The pound-to-New Zealand Dollar forecast is an indication of where technical and fundamental analysts think the GBPNZD price may be in the future. You can use these exchange rate forecasts to help you decide if now is the right time to buy the New Zealand Dollars, or if you should wait until the price improves.

| GBPNZD Price | 1 Day Change | 1 Week Change | 1 Month Change | 1 Year Change |

| 2.2565 | -0.15% | -0.15% | -1.49% | 1.43% |

👉If you have a large upcoming Euro money transfer, we can recommend Currencies Direct as a secure FCA-regulated currency broker that can offer bank-beating exchange rates. Get a quote now.

GBPNZD Highlights

- GBPNZD checks and reverse its near-term uptrend

- Reserve Bank of NZ in accommodative monetary cycle due to slowing economy

- Rate may move sideways as UK’s relative outperformance dwindles; near-term support at 2.150

How has the Pound performed against the New Zealand Dollar recently?

Sterling got off the 2025 in a wobbly manner. The catalyst for the unexpected Sterling sell-off was the sudden spike in gilt yields.

Most investors, by now, would have seen the downbeat news on Sterling. Lower growth outlook drove investors to demand more compensation for holding UK gilts. As gilt yields surged, GBP slumped. Risk aversion jumps. So a vicious cycle – aka ‘doom loop’ – is in play.

For the past 5-7 trading sessions, GBP has been locked in a firm downtrend against most major currencies. GBPUSD sank to 1.210 earlier this week.

As you see from GBPNZD’s chart below, the rate corrected sharply from its multi-year highs near 2.240 to 2.17. In doing so, the rate is testing the well-entrenched uptrend, as delineated by the long-term upward sloping trendline (see below).

Optimists would argue GBPNZD’s uptrend is not yet broken. That’s true. The pattern of higher highs and lower highs remain intact. In fact, the current correction is vaguely similar to the one that occurred back in September 2023, where prices returned to the mean after a period of sustained rally.

As long the rate stays above the prior reaction lower at 2.14-2.15, this sanguine view remains ho hold. Short-term support is noted at 2.150.

Is it a good time to buy the New Zealand Dollar with pounds?

The past few weeks saw Sterling weakened sharply against the New Zealand Dollar.

If you do need the currency now, you may wish to exchange some NZDs with GBP, especially on a rebound back above 2.180. There is some resistance at 2.200, which may limit GBP’s advance.

Of course you may wait further to achieve a better rate. There is supported noted at 2.15. But whether this area will hold back GBP’s decline is an open question.

Will the pound get stronger against the NZD in 2025?

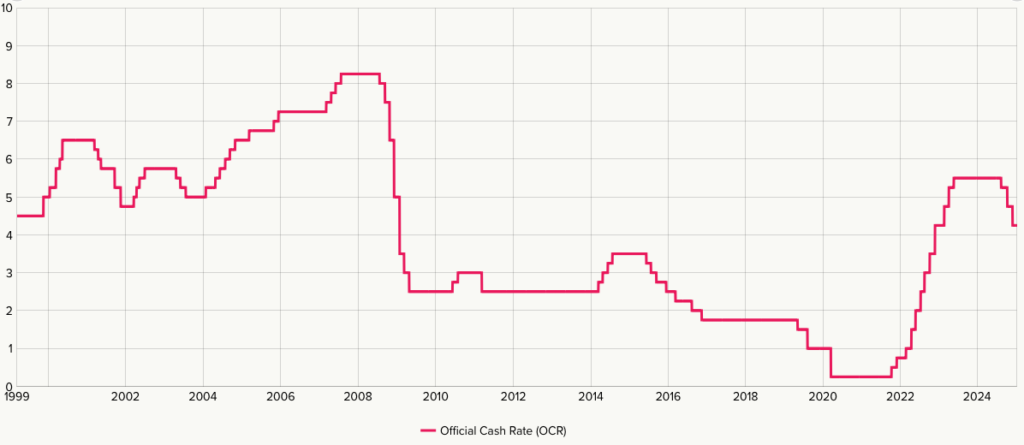

The Reserve Bank of New Zealand is in a rate-cutting cycle. Since our last update last year, the central bank has slashed the policy rate – Official Cash Rate – in November by another 50bps to 4.25 percent (see below).

Why was there a sudden impetus to lower borrowing costs? One reason is the falling inflation rate in the country. The official inflation rate, measured last October, is now at a reasonable 2.2 percent. The other reason is a slowing economy.

In its November monetary update, the New Zealand central bank noted three specific points about the state of local economy:

- “Domestic economic activity remains below trend”

- “Considerable spare productive capacity remains in the economy”

- “Unemployment is expected to continue rising in the near term”

In summary, the New Zealand economy is very sluggish. Weak external demand and high borrowing costs are hitting the corporate and household sectors. If no stimulus action is taken soon, a recession may emerge. That’s why GBPNZD has continued to rise (in favour of GBP) in the last quarter of 2024 despite a darkening outlook in the UK.

What now? With the UK economy also struggling, the case for buying GBP over NZD has weakened. The negative reaction we are seeing in the exchange rate (dropping into 2.17) is the result of this opinion shift.

But if both economies are enduring bumpy rides, then investors have to compare which economy is faring worse. In that, I suspect the market has not made up its mind – yet.

GBPNZD may still be able to resuscitate the uptrend if day-to-day macro dataflow support this. If not, watch for sideways choppy action in the first quarter of this year.

Source: Reserve Bank of New Zealand (Nov 24)

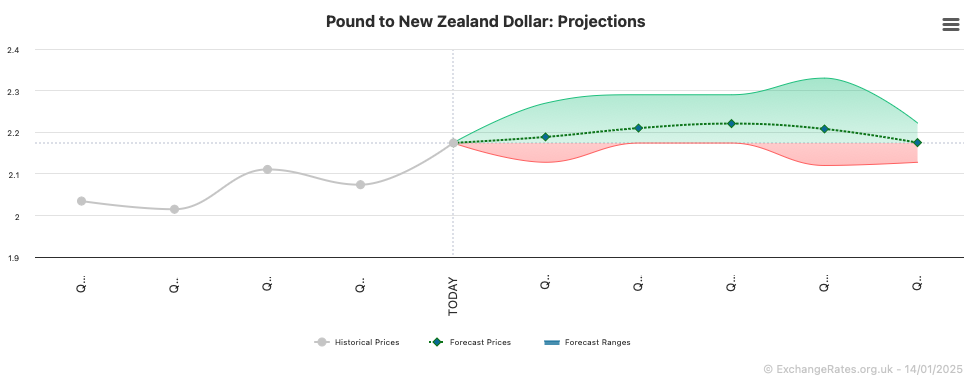

What is the GBPNZD forecast in weeks, months, and years?

The market consensus for the GBPNZD is that it will continue to strengthen. Few brokers are expecting the rate to conquer the 2.10 support in the new few quarters (see below).

The question is, are brokers too sanguine about the developing fiscal situation in the UK? Financial market is a fast-moving beast. New macro catalyst may jolt the rate – up or down – out of the blue and create new trends.

Therefore, while I expect the GBPNZD uptrend to stay for a little while longer, I need price validation to confirm if the trend will reassert.

Source: poundsterlinglive.com (Jan 2025)

Where is the best place for buying large amounts of New Zealand Dollars from Pounds

There are two different ways people buy NZD from Pounds

- Through a currency broker like Currencies Direct, OFX or Global Reach– when transferring money abroad

- Through a forex broker like CMC Markets, City Index or IG – when speculating on the price of currency

You can use our comparison table of currency brokers to see how many currencies they offer, what the minimum NZD transfer is and if they offer forwards and currency options as well as when they were established. You can either visit each currency broker individually or use our currency quote comparison tool to request multiple exchange rates.

Or, if you are more interested in trading GBPNZD, you can compare forex brokers here.

What is the live GBPNZD exchange rate?

The current GBPNZD exchange rate is 2.2565 which is a change of -0.15% from the previous days closing price. Over a week GBPNZD is -0.15%, compared to it’s change over a month of -1.49% and one year of 1.43%.

GBPNZD exchange rate data is updated every 15 minutes.

Other Forecasts:

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.