Currensea Review: Wave goodbye to high holiday FX fees

Provider: Currensea

Verdict: Currensea is an FX card that connects directly to your bank account that can reduce the amount of foreign exchange charges you pay when spending money abroad.

Is Currensea a good card to use abroad?

The main reason why I’ve never used a currency card when on holiday is because quite frankly I can’t be bothered. Every single thing about holidays are expensive, from airport parking to buying three meals a day, to new clothes, to tourist tat, to buying a snorkle in the hotel gift shop for €30.

I know I should be using a currency card, becuase I’ve been involved in the FX markets for 20 years. I know that tourist currency exchange rates are opaque. I know that when I use my Natwest card abroad they charge me nearly 3% in the exchange rate. Just in the same way I know that when I book the holiday using my Amex to collect airmiles I will never use them and that it will never justify the exorbitant APR.

Like so many others I bury my head in the sand when it comes to FX and just ignore it. After all, the charges are in the exchange rate, not added afterwards. Plus, everyone rips you off on holiday. Why should your bank be any different?

I’ve even bought travel money at the airport, just in case I need to tip the taxi driver when we arrive. Oh, the shame!

There is too much admin for holidays as it is, so the last thing I need to deal with is transferring money from my bank to yet another card. Especially as I don’t actually have a wallet anymore. Except for holidays, a very nice Smythson travel wallet for passports that Mrs Berry bought me for Christmas one year. That is in fact where I keep my Amex, expired E111 card, my boating licence, copies of our marriage and birth certificates, passports, foreign notes and shrapnel. And now, my Currensea card…

I do have a Revolut card from when I reviewed it, but I’m certainly not going to bank with them on a day-to-day basis, because they are not a real bank. I like my banks to be traditional profitable companies listed on the London Stock Exchange, not an overvalued fintech with VC backers that don’t make any money.

Why have I decided to use a currency card after all this time?

Well, I was introduced to Currensea, by someone at Wealthify, who I quite like, because they took the concept of investing and made it hassle-free. Which is what Currensea has done for travel money, they made the process of having a currency card for holidays hassle-free. Which is what you want, less admin, not more.

Open banking

With a Currensea card, it connects to your bank account via open banking so you don’t need to move money between accounts. It knows how much money is in your bank account and deducts it straight from there when you use it.

Plus, holidays are now so ruinously expensive, that I thought I should at least try and save some money somewhere.

Before I went away to test Currensea I was having a chat with a friend of mine over lunch at The Ned, about the money apps that do well because they make things easy. I love GoHenry for example, because it’s made pocket money easy, but it does cost £3.99 a month. My friend was singing the praises of Hyper Jar, which he used in Singapore, as he says they don’t charge any FX fees at all, and has no monthly fee. That makes me wonder though, if a financial provider doesn’t charge you, how can it make money? Because if it doesn’t make a profit is your money really safe with them?

Cheap

So, I actually don’t mind that Currensea charges 0.5% in exchange rate spreads (the difference between where you buy and they buy). Because good businesses should make money.

Currensea does offer zero spread exchange rates but you have to pay £25 for their Premium service or £120 for their Elite package. I’ve got no interest in paying for things I may not use and to make my money back on a £25 annual subscription I’d have to spend £5,000 a year abroad, which I probably don’t do, on a regular basis.

Although it would have been helpful this year when I was in Italy over the summer and a carport fell on my rental car during a storm and I had to pay €1,500 in excess insurance. I used my Amex for that, as my Natwest debit card wouldn’t work. No idea why, but for some reason, it never does for car rental. But American Express can have their 2.99% because the whole process of spending 2 hours in the Hertz rental bureau by Perugia station was bad enough and by that point I would have paid anything to get back to the pool. Plus, this was 3 months ago, and I’m still trying to claim the excess back from iCarhireinsurance.com. More holiday admin, and this time the lethal combination of Italian paperwork and insurance company claims department bureaucracy. See what I mean, what’s the point in saving a few euros on FX, when you get stung on so many other things?

So Currensea is cheap, but not too cheap.

However, they are still cheaper than Starling and Revolut. Starling used to be great for money transfers, but when I reviewed them as a comparison to Remitly, they seem to have become very expensive for small international payments.

When I spoke to the CEO of Currensea James Lynn, he was adamant that Currensea are cheaper than both and sent me links to their research about how these neo-banks can widen the spread at weekends and so on.

If you want to dive deeper into how they are cheaper you can read up on Currensea’s research and their pricing comparison to Starling and Revolut.

Easy

Another thing Currensea does really well is make the process of signing up easy. A few months ago, I was having another lunch (again at The Ned) with some forex brokers who live and die on account opening conversions. We were praising the speed at which you can open an account with one of their competitors. It’s one of the reasons they onboard so many customers. The account opening process salami tactics you in a fluid motion. Taking you through the process step by step, with very little drop-off. The comparison to only a few years ago, when you had to send back paper forms is incredible.

This is the new psychology of client acquisition – you have to make it easy, which Currensea does. Any chinks in the armour and potential customers drop off. I know I would have. If an administrative task is unnecessarily hard and you don’t actually have to do it. Why would you?

Safe?

There is one issue though, and that’s that it doesn’t connect to Apple Pay, which would be a pain, if you were on a City break as you’d need to carry the card and can’t pay with your phone. But actually, on the beach, it isn’t an issue because you can’t keep your phone in the zip-back pocket of your swimming trunks. You can keep a card in there, but probably not your main banking card, because if you lost that snorkingly it would be a pain. But if you lose your currency card, you don’t have to update your card details on every website and app you’ve ever used to pay for something.

Another good thing about using a different card abroad is that you can have a different pin number. So you don’t have to worry so much about fraud by giving up your magic four numbers to anyone looking over your shoulder. You can also freeze your Currensea card in the same was as you would be able to with your normal debit card.

The business

It’s not been plain sailing for Currensea though, they were founded in 2017 and went live in 2019 just before the pandemic. But, perhaps this wasn’t such as bad thing as they could focus on the product rather than growth. Some serious currency entrepreneurs founded Currensea, the co-founders Craig Goulding and James Lynn built Barx (the Barclays FX system) and Jet Stream at Credit Agricole

Currensea raised money from some serious people too, who understand the travel industry well. James Lynn told me Marin Muyser one of the co-founders of booking.com was so impress with the idea that he approached them to invest. Currensea have also overfunded on Seedrs to £3m from a £1m raise. I asked James what he thought about raising money as most people hate it, but he claims to actually have enjoyed it. Probably because it went well and they now have a huge amount of brand advocates, who not only use the product but are part-owners of it too.

Now though, Currensea has a Trustpilot score of 4.9, a lot of their customers are men age 45 (dads like me trying to save money on holiday presumably), but they also have a good spread of users from 20-90 years old. Of those 100,000 customers, they spend about 2-3k per year and are sticky too. As, once your Currensea card is connected, you can tuck it away until the next jaunt.

Verdict

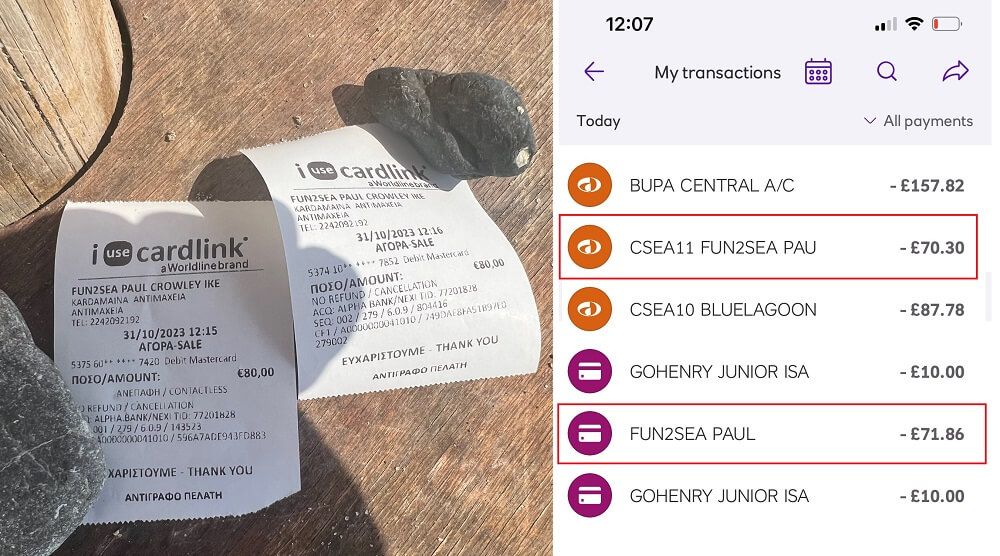

Can Currensea save you money when spending abroad? Yes, it can. I tested it at the water sports centre at the Blue Lagoon Village in Kos, when I went paragliding with my children, which cost €160. I paid half with my Natwest Debit card and half with Currensea.

It was £1.56 cheaper with Currensea.

Pros

- Connects to your bank account

- Bank beating exchange rates

- Easy to use

Cons

- Cannot use on Apple Pay

- Have to pay for zero fees

-

Pricing

(4.5)

-

Market Access

(4.5)

-

App & Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.4Currensea Customer Reviews

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.