makes money, which was something we also discussed when we interviewed InvestEngine.

As a start-up founded in 2019 InvestEngine seem to be following the growth first, profits second path.

Growing a customer base for free by adopting the freemium model then cross-selling a paid-for service is quite normal these days. But you do need to be mindful of it when choosing a long-term investing platform.

Whilst ETFs are held in nominee accounts and are segregated in the event of InvestEngine’s business failing, the inconvenience of moving to another platform would be a pain.

I hope InvestEngine succeeds in producing a good managed ETF portfolio service, but the danger with these is that they do very well in a bull market, but as with everything else, don’t look great when the market turns.

We have reported about this before after Andy Bell the founder or AJ Bell warned on unprofitable fintech investment platforms.

28th July 2025 at 6:04 pm in reply to: IBRK office address in Dubai and contact number please provide #153938 Richard BerryKeymaster

Richard BerryKeymasterHi – You can contact IBKR in Dubai with the below details:

Interactive Brokers (U.K.) Limited (DIFC Branch)

Floor 5, Unit 507, Index Tower, Dubai International Financial Centre, Dubai, United Arab Emirates.

United Arab Emirates

Retail Client Services

+971 8000 311 0143

Institutional Client Services

+971 8000 311 0144

You can also compare other UAE-regulated investing and trading platforms here

Richard BerryKeymaster

Richard BerryKeymasterThanks for your question on Junior ISAs. They are definitely one of the best tools to give children and grandchildren a head start in life, but as you say, there is a danger in giving 18-year-olds access to a large amount of money. This is a common worry, when I interviewed Justin Urquhart Stewart, the founder of 7IM wealth management years ago, he did quip, “don’t put it in a junior ISA so the silly kid gets it when they’re 18. Because the first thing, that’s going to happen is it disappears behind the bar…”

But, I do think so much depends on how you educate children about money and a Junior ISA is exactly the right tool to do that. By getting children involved in the investment process they will learn and grow up understanding the power of compounding returns. One way I get my kids involved is by getting them to pick stocks for their JISA. Fortunately companies like Nike, Roblox and Snapchap are all public compaies you can buy shares in.

Two of my favourite accounts are the Beanstalk JISA (which won best JISA from customer votes in our awards) and Hargreaves Lansdown’s JISA, where you can buy individual stocks as well as funds (and it is also free with no account charge or dealing commission).

So I asked both firms to answer your question, and the good news is that most Junior ISA accounts remain invested after they convert into an adult ISA at 18:

Sarah Coles, Hargreaves Lansdown Head of Personal Finance and Podcast Host for Switch Your Money said this:

“When you give money to children, you have a couple of very straightforward options. A Junior ISA is the most tax-efficient, because growth is completely tax free. You can put £9,000 a year into the JISA, so depending on what is already being paid in, you could make one gift now and one next April, at the start of the new tax year, in order to give the full £10,000-£12,000.

Alternatively, you could consider a bare trust. Assuming you’re not a parent of the child, this will be taxed as belonging to the child, which in most cases means growth and income is tax free. This can be set up easily through an investment company, and you can put in as much as you like each year.

Both are cost effective, and in some cases, you can get a JISA without charges. However, both belong entirely to the child at 18, and it will be up to them how they spend the money.

It’s fairly common for people to worry whether 18 is old enough to make sensible decisions with the money. However, among HL JISA clients, when they mature into adult ISAs, the vast majority still have money invested a year later and almost four in five remain with it to the age of 24. We also did a piece of research asking people what they would have done with a windfall at 18, and the most common answers were saving and investing. If you have a while until they reach 18, you have an opportunity to use the JISA to educate them about investment, and help them build a sense of ownership of the money.

If none of this is reassuring enough, you have two alternatives. You can either give the money to their parents to make decisions on their behalf, or you can set up a trust which specifies they will benefit at 25. Bear in mind these kinds of trusts come with costs, and there will be tax implications too.

The tax on a SIPP works in the same was as any other personal pension. Growth within the SIPP is free of tax. It’s when you withdraw money from the pension that it can be taxed.

Assuming the date for accessing it rises to 57 before you’re old enough to get your hands on it, then at that point you can move your SIPP into drawdown and take 25% of it as tax free cash (you can take this all at once or in a number of lump sums as you go along). After that, any income is subject to income tax – once you make more than the personal allowance of £12,570 a year. Once you qualify for the state pension, that income will also count towards your taxable income.

If you want to retire before 57, it’s worth setting up stocks and shares ISAs and savings to supplement your income until you reach retirement age. If you can do so through ISAs, that income can be tax free. Whatever age you retire, having ISAs will give you flexibility over how you take your income, to help keep a lid on tax bills.”

Cem Eyi, the Co-Founder, Beanstalk & KidStart said:

“It’s a great question and one we often hear from families keen to give their children or grandchildren a meaningful financial head start.

There’s understandable concern about accessing money at 18. But our research at Beanstalk paints a more encouraging picture:

- We see only about a fifth of maturing balances being withdrawn at Junior ISA maturation. The accounts where everything has been withdrawn also tend to be those with smaller balances, typically less than £1,000.

- The majority keep the money invested and plan to use it sensibly, typically for university, travel, or a first home.

- Over 90% of those we surveyed said they felt responsible enough to manage their JISA when the time came.

So while the account legally becomes theirs at 18, the idea that it’s routinely spent recklessly simply doesn’t reflect reality.

And it’s worth asking: is a 25-year-old really that different from an 18-year-old in terms of money mindset? Either a young person has been helped to build healthy financial habits or they haven’t. Encouraging saving and investing early on can help shape those attitudes well before they gain access to the money.

University, training or getting started in adult life all come with costs. Families often need to provide some financial support at 18 anyway. The JISA offers a tax-free, long-term way to prepare for that moment.

For those still keen to delay access beyond 18, a balanced approach could be for example:

Use the Junior ISA allowance (up to £9,000 per child, per tax year) to benefit from tax-free investing and long-term growth.

Keep some savings in the parent’s name, to be gifted when the time feels right – such as age 25. A Stocks & Shares ISA could work here given the long time horizon.When it comes to Junior SIPPs; they can be a great long-term tool, particularly with the government top-up (e.g. £2,880 becomes £3,600). But access is locked until at least age 57 and that age could rise. So while they’re tax-efficient, they’re best seen as a supplement for retirement, not a tool for supporting young adults in their twenties.

Of course, this isn’t personal financial advice – just my own view based on what we’re seeing from families using Beanstalk and our research into how young adults actually use their JISAs”

Richard BerryKeymaster

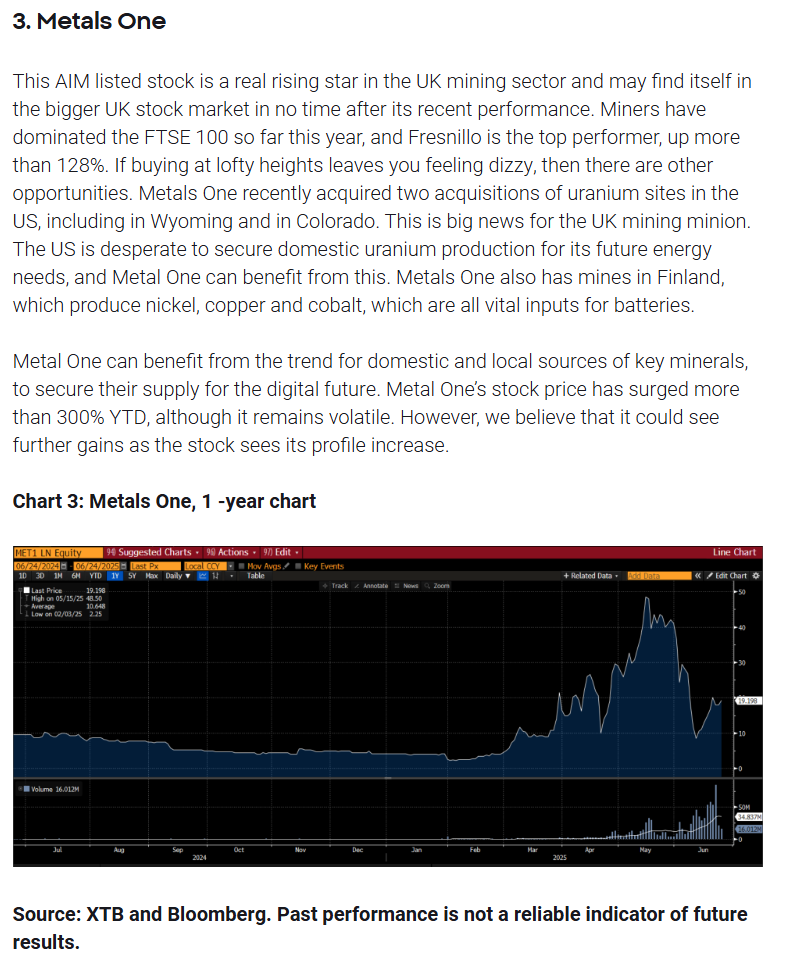

Richard BerryKeymasterHi, thanks for getting in touch – I’m afraid we can’t give direct investing advice as we don’t know your personal circumstances. However, as with all very small mining companies listed on AIM, I would not invest more than I was prepared to lose and view it as part of the very high-risk part of a portfolio. A bit like buying a long dated call option where if you’re right you’ll do well, but if not the investment will be worthless.

I did notice however that XTB have added this as one of their stocks to watch for the second half of 2025, so who knows, maybe there is some fundamental basis despite the pump and dump surrounding it.

A bit odd, as you can’t even buy it on XTB’s trading platform: https://www.xtb.com/en/education/top-5-stocks-to-watch-right-now

Richard BerryKeymaster

Richard BerryKeymasterWe have a few guides that can help with how to invest in stocks you may find helpful:

- How to buy shares in the UK

- How to invest in stocks for beginners with little money

- The different types of investing accounts in the UK

We also produce weekly analysis that features some trending stocks and sectors that investors are focussed on. You can see this here: https://goodmoneyguide.com/analysis/

Or if you are interested in a video demo of how to buy shares please view the below which explains the process whilst reviewing one of the most popular investment platforms in the UK.

Richard BerryKeymaster

Richard BerryKeymasterLong gone are the days when you could walk into your local bank and sell share certificates over the counter. Today it is still possible, but a bit more complicated.

Laith Khalaf, head of investment analysis at AJ Bell told us that “If you hold share certificates, you just need to get in touch with a broker to sell, who will be able to cash them in for you, though there will be a commission to do so, and this is likely to be higher than trading online because the shares are held in certificated form.

“It’s also possible there could be tax implications as part of the sale, depending on how much profit you have made and how you acquired the shares in the first place.”

However, Hargreaves Lansdown, gave us a bit more information depending on different circumstances, saying “it’s a process that has a few steps to it, and those steps vary slightly depending on how the shares are held and how long has passed since the Save As You Earn (SAYE) scheme matured.

It also assumes the shares they hold are in a UK-listed company.”

Depending on how you hold the shares and when the Save As You Earn Scheme matured, there will be a few different options for how you can sell up. For example, if you’re able to transfer them directly into an investment ISA before selling, you’ll avoid any CGT liability. Your best bet would be to contact an investment platform and talk through the best path to take.”

Full information on how to transfer shares from a SAYE scheme is available on the HL website. For any further help, your reader can contact our Helpdesk on 0117 900 9000.

In summary, once someone has bought the shares available to them through the SAYE scheme, they have three options:

- Keep the shares in certificated form or in a standard investment account

- Sell the shares

- Transfer the shares into a pension or an ISA directly with 90 days of the end of the scheme, which wouldn’t count as a disposal for capital gains tax reasons – it would then be possible to sell the shares within the tax wrapper if desired

If more than 90 days have passed, then to sell the share certificates, your reader will need to open an HL Fund and Share Account and deposit the shares electronically, at no cost, before then instructing an online sale and withdrawing the proceeds.

- Open an HL Fund and Share Account

- Complete the attached CREST Transfer Form

- Send us the completed form with the original share certificates

- We’ll process the lodgement, and your reader will then be able to hold the shares, view the latest value, and sell when they wish

- Shares can then be sold online

- The proceeds can then be paid to their bank account

Full detail of the process is available online, by selecting “share certificates” from the dropdown menu.

If 90 days haven’t passed since the maturity of the SAYE scheme, your reader can transfer them into an ISA or SIPP prior to selling in order to avoid any potential capital gains tax liability.

If the shares are held as certificates, they will need to complete the attached CREST Transfer Form as well as the SAYE Form.

Full details of what’s required in this scenario are included on the form.

Richard BerryKeymaster

Richard BerryKeymasterThanks for highlighting this group, my first reaction would be to run a mile and avoid any further interactions and block the group.

Firstly, I could not find any information on Tim Wood as an investment professional on the web or Linkedin, nor did any thing show up for Emily Grace Smith.

Alarm bells should be ringing if you cannot find any trace of some someone offering financial advice without being connected to an established or regulated firm with no online presence. Checking for reviews on trusted sources is one of the first steps people should take before thinking about investing with a new firm.

Secondly, you said that there were 117 members in the group and that they follow the advice. The screen shots of the messages you sent us state at the bottom that “Only admins can send messages” yet, there are messages from members of the group asking questions like “Can you please tell me about AAON? Shall I still hold?” and another asking “Morning FTSE prediction 8795. Be interesting what spending review impact is”.

However, as only admins can post messages and it’s unlikely that members would be made admin, that suggests to me that they are fake prompts to illicit positive feedback. Which is clear from other comments from fake members like “I’m planning to put £2k into BAE Systems”.

You also state that all the recommendations seem to good to be true, and that is usually the case. It’s a fairly standard scam trust building exercise to tip large cap stocks and then hit you with a rogue recommendation.

This appears to be what is going on here, as you mentioned an invitation for a VIP Group, which is where you will either be encouraged to pay for a service, open an account with an offshore unregulated broker or given penny stock tips for pump and dump schemes.

I also noticed that on the performance chart you sent they were using the icon and branding of a UK regulated brokerage XTB. I checked with XTB who stated “XTB does not actively manage any public or client based Whatsapp groups. All client communications are sent by verified methods such as push notifications, emails and SMS. We regularly email clients on how to avoid online investment scams and impersonations. This site / group has nothing to do with XTB and is, therefore, an example of such risks. We would urge all clients – with XTB or any broker – to be highly vigilant in how or where they seek investment information.”

As for the in-depth knowledge displayed, this is easily replicated with AI these days. There are a few tell tale signs like using emoji numbers and written numbers, it’s neutral, logical and doesn’t give an opinion. Plus the use of phrases like “dire scenario” and “degrading public service quality” whilst not in context of an opinion is something that AI writing tools do to emphasise a point.

I’d avoid, delete, block, unsubscribe and report to WhatsApp.

You can help others by reporting scams as soon as you spot them to:

- Action Fraud: https://www.actionfraud.police.uk/reportscam

- National Cyber Security Centre: https://www.ncsc.gov.uk/collection/phishing-scams/report-scam-website

- Financial Conduct Authority: https://www.fca.org.uk/consumers/report-scam

Richard BerryKeymaster

Richard BerryKeymasterWe are not affiliated with that firm in any way and it does indeed look like a scam site. You should avoid any contact with this firm.

For more information about pig butchering and investing scams see here: https://goodmoneyguide.com/investing/how-to-spot-and-avoid-investment-scams/

Richard BerryKeymaster

Richard BerryKeymasterJordan Gillies, Partner at Saltus has provided the following answer:

There appears to be some confusion about the application of the standard £325,000 nil rate band (NRB). This is available to all individuals and can be used against any asset type on death. This includes a primary residence. The £175,000 residence nil-rate band is an additional relief available to those passing on a qualifying residence on death.

Therefore, in the example below, the £325,000 NRB will be fully utilised by £300,000 of the personal assets in the estate and £25,000 of the property value. The £175,000 residence nil rate band (RNRB) could then be applied to the remaining £175,000 of the property value. There would consequently be no IHT to pay. Unlike the standard NRB, the residence nil rate band only applies to an eligible property and cannot be used for any qualifying asset for IHT.

More information on how the allowances are applied and the impact of tapering on the RNRB can be found on Gov.uk

Nothing within this content is intended as, or can be relied upon, as financial advice. tax rules may change and the value of tax reliefs depends on your individual circumstances.

-

AuthorPosts