Ever since the sudden emergence of generative AI, an arms race has been underway to lock in a leadership position. In this frantic winner-takes-all quest, Google (GOOG), Microsoft (MSFT) and Meta (META) are spending billions to buy the newest hardware equipment – specifically, Nvidia’s chips – to build their ever-advancing AI models. OpenAI’s latest model, released last month, is ChatGPT-4o (‘Omni’).

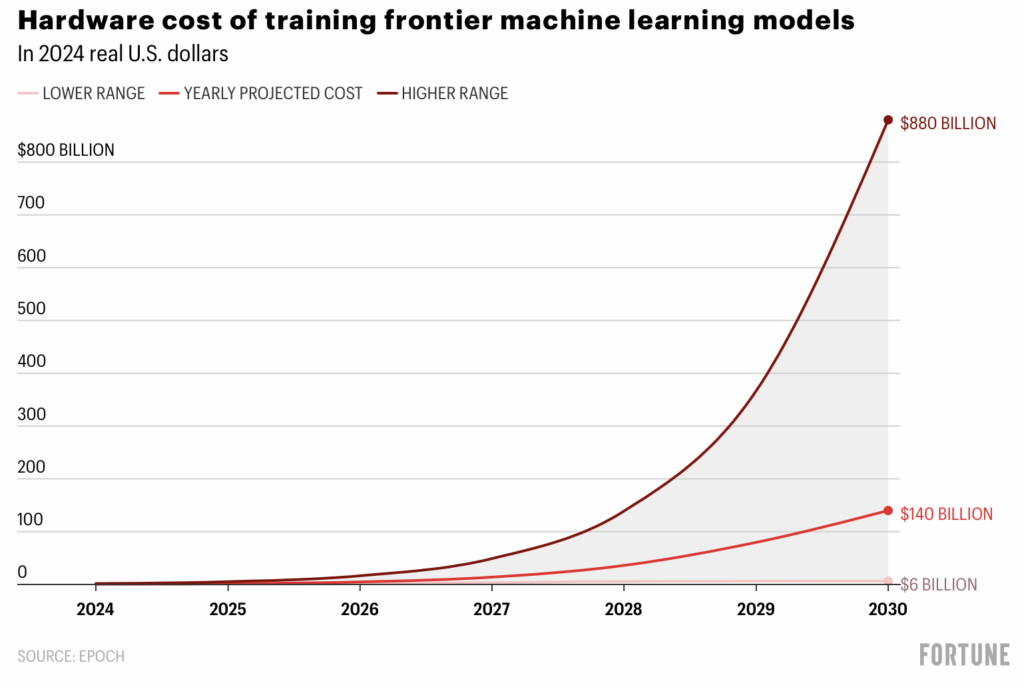

What’s clear in this race is that training is both imperative and dear. ChatGPT-3 has 175 billion parameters. ChatGPT4? 1.77 trillion. That’s a staggering number. Moreover, each update will only increase the parameters further. Just training these GenAI models will cost tens of millions of dollars one turn. More parameters mean more training, which means more data and more computing power, which means more investments (see below). Only the richest tech firms can engage in this war of financial attrition.

Source: Fortune (Apr 2024)

Slowly but surely, however, another often overlooked problem emerges: Energy.

According to Goldman Sachs (article here), each ChatGPT search expends 10x more energy than a Google search. As GenAI applications proliferate, this usage will only go up massively. To house all the chips that tech firms are ordering right now, many new data centres are needed. Engineers and models aside, these energy-intensive factories have to be powered by energy.

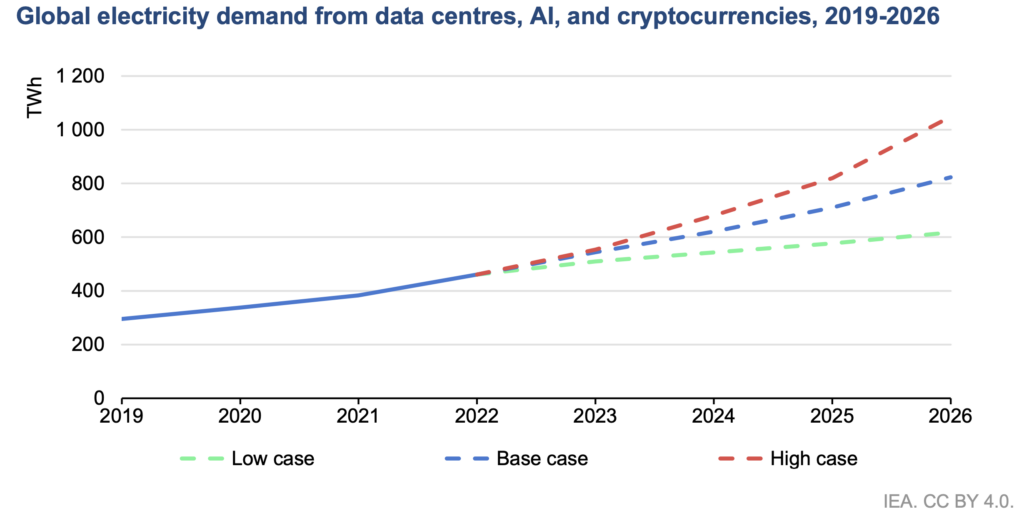

Right now, the International Energy Agency (IEA) estimates that there are 8,000 data centres globally. About a third are located in the United States. Together with crypto mining, AI and other recent inventions occupy about 2 percent of the entire global electricity demand. That’s a lot.

Take Ireland. Due to its low tax rates, the nation houses about 82 data centres. As the industry booms, the country plans to create even more data factories. But this sector already uses about 17 percent of Ireland’s total electricity capacity. For Denmark, the percentage is even higher – 20 percent. Unsurprisingly, Irish household electricity prices are already amongst the highest in the world. More data centres will only consume a large share of the country’s total electricity usage.

Think about the consequences when ChatGPT 7.0 or 8.0 arrives. The amount of energy used by new AI applications would be gargantuan. IEA estimated that the global electricity demand from these data centres, AI and cryptocurrencies (eg mining) would go up by 50-100 percent from 2022 in just a few years (see below).

Another competing usage for electricity is electric cars. Governments are forcing this transition from fossil-powered cars to EVs. In sum, the demand for electricity will only go up and up.

Source: IEA: Electricity 2024 to 2026

Where is this new electricity supply going to come from? One particular area that many investors are looking at is nuclear.

For example, uranium spot prices soared earlier this year when investors anticipated the increased demand for U3O8. Prices touched a multi-year high of $100 per pound (see below). Small, modular reactors (SMR) are helping to increase demand for the compound (see, eg, here).

Source: TradingEconomics.com

Miners of the uranium compound like Cameco (US:CCO), Paladin Energy (ASX:PDN), NexGen (US:NXE) all saw a steep rally in their share prices this year. In the UK, Yellowcake (YCA) also profited from a cyclical rally in uranium prices. Rolls Royce (RR.), for example, benefitted massively from this renewed interest in nuclear energy. Its share price soared from sub-100p to 450p.

Is this, then, a ‘one-way’ bet? Chartwise, most uranium-related securities are overbought and in a correction to unwind these technicals. How long will the current regression last? Few know. However, long-term patient investors may look to pick up some uranium miners when they become very oversold.

A more speculative development in the nuclear industry is the Micro-Reactors. These portable reactors can be deployed in areas previously underserved by the grid. According to the US Office of Nuclear Energy, MicroReactors are:

able to produce 1-20 megawatts of thermal energy that could be used directly as heat or converted to electric power. They can be used to generate clean and reliable electricity for commercial use or for non-electric applications such as district heating, water desalination and hydrogen fuel production.

Deployment of these new nuclear technologies in the next decade is feasible. Already, investors are piling into companies that are engaging in this area, such as Nano Nuclear Energy (NNE, see below). Another stock to look at is NuScale Power (SMR), which is on the verge of establishing new 52-week highs.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please ask a question in our financial discussion forum.