If you are new to UK Real Estate Investment Trusts (REITs), throughout this guide, we will go through the basics of REITs and how they can serve your investment needs. By the end of this guide, you will be confident enough to buy your first REIT.

How to invest in REITs

To invest in REITs you need a stock broker like Hargreaves Lansdown, Interactive Investor or AJ Bell. You can use our comparison of what we think are the best accounts for investing in REITs to compare how much it costs to buy and sell REITs, the costs of holding a REIT as an investment and in what type of account you can hold the RIET. As well as also buying REITs in general investment accounts you can also hold them in a wide range of tax efficient investment accounts like stocks and shares ISAs and SIPPs.

| Name | Logo | GMG Rating | Customer Reviews | Annual Fees | Dealing Commission | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews 4.2

(Based on 1,105 reviews)

|

Annual Fees 0% – 0.25% |

Dealing Commission £3.50 – £5 |

See Offers Capital at risk

AJ Bell Reviews |

Features:

|

AJ Bell Share Dealing Review Provider: AJ Bell Share Dealing Verdict: AJ Bell is a low-cost online investing platform and is the cheapest share dealing platform for buying and selling shares for the UK do-it-yourself (DIY) investor. They also offer plenty of investment ideas, including investment guides and equity research. Summary A great choice to deal shares with low costs in a variety of investment accounts.

Fees: AJ Bell share dealing account fees are capped at £3.50 a month. Dealing costs are £1.50 for funds and £5 for shares but drop to £3.50 when there were 10 or more online share deals in the previous month. Special Offers:

Pros

Cons

Overall4.2 |

||

|

GMG Rating |

Customer Reviews 3.8

(Based on 1,774 reviews)

|

Annual Fees 0% – 0.45% |

Dealing Commission £5.95 – £11.95 |

See Offers Capital at risk

Hargreaves Lansdown Reviews |

Features:

|

Expert Review Account: Hargreaves Lansdown Share Dealing Description: Hargreaves Lansdown offers access to the widest selection of stocks for share dealing accounts in the UK. The platform also has one of the best research portals for analysing stocks. Is it expensive to buy and sell shares on Hargreaves Lansdown? Hargreaves Lansdown is not as expensive as it used to be as there is no account charge for holding shares in a general investment account and a max of £3.75 in a stocks and shares ISA. HL does still cost more than competitors like AJ Bell and Interactive Brokers to buy and sell shares, but the account running costs can be lower because of the monthly cap. HL won the Best Stock Broker in our 2024, 2022 awards, and in 2021, it won Best Full-service Stockbroker for their all-round approach to customer service.. Another added bonus of dealing shares through HL is that their clients benefit from price improvements for best execution. HL say they reach out to multiple brokers to get the best prices for a trade and clients can make a saving of £18 per trade on average. This is particularly relevant if you are dealing with cap UK shares, which is where Hargreaves Lansdown excels. Overall, Hargreaves Lansdown is an excellent choice for most types of share dealing on UK and international markets. Pros

Cons

Overall4.9 |

||

|

GMG Rating |

Customer Reviews 4.1

(Based on 125 reviews)

|

Annual Fees 0.4% – 0.08% |

Dealing Commission £1 – 0.08% |

See Offers Capital at risk

Saxo Reviews |

Features:

|

Saxo Share Dealing Review: Lower fees and professional grade tech Account: Saxo Share Dealing Description: Saxo’s platform has share dealing on more than 50 stock exchanges around the world with 22,000 shares available for investors. Making it one of the most diverse investment platforms for share dealing in the UK. Its forte is on the trading side for traders that need direct market access and are more price-sensitive to bid/offer spreads. Is Saxo any good for share dealing? Yes, you can deal shares directly on exchange with Saxo. In fact, Saxo is one of the best DMA brokers for trading shares inside the bid/offer price as you can place your orders directly on the order book. Saxo’s platform has share dealing on more than 50 stock exchanges around the world with 22,000 shares available for investors. Making it one of the most diverse investment platforms for share dealing in the UK. Its forte is on the trading side for traders that need direct market access and are more price-sensitive to bid/offer spreads. Saxo is a good share dealing platform for sophisticated and advanced investors who also need direct access to capital markets. Fees: Saxo Markets charges a share dealing commission based on a percentage of transaction size. They are very competitive though, and UK share dealing commission starts at 0.1% (£100 if you buy £100,000 worth of stock) and drops to 0.05% for more active traders. As Saxo is a prime broker with a retail and institutional client base, they are one of the best share dealing platforms for larger customers. However, there are some downsides. Firstly they do not offer acesss to smaller cap shares on their trading platform like brokers Spreadex and IG, who have a much braoder range of shares to trade online. Secondly, you cannot trade shares as financial spread bets (where profits are free of capital gains tax). Finally, the cost of dealing shares with Saxo is higher than with a broker like Interactive Brokers. But Saxo wins hands down when it comes to customer services, research and analysis. Pros

Cons

Overall4.3 |

||

|

GMG Rating |

Customer Reviews 4.5

(Based on 1,347 reviews)

|

Annual Fees £0 |

Dealing Commission £3 |

See Offers Capital at risk

Interactive Brokers Reviews |

Features:

|

Interactive Brokers Share Dealing Review Provider: Interactive Brokers Share Dealing Verdict: Interactive Brokers is an excellent account for sophisticated share dealers who want to manage their own portfolio with complex order types actively and need access to a wider range of investment products like derivatives, options, and futures. They also offer fractional share dealing if you only want to start trading a small amount. Summary One of the most advanced share dealing platforms for beginners and professional investors.

Fees: Interactive Brokers does not charge share dealing custody fees and minimum share dealing commissions are £1 in the UK or 0.05% of the deal size. Pros

Cons

Overall4.3 |

||

|

GMG Rating |

Customer Reviews 3.9

(Based on 695 reviews)

|

Annual Fees £0 – £96 |

Dealing Commission £0 |

See Offers Capital at risk

IG Reviews |

Features:

|

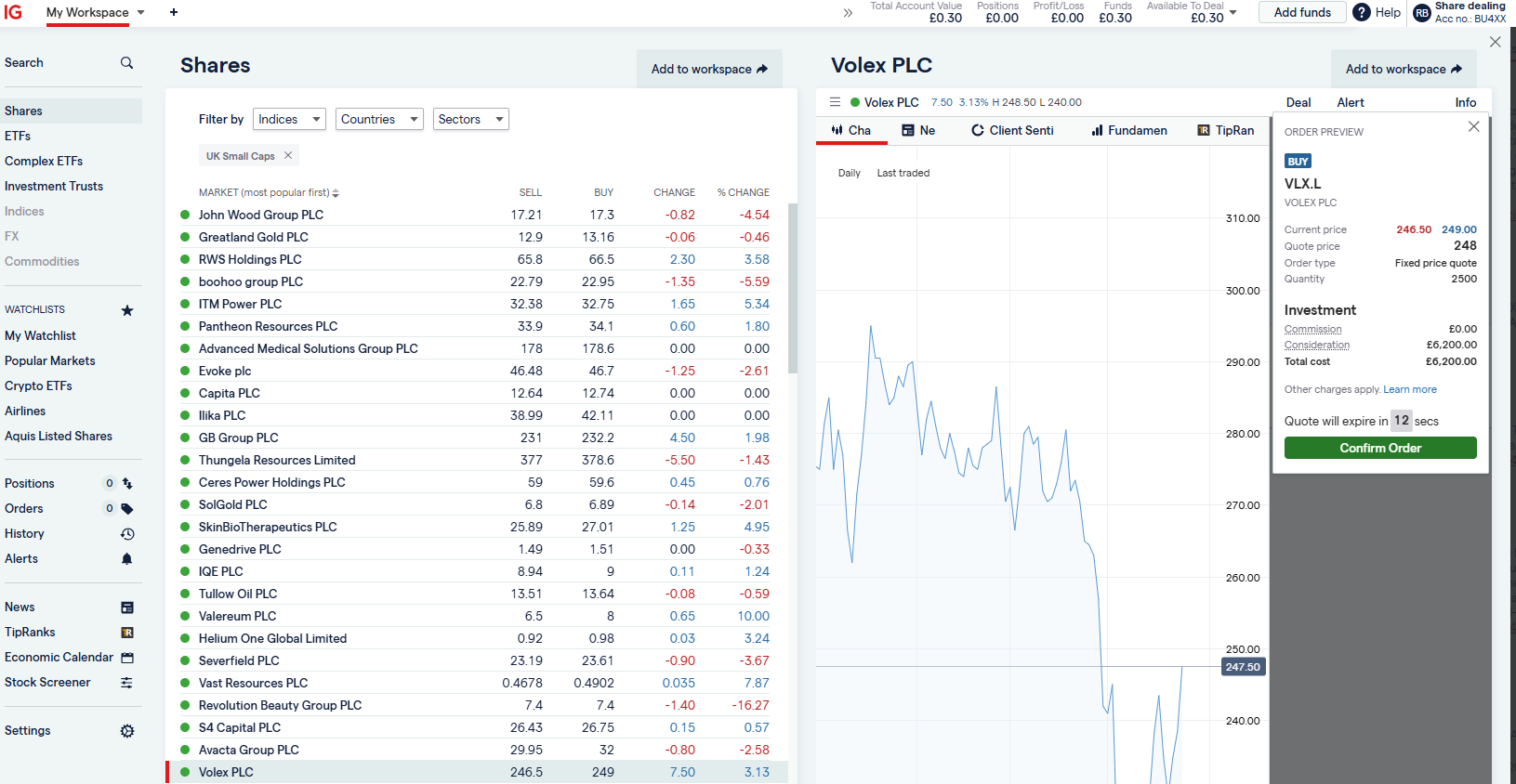

IG Share Dealing Expert Review Account: IG Share Dealing Description: With IG you can deal in over 13,000+ shares, funds and investment trusts with zero commission on US stocks and UK shares, with a foreign exchange fee of just 0.5%. You can also deal on a limited amount US shares while the market is closed. Is an IG share dealing account any good? An excellent share-dealing platform for those who want to deal shares regularly in the short and long term. You also get access to a huge range of UK small-cap shares, where you can request quotes from marketmakers via RSPs. This is something that is not available from other trading/investing platforms like CMC or Trading 212. An IG share dealing account is different from a spread betting or CFD trading account in that you actually own physical shares as opposed to trading derivatives. The ability to deal in shares with IG means that you can invest in companies for the long term alongside your short-term higher-risk speculation. An excellent share-dealing platform for those who want to deal in shares regularly in the short and long term.

Pros

Cons

Overall4.4 |

||

|

GMG Rating |

Customer Reviews 4.3

(Based on 1,123 reviews)

|

Annual Fees £59.88 |

Dealing Commission £3.99 |

See Offers Capital at risk

interactive investor Reviews |

Features:

|

Interactive Investor Share Dealing Review Provider: Interactive Investor Share Dealing Verdict: Interactive Investor is a low-cost share dealing platform that offers investors access to over 40,000 shares. II won the 2021 and 2023 Good Money Guide award for Best Investment Account. Summary Interactive Investor is a great choice for anyone who wants to buy and sell shares on a regular basis and has a large portfolio.

Dealing Fees: Interactive Investor share dealing commissions are a free trade every month, then UK Shares and Funds, US Shares charged £7.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free. Special Offers:

Pros

Cons Fixed-fee expensive for very small share dealing accounts below £1,000

Overall4.3 |

- Related Guide: Compare the best investment platforms in the UK here

You can even leverage up with financial spread betting and CFD trading. The harder bit, however, is knowing when to do so.

What is a REIT?

A Real Estate Investment Trust (REIT) is a corporate vehicle that owns and manages rental properties on behalf of shareholders.

This type of investment trust was popularised in the UK about a decade ago due to changes in legislation. Many listed property firms have sought – and converted – into REIT-status. Firms such as Land Securities (LAND), British Land (BLND) and SEGRO (formerly Slough Estates, SGRO) – all of which belong to the growing REITs club.

To become a REIT is fairly straightforward. Simply, the firm’s rental income must be its major source of profits, and the bulk of this income must be distributed to shareholders (see government’s guidance here). This untaxed cash flow to investors will be treated as property income. It used to be a condition for a REIT that a listing in a recognised exchange, such as the London Stock Exchange, is required. No longer. Institutionally owned property companies can also be converted into REITs.

- Related data: List of UK REITs on the LSE

REITs 2026 Outlook: Are Housebuilders Making A Comeback?

Is now a good time to invest in REITs? While macro-data coming out of the UK economy these days is generally ‘subdue’ (latest GDP +0.1% in 4Q25), investors seem to be warming up to the housebuilding sector.

Yesterday, a few property instruments broke out to the upside.

One major speculation is that the beleaguered Labour government may revive the ‘Help To Buy’ program.[1] The last time the UK government initiated HTB, a housebuilding boom resulted.

But any HTB program this time may not have the same desired impact. For two potential reasons: One, the scale of the program may not be as large as before due to budget tightness; Two, house prices have risen significantly since 2013.

Still, if the government can enact a new HTB, it will stabilise house prices and lift market sentiment.

Let’s take a look at what the market is saying on these large-cap UK housebuilders:

Persimmon (PSN) – broke out to new 52-week highs this week, trading above the 2025 resistance at 1,400p.

Taylor Wimpey (TW.) – edged above the previous reaction highs at 115p; another resistance level lies above at 125p. Generally still developing a wide base formation.

Barratt Redrow (BTRW) – rebounded hard from the lower side of the trading range (350-400p) to threaten a potential range breakout. Unless prices venture north of this ceiling, assume the base pattern remains intact.

Berkeley (BKG) – has been trading in a very wide price range since late 2024. Currently on the ‘third’ rally from 3,500p; given its proximity to the resistance, BKG may assert an upside breakout.

Overall, the sector is generally improving, although we’re seeing quite a disparity in share price performances in the industry. Whether the HTB catalyst will materialise remains an open question.

How does a REIT work?

A UK Real Estate Investment Trust (REIT) is just like any other listed company traded on the London Stock Exchange (itself is listed, ticker: LSEG). Any investor can:

- Buy and sell a REIT throughout a trading session;

- Prices of a REIT fluctuate just like any other listed securities depending on supply and demand

The biggest difference between a REIT and other property companies is what they do with the rental income.

Broadly speaking, according to the UK government’s REIT rules (originally under Finance Act 2006), a REIT vehicle must have most of its assets in property and the majority of its rental income must be distributed to shareholders. Specifically, a REIT must

- distribute 90% of property rental business must be paid to shareholders each year

- have most of its assets in property rental business

This removes the problem of ‘double taxation’ (tax at a corporate and then on a personal level). Now, REIT investors who received income from them are only taxed once.

Recently, there were some minor amendments to the REITs rules (Finance Bill 2023-24) but these changes have limited impact on general retail investors. You can see the list of HMRC REITs rule here.

Why Invest in REITs?

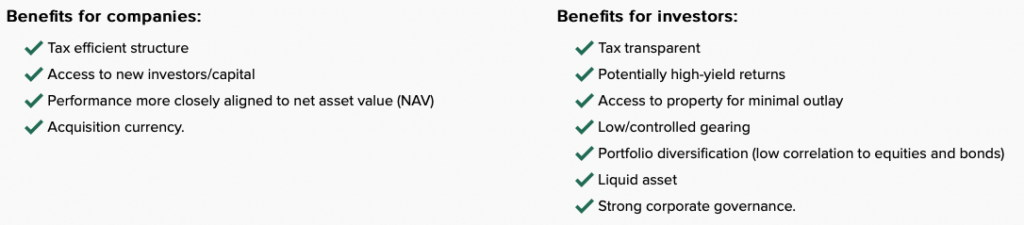

The structure of a Real Estate Investment Trust is tax efficient.

- REITs offer investors access to a wide portfolio of properties at a corporate level. A REIT save investors the hassle of direct property ownership.

- Rental income within the REIT are tax-exempt.

- You can trade major REITs throughout a trading session just like any other stock. Investing £1,000 or £1 million in a REIT will earn a proportional amount of income. Unsurprisingly, many pensions and large investors acquire REITs shares for their yield.

Some REITs have a wide portfolio of commercial and residential properties, assembled by an experienced team and managed professionally on the behalf of shareholders. Due to the nature of UK commercial leases. REITs offer the prospect of a stable income for owners.

Lastly, the ability to trade major REITs throughout a normal trading session like any other stock should not be overlooked. Liquidity is fairly good on a large FTSE REIT. Unlike some property funds, REIT investors are seldom ‘gated’. In 2022, for example, two fund managers gated nearly £8 billion of property funds. Redemptions are suddenly halted in some property funds to prevent a fire sale.

In summary:

Source: London Stock Exchange

Types of Real Estate Investment Trusts

In the UK, most REITs belong to the ‘equity’ type. An equity-REIT may own, among others, offices, shopping complexes, apartments, student accommodation et cetera, to produce the required income for shareholders. The other major type is a mortgage-REIT (see their difference here), which derived its income from mortgage-related activities.

A REIT may specialise in certain property sectors. Within the REIT industry, there are residential, offices, retail, healthcare, logistics, student, and care home subsectors.

For example, Segro (SGRO) concentrates on industrial properties, logistics and warehousing – a sector on the rise due to the popularity of online delivery. Its £20 billion worth of prime property propels it to the largest UK REIT and allows the firm to increase dividends over time.

Unite Group (UTG) is another specialist REIT (conversion in 2017). Its core competency is student accommodation. The firm has achieved excellent progress in the sector with partnerships with universities (60+). Its 2024 half-year rental topped £125 million and fetches a market capitalisation of more than £4 billion (yield =43 percent).

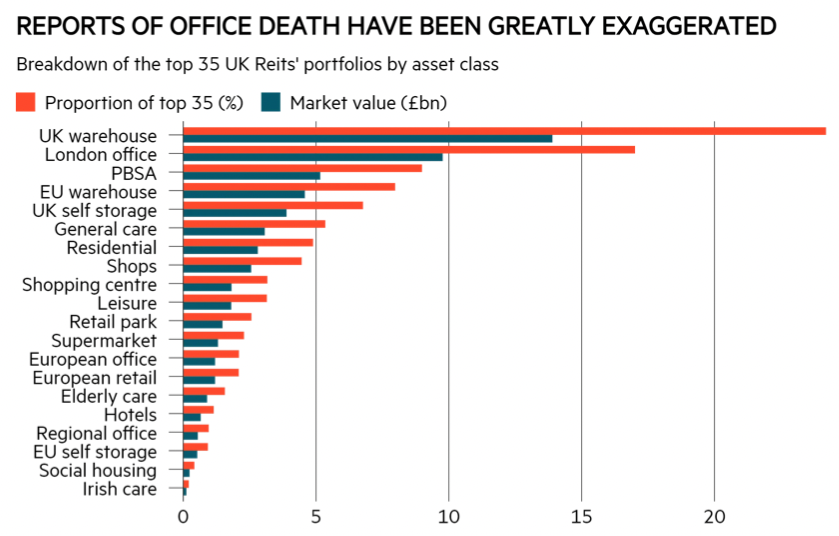

A recent analysis from the investment magazine Investors’ Chronicle below shows a few types of property subsectors where major REITs are investing their resources (see below). UK warehouse is the number one sector, followed by London office. There are a few points to remember about these property sectors:

- Property sector performance vary over time. Some sector may grow faster than others due to a boom in demand (for example, student numbers)

- This will impact REITs’ financial performance and its assets valuation

- All these factors will, in turn, affect a REIT’s share price

Source: Investors’ Chronicle (2024)

How to Profit from REITs?

Investors can benefit from REITs in two distinct ways.

The first is through share price appreciation. Recall that REITs trade like stocks. Their prices can go up and down significantly. If you, for example, bought British Land for 350p in 2020. A year later, the same share fetched 500p. You pocketed a capital gain of about 42 percent (excluding dividends).

Secondly, REIT shareholders benefit from a rise in rental income. This means higher income distribution via dividends.

In practice, REITs are not a one-way street for investors. Companies that pay the rent can – and do – go bust. For example, since 2018 some retail REITs had been slammed by a ‘perfect retail storm’: Covid, a surge in web shopping and work-from-home. This led to a persistent drop in rental income from some REITs property portfolios. As a result, dividends are slashed. A casualty of this retail downturn during Covid was Hammerson.

What to Look For in UK REITs?

Before you invest in any REITs, you need to know a few things specific about them. Not all REITs are equal. Some have more attractive properties and better financial stability.

- What are their properties? The ability to generate rental income is dependent on the quality of property assets, tenant mix, and the sector demand.

- What is the geographical tilt of the REIT?

- Is the REIT trading at a premium or discount to their property value (called Net Asset Value)?

- Is the REIT profitable?

- What is the REIT’s current dividend yield?

Some REITs are only operating in a niche sector or area. Shaftesbury Capital (SHC), for instance, is a REIT focussed mainly in London West End (see below). Some concentrate on Healthcare; others on industrial. Target Healthcare REIT (THRL) is a REIT that focuses on care homes.

Note, too, REITs can actively change its property mix over time through acquisition and disposal.

How to choose which UK REITs to buy?

Once you have done some basic research about REITs, you should then stick with these principles:

- Check property portfolio and the discount/premium to Net Asset Value. Is the discount reasonable?

- Ride with long-term uptrends

- Include stops in all your dealings.

Since you can’t buy every single REIT for your portfolio (unless you use a fund), you have to choose. And you choose according to some favourable yardsticks.

For example, invest in the property sector/area that you know best. Then, choose REITs with prices that are performing the best. If, for example, you buy a REIT that is falling consistently to new 52-week lows, it tells you firmly that the market is bearish on the security. Avoid – unless you know more than what the market is pricing in.

Once you have narrowed down a list of REITs, look at their long-term trends. Buy the ones that are doing well, or have seen a change in their long-term trends. For example, I use the 200-day moving average as a simple yardstick to tell me their long-term trends. If a REIT’s trend is bullish, prices should trade above this trend line. In investing, timing is an important factor. Be consistent with these filters.

Point three is equally important: Property is cyclical. Property prices go up a lot and then correct. The fortune of REITs is cyclical: Boom and bust is a recurring feature of the property market. Using stops to protect yourself is thus immensely helpful. Investing without stop losses is like driving without seat belts.

As a general rule of thumb, REITs must only be part of one’s diversified portfolio. Buying REITs after a cyclical downturn has better risk-reward ratios since many property funds are trading at a substantial discount to their net asset values.

Of course, you may object to the use of price performance as a yardstick. Many prefer Buffett’s: Cheaper the better. Dividends, especially among REITs, are equally important. These days, a few of them are yielding five percent and above. I have no problem with all these arguments. Many investors are extremely knowledgeable about the REITs sector and would be in a position to spot good deals.

The issue is relative cost. Many of these high-yielding REITs saw substantial share price declines since 2020. Compare their performances against that of the US stock market. The difference in returns is too large to ignore.

REIT ETF: iShares UK REIT (IUKP)

If you are not an expert in the REIT sector and still want to gain exposure to the industry, perhaps buying a diversified ETF is a better choice.

In the UK, the largest ETF that invest in REITs is the iShares UK REIT (IUKP). Its benchmark index is the FTSE NAREIT UK Index and the fund has a decent £550 million assets under management in January 2025 (see factsheet here). The portfolio contains 39 REITs, which is diversified enough for any investor. The ETF’s top three holdings are: Segro (19 percent weighting), Land Securities (8.7 percent) and British Land (7.1 percent).

Technically, the ETF is trying to find a floor above 400p right now. The instrument had tested this support a few times. But did not clear the level sufficiently. Adverse UK macro conditions are holding the sector back.

But should UK’s economic outlook improve, a rally from here is possible. But like before, it is a bit premature to say if this will happen anytime soon.

(Alternatively, you may want to look at iShares Global REIT (REET:US))

List of the UK Real Estate Investment Trusts (REITS) on the LSE

The below table compares all the UK REITs on the LSE by name, market cap, price and price change over the last month, 6 months and year. REIT share prices update every 15 minutes.

| UK REIT | Price | Market Cap | P/E Ratio | EPS | 1M % Change |

|---|---|---|---|---|---|

| ABRDN PROPERTY INCOME TRUST LIMITED | 2.3 | £0.01 bn | #N/A | #N/A | 27.78 |

| AEW UK REIT PLC | 110.4 | £0.18 bn | #N/A | #N/A | 2.99 |

| ALINA HOLDINGS PLC | 12 | £0.00 bn | #N/A | #N/A | -11.11 |

| ALTERNATIVE INCOME REIT PLC | 78 | £0.06 bn | #N/A | #N/A | 0.78 |

| ASSURA PLC | #N/A | #N/A | #N/A | #N/A | #N/A |

| BALANCED COMMERCIAL PROPERTY TRUST LIMITED | #N/A | #N/A | #N/A | #N/A | #N/A |

| BIG YELLOW GROUP PLC | 1046 | £2.06 bn | #N/A | #N/A | 1.75 |

| BRITISH LAND COMPANY PLC | 409.8 | £4.10 bn | #N/A | #N/A | -1.35 |

| CAPITAL & REGIONAL PLC | #N/A | #N/A | #N/A | #N/A | #N/A |

| CUSTODIAN PROPERTY INCOME REIT PLC | 87.3 | £0.42 bn | #N/A | #N/A | 2.71 |

| DERWENT LONDON PLC | 1814 | £2.04 bn | #N/A | #N/A | -7.02 |

| EMPIRIC STUDENT PROPERTY PLC | #N/A | #N/A | #N/A | #N/A | #N/A |

| GREAT PORTLAND ESTATES PLC | 347.26 | £1.41 bn | #N/A | #N/A | -6.27 |

| GROUND RENTS INCOME FUND PLC | 18.25 | £0.02 bn | #N/A | #N/A | 4.29 |

| HAMMERSON PLC | 371.4 | £1.97 bn | #N/A | #N/A | 3.57 |

| HELICAL PLC | 206 | £0.25 bn | #N/A | #N/A | 5.21 |

| HIGHCROFT INVESTMENTS PLC | #N/A | #N/A | #N/A | #N/A | #N/A |

| HOME REIT PLC | 9.1 | £0.07 bn | #N/A | #N/A | #N/A |

| IMPACT HEALTHCARE REIT PLC | #N/A | #N/A | #N/A | #N/A | #N/A |

| KCR RESIDENTIAL REIT PLC | 12 | £0.00 bn | #N/A | #N/A | 17.07 |

| LAND SECURITIES GROUP PLC | 632.5 | £4.71 bn | #N/A | #N/A | -3.21 |

| LIFE SCIENCE REIT PLC | 42.5 | £0.15 bn | #N/A | #N/A | -0.70 |

| LONDONMETRIC PROPERTY PLC | 216 | £5.06 bn | #N/A | #N/A | 6.82 |

| LXI REIT PLC | #N/A | #N/A | #N/A | #N/A | #N/A |

| NEWRIVER REIT PLC | 81.45 | £0.35 bn | #N/A | #N/A | 12.34 |

| PALACE CAPITAL PLC | 216 | £0.04 bn | #N/A | #N/A | -0.46 |

| PICTON PROPERTY INCOME LD | 87 | £0.45 bn | #N/A | #N/A | 4.69 |

| PRIMARY HEALTH PROPERTIES PLC | 108.6 | £2.82 bn | #N/A | #N/A | 4.12 |

| PRS REIT (THE) PLC | #N/A | #N/A | #N/A | #N/A | #N/A |

| REAL ESTATE INVESTORS PLC | 31.4 | £0.05 bn | #N/A | #N/A | -1.26 |

| REGIONAL REIT LIMITED | 99.1 | £0.16 bn | #N/A | #N/A | -2.27 |

| RESIDENTIAL SECURE INCOME PLC | 56 | £0.10 bn | #N/A | #N/A | 0.00 |

| SAFESTORE HOLDINGS PLC | 801.5 | £1.75 bn | #N/A | #N/A | -2.73 |

| SCHRODER EUROPEAN REAL ESTATE INVESTMENT TRUST PLC | 63.6 | £0.08 bn | #N/A | #N/A | 1.27 |

| SCHRODER REAL ESTATE INVESTMENT TRUST LIMITED | 56.2 | £0.27 bn | #N/A | #N/A | 0.90 |

| SEGRO PLC | 840.4 | £11.37 bn | #N/A | #N/A | 9.86 |

| SHAFTESBURY CAPITAL PLC | 154.8 | £3.02 bn | #N/A | #N/A | 7.50 |

| SIRIUS REAL ESTATE LD | 111.89 | £1.79 bn | #N/A | #N/A | 10.35 |

| SUPERMARKET INCOME REIT PLC | 88.57 | £1.10 bn | #N/A | #N/A | 5.82 |

| TARGET HEALTHCARE REIT PLC | 106.8 | £0.66 bn | #N/A | #N/A | 2.10 |

| TOWN CENTRE SECURITIES PLC | 124 | £0.05 bn | #N/A | #N/A | 2.06 |

| TRIPLE POINT SOCIAL HOUSING REIT PLC | 77.1 | £0.30 bn | #N/A | #N/A | 5.04 |

| TRITAX BIG BOX REIT PLC | 170.5 | £4.61 bn | #N/A | #N/A | 3.46 |

| UK COMMERCIAL PROPERTY REIT LIMITED | #N/A | #N/A | #N/A | #N/A | #N/A |

| UNITE GROUP PLC | 508 | £2.75 bn | #N/A | #N/A | -11.27 |

| URBAN LOGISTICS REIT PLC | #N/A | #N/A | #N/A | #N/A | #N/A |

| WAREHOUSE REIT PLC | #N/A | #N/A | #N/A | #N/A | #N/A |

| WORKSPACE GROUP PLC | 430 | £0.83 bn | #N/A | #N/A | 2.02 |

Recommended Brokers For REIT Investing

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.