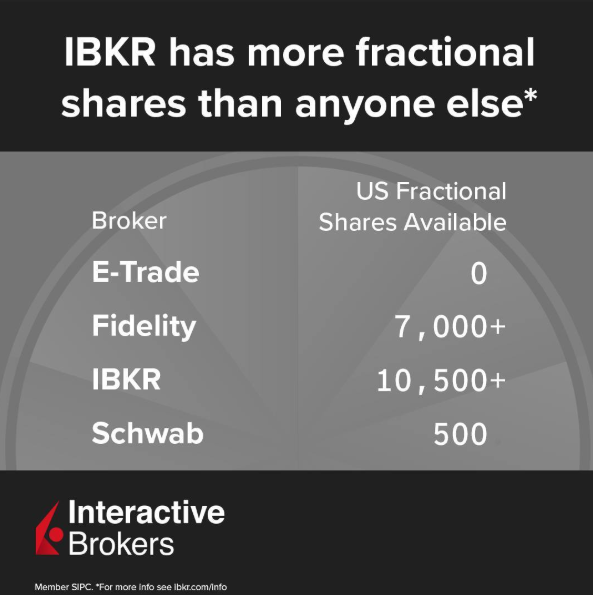

Interactive Brokers (IBKR) has stated it offers more US fractional shares than any of its rivals. The trading and investment US stock broking platform noted it offers fractional shares in more than 10,500 US listed companies.

IBKR says they have more fractional shares than anyone else, when comparing the firm’s offering with that of competitors Fidelity, Schwab and E-trade.

Fidelity offers more than 7,000 US fractional shares, while Schwab offers around 500 and E-Trade offers none.

IBKR’s claim to be the leader here checks out with other online sources, though the Good Money Guide has not independently verified it.

In a 2019 interview with the Good Money Guide, the firm’s founder and chairman, Thomas Peterffy, emphasised the importance of both competitive pricing and a strong product-line up for the company.

Our review of the platform finds it overall to be “unmatched in terms of market access, account types and execution options for retail traders”.

“It always has been and remains one of the cheapest trading and investing platforms globally,” Good Money Guide founder Richard Berry wrote.

What is fractional share ownership?

Fractional share ownership allows investors to purchase less than one full share in a company. You can check out our comparison of the best brokers for fractional share investing here.

Fractional shares are good for beginners or those who do not want to invest more money than they would like in a single firm.

Fractional shares tend to be US-centric, which makes sense given that single shares in leading US companies are often quite pricey by international standards.

They have not been adopted by every broker, and the major UK brokers Hargreaves Lansdown, AJ Bell and Interactive Investor do not yet offer them.

In September this year HMRC changed its guidance to allow fractional shares to be held in a stocks and shares Individual Savings Account (ISA), with all the accompanying tax benefits.

Robin has more than six years of experience as a financial journalist, most of which were spent at Citywire, and covers the latest developments in the investing, trading and currency transfer space. Outside of work, he enjoys reading literature and philosophy and playing the piano.

You can contact Robin at robin@goodmoneyguide.com