Silver is often thought of as the poor relation among the precious metals’ family, perhaps that’s because of its relative abundance compared to gold, platinum and palladium, but in truth, it’s probably an undeserved reputation. after all Silver was once a global reserve currency.

Interest in Silver has been picking up once more , and in early June ( 2025) price has moved to new 10-year highs, north of $36.87 per ounce.

One way that retail traders can gain exposure to Silver is through the ETF market and in this guide, we will take a look at how you can do that and what you need to know

Where to buy, invest in and trade Silver ETFs.

You can invest in Silver exchange-traded funds (ETFs) directly with the fund managers, as you would in a mutual fund, but unlike a mutual fund, you can also buy and sell the ETFs as you would with other stocks and shares through a stockbroker like Hargreaves Lansdown.

But how do Silver ETFs work? ETF managers hedge their exposure by tracking the performance of the underlying asset class.

In the case of commodities such as Silver, that means having exposure to physical bullion or derivatives, such as futures over the same.

Though the exact nature of this hedge can vary from fund to fund.

So it’s always worth doing your research and seeking appropriate advice before investing.

The good news is that many ETFs and ETF-like products were designed with retail investors in mind. Which means that there is usually plenty of information about the funds and their holdings, fee structures, etc., available online.

Why Silver?

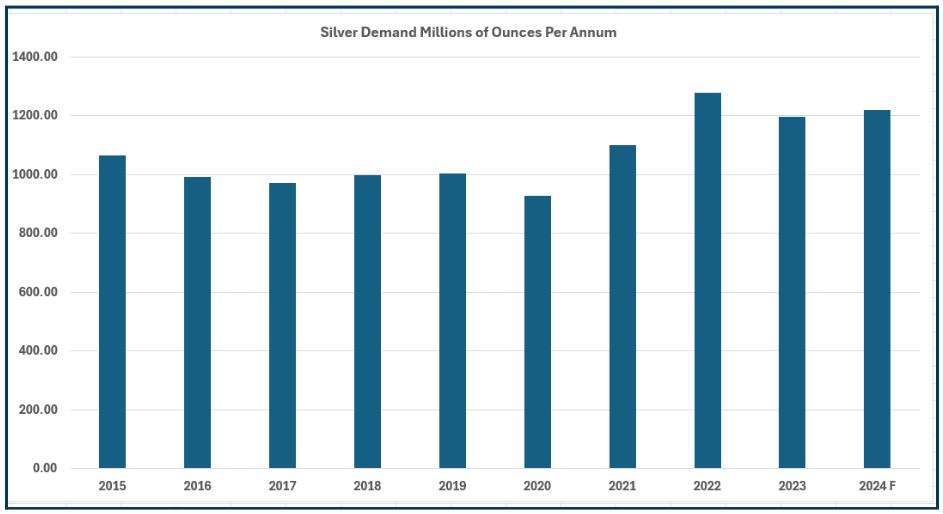

Silver may be the most common of the precious metals, but it is also the most versatile with many industrial, medical and scientific uses. The chart below tracks global demand for Silver in millions of ounces per annum (the 2024 data is a forecast).

Source: The Silver Institute/Darren Sinden

The jewellery trade was once the biggest user of Silver, but these days industry is its biggest consumer. Industrial uses are estimated to have consumed some 711 million ounces in 2024, more than +70.0% of global production of just over 1.0 billion ounces.

Silver’s physical and chemical properties make it ideal for use in electronics.

For example, silver paste is a key component in printed circuits that are used in RFID chips and tags, which allow modern supply and logistics chains to track goods from packaging through to their end destination.

Like gold (which you can buy through Gold ETFs), silver is traded in troy ounces and is usually priced in US dollars. Silver prices peaked in early April 2011 at US$49.79 an ounce and drifted lower from there; however, they have been rising once again.

Indeed, silver prices have increased by more than +106.0% over the last 5 years. The long-term trend is also higher, and over 20 years, Silver prices have risen 4-fold

Silver has always correlated with gold, and the gold-silver ratio is used by precious metal traders as a benchmark for the metal’s relative values.

Gold reached new all-time highs in May 2025 and heightened geopolitical risk, coupled with economic uncertainty, may push the price if the yellow metal higher still.

Over the last 12 months (as of the time of writing), Gold was up by +47.00%, whilst silver had added just +21.0%. Though that said, Silver has posted 23 new highs year to date, so Silver has been trying to push higher

Given this improving upside momentum, is now the time to consider a position in Silver? And if so, through what vehicle or method?

There are plenty of variables and unanswered questions in the markets at the moment that degree of uncertainty tends to favour risk-off and uncorrelated assets, of which Silver is one.

Perhaps now is the time to be on alert for a fresh high in Silver. I note from the long-term chart of silver that there is very little in the way of resistance above $37.00

One of the most convenient ways to trade or invest in silver is through a silver ETF

ETFs or Exchange Traded Funds, to give them their proper title, are open-ended funds that aim to track and replicate the performance of an index, asset class or other benchmark.

Unlike actively managed funds, the ETF does not seek to outperform the underlying assets it tracks, but rather it tries to mirror their returns regardless of whether they are positive or negative.

The open-ended nature of these exchange-traded funds means that their price is dependent on the performance of the instruments they track and not the supply and demand for units in the fund.

The number of “units” in issue ebbs and flows with the amount of money that enters or leaves the fund; as such, many ETFs are said to be passive investments.

ETFs have been increasing in popularity over the last twenty years, and they have moved well away from their equity index tracking roots. And there are now ETFs available for most strategies and asset classes.

ETFs were designed to allow those investors who didn’t have access to futures, options and derivative markets to be able to trade in and gain exposure to equity indices and other products, like currencies, commodities and specialist investment strategies and factors, such as growth and value.

Buying or selling ETFs

You can invest in ETFs directly with the fund managers, as you would in a mutual fund.

However, unlike a mutual fund, you can also buy and sell the ETFs, as you would any other stocks and shares, through a stockbroker.

ETF managers hedge their exposure by tracking the performance of the underlying asset class.

In the case of commodities such as Silver, that means having exposure to physical bullion or derivatives, such as futures over the same.

Though the exact nature of this hedge can vary from fund to fund.

So it’s always worth doing your research and seeking appropriate advice before investing.

The good news is that, as many ETFs and ETF-like products were designed with retail investors in mind, there is usually plenty of information about the funds and their holdings, fee structures, etc., available online.

Best Silver ETFs

The table below shows 10 leading silver ETFS and ETNs and ranks them by AUM, or assets under management, which is simply the amount of money invested in the ETF at a given point in time.

The table also highlights metrics such as the fund’s expense ratios (the cost of annual ownership) and the one-month and year-to-date performance of these funds.

|

ETF Name and Exposure |

1M performance |

YTD performance |

1M flows |

YTD flows |

AuM |

E/R |

|

SLV iShares Silver Trust ETF – USD This ETF provides exposure to Silver |

9.34% |

24.53% |

+£531M |

+£315M |

£12.55B |

0.50% |

|

PHAG WisdomTree Physical Silver ETC – USD This ETC provides exposure to Silver |

12.94% |

24.89% |

-£149M |

+£229M |

£1.5B |

0.49% |

|

SIVR abrdn Physical Silver Shares ETF – USD This ETF provides exposure to Silver |

12.96% |

25.00% |

+£62M |

+£99M |

£1.41B |

0.30% |

|

ISLN iShares Physical Silver ETC – USD This ETC provides exposure to Silver |

9.37% |

24.69% |

+£295M |

+£412M |

£1.31B |

0.20% |

|

ZSIL ZKB Silver ETF AA CHF – CHF This ETF provides exposure to Silver |

7.40% |

12.51% |

+£15M |

+£73M |

£1.29B |

0.60% |

|

ZSILUS ZKB Silver ETF AA – USD This ETF provides exposure to Silver |

11.41% |

25.39% |

+£21M |

+£49M |

£516M |

0.60% |

|

AGQ ProShares Ultra SILVER ETF (D) – USD This ETF provides leveraged exposure (2x) to Silver |

20.23% |

44.32% |

-£3.9M |

-£86M |

£511M |

0.95% |

|

WSLV WisdomTree Core Physical Silver – USD This ETC provides exposure to Silver |

12.97% |

25.06% |

+£296M |

+£397M |

£463M |

0.19% |

|

ZSILEU ZKB Silver ETF Dist – EUR This ETF provides exposure to Silver |

6.89% |

12.10% |

-£1.5M |

+£7.6M |

£348M |

0.60% |

|

SSLV Invesco Physical Silver ETC – USD This ETC provides exposure to Silver |

12.97% |

25.06% |

+£46M |

+£64M |

£319M |

0.19% |

Source: Trackinsight

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

To contact Darren, please see his Invesdaq profile.