OFX Customer Reviews

Tell us what you think of this provider.

4/5

Fast efficient service, with good…

Fast efficient service, with good exchange rates

Joined but never used

Joined but never used

Very easy to do

Very easy to do

Exchange rates offered got worse…

Exchange rates offered got worse over time

great customer service, easy to…

great customer service, easy to use app

ok

ok

Good serice

Good serice

2/5

Pros:

online app is good

Cons:

pick up their phone – on hold for over 45 minutes

3/5

Pros:

They are ok.

Cons:

Better follow up of errors.

5/5

Pros:

Ravi

5/5

Pros:

Convenience

Cons:

Nothing

5/5

Pros:

Low fees

Cons:

Nothing

5/5

Pros:

The best exchange rate I could find. Executing exchange super fast. No commissions.

Cons:

To offer even better exchange rate for returning customers

5/5

5/5

5/5

Pros:

I have no words to describe them

5/5

5/5

Pros:

Easy

Cons:

Half price offer

OFX can get you bank beating exchange rates on large currency transfers

Provider: OFX

Verdict: OFX is a leading currency broker offering currency services to more than 170 countries around the world. Originally known as OzForex, it was launched by Matthew Gilmour in 1998 as an information only website. Since then, it has grown rapidly handling more than AUD$2000bn transfers for more than a million individual and business customers worldwide.

Is OFX a good currency broker?

Yes, we rate OFX as a very good currency broker as they offer discounted exchange rates, personal service for individual buying a property abroad of for businesses needing more complex services like integrated Amazon payments or currency hedging strategies.

OFX offer a great way to time and save money on large currency transfers for either foreign property purchases international moves or for business transactions.

If you have a large currency conversion coming up OFX can help you reduce costs when buying a holiday home abroad, or moving to another country. These key benefits of using a currency broker like OFX for international property purchases are:

Better exchange rates

Control over the price and time of the conversion

Personal support

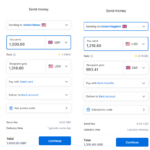

OFX Offer Competitive Exchange Rates

When purchasing property abroad, exchange rates can significantly impact the overall cost, especially if you send the money from a traditional high street bank, which can charge up to 4% of the value of the foreign currency. Using a currency broker like OFX means that you can negotiate lower commissions. Whilst FX pricing may seem complicated, it’s quite simple to calculate. We’ve produced guides on ‘how to compare exchange rates‘ and how to avoid ‘honeymoon exchange rates‘, which will help you get better exchange rates when sending money abroad.

Transfer Timing & Flexibility

When you transfer money with your bank you have little or no say over when it is done or at what exchange rate is used, as the bank just provides a rate which you can either accept or not. But OFX will let you set a limit if you have a price in mind and you can also lock in an exchange rate for a future transfer (using forward contracts) or want to set up regular payments for a mortgage.

24/7 Service and Support At OFX

Again, banks are quite impersonal things, and even the new breed of digital banks like Starling and Monzo (who do provide good exchange rates) don’t offer personal services. Large currency transactions for buying property in another country can be stressful, especially when navigating different time zones and dealing with the onerous AML requirements and delays. It’s important and actually quite reassuring to have an account manager at OFX you can call for support, ensuring that you can get help whenever you need it, no matter where you are in the world.

Pros

- Bank beating exchange rates

- Personal service and good tech

- Currency hedging solutions

Cons

- Better for larger transfers

-

Exchange Rates

(4.5)

-

Available Currencies

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(5)

-

Research & Analysis

(4.5)

Overall

4.6OFX Facts & Figures

In a nutshell:

- OFX was founded in Sydney in 1998 (26 years in business)

- Listed on the Australian Securities Exchange (ASX) since 2013

- 700+ employees across eight global offices

- Registered as an e-money institution with the Financial Conduct Authority (FCA) in the UK

- Overseen by 50+ regulators globally

- Ability to make payments in 50 currencies to 170 countries

- To date, managed transfers of AUD $200+ billion, for 1M+ clients

- 15 Tier 1 banking relationships, including Barclays.

| 💱 Total Currencies | 50 on offer |

|---|---|

| 💵 Min Transfer | £250 |

| 💰 Max Transfer | None |

| 🛒 Customers | 1 million+ |

| 🏛️ Founded | 1998 |

| 💱Transfers | £82 billion so far |

| 🏢HQ | Sydney, Australia + local offices around the world. |

| ⚖️ Regulated | FCA, ASIC, FINTRAC + more |

| Account Options | |

| 🧍 Personal Transfers | ✔️ |

| 👔 Business Transfers | ✔️ |

| 📅 Currency Forwards | 12 months |

| 💸 Currency Options | ❌ |

| 🤝 Personal Service | ✔️ |

| 📱 Phone Dealing | ✔️ |

| 🖥️ Online Platform | ✔️ |

| ⭐ GMG Rating | |

| 🌐 Website | Visit OFX |

OFX News

Is OFX any good for Currency Forwards?

In this review we look how good OFX is for currency forwards and how far into the future you can lock in an exchange rate. Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades

Is OFX good for business money transfers?

In this review, we look at if OFX is a good currency broker for businesses to manage their foreign exchange risk and international payments. OFX Becomes an Amazon-Approved Payment Services Provider Currency broker OFX has become a member of Amazon’s new approved payment services provider program. The move will make it easier for Amazon sellers

Sarah Webb, OFX UK President on the importance of personal service for large currency transfers

Foreign exchange is a minefield. No one really knows what is going to happen to currency rates when markets are incredibly unpredictable. Mis-timing a transaction can seriously leave you vulnerable if you aren’t prepared. So, if you have any upcoming large transaction how do you know what broker is going to offer you the best

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.