-

Reviews By

Richard Berry

Reviews By

Richard Berry

- Updated

Direct Market Access (DMA) brokers give traders direct market access to exchange order books for better pricing and execution of futures, options and CFDs.

| Name | Logo | DMA Markets | Min Deposit | GMG Rating | Customer Reviews | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

DMA Markets 9,000 |

Min Deposit £1 |

GMG Rating |

Customer Reviews 3.6

(Based on 74 reviews)

|

Visit Platform 62% of retail investor accounts lose money |

DMA Account Types:

|

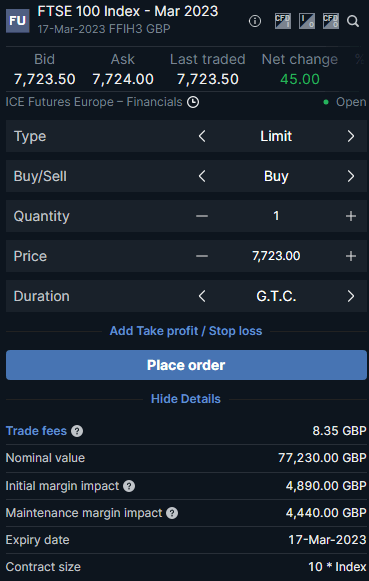

Saxo's DMA gives you direct market access to multiple futures and stock exchanges Account: Saxo DMA Trading Description: Saxo Markets won “best DMA broker” in our 2023 and 2020 awards. They offer an robust and intuitive trading platform with wide exchange and market access. Commissions are competitive, but dealer support is what makes them stand out. Is Saxo good for hedge funds and DMA trading? Yes, Saxo provides DMA access to a wide range, but they may not be the best broker for direct market access. I would say that Saxo is the best DMA CFD broker for trading equities for the majority of retail traders. But, if you are a very advanced trader Interactive Brokers offer more execution functionality like the ability to trade pairs with a single click as a percentage or spread, as opposed to Saxo where you have to execute two individual buy and sell orders. With Saxo Markets you can trade DMA stock CFDs, on-exchange futures and options with ultra-tight DMA spreads, with prices derived from a wide range of Tier 1 institutions. Over the last 15 years I’ve traded with Saxo Markets as a retail client, I’ve been a competitor as a broker at Man Financial, and I’ve been an institutional customer when I had a white label of their trading platform when I was at Investors Intelligence. I’ve also interviewed two of the Saxo UK CEOs and been to their offices a few times, so I know a fair bit about them. In this review, I tell you what I think of Saxo from a trader’s perspective and what sort of client will get the most from their brokerage services. The thing about trading is that it is completely misunderstood. People still think they can beat the market with little or no knowledge about how global macroeconomics or a company’s balance sheet works. Trading is no different to any other skill, hobby or career, it requires experience. There are some great quotes in a book called Reminiscences of a Stock Operator, it’s a ripping yarn and was written 100 years ago, but some of the lines are still particularly relevant. One, for example, is, “If it takes 5 years to get a bachelor’s and master’s in a subject and 10,000 hours in other skills, why should it be different for stocks?” I bring it up because when I interviewed the UK CEO of Saxo Markets, Charlie White-Thomson before writing this review, he said that was one of his favourite books on investing. It’s true, trading is hard, you have to know what you are doing, study, learn, and develop. It’s not for everyone. People think it’s easy. It’s not, it’s very high risk. If you are going to trade you have to understand it. What it is, why you’re doing it and what the risks are. My point here is that there are many different trading platforms and brokers to choose from, and all cater to slightly different audiences. Some cater to absolute beginners, some are more focussed on FX, others on stocks, some on automated trading strategies, and some for people that just want to tap away during the day scalping the markets. But Saxo Markets, in my view anyway, has always catered to the more experienced traders, ones who may have already spent five years cutting their teeth as a risk warning statistic. Saxo were in fact one of the earliest brokers to offer multi-asset trading from a single platform with direct market access, which puts them at the most sophisticated end of the spectrum. Saxo – Ideal For Experienced TradersFor more experienced traders Saxo Markets offers CFD trading with direct market access. This means that instead of trading at prices set by the broker (usually slightly widened from the underlying bid/offer) you trade at the price you see on the exchange. By trading DMA CFDs your orders are placed directly on the order book letting you work limits inside the best bid/offer, meaning if you don’t want to deal at the market you’ll get better pricing than anywhere else if filled. Because you are trading DMA, your commission is charged afterwards and not included in the spread. This type of trading is particularly suited to larger and more professional traders, which is Saxo Markets ideal customer. Futures, Options & DMASaxo are also one of the few trading platforms in the UK that offer retail traders (private clients) access to futures and options. Again an indication that Saxo goes after and caters to more experienced customers, because trading futures is for higher value accounts. FTSE futures for example are traded on ICE, and 1 lot is valued at £10 per index point. So, if for example the FTSE is trading at 7723 (as they are today) the smallest trade you can put on gives you £77,230 of exposure to the 100 biggest companies in on the LSE. Which is an initial margin of £4,890.

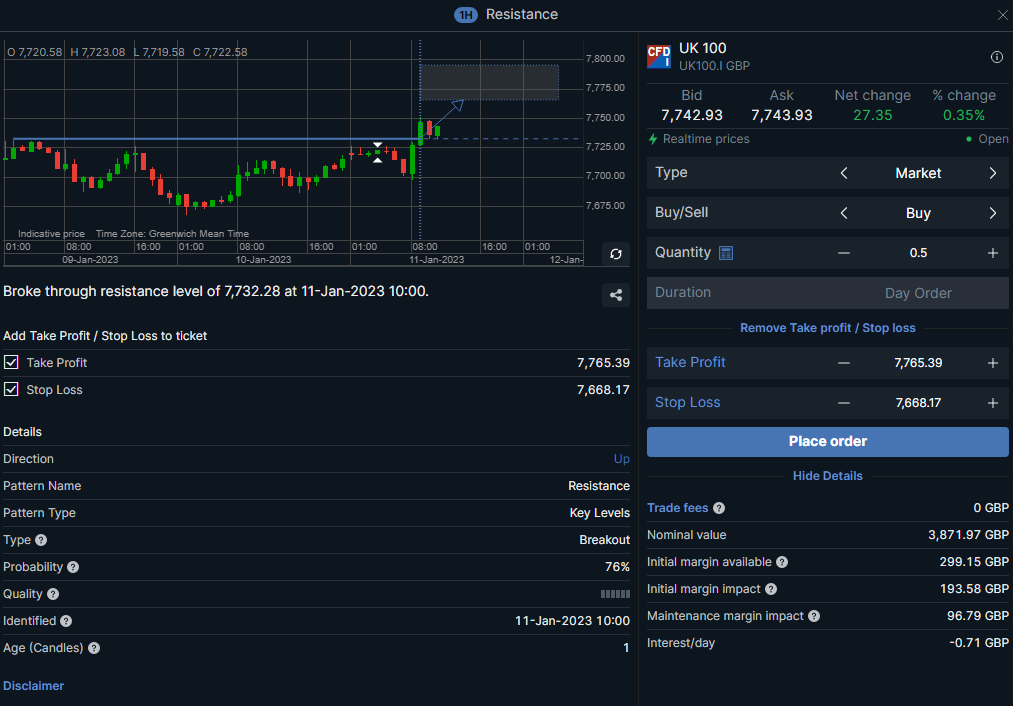

Other brokers like IG who (as well as looking after larger customers and funds) cater to smaller more inexperienced traders will let you trade the FTSE at 50p a point (£3,861.50 exposure). Limiting RiskSaxo are also quite risk averse for a margin trading business, as they do not offer excessive margins. Compared to Interactive Brokers (probably their closest competitor for product range and accounts types in the UK) their margin rates are quite high for CFDs as they don’t want their customer blowing up. Instead, as they’ve told me on many occasions, they are more interested in building long-term mutually beneficial and profitable relationships with their customers. Saxo – Robust Trading PlatformAs far as the trading platform is concerned, it’s excellent and well laid out. Markets are easy to find and you get the choice with each asset if you want to trade it as a future or CFD if it’s an index, commodity or currency pair. If you’re trading stocks you can either deal as a CFD or a physical equity for longer-term investing. You can drag and drop instruments from watchlist to the charting screen, then bring up options boards, and product overviews which give you all the pertinent details and market depth with level-2 pricing. Some markets though (like FTSE futures) you need a subscription to see live exchange data. Research & AnalysisIn the research tab you get access to trading signals from Autochartist, which is probably worth taking with a pinch of salt because most platforms have this. But they are really well integrated into the platform where you can deal straight from the signal and add pre-determined stops and limits.

There is also a high selection of curated webinars, educational article and news feeds which you can filter by instrument, and an overview of which markets are trending by asset class. There’s no client sentiment though, but that’s to be expected because they have some very large accounts which would skew the data and hedgies are notoriously secretive about their positions. Saxo – Our ConclusionOverall, I’ve always enjoyed trading on the Saxo Market’s platform, but then I’ve been doing this for twenty years. For new traders, it might be a bit much, but if you want to get started with a platform you can continue to use as you become more experienced, you can also invest in ETFs, bonds and shares instead of trading. However, if you’ve got the experience and treat trading with the respect and dedication it deserves, then Saxo Markets could be the broker for you. Pros

Cons

Overall4.9 |

||

|

DMA Markets 20,000 |

Min Deposit $2,000 |

GMG Rating |

Customer Reviews 4.5

(Based on 1,330 reviews)

|

Visit Platform 59.7% of retail investor accounts lose money |

DMA Account Types:

|

Interactive Brokers has one of the best DMA offerings for professional traders Account: IBKR DMA Description: IBKR offers direct market access to 30+ market centres with low commissions from USD 0.25 to 0.85 per contract and a trading platform with advanced order execution types and futures tools. Is Interactive Brokers good for Direct Market Access trading? Yes, Interactive Brokers has one of the best DMA offerings for professional traders. IBKR offer direct market access to the most exchanges at the lowest cost of all the brokers we compare. Pros

Cons

Overall4.7 |

||

|

DMA Markets 12,000 |

Min Deposit £250 |

GMG Rating |

Customer Reviews 3.9

(Based on 678 reviews)

|

Visit Platform 67% of retail investor accounts lose money |

DMA Account Types:

|

IG DMA trading gives you more than just level-2 pricingAccount: IG DMA Trading Description: IG’s L2 Dealer lets you trade on over 12,000 shares and 80 forex pairs against multiple liquidity venues, including primary exchanges, multilateral trading facilities (MTFs), dedicated market makers and dark pools. Is IG a DMA broker with a professional trading account? You can trade DMA with IG, but they only offer direct market access to equities. You can trade DMA shares with IG via IG markets as a CFD, but you cannot trade on exchange futures and options. If you want DMA access to futures exchanges, you will need a futures broker like Saxo or Interactive Brokers. When the new ESMA rules came into place, IG Pro was introduced as one of a number of accounts which help investors get around new European restrictions on trading, but is it worth the risk? In 2020 European restrictions had financial spread betting companies finding new ways to keep the revenue coming in. IG Group’s approach was to introduce its IG Pro account which allows experienced and professional investors to continue trading financial spreads. It is a way to get around the rules, but it does not come without risk. So, before choosing an IG Pro Account, you need to be clear about what you’re letting yourself in for. Going Pro By opening an IG Pro account, you will not be subject to the ESMA’s restrictions and can continue trading these products as before. In order to do so, you’ll have to be able to answer ‘yes’ to these questions:

The rules are there to try and ensure the only people trading in these high-risk instruments are those who understand the risks they are taking. If you do qualify, you will continue trading many of these restricted products such as the Digital 100s, use up to 95% of your share collateral as margin and secure a higher margin on your trades thanks to the greater flexibility this offers. In addition, the account means you will be eligible for a range of additional features open only to professional investors. Now come the downsides. When you use the professional platform, you forego some of the protections which are normally open to professional clients. There will be no negative balance protection – losses can exceed the balance in your account, and the platform may not go out of its way to use clear and easy to understand language. It will assume a certain level of professionalism on your part and expect you to understand sophisticated terminology. They may also prioritise factors such as speed and likelihood of execution over the best price. This is something to come into with your eyes open. It allows you continue trading restricted products and to get around new regulations. At the same time, though, this is only a platform for someone who really knows what they are doing and is prepared to accept the risk. Pros

Cons

Overall4 |

❓Methodology: How Good Money Guide Chose The UK’s Best DMA Brokers

- Analysis of over 30,000 customer votes and reviews in our annual awards

- Our experts’ own experiences testing the direct market access accounts with real money

- A deep dive of the stand-out features each DMA broker offers

- Good Money Guide’s exclusive interviews with the DMA broker CEOs and senior management

- Read more about how we rate and review financial service providers here.

How do you choose a direct market access broker?

The main things to consider when comparing direct market access brokers are:

- Commission rates – these are often volume-based for larger DMA traders and can be significantly cheaper than the published rate card.

- Leverage and margin – exchanges set margins for DMA futures and options trading, but DMA brokers set their own margin rates for DMA CFDs

- Types of DMA – Do you need direct market access for trading futures, options or CFDs?

Futures

Saxo Markets is the best DMA broker for futures trading as they offer DMA futures on 300 contracts across 16 future exchanges. Saxo Markets has won ‘best futures broker’ in our awards three out of the past four years. For more information on futures trading platforms, you can compare futures brokers here.

Options

Saxo Markets is the best DMA options broker as it offers options trading on over 30,000 stocks and indices across 60 exchanges. Saxo Markets has won ‘best options broker’ in our awards three of the past four years. For more information, you can compare options brokers here.

CFDs

Saxo Markets is the best broker for trading DMA CFDs as it offers CFDs with direct market access on over 9,500 shares, indices and commodities. Saxo Markets has also won ‘best CFD broker’ in our awards for the past four years.

DMA CFDs (offered by CFD brokers that offer professional accounts) are for when you have a big account and work big orders or are trading on a high-frequency basis or a trading strategy requires you to be inside the bid/offer spread.

Forex

Saxo Markets is the best broker for trading forex DMA as they offer on-exchange forex futures and options compared to other forex brokers like IG and CMC Markets that only offer DMA forex to institutional clients as a prime offering.

UK Shares

IG is the best DMA broker for UK equities according to Good Money Guide’s broker matrix as they offer access to the most shares. With IG you can also trade UK shares as a spread bet or CFD whereas other DMA stock brokers do not.

US Stocks

Interactive Brokers is the best DMA broker for trading US stocks. IBKR are US based but take on non-US residents through their international offices.

Pros & Cons Of Direct Market Access Brokers

Here is a round-up of the advantages and disadvantages of using DMA brokers.

Pros

- Clean pricing: You can place your DMA orders directly on the exchange and get in between the bid and offer price

- Speed of execution of trade: Cutting out the ‘middle man’ means a slicker, quicker trading process

- Better prices: No middle man means less people taking a cut of the trade

- Less risk of error: As a broker is acting on your behalf this decreases the chances of a human error on your part

Cons

- Account size: DMA brokers may only be looking for larger accounts

- Tax: There are no tax benefits of financial spread betting

- Charges: You need to factor in the commission charges the DMA broker imposes into your profit/loss calculations

⚠️ FCA Regulation – What You Need To Know

All DMA trading platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority. They are responsible for ensuring UK direct market access trading platforms are properly capitalised, treat customers fairly and have sufficient compliance systems in place.

Good Money Guide only features DMA brokers that are regulated by the FCA, where your funds are protected by the FSCS.

DMA (Direct Market Access) Broker FAQs:

Yes and no. If you want to get inside the bid-offer you need to be trading with direct market access (DMA). However, this is a tricky thing to do if you want a spread betting broker to provide direct market access.

The reason is quite simple. The mechanics just don’t work. Spread betting is over the counter (OTC), in that it is conducted off-exchange and structured as a bet. There is no exchange to access and the quotes provided by the spread betting brokers are based on the prices in the underlying exchanges.

It is possible to spread bet with DMA, although it’s all about relationships. You can ask your dealers at brokers like IG or Spreadex to work order in the market for you. However, you will need a big account and a good relationship with your account executive to get the service.

Yes, IG offer direct market access trading. You can find out more about their account offering here. Other brokers like Saxo Markets & Interactive Brokers also offer it.

Yes, DMA brokers if you are a high-frequency day trader making short term trades you will get better pricing and fills with direct market access.

Yes, as they provide direct market access to exchange order books they do not have to internally match or decide whether or not to hedge client positions.

DMA stock trading means buying and selling shares on stock exchanges like the LSE with direct market access. It enables clients to place bids and offers directly on the exchange order book.

No, DMA trading platforms are not suitable for beginners. Leveraged trading is a high-risk form of speculation and generally, it’s only economical using a direct market access provider if you are trading with over £50,000 and are a regular and experienced trader.