Coinbase Customer Reviews

Losing money to a scammer was one of the most challenging experiences of my life. I was skeptical about ever recovering it until I came across Alpha Recovery firm. Their team was professional, supportive, and transparent from the very beginning. They guided me through the process step by step, answering all my questions and keeping me informed at every stage. What impressed me the most was their persistence and expertise in handling my case. Against all odds, they successfully recovered my funds, something I never thought possible. I wholeheartedly recommend their services. They truly deliver on their promises. You can easily reach their team email via alpharecoveryfirm@gmail.com Or their support team WhatsApp number +1 (912) 802‑9426……. The verification link provided by the QR code just goes to a 404 page not found leaving me in limbo. The current catch 22 situation is the last straw for me with the supposed telephone contact just routing me back to the website where, as I can’t log in I am unable to access any chat support. I removed the bulk of my funds from this platform ages ago because of the ridiculous obstacles in place that make me repeatedly verify my identity, I am not going to try going through the process any more and I just want the last remaining funds which I believe is only around £50 in value to be sent to my bank in cash and close the account. A well trusted crypto provider that seems to be fair and transparent.Tell us what you think of this provider.

best recovery firm

Appalling customer service repeatedly locks acco6

Coin base

Coinbase Expert Review

Coinbase Expert Review: Safety in numbers of a listed crypto exchange

Provider: Coinbase

Verdict: Coinbase is a cryptocurrency exchange that lets you buy and sell various cryptocurrencies like Bitcoin, Ethereum, Cardano and Solana. Coinbase was listed on the NASDAQ exchange in 2012 and claims to have over 273 billion assets on account in over 100 countries and process $185 billion in quarterly volume.

Is Coinbase good for Crypto investing?

Coinbase is one of the largest cryptocurrency exchanges with over 100 million users and is publically listed on the NASDAQ exchange (COIN). It offers access to large selection of cryptocurrencies that can be traded on it’s crypto exchange or withdrawn to a cryptocurrency wallet.

Coinbase is a little more sophisticated than eToro. Yet it’s still easy to use thanks to its clean interface.

And there is a wide range of crypto-assets available to investors. As with eToro, you can invest in Bitcoin, Ethereum, Cardano, and many other digital assets.

On the downside, Coinbase has a slightly more complex fee structure. When buying or selling crypto, the cost of the trade is calculated at the time you place your order and is determined by several factors including your location, the size of the order, the selected form of payment, and market conditions such as volatility and liquidity.

Overall though, the platform is quite well suited to beginners. It’s worth noting that earlier this month, Coinbase won approval from the UK’s FCA as a registered virtual asset service provider (VASP).

Pricing: It’s expensive, when Iwas testing the app I bought some Bitcoin to test the app, I was charged over 3% in commission, that’s far more than eToro who at the moment only charge 1%. But having said that, I did double my money as Bitcoin had a bit of a rally after my original review, so it’s not all bad, if it goes up that is…

Market Access: Coinbase offers the most cryptocurrencies compared to other exchanges, which makes them a great venue if you are interested in spreading your risk or looking for more volatile cryptos with a higher risk/reward ratio.

App & Online Platform: No complaints here, just does what it’s supposed to. No stand out features or research though.

Customer Service: Pretty good. I had a question, they answered it. Sorted.

Research & Analysis: No research on the app, but then again, brokers only provide research to get people interested in markets and I don’t think I’ve had a conversion about money in the last 12 months that hasn’t included crypto in some way so no stimulus needed.

One thing I do like about Coinbase though is that it’s a US company listed on the NASDAQ so in theory, if there are any problems with it that should be reflected in the share price.

The test: Why should investors be more cautious when investing in crypto assets with Coinbase

I knew I should have sold when Bitcoin reached $100,000! When I reviewed Coinbase back in July last year, I some bought Bitcoin and Ethereum to test the app, and then forgot all about it. As Bitcoin has reached record highs, it jogged my memory and I was delighted to see when I logged back in that it’s now worth double. But I still think cryptocurrency is an imaginary asset and should be treated with extreme suspicion, here’s why.

I don’t really like crypto as an investment, I think it’s daft. Yes, there is money to be made from crypto, but not necessarily if you are investing in it. Yes, some will make huge amounts from exchanges like Coinbase, and they will be the most vocal about the merits of digital currencies as an asset class. But no, not everyone or even the majority will make money.

However, it it fairly undeniable that Bitcoin is now mainstream and that as major funds start buying it and it becomes easier to trade on regulated stock exchanges it does have a place in most people’s portfolios.

But it’s the hype that is driving crypto prices, rather than the use case. The young though are taking massive risks and dangerously putting all their eggs in one baskets. And most worryingly being heavily influenced by people ramping crypto prices and coins on social media.

The mentality of following the herd is not new, two decades ago when I first started out as a stockbroker it was mining and oil stocks. Companies would raise money on the stock market from people buying new shares to drill a hole in the ground. If they struck gold or “black gold” the share price would go through the roof, but if they didn’t it would be worthless.

Then it was tech stocks, same story, The City filled their boots as it wasn’t really about what the company was worth or even if they made any money, it was about how many people were buying them, and what the perceived future value could be.

Then carbon credits, which although a real thing, crooks in call-centres in Spain basically made up to cold-call and pressure sell investors into buying them on the basis they would be worth more in the future. All very Wolf of Wall Street, it wasn’t even stuffing people into an investment for high commissions it was just lying and stealing money.

- Worried a crypto coin is a scam? Check out our list of the biggest crypto shitcoin disasters.

Next came binary options, which I actually quite liked as they were a form of limited risk short-term bet on the movement of a market. In theory, the perfect way to day trade. The market is either going to do one of two things during the day, go up or go down, so you just placed a bet on what you thought was going to happen and your risk was capped based on your stake. This I felt was slightly safer than CFDs and spread betting because with those your potential losses are unlimited (or were at the time before negative balance protection and leverage caps). Plus one of the major mistakes that traders make is not cutting their losses (another is banking profits too soon).

But the problem with binary options wasn’t the product it was the fact that they were not regulated by the FCA. Reputable firms in the UK did offer them in a regulated environment to their customers, but, then, the carbon credit scammers moved on to binary options, and set up basic platforms without hedging any underlying risk and stuffed punters full of welcome bonuses and “trade ideas”, again just lying and stealing.

So, now that binary options have been banned, where have the scammers gone? Crypto, that’s right. But then, the FCA’s in their ultimate wisdom, decided to ban retail traders in the UK from trading through spread bets and CFDs. Now clearly in some respects, this was a good thing because trading a product on leverage which has price moves of 50% a day is clearly very high-risk and will almost definitely result in high financial losses for the majority of people that trade them. But what happened, was that because the FCA didn’t want to take responsibility for regulating crypto, it was binary options scams all over again. Honestly and with no hyperbole, I have just received a call on my mobile whilst writing this review from a Germany number asking me “how my investments are performing and if I’d heard of crypto”. I get these at least twice a day. I don’t even bother answering my phone anymore.

But, if there is a market, people are going to want to trade it and you just have to look at any analytics to see that crypto is what people want to invest in and trade.

As it becomes a more regulated financial asset, it will become safer to buy and hold, but not nesseicarly as an investement.

The FCA is taking steps to regulate providers to ensure that customers are treated fairly, but you still don’t get FSCA protection.

If you want to buy cryptocurrency you have two options really, you could go with a provider like eToro or Revolut, who are regulated by the FCA for other products or you can go with one of the massive VC backed crypto exchanges.

I used Coinbase, but it isn’t the cheapest though as when I did some test trades the fees were 3.84% for buying Bitcoin and Ethereum compared to eToro’s 1% and Revolut’s 2.5%. Coinbase does offers the most cryptocurrencies to trade though, 150 versus 120 and 30 respectively. Coinbase is at least a public company so you can keep an eye on their finances to see how likely it is they are going to go bust. Coinbase is currently traded on the NASDAQ and at the time of writing worth $14bn, (although the share price is down 85% since they IPO’d in April 2012). eToro and Revolut are still private companies (not for the want of trying to IPO mind).

I’ve traded crypto as a derivative before it was banned (although you can still trade crypto with a professional account), I’ve traded $50m clips of FX, worked £10m positions when trading stock CFDs, but oddly enough, I felt more nervous when depositing £500 into Coinbase to buy some Bitcoin for that review. I even used my secondary bank account, because I did’t want the transaction on my main personal account, just in-case when we came to re-mortgage “the computer says no” because they viewed me as some sort of crypto bro.

I’m still not sure about crypto, but this shouldn’t really be about crypto it’s about Coinbase, after all they are just giving people what they want. They are not forcing anyone to buy crypto (Twitter, Youtube and Instagram do that), they are just making it easy. And it is easy, it’s an incredible piece of tech, like Betfair was to gambling and what the LSE was to share trading, if you want to trade it you can.

But it’s still in it’s infancy as a regulated product and so as an “investor” you are not protected if anything goes wrong. Coinbase say they provide FDIC insurance if someone hacks them and nicks your crypto (up to $250k), but this doesn’t cover you if you get hacked, or Coinbase goes bust.

Unlike buying stocks in the UK where you are covered by the FSCS and shares and investments are held in nominee accounts in a very well-established and highly-regulated banking infrastructure. In the immortal words of Mark Corrigan,

There are systems for a reason in this world, economic stability, interest rates, growth, it’s not all a conspiracy to keep you in little boxes all right.

If you want to have a punt on crypto, you pays your money, you takes your chances, caveat emptor.

Pros

- Wide range of cryptocurrencies

- Publically listed company

- Exchange and withdrawals

Cons

- Very high-risk investment types

- You can lose all your money

- Cryptocurrency still unregulated

-

Pricing

(4)

-

Market Access

(5)

-

App & Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.4

Coinbase launches in-app FSCS-protected savings account paying 3.50% AER

Coinbase has launched a new instant access savings account for UK customers, allowing users to earn 3.50% AER on uninvested cash held within the Coinbase app. The new savings feature is powered by ClearBank and is available to eligible UK customers from January 2026. The account sits alongside a customer’s existing GBP balance on Coinbase

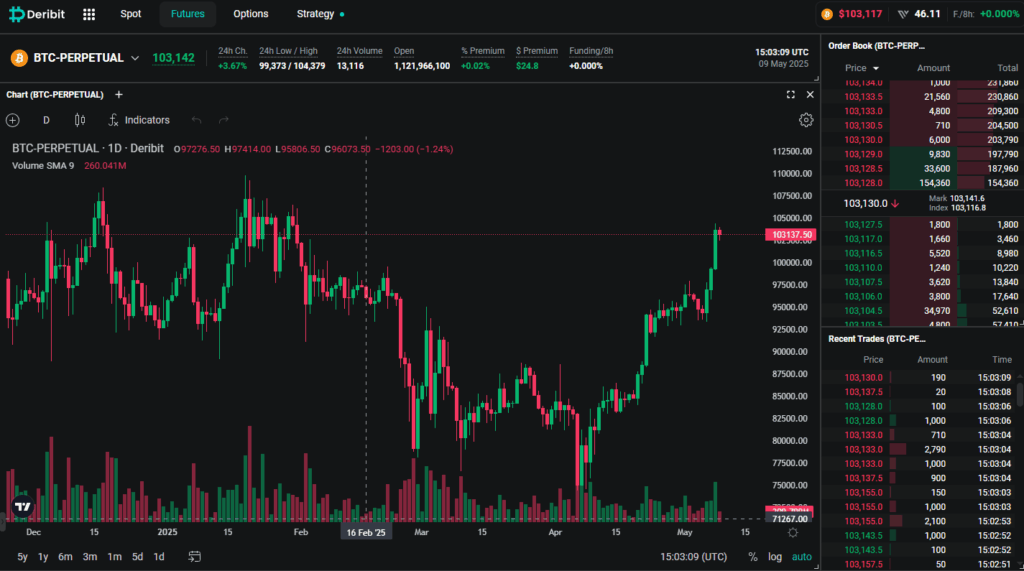

Coinbase spends US $2.90 billion on Crypto options platform Deribit

Coinbase Global has announced the $2.9 billion acquisition of crypto options exchange Deribit. A deal which could signal a watershed moment for cryptocurrency markets. This deal represents Coinbase’s most aggressive move yet into the Crypto derivatives sector, which has long been dominated by offshore exchanges. Through the acquisition of Deribit—which processed an impressive $1.20 trillion

Coinbase gets direct approval for UK crypto exchange from FCA

The Financial Conduct Authority (FCA) has authorised Coinbase to directly offer crypto-related services to customers, with the US crypto exchange successfully registering as a Virtual Asset Service Provider (VASP). According to Coinbase, the regulator’s green light makes it the among the largest legitimate cryptoasset businesses in the UK. The firm previously offered its exchange services

Coinbase’s Apple Pay integration is another green light for crypto as Bitcoin tops $100,000

Coinbase has enabled Apple Pay, allowing for immediate conversions between fiat currencies such as dollars and pounds and crypto currencies. The new feature is accessible through Coinbase Onramp, which facilitates fiat payments for eligible users of the Coinbase app. In a statement announcing the update on 2 December, Coinbase said it would make for “a

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.