Yes, you can invest in a huge range of index funds (including Vanguard funds) when you have a GIA, ISA or SIPP account with Interactive Investor.

Interactive Investor: Fixed-fee index fund investing

Provider: Interactive Investor Index Fund Investing Review

Verdict: Interactive Investor offer a wide range of index tracker funds. A good choice for large index fund portfolios, as they offer good coverage and the fixed-fee model means that the bigger your account size gets, your costs stay the same. You can either pick your own or choose from some featured funds from their Super 60 investment list.

Capital at risk.

Summary

Pricing: For the Core accounts a commission of £3.99 per trade is charged on index funds; however, if you are on the £39.99 a month Premium plan, index fund traders are free.

Market Access: Great global market access to index funds,

Platform & Apps: Clear-to-use website, and simple apps – nothing too complicated for DIY index fund investors.

Customer Service: Very good, you can call their UK office for any issues. Not just be relegated to a chatbot.

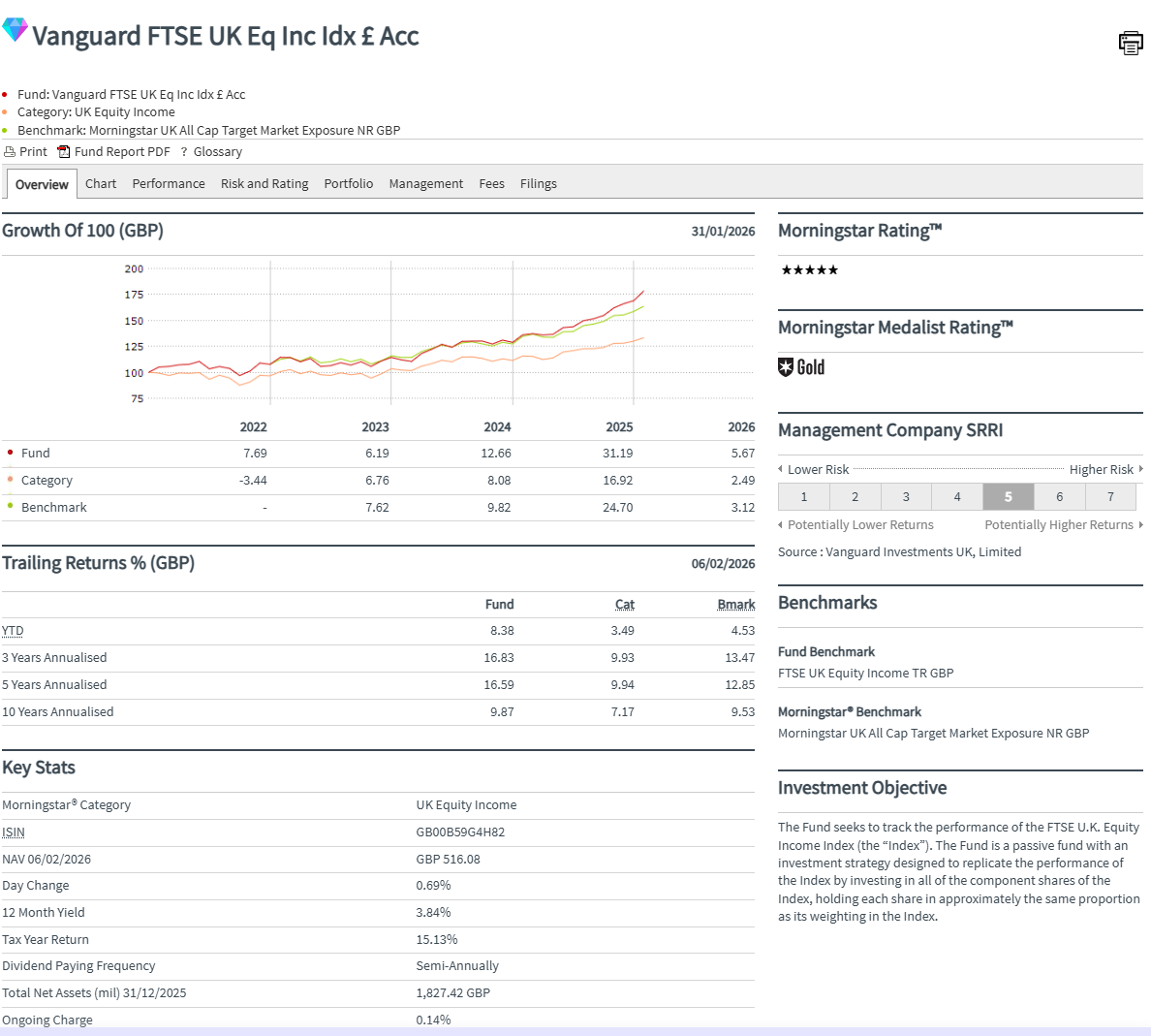

Research & Analysis: Excellent index fund screeners that show funds by yield and performance. Although it is a bit irritating having to score horizontally to get all the info. Plus lots of fund data from Morningstar.

Pros

- Fixed account fee from £5.99

- £1 minimum deposit

- Great Index Fund screener tools

Cons

- Fixed fee is not great for very small accounts

- A commission of £3.99 is charged per trade

- High FX fee on 0.75% unless on a premium plan

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Platform & Apps

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(5)

Overall

4.6- Expert opinion: Interactive Investor reviewed & rated

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.