City Index: Good Options Trading Broker For Spread Betting & CFDs

Account: City Index Options Trading

Description: City Index offer options trading via spread bets and CFDs, the benefit of the course of trading options as a spread bet for UK customers is that profits are free from capital gains tax. Phone trading is one feature that sets City Index apart from other retail options brokers.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Is City Index a good options broker?

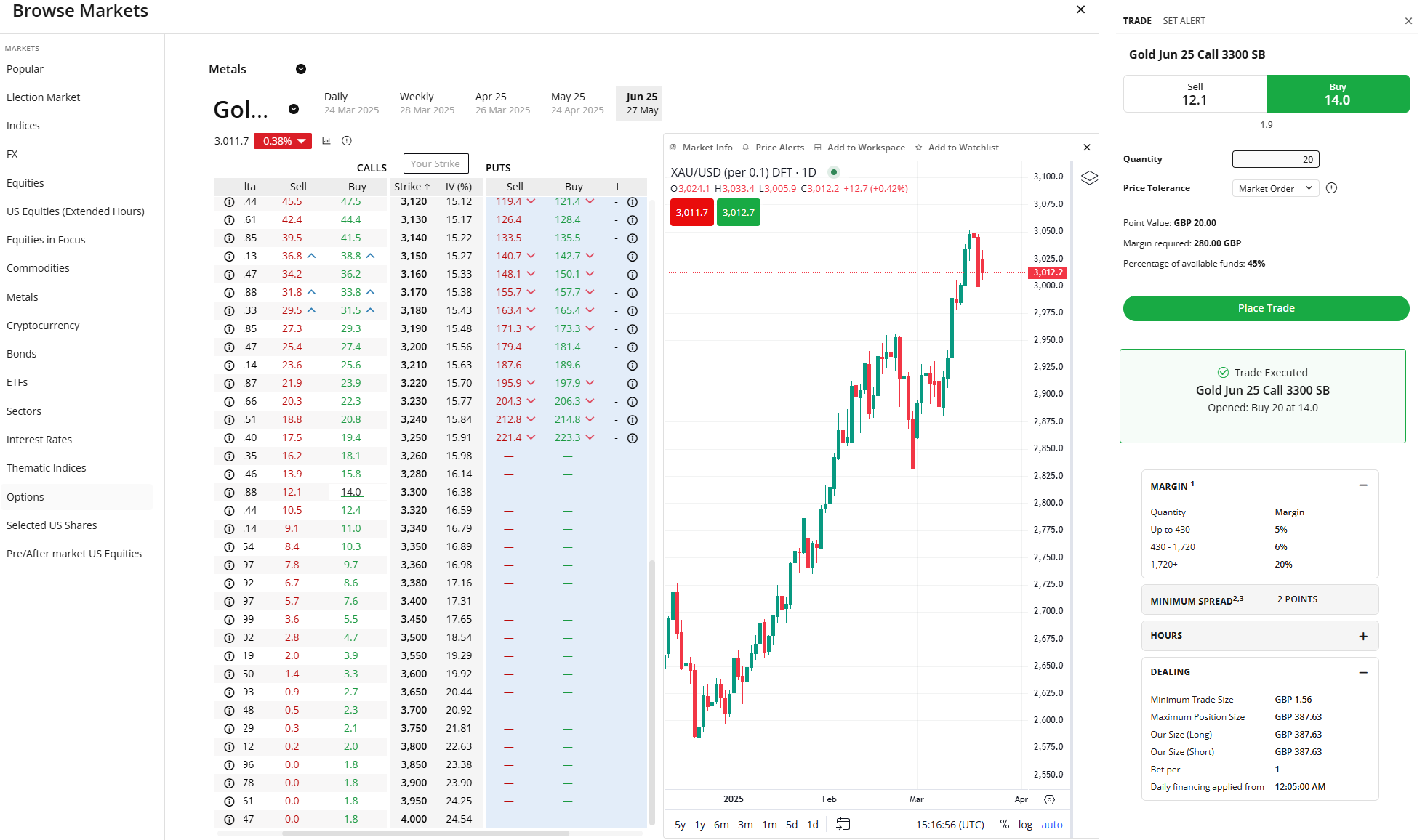

You can trade options with City Index. However, you are limited to trading them as a financial spread bet or a CFD and you can only trade options on some of the most popular major markets like the FTSE or Gold online. If you want to trade stock options, you have to phone the options desk. Which is nice actually becuase most brokers don’t have voice brokerage any more. It’s particulary useful for options trading, becuase it can be, for want of a better word, complicated.

Sometime’s it’s much easier to tell a dealer what you want to to and let them take on the risk of making sure they buy and sell the right strategy.

It’s really simple to trade options with City Index online, if you just want to take a limited risk directional bet. There are no options strategies available so if you want to trade basic call or put spreads, you have to trade the individual legs.

However, as profits from options trading as a spread bet on City Index are tax-free I thought I’d test the platform by trading some Gold options.

Jackson wrote some great analysis on Gold’s bull run, as it just topped $3,000 and doesn’t show any sign of stopping. So I’ll go long. When you’re trading Gold CFDs or spread bets you have to worry about high overnight financial charges on long term positions. But that’s not the case with options, you just pay your premium and wait. City Index earn their money on options by widening the spread.

I’ve given it till June and hoped that Gold goes up by another 10% and bought some $3,300 June Calls. If the market comes off before then, I’ve lost my premium, but if it pays off, I’ll buy Mrs Berry something yellow and shiny for her 40th Birthday.

For more sophisticated options traders, Interactive Brokers or Saxo offer direct market access on a wider range of equity options (but no financial spread betting for tax-efficient trading).

Pros

- Options as a spread bet

- Performance Analytics

- Easy-to-use options trading platform

Cons

- Limited US stock options online

- No options strategy order types

- No DMA options

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

4

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.