No – XTB & Xtrade are two completely separate trading companies. XTB is a popular forex and CFD broker. Through its platform, you can trade a range of financial instruments, including currencies, stocks, ETFs, indices, and commodities.

Who is XTB?

XTB is a trading company that has been around for a few decades now. Today, it’s one of the largest stock exchange-listed FX and CFD brokers in the world with offices in over 13 countries including the UK, Germany, France, and Poland (it’s headquartered and listed in Poland).

What can be a bit confusing is the fact that originally, the company was called ‘X-Trade Brokers’. It wasn’t until 2009 that the company rebranded to ‘XTB’.

Who is Xtrade?

Turning to Xtrade, it’s a forex and CFD trading company that is headquartered in the Central American country of Belize. Like XTB, it offers access to multiple financial instruments including currencies, shares, ETFs, indices, and commodities.

It’s not quite as well known, or as popular, as XTB, however. And it doesn’t offer as many products on its platform.

What are the differences between XTB and Xtrade?

In terms of the differences between the two forex and CFD trading companies, here are some things you need to know:

- XTB is regulated in the UK while Xtrade is not – XTB is regulated by the UK’s Financial Conduct Authority (FCA). However, Xtrade is only regulated by the International Financial Services Commission (the Belize government agency responsible for financial regulation). So, for UK traders, XTB is probably a safer platform.

- XTB is listed on a stock exchange while Xtrade isn’t – The fact that XTB is a listed company means that there’s a lot more transparency with this company. For example, it’s easy to find out how many users it has (over 1 million as of March 2024). With Xtrade, it’s hard to find key details about the company.

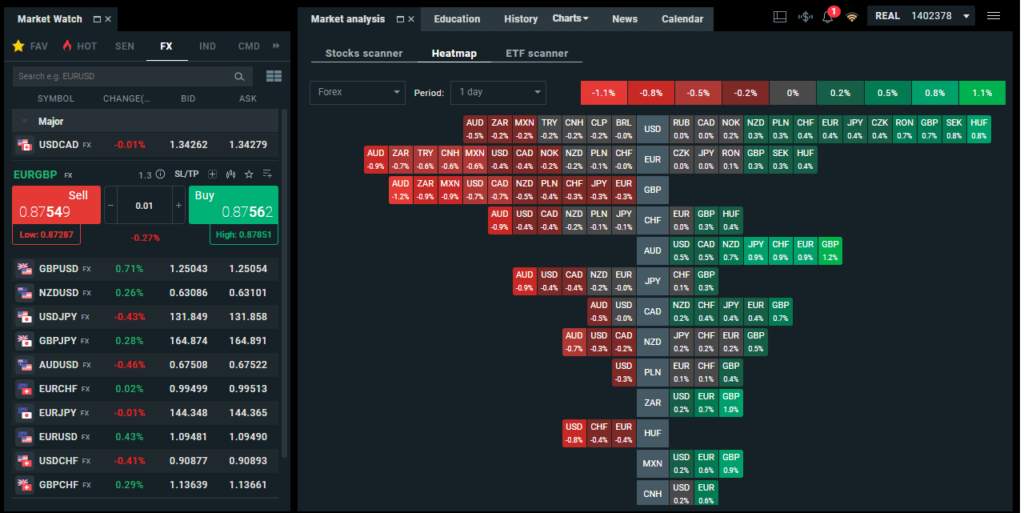

- XTB offers more instruments to trade – Currently, XTB has more than 5,800 financial instruments on its platform. By contrast, Xtrade only has around 1,000 financial instruments.

- XTB has slightly better reviews – On Google Play, XTB has a rating of 4.4 stars from 61.3k reviews (5 million+ downloads). By contrast, Xtrade has a rating of 3.9 stars from 38.3k reviews (1 million+ downloads).

- XTB has a lower minimum deposit – With Xtrade, the minimum deposit to open an account is $250. For XTB, it is $0.

Summary

- XTB are Xtrade are two different forex and CFD trading companies

- Both companies offer access to a range of instruments including currencies, shares, ETFs and commodities

- XTB is regulated by the FCA in the UK while Xtrade is not

- XTB has a lower minimum deposit

Based in London, Edward is a distinguished investment writer with an extensive client portfolio comprising a diverse array of prominent financial services firms across the globe. With over 15 years of hands-on experience in private wealth management and institutional asset management, both in the UK and Australia, he possesses a profound understanding of the finance industry.

Before establishing himself as a writer, Edward earned a Commerce degree from the prestigious University of Melbourne. Complementing his academic background, he holds the esteemed Investment Management Certificate (IMC) and is a proud holder of the Chartered Financial Analyst (CFA) qualification.

Widely recognised as a sought-after investment expert, Edward’s insightful perspectives and analyses have been featured on sites such as BlackRock, Credit Suisse, WisdomTree, Motley Fool, eToro, and CMC Markets, among others.

To contact Ed, please see his Invesdaq profile.