An intense price war is going on the US brokerage sector.

ETrade, following Charles Schwab and TD Ameritrade, is charging $0 for trades in stocks and exchanged-traded funds (ETFs). This move will cost the company an estimated $75 million in its second quarter earnings.

Understandably, investors gave the stock a thumb down. E-Trade, with the ticker ETFC, plunged to new 52-week lows. Meanwhile, Charles Schwab (SCHW) also exhibited a similar price trend, with prices sliding into the $40 major round-number support.

One of the reasons behind this zero commission war is to protect themselves against upcoming brokers like Robinhood, which are luring customers with zero commissions.

In the UK, I am watching this fight with great interest because developments there tend to ripple across the Atlantic sooner or later.

For example, GoodMoneyGuide has been highlighting (free stock trading here to stay & IBKR Lite) some of the on-line brokers that charges zero commission for certain trades, such as Freetrade, which, according to its funder Adam Dodds, is the first company to ‘brings free, frictionless stock investing to the UK and Europe for the first time ever.’ (read GMG interview here). I suspect the downward pressure on trade commission will only grow over time.

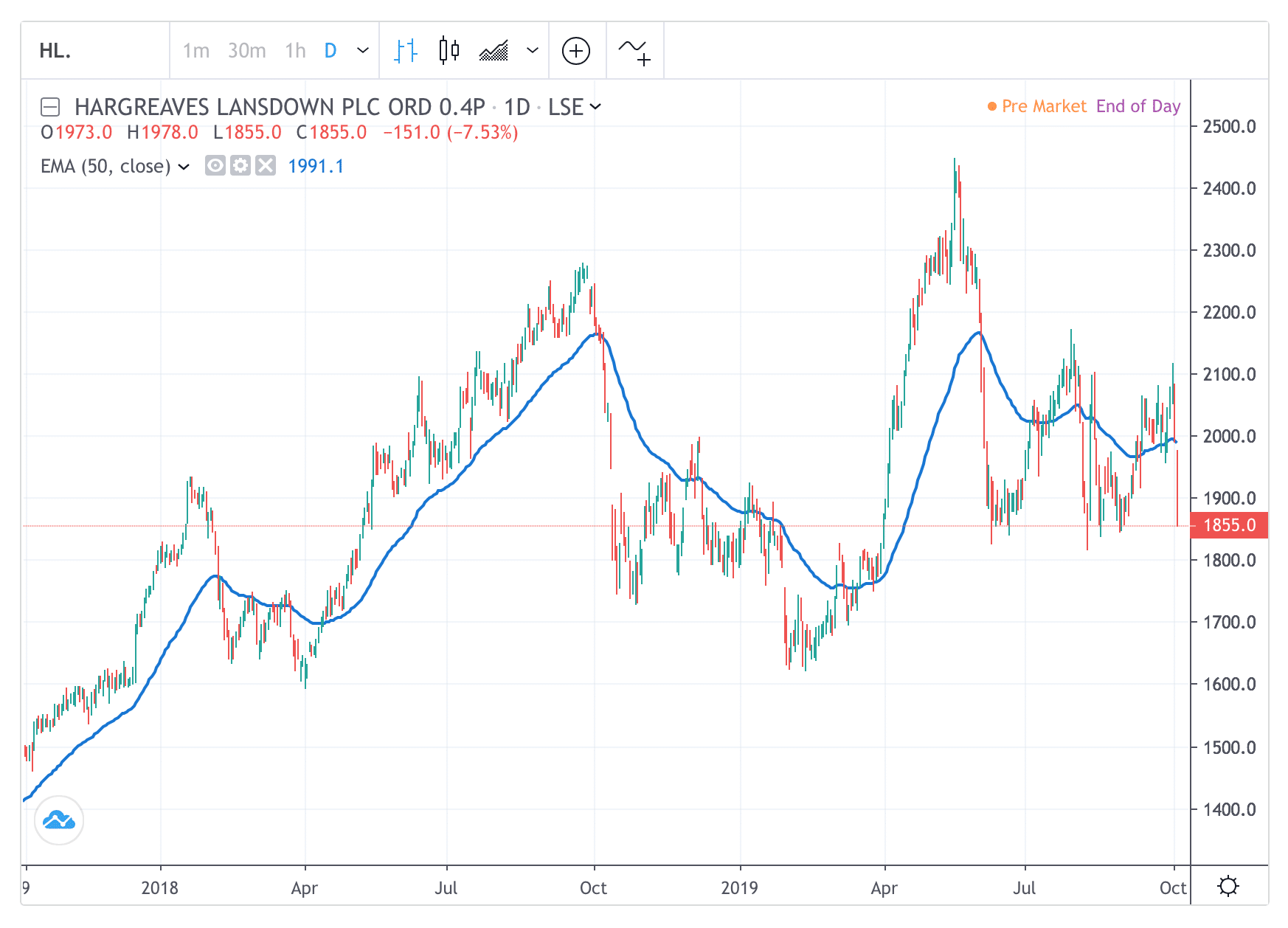

These developments will probably exert substantial pressure on many UK established brokers, such as Hargreaves Landsdown (HL/). Its share price is flirting with a major breakdown below 1,850p (see below).

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com