The ‘Santa Rally’ describes the bullish sentiment that bubbles up at the end of a calendar year. In this analysis, we look at the best stocks and markets to buy during the Santa Rally period, what has happened in the past and what may happen to the markets during the 2024 Santa Rally period.

As the year slowly draws to a close in December, stock markets, unlike the frosty weather outside, are usually abuzz with excitement. According to many observations and studies, the last quarter of the year, together with early days of the new year, is often bullish which is anecdotally attributed to the “Santa Rally” period.

Reasons that induce the ‘feel good’ factor from the Santa Clause Effect include the ongoing festive season, extra monetary compensation (especially bonuses) and renewed optimism for the coming year. Psychologically, the happy mood all around entices consumers – and investors – into buying rather than selling during the Santa Rally.

To some extent, the Santa Rally also coincides partially with the ‘January Effect‘ – a calendar anomaly whereby stock prices rise in the first month of the year more frequently than all other months.

Despite this widespread festive mood, there are, of course, many instances which saw the stock market year end with downright gloom. The banking crisis in December 2008 was one. The spike in inflation and the Ukraine war in 2022 was another.

Last year, Wall Street exhibited mild returns during the holiday season. This year, however, the mood has turned uber-bullish. The S&P 500, Nasdaq and Dow are all flirting near all-time highs. Many US stocks and sectors (crypto in particular) surged to elevated price levels following Trump’s presidential victory. Investor sentiment, in summary, has never been more optimistic. Many expect this bullish momentum to persist into the new year. Unsurprisingly, one economic commentator calls the current US equity market the ‘Mother of All Bubbles.’

What dates are the Santa Rally from?

This year the Santa Claus Rally for 2024 spans from Tuesday, December 24, 2024, to Monday, January 6, 2025.

According to Yale Hirsch, the market analyst who first coined the term Santa Claus Rally back in 1972, the Santa rally starts in the last 5-10 trading days of the year. It then straddles the New Year and stretches into the first 2-5 days of the following year.

This strict definition has allowed investors to calculate the returns of the Santa rally objectively, and compare this seasonality effect over time.

What have been the historic Santa rally results?

The Santa Rally, at the most fundamental level, is really a market hypothesis about the seasonality of markets. Are some periods, during the course of a calendar year, more bullish than others? If so, what is the return we expect from this extra returns?

Many traders have attempted to exploit this hypothesis in the past, with varying results. Does the hypothesis still hold in today’s market when electronic trading dominates? Speed matters in finance, because a lot of financial mispricings can be arbitraged away in a blink of an eye.

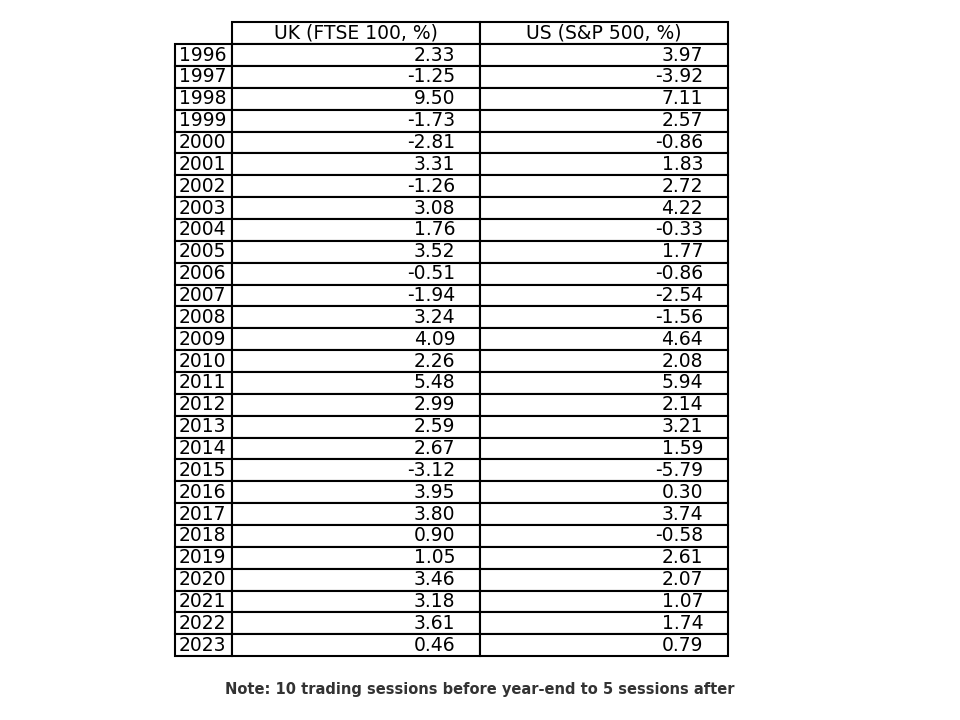

To answer this, I calculated the previous Santa Rally returns all the way back to 1996 (and updated the calculations this year). I obtained the returns from the Santa dates for the UK/US using the FTSE 100 Index (UK) and the S&P 500 Index (US) as the market proxy respectively. The table below shows the returns for the Santa period (five final trading days of the year plus the first two trading sessions of the following year). Returns are in percentages.

By and large, the two benchmark equity indices in recent years did indeed exhibit mild Santa rallies. Footsie’s biggest Santa rally post-2008 was recorded in 2011 at 3.88 percent. The lowest at -2.74 percent in 2014. For the S&P, the results were relatively flat, but positive. Santa returns during 2016-2022 all came in below 1.3 percent (see below).

Source: Author’s calculations (updated 2024)

Is the Santa Rally exploitable?

The relevant question that every investor wants to know: Is the Santa rally really exploitable? Perhaps. To judge if this strategy has practical use, one has to take a few trading considerations into account:

- Transaction costs – once fees are included are these returns still positive?

- Liquidity – is thin during the holiday seasons (Christmas to New Year). This exacerbates the pricing issue and potentially widens the bid-ask spreads

Remember that the original Santa Rally holding period is narrow, lasting only about 5-7 trading sessions. With an investment timeframe this narrow, randomness can dent the profitability of the strategy.

If we, however, extend the Santa period by doubling the holding period, does it improve the trading result?

When the holding period doubles, returns increase markedly. For instance, FTSE 100 generates returns in excess of 3 percent during 2020-2022 during the turn of the year (see below). The S&P also shows a higher level of return.

Perhaps the Santa Rally is really too short a period to generate meaningful returns. Only when we extend the holding time do we benefit from the general upward drift in the stock market. Time in the market, as the old adage says, beats timing the market.

Or perhaps the Santa Rally has moved forward. Gains generated in the early to middle of December, rather than the last few days of the month, are crystallised by traders before the holiday season starts. This dampens buying interest after Christmas.

Source: Author’s calculations (updated 2024)

Will there be a Santa rally in 2024?

The US equity market is in a long, long bull trend.

The secular bull market that started way back in 2009 has continued, to the surprise of many, to this day. Take a look at the weekly chart of the S&P 500 ETF (ticker: SPY). Deep corrections are few and far in between during this generational upswing. The last bear trend ended back in 2022; prices have been marching firmly higher since. Having recently broken 6,000 (at index level), prices are now in uncharted waters (see below).

With a trend this strong, bears have all but capitulated. Even veteran short-selling funds have exited the market, like Jim Chanos last year.

The question of whether we will have Santa rally this year is, I think, no longer that important. After all, S&P’s 1-year return is now an amazing +31 percent. This is one of the largest annual returns for the S&P. Many stocks are in triple-digit return territory. Adding a couple of low percentages here and there during the Santa period will not increase S&P’s returns meaningfully.

In fact, many funds have already bagged good gains during this spectacular year. They may even be inclined to sell at good prices in the year-end to book the gains and turn paper profits into real gains.

Still, as we enter the last month of the year, returns are usually positive for the blue-chip index.

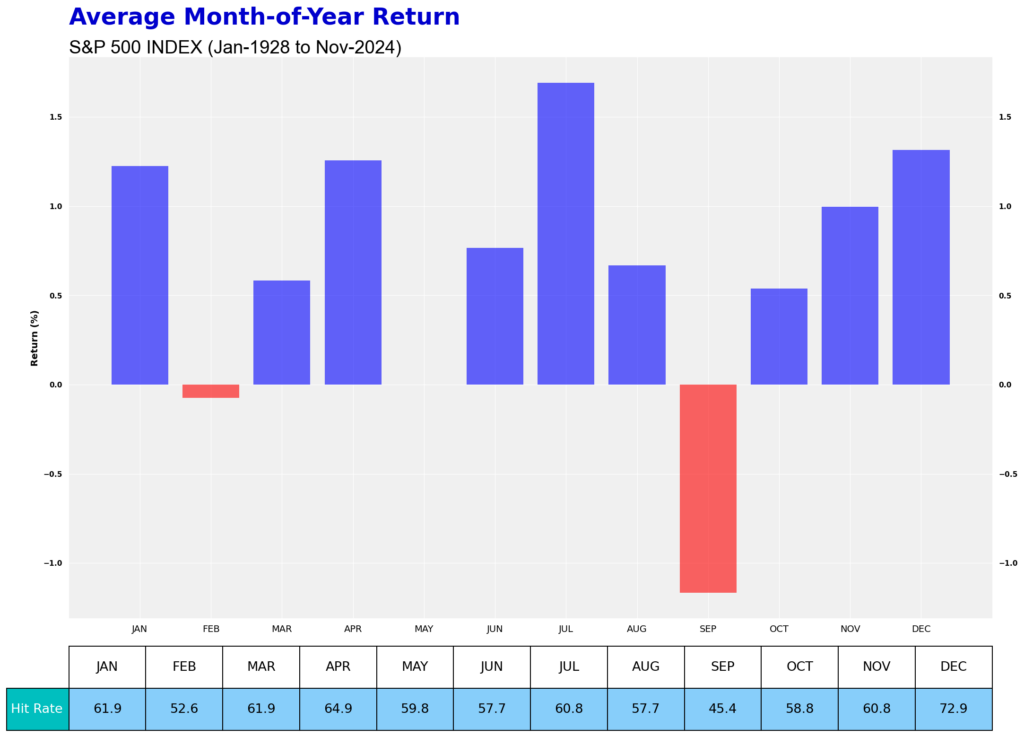

The chart below tabulates the average monthly return for the S&P since 1928. December is the second highest return month of the year, with a “Hit Rate” in excess of 70 percent. In other words, the S&P rises in the last month of the year seven times out of ten. When dealing with uncertainty, that’s not a bad predictive outcome.

So, will we see a Santa Rally this year? Perhaps it has already started, last year.

Source: Author’s calculations (updated 2024)

What are the best stocks to buy to take advantage of the Santa Rally?

If the Santa Rally is happening, how should we take advantage of it? In other words, what should we buy?

Well, for many the answer is obvious: tech. Returns there are highest and their business model most ‘attractive’. Cash generative, profitable, and forward looking. As we scan the entire market, few industries are doing better than US tech stocks. The latest trillion-dollar company came from the sector – Nvidia (NVDA), now worth a staggering $3.4 trillion, the second most valuable company in the world.

Look at the tech ETF below (as proxied by Nasdaq 100, ticker: QQQ). Prices are surging into new all-time highs after brushing aside the 500 psychological level.

But the tech trade is very crowded. The mid-cap 400 (ticker: IJH) could be another instrument to look at.

In the UK, the answer is probably the blue-chip FTSE 100 Index (either using the ETFs such as ISF or futures).

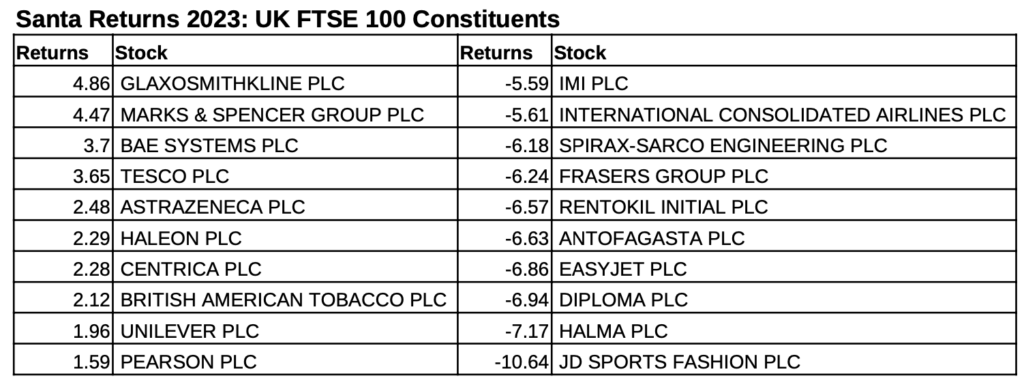

The answer is because of the wide variability of individual stock returns during the Santa period. For example, I gathered the Santa returns from FTSE 100 constituents last year (2023) and ranked them accordingly. At the top of the table sit Glaxo (GSK) (+4.8 percent). while JD Sports (JD) is at -10 percent. That’s quite a big difference in returns over a short time.

Even with the same sector, the disparity in return was stark. Compare the retail stocks. Marks & Spencer (MKS) rose a chunky 4.5%, wile Frasers (FRS) sank 6.2%.

In sum, pick the wrong stocks to bet on the Santa rally, it seems, could be highly detrimental to the portfolio returns. A poor RNS could hammer a stock. Finance, after all, is a social science. What works this year may stop working next year.

Therefore, anyone betting on this calendar-based Santa Rally effect, do so with prudence and within the parameters of your risk management framework.

Source: Author’s calculations (updated 2024)

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com