Yes, we rate AJ Bell as a very safe share-dealing platform. AJ Bell are regulated by the FCA and customer funds (cash) are protected by the FSCS up to £80k. Shares you hold in AJ Bell nominee accounts are held in CREST safe custody accounts and will be transferred to another broker if they were to go bust.

The AJ Bell Dealing account is an easy-to-use, cost-effective account for investing online. With this account, you can choose from a wide range of investment options, including shares, funds, and ETFs. Key advantages of the AJ Bell Dealing account are that it is clear, well laid out, and user-friendly. Additionally, it offers access to a wider variety of investments than some other brokers.

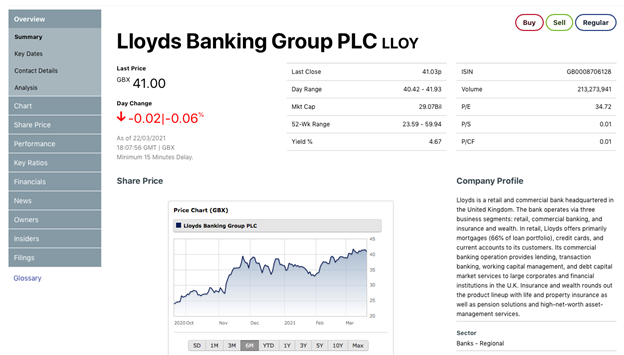

Buying and selling shares online through AJ Bell’s Dealing account is a straightforward process. You simply search for the company you’re interested in and click through to its research page. Here, you’ll receive a quote for the security. You then have 15 seconds to confirm your order at the quoted price.

Once your deal is completed, you’ll receive a contract note with all the details of your trade.

Shares can be bought and sold online through the website or app when the market is open. For UK shares, this is between 8:00am and 4:30pm. Overseas markets have different trading hours.

Unlike a tax-efficient account such as an ISA or SIPP, there are no limits to the amount you can pay into your Dealing account. And you can withdraw your money whenever you like.

The charges and fees for AJ Bell’s Dealing account are shown below. Trading fees are lower than those offered by Hargreaves Lansdown. However, they are higher than those of some newer brokers such as Freetrade and Trading 212, which both offer zero commissions on share purchases.

Account Charges & Fees

Buying and selling investments (per deal) |

|||

| Funds (including unit trusts and OEICs) online | £1.50 | ||

| Shares (including investment trusts, ETFs, gilts, and bonds) | £9.95 | ||

| Shares, where there were 10 or more share deals in the previous month | £4.95 | ||

Funds custody charge (including unit trusts, OEICs, and structured products) |

|||

| On the first £250,000 of funds | 0.25% | ||

| For funds between £250,000 and £1m | 0.10% | ||

| For funds between £1m and £2m | 0.05% | ||

| For funds over £2m | No charge | ||

| Shares custody charge (including investment trusts, ETFs, gilts, and bonds) | 0.25% | (max £3.50 per month) | |

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.