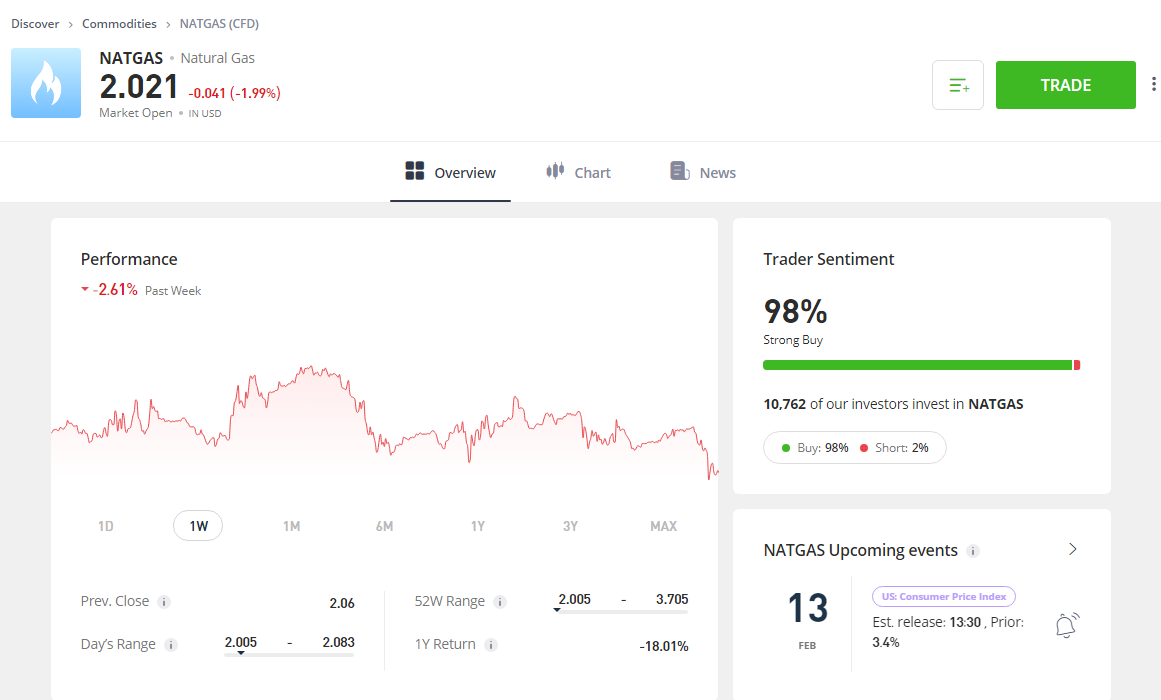

You can trade Natural Gas as a CFD with eToro, and either go long or short. You can also reduce your leverage by setting your margin rates from as much as 100% (a fully paid-up position) or as low as 10%. You can also see what percentage of other eToro traders are speculating on the Natural Gas price going up or down. You can also trade the EuroNatGas variant with eToro, but your profit and loss with still be in USD and you will have to pay for the USDEUR conversion.

I’d say eToro is a good choice for taking a medium-term view on Natural Gas, if you are just placing a one-off trade. If you are interested in intraday trading, a futures broker will give you better pricing, or in the longer term, a CFD broker with lower overnight funding charges would save you a significant amount on interest charges.

- Comparison: If you are interested in trading commodities, you can compare the best Natural Gas brokers here.

Nat Gas Trading Very Popular At eToro

eToro has exclusively told the Good Money Guide, that natural gas, has rarely been outside of its top ten most actively traded instruments, since September 2021, prior to which it barely featured at all.

That revenue growth was attributed to a significant increase in the number of active UK clients, particularly those who want to trade the markets via a socialised platform, where they can swap ideas and talk to fellow traders.

- Want to know what we think of eToro? Read our expert eToro review here.

eToro’s UK registered users numbers rose to 3.20 million by August 2022, and they now account for more than 10% of the firm’s global client base. The growth in client numbers and revenue has come at a time when traditional markets have been under pressure.

Crypto Alternative

eToro‘s UK clients are seemingly undeterred by those numbers and have also been quick to embrace other asset classes.

eToro has long been associated with retail crypto trading, dealing in physical coins, rather than derivatives. Which, of course, are off-limits to private investors in the UK and Europe.

However, it’s not just cryptocurrencies that have caught the attention of the firm’s UK client base. Commodities and in particular, the energy markets have also proved popular.

Natural gas has become a mainstay among UK traders, something that the MD of eToro’s UK operations, Dan Moczulski, puts down to the fact that gas prices are often in the headlines.

Natural Gas Volatility

Natural Gas prices have been particularly volatile since Russia invaded Ukraine, and the Western powers sanctioned Russian exports, of which oil and gas are a major part.

As a result, natural gas was one of the most actively traded instruments at eToro during August. However, the interest in gas among retail traders goes back much further.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com