Customer Reviews

Tell us what you think of this provider.

Shares delisting that are stuck in limbo for 4 years!

Support desk that comes up with different stories.

Website does not offer a basic sort on shares alphabetically and doesn’t give you a history like HL. Performance figure is nice but that’s about all.

Barclays Smart Investor Expert Review

In this review, we show you what Barclays Smart Investor offers in their accounts and investments as well as its fees and charges. You’ll also see how the platform stacks up against its competitors.

When I went through the account opening process to test Barclays Smart Investor I got pretty much what I was expecting from a legacy high street bank, and that was… a…wait.

There’s no clear way to open an account, and the main click throughs leads you to a Barclays Online Banking login page, which is a bit annoying. If I wasn’t testing it I would have given up. There is very little explanation on the page that you have to apply separately and to open an account you have to click a ‘No Login’ button , which looks like a ‘Forgot Password button.

There are a few other annoying bits too, like not having the option to add a National Insurance number later (this is a huge drop-off point when people are opening accounts).

It’s slightly better on mobile – but they basically need a massive button at the top that says ‘OPEN ACCOUNT HERE’.

But, we got there in the end.

Barclays Smart Investor Review: Access over 8,000 investments including ready-made portfolios

Provider: Barclays Smart Investor

Verdict: Barclays Smart Investor is an investment platform that allows you to invest in stocks, funds, investment trusts, bonds, and more. It has been designed to make investing easy and accessible, whether you’re a complete novice or an experienced investor.

Is Barclays Smart Investor a good investment account?

If you’re looking to invest with a well-known bank, Barclays Smart Investor could be a good option for you. It’s an investment platform operated by Barclays – one of the biggest banks in the UK.

The platform is owned and operated by Barclays Bank. It’s a diversified UK bank that has been around for several centuries now and is listed on the London Stock Exchange.

Summary

- Barclays Smart Investor is an investment platform operated by Barclays – one of the largest banks in the UK.

- Through Barclays Smart Investor, you can invest in stocks, funds, ETFs, ready-made portfolios, bonds, and more.

- In total, there are over 8,000 investments on the platform.

- Barclays Smart Investor’s fees are not bad but there are cheaper options out there.

Pros

- A wide range of investments are on offer.

- Good research tools and content are available on the platform.

- The platform is operated by a well-known bank.

Cons

- It can take time to open an account if you are not a Barclays customer.

- There are only three types of accounts available.

- It is not the cheapest platform out there.

-

Pricing

(4)

-

Market Access

(4)

-

App & Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4What Accounts Does Barclays Smart Investor Offer?

Barclays Smart Investor only offers three types of investment accounts:

- An Investment ISA (Stocks and Shares ISA) – This is a tax-efficient account where you can invest up to £20,000 per year

- A Self-Invested Personal Pension (SIPP) – This is a pension account designed for retirement savings

- A General Investment Account (GIA) – This is a flexible investment account that has no restrictions in terms of contributions or withdrawals.

The platform doesn’t offer Lifetime ISA, Junior ISA, or Junior SIPP accounts. If you are looking to invest within one of these types of accounts, you will need to invest with another broker.

What Investments Are Available Through Barclays Smart Investor?

One of the biggest attractions of Barclays Smart Investor is it offers access to a vast range of investments. Through the platform, you can invest in:

- UK stocks

- International stocks

- Investment funds

- Investment trusts

- Index funds

- Exchange-traded funds (ETFs)

- Bonds/gilts

- Ready-made portfolios

There are more than 8,000 investments to choose from. This is by far the broadest investment offering from any UK bank.

What Ready-Made Portfolios Does Barclays Smart Investor Offer?

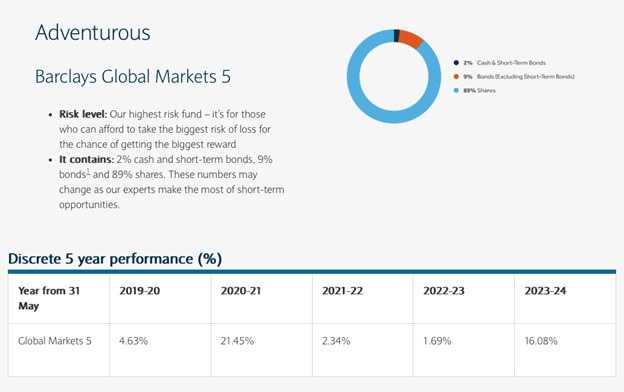

Barclays Smart Investor offers five different ready-made portfolios. These are named: Defensive, Cautious, Balanced, Growth, and Adventurous.

The Defensive fund is the lowest risk product and is mainly invested in cash and short-term bonds. The Adventurous fund is the highest risk product and is mainly invested in stocks.

The ongoing fee for these ready-made portfolios is 0.45% per year. This fee is on top of platform charges.

Barclays Smart Investor Fees & Charges

There are several fees to be aware of with Barclays Smart Investor.

First, there are annual customer fees. These are 0.25% on investments up to £200,000 and 0.05% on investments above £200,000. There is no fee on cash.

Then, there are trading fees. These are £6 per deal for UK shares (including ETFs, investment trusts, bonds, and gilts).

International shares are subject to international brokerage fees and FX fees. International brokerage fees are an extra 0.03% while FX fees are:

- First £5,000 – 0%

- Next £5,000 – 75%

- Next £15,000 – 50%

- Next £225,000 – 25%

- Amounts over £250,000 – 10%

Investors also need to pay ongoing charges for funds. These vary depending on the fund and can be anywhere between 0.05% (for index funds) and more than 1% (for active funds). As noted above, fees on ready-made portfolios are 0.45%.

In addition to all these fees, there are extra account administration fees for SIPPs. For these accounts, there’s a fee of £31.25 + VAT per quarter or part thereof (£125 + VAT p.a). This fee is collected by Barclays and paid to AJ Bell who administers the SIPP accounts.

Overall, Barclays’ fees are relatively competitive. But there may be cheaper platforms for you depending on the size of your portfolio, the investments you like to own, and how many trades you execute.

For example, if you had a £100,000 stocks and shares ISA that was entirely invested in UK stocks and you only made one trade per month, the annual fees and trading charges (excluding Stamp Duty) with Hargreaves Lansdown would be £188.40 versus £322 for Barclays Smart Investor.

Activity | Cost |

Buying and selling shares | £6 per deal |

Buying and selling funds | No charge |

Regular investments | No charge |

Dividend reinvestment | No charge |

Holding cash | No charge |

Transferring investments | No charge |

Cash withdrawal and account closure | No charge |

Barclays Smart Investor App

Barclays Smart Investor can be accessed through the Barclays app. With this you can:

- Check the value of your investments

- Pay into your account (you can’t do this with Barclays SIPP accounts)

- Browse the range of investments

- Make trades.

However, that if you don’t already have a Barclays account, it may take some time to set up the app. Some users have also complained of glitches.

What Is The Barclays Price Improver?

Barclays Price Improver is a feature that aims to get customers better share prices when buying and selling UK shares. In 2023, 92% of share trades placed on Barclays Smart Investor got a better price than quoted on the London Stock Exchange, with customers benefiting by an average of £14.60 per deal.

Who Is Barclays Smart Investor Best Suited To?

Barclays Smart Investor could be well suited to:

- Those with Barclays bank accounts who want all their money in one place

- Those looking for a do-it-yourself (DIY) investment platform

- Those looking for a wide range of investments

- Those looking to invest with a well-known UK bank.

What Are Some Alternatives To Barclays Smart Investor?

If you’re looking for alternatives to Barclays Smart Investor, you may want to check out the following platforms:

- Hargreaves Lansdown – Hargreaves Lansdown offers excellent customer service and its platform can be very economical if you only own stocks

- AJ Bell – AJ Bell has more account options than Barclays and the platform is very easy to use

- Interactive Investor – This platform offers a flat-fee structure, which can be very effective for large investment portfolios.

All of these platforms offer a broad range of investments, just like Barclays Smart Investor. You can find comprehensive reviews of these specific platforms, and many more, here at Good Money Guide.

Barclays Smart Investor FAQ

Yes – Barclays Smart Investor is regulated by the UK’s Financial Conduct Authority (FCA). So, you should consider it safe.

Barclays General Investment Account and its Investment ISA are solid products. With these accounts, you can access over 8,000 investments including UK stocks, international stocks, funds, ETFs, and bonds.

No. There are several charges you need to be aware of including annual fees, trading fees, fund fees, and pension administration fees.

The only ISA available at Barclays Smart Investor is an Investment ISA. This is a Stocks and Shares ISA.

On Barclays Smart Investor, there is a wide range of funds to choose from including active funds and passive funds. The best fund for you will depend on your goals and risk tolerance. If you are just starting out and looking for a cheap fund to invest in for the long term, it could be worth looking at one of Barclays’ global equity index funds.

The fees for Barclays’ Investment ISA are 0.25% per year on investments up to £200,000 and 0.05% on investments above £200,000. Investors also need to pay trading commissions.

Investment ISAs can be very effective vehicles for building wealth. With these ISAs, it’s possible to generate high returns and pay no Capital Gains Tax.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.