If you want to invest in Graphene the first thing you need is a stockbroker that will allow you to buy companies that have exposure to Graphene. In this guide to investing in Graphene, we will run through what Graphene is, the pros and cons of investing in it, and the major risks involved.

Graphene Stocks

These are some of the most popular stocks in the graphene sector. Most are quite small and illiquid so make sure you understand the risks of investing in small-cap companies.

- Haydale Graphene Industries

- Versarien

- Graphene NanoChem

- G6 Materials

Graphene ETFs

One of the advantages of investing in Graphene ETFs, is that your risk is spread across other materials and not completely correlated to Graphene. There are not many Graphene ETFs, howveer, the Disruptive Materials ETF from Mirea Asset “seeks to invest in companies producing metals and other raw materials that are essential to the expansion of disruptive technologies, such as lithium batteries, solar panels, wind turbines, fuel cells, robotics, and 3D printers. Targeted materials include companies involved in the exploration, mining, production and/or enhancement of Rare Earth Materials, Zinc, Palladium & Platinum, Nickel, Manganese, Lithium, Graphene & Graphite, Copper, Cobalt & Carbon Fiber.”

What is Graphene

Graphene is a carbon-based material, in fact, its single layer of carbon atoms that are arranged in a hexagonal lattice or honeycomb shape. Each carbon atom in the lattice is connected to three neighboring atoms. Similar bonds between atoms are found in carbon nanotubes.

These atomic bonds provide graphene with some unique properties such as super-strength, highly efficient heat, and electrical conduction and absorption of light across all visible wavelengths, making Graphene appear to be black in colour. Though being only an atom thick it is effectively transparent. Graphene was first observed using electron microscopes in the early 1960s but was only properly isolated and studied as recently as 2004, by Andre Geim and Konstantin Novoselov at the University of Manchester who received the Nobel prize in 2010 for their work.

What is Graphene used for?

Despite it being such an interesting and unusual material, you can harvest graphene at home using a pencil, some paper, and adhesive tape. Simply shade an area of the paper with the pencil until you have a thick covering of colour. Then press some of the adhesive tape on to the shaded area and peel it off. If you look at the surface of the tape you should see a slight discolouration which is a layer or layers of graphene.

Graphene’s combination of conductivity, strength, and optical properties make it an ideal material for use in high-end electronics such as the touch screens on mobile devices. LED lighting, and specialist printing inks. There are also applications for graphene infiltration, specialist composite materials which are both lightweight and extraordinarily strong. As well as solar, photovoltaic, and energy storage solutions.

In powdered formats, graphene can be used as a lubricant or indeed as a coating or paint. Other uses include thermal and temperature management, 3-D printing, and as light absorbent coatings on glass surfaces and windows. Graphene is likely to play a major role in the future of wearable technology its strength and flexibility could well change the form factors of the devices that we use which could integrate seamlessly into our clothing.

Though still in development graphene may be able to speed up the transmission of information through semiconductors and could greatly improve the efficiency with which solar cells convert sunlight into electricity. And perhaps most exciting of all graphene exhibits superconductive properties at temperatures of just -70c far above the normal temperatures that superconductivity is observed in other materials.

How to Invest in Graphene

Graphene is what is known as an emerging technology and many products and uses are still in a developmental stage. However, there are more than 100 companies worldwide that are involved in the production of graphene or in the development and manufacture of graphene-related products.

The table below (source thomasnet.com) contains a list of some graphene manufacturers

| Global Manufacturers of Graphene | ||

| Company Name | Location | Market Cap* |

| Directa Plus PLC | Italy | $ 242.0 million |

| Talga Resources Ltd. | Australia | $ 116.0 million |

| Versarien PLC | United Kingdom | $ 100.1 million |

| Saint Jean Carbon Inc. | Canada | $ 94.7 million |

| Haydale Graphene Industries | United Kingdom | $ 51.6 million |

| Group NanoXplore Inc. | Canada | $ 20.3 million |

| Graphene NanoChem LLC | United Kingdom | $ 7.1 million |

| First Graphene | Australia | $ 6.9 million |

| Elcora Advanced Materials | Canada | $ 5.9 million |

| China Carbon Graphite Group | China | $ 2.4 million |

In the UK aim listed Versarien (Ticker VRS LN) develops advanced materials using graphene including electrically conductive inks and nanomaterials that have applications in green energy and energy storage. As well as graphene-enhanced plastics that are more flexible and offer greater durability. Versarien and its subsidiaries hope to capitalise on both their intellectual property and their skill in manufacturing graphene products

Canadian venture exchange listed G6 Materials is a manufacturer of contact adhesives advanced materials and composites and specialty organic chemicals. The company also produces a range of graphene-based materials for sale and use in external R&D projects be they in university labs, startups, or other established companies. G6 materials have had some 20,000 + customers worldwide and some success monetizing its IP and products but it’s still very much a fledgling business overall.

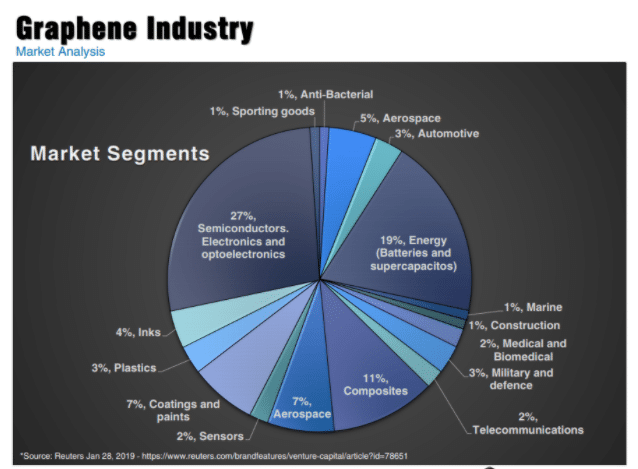

The graphic below via Reuters and G6 Materials shows the breakdown of the end-user markets for graphene and graphene-based products.

Where to trade Graphene

Graphene prices have fallen consistently advances in manufacturing technology have allowed its production to scale up. Graphenea a Spanish based research and production cooperative and producers of the chart above. suggest that they can offer enough for any graphene application.

Lower graphene prices should mean that it becomes easier and cheaper for companies to develop graphene technologies and products and that these may be adopted in mainstream consumer products services. But for the moment the global graphene business is really in a late-stage R&D phase more akin to a frontier market than anything else. If you do choose to trade or invest in graphene companies then you are going to need a broker with access to smaller companies and pink sheet listings around the world.

Should you invest in Graphene?

Graphene could be a gamechanger for many of the world’s existing technologies and usher in new ones as well. However, the technology is currently unproven, and the end uses largely speculative. As such graphene is a marketplace for risk-takers such as specialist venture capitalists. who may invest in a dozen companies in a space or new technology, knowing that many of these investments will fail but hoping that those businesses that survive will more than compensate for the failures. In these circumstances, its often considered best practice to invest in a fund to diversify your exposure rather than concentrating risk in one or two direct investments. However, at the time of writing, I couldn’t find a fund specifically focused on the graphene market.

No doubt there will be big rewards for early-stage investors in graphene technologies, companies, and their owners. If you do invest in the graphene market, I think you will need to consider the money you invest as being written off.

Not least because many of the quoted companies in the space are small and micro caps and can be illiquid. As such the chances of selling your holdings in adversity would be slim to none.

That said there will be multi-baggers among them and more to come as the graphene markets develop and the technology moves into the mainstream. In a similar perhaps to the way that lithium-ion battery technology developed over the last decade or so. So, it’s very much a case of caveat emptor here but also perhaps to the victor the spoils.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

You can contact Darren at darrensinden@goodmoneyguide.com