Bitcoin is the first and most valuable cryptocurrency, created in 2009. It’s widely used as a decentralised digital currency and store of value, secured by proof-of-work mining and scarcity.

| Name | Logo | GMG Rating | Customer Reviews | Cryptos | Commission | CTA | Feature | Expand | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews 3.3

(Based on 3 reviews)

|

Cryptos 150 |

Commission 3.5% |

Features:

|

Buying crypto with Coinbase A fourth option for those in the UK is Coinbase. It’s one of the world’s largest crypto exchanges, I bought some Bitconi on it ages ago and thankfully forgot about it because it’s done ok, you can read about it in my Coinbase review Coinbase review here).

I’ll be honest I didn’t think it would, and I have no idea where Bitcoin will go from here. There is a very basic broswers based portal and app, and also an advanced platform (just click the toggle in the bottom left) which sould be considered a little more sophisticated/complex than the other platforms I’ve highlighted above. Yet buying Bitcoin is still relatively straightforward. To buy Bitcoin via Coinbase, you’ll need to sign up for an account and then fund the account.

You then search for Bitcoin (either on the app or desktop platform) and enter your trade details.

Compared to eToro and Revolut, Coinbase has a more complex fee structure. For example, if I were to sell my Bitcoin, it would cost £7.50 in flat fees on the app, but if you’re trading on the advanced platform, you can pay as little as 0.00% as a maker and 0.005% as a taker.

When buying Bitcoin on Coinbase, the cost of the trade is calculated at the time you place your order and is determined by a range of factors, including your location, the selected payment, the size of the order, and market conditions such as volatility and liquidity (fees will be listed in the trade preview screen before you submit your transaction). |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 4.5

(Based on 1,330 reviews)

|

Cryptos 8 |

Commission 0.12% to 0.18% |

Features:

|

Interactive Brokers Cryptocurrency Trading Expert Review Account: IBKR Crypto Trading Description: Interactive Brokers, offers cryptocurrency trading for its UK clients through Paxos that allows individuals, institutional investors, and financial advisers, to trade popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH). This is in addition to other more traditional investment products, such as stocks, options, futures, currencies, bonds, funds, and ETFs. All from a single unified platform. Is Interactive Brokers Good For Crypto Trading? Interactive Brokers has partnered with the Paxos Trust Company, a New York-based regulated trust company and custodian with expertise in digital assets, securities and payments, to provide cryptocurrency brokerage. Interactive Brokers’ UK clients will have a unified view of their IBKR securities brokerage account and their crypto account at PaxosTrust Company. This means clients will be able to manage their cash, trade cryptocurrencies, and invest in other asset classes, all from a single trading screen. Gerald Perez, Chief Executive Officer at Interactive Brokers (U.K.) Limited said of the new service: “Interactive Brokers offers a wide selection of global investment products, sophisticated technology and competitive pricing,” He added “Introducing cryptocurrency trading gives UK clients enhanced flexibility to invest across markets and asset classes while also adding exposure to digital assets.” Platforms for newbies and pros There are two types of crypto account for UK traders on Interactive Brokers Basic Crypto lets you trade and hold Bitcoin, Bitcoin Cash, Ethereum, and Litecoin through the IBKR platform. There are no additional or separate funding transactions are required and IBKR handles all required cashiering for you automatically, and unvested cash is always kept in your IBKR brokerage account. Crypto Plus lets you fund your crypto account, trade using non-marketable limit orders, and enjoy 24/7 trading. You will be able to hold USD in addition to cryptocurrencies in a dedicated Paxos account with access to 24/7 trading and place non-marketable buy limit orders. With Crypto Plus, all trading of crypto will require prefunding of your dedicated Paxos account and you will be responsible for managing all fund movement between your IBKR brokerage account and your Paxos crypto account. You can also trade crypto immediately when you transfer funds to your dedicated Paxos account during normal US banking hours. I opted for Basic Crypto so my cash would stay with IBKR rather than a third party, as I prefer to know who I’m dealing with. To enable crypto investing permissions on IBKR you have to complete a fairly basic questionnaire to prove that you understand the risks involved, which only takes a few minutes. You also have to prove that you are a sophisticated or professional investor. And then, just to be double careful, you’re not getting a severe case of FOMO, you have to wait 24 hours before you are able to buy cryptocurrencies on Interactive Broker (this is a regulatory requirement introduced by the FCA in 2023).

Overall, Interactive Brokers continues to be one of the cheapest places to trade anything. You can see in the below cost comparison below Coinbase and eToro execution costs are very low.

There are several benefits to trading crypto on IBKR: Consolidated platform: Clients can access a wide range of global investment products, including cryptocurrencies, on a single sophisticated trading platform, eliminating the need for multiple platforms. Competitive pricing: Cryptocurrency commissions are low at 0.12% – 0.18% of trade value, depending on monthly volume, with a minimum of $1.75 per order. There are no added spreads, markups, or custody fees. Currency conversion: Clients can convert GBP or other currencies to USD (the denomination for cryptocurrencies on the platform) at tight spreads as low as 1/10 of a PIP. Efficient portfolio management: Financial advisers can easily allocate a percentage of client assets to cryptocurrencies and manage their clients’ portfolios more efficiently. However, it’s important to note that cryptocurrency is still a very high-risk investment and even tough the costs of trading are lower, there is a high possibility that crypto could become worthless. Interactive Brokers (U.K.) Limited is registered with the Financial Conduct Authority as a crypto assets firm under the relevant regulations. Pros

Cons

Overall4.8 |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 3.3

(Based on 7 reviews)

|

Cryptos 400 |

Commission 0% |

Features:

|

Crypto.com UK Review 2025: Low Trading Fees and GBP Cryptocurrency Trading Provider: Crypto.com Verdict: Crypto.com offers a broad crypto trading experience with competitive maker-taker fees and a wide GBP market selection, avoiding FX charges. The app is easy to use with limit orders and curated baskets like Blue Chip Tokens for diversification. However, customer support is largely automated, research tools are limited, and fees rise quickly after free deposits. Summary Pricing – There is a 2.99% fee for using a credit or debit card to deposit funds which is quite steep. You can use Open Banking but only with ClearBank and BCB. There is also a withdrawal fee of £1.90 with a minimum amount of £70. A maker-taker model applies so if you are providing liquidity through limit orders your rates will be lower than if you are dealing at market. Crypto commission rates typically start from 0.25% to 0.08% for makers and 0.5% to 0.18% for takers. If you join the Level Up program, and pay a monthly subscription you can get these trading fees reduced and earn 1.5% cash on deposit too, but rates are higher than that in the bank. Market Access – You can trade around 150 cryptocurrencies in GBP, which is great because you don’t get stung with USD FX charges where you are required to convert GBP into USD. You can also trade crypto baskets, which is a collection of cryptocoins all lumped into one. For this review, I bought £100 worth of the Blue Chip ETF Tokens baskets, which is mainly Bitcoin with a few others added in like Ethereum, Solana, Cronos and Ripple. Mainly because I like diversification, and I’m only buying crypto for the sentiment value and that basket was the best performing over a year, and judging from the charts on Crypto.com seems to consistently outperform Bitcoin over 3 months, 6 months and a year. You can also set the basket to rebalance to keep the ratios right.

App & Platform – Crypto.com’s website is simple to use, almost too simple if I’m honest, I’d like to see more bid/offer spreads on the pricing pages. The Crypto.com app is better as you can work limit orders (as opposed to just market, so it’s cheaper). Customer Service – As far as I found the support is mainly a bot, which did answer my questions quickly. When I asked the customer service bot about this it couldn’t quite understand the question. There is no telephone number, which is not surprising for a crypto exchange. Research & Analysis – On the crypto.com app there is an “Insights” tab, which is not available on the website, which gives you crypto news as well as signals. Where you can trade from the feed, however, I’d take those with a pinch of salt and do your own research before deciding what to buy and sell. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Pros

Cons

Overall4.2 |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 0.0

(Based on 0 reviews)

|

Cryptos 600+ |

Commission 0.99% |

Features:

|

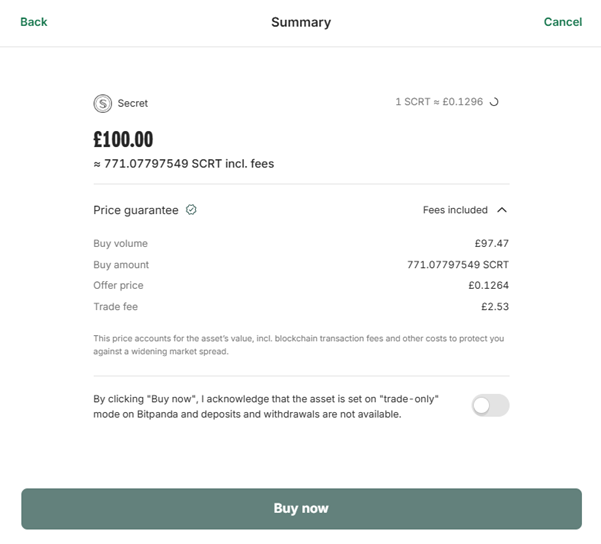

Bitpanda Review 2026: Is It Safe and Worth Using in the UK? Provider: Bitpanda Verdict: Bitpanda is a European investment platform founded in 2014 in Vienna, Austria. Originally built as a simple way to buy Bitcoin, in Europe it has expanded to offer trading in cryptocurrencies, ETFs, stocks, precious metals, and commodities. The company is privately owned, with founders Eric Demuth, Paul Klanschek, and Christian Trummer still actively involved. Bitpanda now claims several million users across Europe. Is Bitpanda any good? In this expert review we put Bitpanda to the test with real money and buy some crypto from the UK to find out if Bitpanda is any good. Pricing I was able to deposit GBP free via debit card which makes it cheap to get started (compared to other UK crypto platforms that are currently charging 2.9% on debit card deposit). When buying actually cryptocurrency, I was charged £2.52 when I bought £100 worth of crypto for this review so you can assume the commission rates are 2.53%, but Bitpanda say their fees range from 0.99% to 2.49% – so assume the smaller (less liquid) the cryptocurrency the higher the fees will be. Bitcoin for example should be 0.99%.

Market Access Bitpanda offer one of the widest ranges of cryptocurrencies with over 600 assets available on the platform. There is also a good selection of digital assets for staking and earning rewards of up to 29.82%, but when I checked the highest paying one, Coreum, it was unavailable for staking. The second highest was Secret, paying 13.28% so I bought £100 worth and staked all of it. As with all crypto, I fully accept that I may lose all my money, but it might, just might pay off in the future so I’m always happy to risk some fun money on it. App & Online Platform Simple to use for beginners, but for larger traders not having access to level-2 pricing from a crypto exchanges means you can’t check liquidity. But if you are just buying some crypto to tuck it away and see what happens, it’s straightforward. However, it did take a few moments for my funds to be allocated to my account before I could buy some crypto. It kept saying “Fiat wallet could not be found”. Customer Service When I went to the my account tab to try to find my Fiat Wallet, the Contact Support link was greyed out. But when I managed to copy and paste “Fiat wallet could not be found” there was an article, but it didn’t really help. It just told me the steps I’d been through. No phone support, but I was able to submit a ticket to help resolve the issue. The system had auto resolved it before I got a response though. Research & Analysis There are some educational guides on the main website. But, Bitpanda does not have any news flow or analysis on the site, and for altcoins like Secret, there are no descriptions of what it does other than the risk warning. I’d like to see more information in the “About” section. Can Bitpanda Be Trusted? Bitpanda is generally considered a trustworthy and reputable platform within Europe. You can cash out to your bank easily (withdrawals to SEPA accounts typically take 1-3 business days), although some UK users report longer times due to banking friction. Bitpanda offers zero deposit and withdrawal fees on all payment methods. Bitpanda is not a “get-rich-quick” crypto app, rather, it’s a balanced investing platform offering crypto, stocks, ETFs, and commodities within a regulated environment. Is Bitpanda Available in the UK? Yes, Bitpanda is available in the UK, but with some limitations. You can open an account, deposit GBP, and buy assets. However, some crypto-related services (like derivatives) are unavailable.. Bitpanda supports GBP and EUR deposits via bank transfer, debit card, and SEPA. UK users can also pay with Visa or Mastercard, though fees vary depending on method. While most UK banks now allow crypto transactions, some (e.g. HSBC and Nationwide) still block payments to certain platforms. Bitpanda, however, usually works fine with major banks like Barclays and Monzo. I had no problems depositing funds from the Natwest Mastercard (debit card). Bitpanda is a legitimate alternative for UK users who want a wide range of digital assets. Is Bitpanda Regulated in the UK? No, in the UK Bitpanda is registered (not Regulated) by the FCA to provide cryptoasset services. Ffunds are not protected by the FSCS and you will not have access to the financial ombudsman service if anything goes wrong. You can check on Bitpanda’s status in the UK here: https://register.fca.org.uk/s/firm?id=0014G00002UyCuqQAF Bitcoin and crypto are not illegal in the UK, and holding or trading them on Bitpanda is perfectly lawful, though users should understand that cryptoassets remain largely unregulated and high-risk. Who Owns Bitpanda? Bitpanda remains a privately held company co-founded by Eric Demuth (CEO), Paul Klanschek, and Christian Trummer. It has raised significant funding from investors including Valar Ventures (backed by Peter Thiel), positioning it among Europe’s fintech unicorns. In the UK, Bitpanda makes money through trading spreads and fees and its savings plans and staking services. Pros

Cons

Overall4.2 |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 1.0

(Based on 1 reviews)

|

Cryptos 395 |

Commission 0.02% – 0.04% |

Features:

|

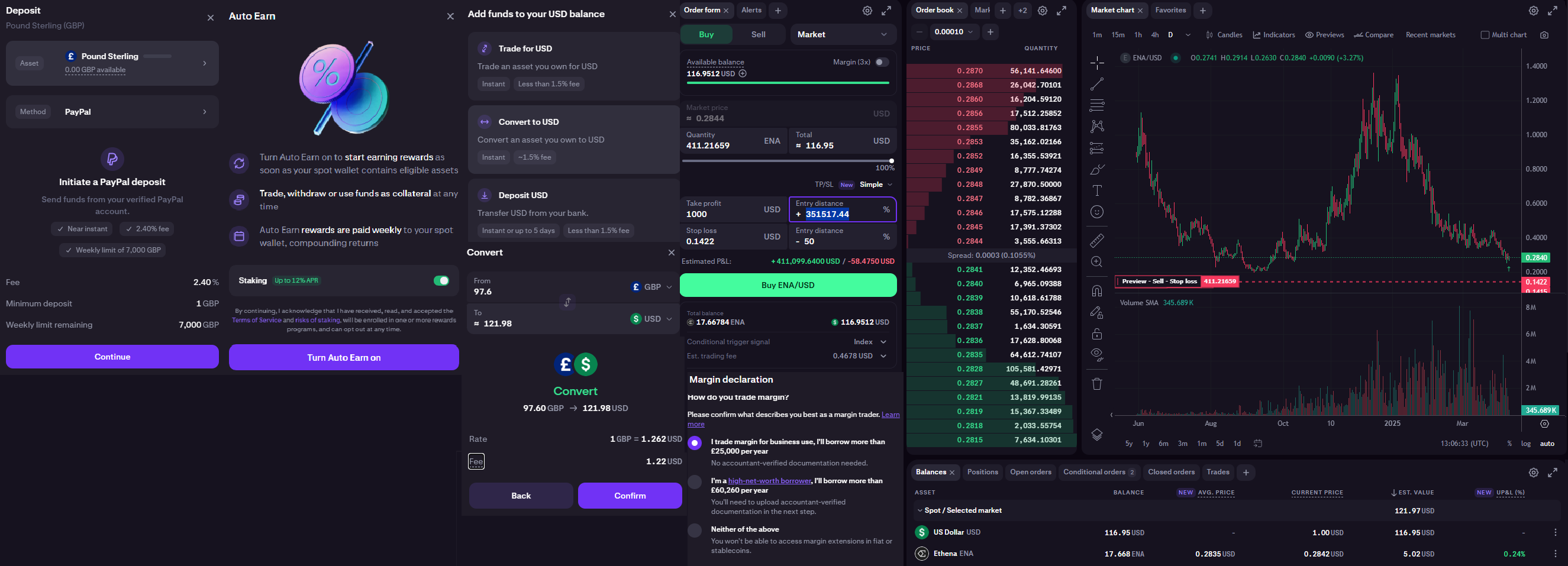

Kraken Pro Expert Review: TikTok Testing & Trading Provider: Kraken Verdict: Kraken is one of the world’s largest cryptocurrency firms and recently launched a “Kraken Pro” platform. When you’ve signed up to Kraken, you can access Kraken Pro with no extra charges. The new Kraken Pro trading platform brings all of the firm’s services together in one place. It is designed to be accessible to all traders, be they retail, professional or even institutional clients. Is Kraken Good for Cryptocurrency? The Test: For now, this is a quickfire test of just the Kraken Pro platform because I have spent all day testing crypto platforms and I’m knackered.. I think my bank would be a little concerned if I used my account for any more crypto deposits today, so I’m funding my Kraken Pro account via PayPal, which comes with a 2.4% fee, but that’s OK because I’m only putting in £100. You’ll see why in a minute. If you are depositing more, it would be sensible to use Plaid Open Banking, because it’s cheaper. I opened my Kraken account years ago, so I didn’t have to wait for the 24-hour cooling off period. Whilst I waited for my funds to be processed, I turned on the Auto Earn options. This means that whatever eligible crypto I own, I can stake it automatically (and also use it as collateral) and earn rewards of up to 12%, which are paid weekly. If I’m honest, I’m unconvinced by the whole “crypto as an investable asset class” idea because I think crypto is mainly driven by sentiment. But that doesn’t mean there is opportunity. So when deciding what cryptocurrency to buy on Kraken (there are over 300 of them) I turned to the most rampant ramping source possible, TikTok. I Googled how to search for the most popular cryptos on TikTok and the first video was of a teenager very convincingly talking about the best cryptos to buy during a market crash. I decided to follow his first tip – Ethena. He was going through his “top picks” with “massive discounts right now” but didn’t say what discount it was or even what the fiat value should be. But as he has 1.2 million followers I assumed that some other people may be listening to him and also buying the same coins. Which would mean that sentiment may drive them up. The first one he mentioned was Ethena at an apparent 73% discount. Which looked like it had been ramped towards the end of 2024 but was now trading on what technical analysts would call “support” although I don’t think that is necessarily relevant here. But first I’d have to convert my GBP into USD, which is instant, but comes with a 1.5% ($1.22) fee. So my £100 is now $121.98 which at the GBP-USD mid-rate of 1.2804 is £78.10. So I’m already down 22%, and I haven’t even lost any money on crypto yet! This is because of the conversion rate that Kraken applies, as crypto is generally priced in USD. There are quite a few order options when you buy, which is great if you’ve got size but I don’t so it’s pointless working an iceberg, which pecks away at the market bit by bit of setting a limit below, so I just went balls in at the market. But not that deep because I put a stop loss in 50% below. I have zero expectations of this growing gradually, but rather hoping for some sort of social media pump and dump to drive it higher so put my take profit in 350,000% higher, hoping to nick $1,000 profit if that happened. Either way it meant I didn’t have to add Ethena to any watch list to keep track of it. 🤞 You can actually trade that coin on 3x margin, but I’m not daft enough for that. T-20 trading AIM stocks was fun enough and at least they had fundamental value, well some of them at least. I think when it comes to crypto, you pays your money, you takes your chance. What Does Kraken Pro Look Like?

What is Kraken Pro Like to Use? You can configure Kraken Pro, customising the layout to suit your trading style, using the platform’s trading and data modules as required, inside the drag-and-drop desktop interface. Kraken Pro’s functionality is more suited to experienced users. You can also switch seamlessly between trading and staking products and services. You can track and monitor all of your positions and performance from one clear and consolidated portfolio view. All of which is powered by real-time data. The platform allows you to search for the top gainers and losers and the most actively traded and newly listed cryptocurrencies. That comes alongside a dedicated charting package that lets you compare four markets simultaneously and apply a range of indicators to those instruments. At the same time, you can monitor live order books and stream time and sales data to keep up to speed with market trades. Kraken Pro’s user interface is intuitive to navigate around and use. You can drill down to surface a token or coin from the platform’s markets view, which displays a heat map of the available asset classes. So, for example, clicking on the heatmap icon for layer 1 protocols brings up tokens such as NEAR. Clicking on that icon brings up a chart and an order entry box, alongside the order book in the NEAR/USD pair. There is a series of how-to guides and walk-through videos. As well as information on order types and dedicated API documentation. Kraken also prides itself on answering and attempting to resolve support queries quickly. Who is Kraken? Kraken was founded in San Francisco back in 2011. The firm operates in more than 190 countries and is regulated in various jurisdictions, including the US, UK, Canada, Australia and Europe. Kraken is one of a select group of businesses authorised by the UK Financial Conduct Authority (FCA) to offer cryptoasset services in the UK. Kraken offers trading in more than 300 individual cryptocurrencies and crypto pairs. Kraken’s trading volume in 2024 was more than $207 billion and it has more than 9 million unique clients. Despite recent market volatility, cryptocurrencies seem to be enjoying a new lease of life, and there is growing interest among both professional and retail traders. That is perhaps driven in part by a change of heart among US regulators and moves by the White House to establish a US national cryptocurrency reserve. It may take some time for that thaw to spread across the Atlantic, but dedicated cryptocurrency enthusiasts haven’t ever paid much attention to national borders. Kraken UK FCA-Authorised as an Electronic Money Institution Kraken was one of the first crypto exchanges in the UK to offer GBP-BTC trading, in 2014, and has been authorised as an e-money institution by the UK’s FCA. Whilst this doesn’t mean you get the same protections as if you were buying shares on a stock exchange, it does mean that Kraken is one of a handful of Bitcoin brokers that the regulator has deemed responsible enough for UK crypto investors. It’s worth noting, though, that crypto is largely unregulated in the UK. Kraken currently offers 300+ cryptocurrencies in the UK and hopes to make it easier than ever for the 7 million crypto traders in the UK to invest in digital assets. In early 2025, Kraken received a MiFID regulatory licence to buy and sell crypto derivatives within the European Union (EU). The cryptocurrency exchange gained the licence through buying a Cypriot investment firm which had recently received the licence from the Cyprus Securities and Exchange Commission (CySEC). The move allows Kraken to offer crypto derivatives products to traders resident in the 27 EU countries, aiding its plans to expand across the continent. The buyout came after Kraken had acquired Crypto Facilities, a UK FCA-registered crypto futures platform, in 2019. The acquisition of the new licence follows the firm’s launch of Kraken Pay in January 2025. This service allows users to send payments internationally using more than 300 cryptocurrencies and fiat currencies. In December 2024, rival exchange Coinbase enabled Apple Pay, allowing for immediate conversions between fiat currencies, such as dollars and pounds, and cryptocurrencies. FCA data shows the percentage of people in the UK who own some crypto rose to 12% in 2023 from 10% in 2022. The average value held rose from £1,595 to £1,842 over the same period. In 2024, the financial watchdog reiterated its rules against selling cryptocurrency derivatives such as exchange-traded funds (ETFs) to retail investors in the UK. Pros

Cons

Overall4.5 |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 4.2

(Based on 1,094 reviews)

|

Cryptos 38 |

Commission 1.49% |

Features:

|

IG, is one of the largest brokers in the world, and is listed in the FTSE 100 on the London Stock Exchange and has just launched cryptocurrency investing in partnership with Uphold. They are one of my favourite brokers and although a little late to the party, if I had a sizeable Bitcoin position, I’d certainly keep at least some of it with IG. IG have offered crypto CFDs and tax-free Bitcoin trading to retial traders in the past, but now those derivatives are only available to professional clients. However, this new launch means that everyone can invest in cryptocurrency with IG. One note though, as IG is regulated by the FCA, when you open a new cryptocurrency account, (as I did when testing it), you’ll have to wait 24 hours before being able to buy your first Bitcoin.  |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 4.6

(Based on 511 reviews)

|

Cryptos 30 |

Commission 1.49% |

Features:

|

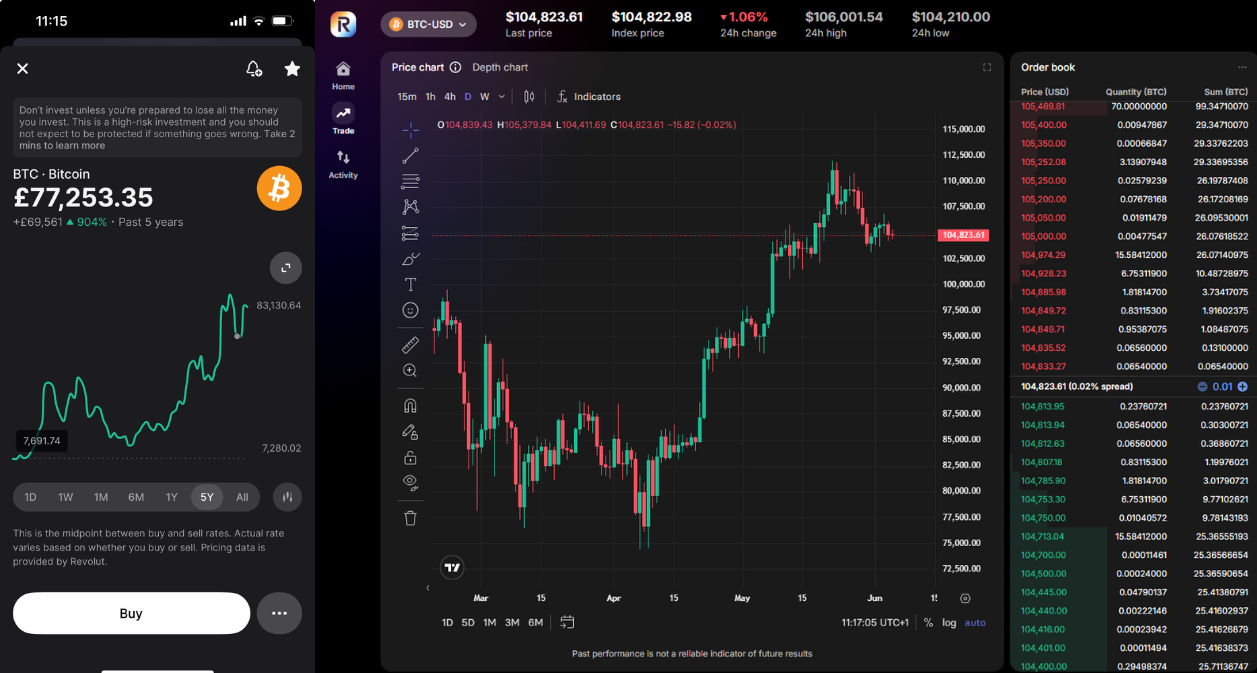

If you’re more interested in buying Bitcoin through your bank, Revolut, has a very simple interface on it’s app for buing Bitcoin. It’s a digital bank that was founded in 2015 and now has around 45 million customers globally (find our full review here). Buying Bitcoin with Revolut is quite straightforward. The first step is to download the Revolut app (there is no desktop browser version of Revolut at present) and sign up. The second step is to add money to your account. Finally, go to the Crypto section, find Bitcoin, and enter your trade details. With Revolut, trading fees depend on the plan you choose when you sign up. But if you just go with a standard plan (the ‘Standard/Plus’ plan), fees start at 1.49% per trade. When you buy Bitcion on Revolut via the app you do in GBP, which reduces your foreign exchagne costs, but they also have Revolut X which is their more advanted cryptocurrency trading platform, where you can get much more market information and also buy Bitcion in USD.  |

How To Buy Bitcoin In The UK

If you want to buy Bitcoin (BTC) you need a crypto platform like eToro, an investing account like IG, or a cryptocurrency exchange like Coinbase. In this guide, we look at four easy ways to buy the popular crypto-asset for your portfolio, plus the risks involved.

Bitcoin: How to invest in the UK

To buy Bitcoin in the UK you need to follow these simple steps:

- Find a crypto exchange that offers Bitcoin like eToro, Coinbase or Revolut.

- Open an account – you will have to prove your identity and answer some suitable questions. It’s important to note that if you want to withdraw money from a Bitcoin exchange, you will have to provide ID documents for AML (anti-money laundering)

- Deposit funds (GBP, USD or Euro) – you can do this using a debit card or a money service like Paypal (most banks and credit cards in the UK have banned transactions to crypto exchanges).

- Choose how much Bitcoin you want to buy. As a single Bitcoin is very expensive, you can buy fractions of a Bitcoin as a decimal transaction.

- Once you have bought your Bitcoin you can decide to keep it on the exchange in the hope of selling it for profit at a later date. Or you can withdraw it to a crypto wallet.

How To Buy Bitcoin Safely In The UK

- Use only FCA-regulated exchanges to avoid scams.

- Allocate only a small portfolio percentage to Bitcoin.

- Store holdings in secure wallets, but beware, lost keys mean lost Bitcoin.

I’ve bought Bitcoin with a few different platforms whilst reviewing them, and despite it’s popularity buying Bitcoin in the UK is not as simple as you think.

But it is easy and safe if you do it right. However, there are some significant risks compared to investing in stocks and shares. So, in this guide, I explain how to buy Bitcoin safely in the UK using FCA-regulated providers who must treat customers fairly.

Here are five ways to reduce risk when buying Bitcoin in the UK.

Offshore cryptocurrency exchanges are not regulated by the FCA and for uk investors wanting to buy Bitcoin there is very little protection or oversight.

Always use an FCA-regulated cryptocurrency exchange or investing platform.

You should also avoid buying Bitcoin privately. It is possible to send cryptocurrency to others and pay privately through money transfers, but this is very dangerous as there is no middleman supervising the deal and could lead to you getting ripped off.

A cryptocurrency exchange acts as a broker between buyers and sellers and means that you are trading anonymously and all transactions are managed online in an environment which is now regulated by the FCA.

You can read more about our research on cryptocurrency scams here.

A Bitcoin wallet or an account with a cryptocurrency exchange. A wallet lets you withdraw your Bitcoin and keep it in digital storage offline. With crypto platforms like eToro you can buy Bitcoin online and then withdraw it to a cryptocurrency wallet.

The advantage of using a Bitcon wallet is that you are in complete control of your Bitcoin, but it’s a bit like keeping your cash under the mattress. Whilst you are not at risk of your broker going bust, if you lose your crypto wallet you also lose all your Bitcoins.

There is an ongoing saga of a man who claims that he through his Bitcoin out, which is now worth an estimated £500m.

However, even institutional funds and professional investors use crypto wallets, Binance reported that Blackrock (one of the world’s biggest Bitcoin investors) quietly moved 100,000 Bitcoin ($BTC) to undisclosed wallets to keep it safe.

On the surface, investing in Bitcoin is the same as investing in shares. You open an account, deposit funds and buy Bitcoin. Bitcoin is a natural asset for investors and traders due to its history of rapid gains and fluctuations in value.

But, Bitcoin is sentiment-driven as it has little or no proven fundamental value. Don’t buyinto Bitcoin just becuase people are talking it up on social media.

This volatility makes it both very risky and potentially very lucrative as an investment. Unlike investing in shares, though, where stocks are traded on stock exchanges, cryptocurrencies like Bitcoin are traded on a peer-to-peer basis on cryptocurrency exchanges and are recorded in the blockchain.

Bitcoin is a very high-risk investment. Whether or not Bitcoin is a good investment depends on your investment objectives.

Always do your own research.

Whilst there is no denying that the price of Bitcoin has skyrocketed over the last decade, it’s important to follow one of the most basic rules of investing, diversification. Basically, don’t put all your eggs in one basket.

Bitcoin is a very volatile and risky investment, and cryptocurrency as an asset class could still crumble without warning.

So when buying Bitcoin treat it as a high risk investment and allocate a percentage of your portfolio accordingly. By this I mean that only a small percentage of your investments should be in high risk volatile asset classes like cryptocurrency.

The rest should be sensibly allocated to your pension, ISA or GIA in what are considered safer investments like the stock market and bonds.

Our research has shown that social media platforms are rife with scammers who promise high returns for investing in cryptocurrency.

These usually come in the form of videos promising copy trading or quick profits. These are all fake; the FCA has even recently stated fining “finfluencers” for promoting fake investment schemes related to crypto.

Buying Bitcoin: Risk vs Rewards

Bitcoin is unique, and it’s very different to traditional assets such as stocks and bonds. And as such the risks and rewards are amplified.

On the potential reward side, many experts believe that Bitcoin’s price will continue to rise in the years ahead. For example, Tom Lee at research firm Fundstrat has said that Bitcoin could potentially hit $250,000 in 2025. He believes that the digital asset will benefit from government adoption under the Trump Administration. Meanwhile, fund manager Cathie Wood has a 2030 ‘bull case’ target of $1.5 million, citing institutional interest and a more favourable regulatory backdrop as key drivers.

However, before you rush out and buy a ton of Bitcoin, it needs to be stressed that this is a very risky, volatile asset (that has a history of big falls). And you should only invest money that you can afford to lose. Moreover, financial experts generally advise that you should invest a maximum of 1-2% of your overall portfolio in Bitcoin. So for example, if your investment portfolio is worth a total of £50,000, £500-£1,000 might be appropriate for Bitcoin exposure.

Different ways to buy Bitcoin in the UK

There are three different ways to invest in Bitcoin in the UK. You can invest in Bitcoin through a:

- Bitcoin exchanges

- Investing platforms that offer Bitcoin

- Bitcoin stocks & ETFs

- Bitcoin derivatives (CFDs & spread bets)

Buying Bitcoin on cryptocurrency exchanges

All crypto exchanges that let investors buy Bitcoin in the UK need to be regulated by the FCA. There are only a handful in the UK, but the major ones are Coinbase, Kraken and Uphold.

The costs of investing in Bitcoin through a cryptocurrency can vary dramatically. The key things to consider are:

- Bitcoin commission– some Bitcoin accounts will charge a fee when you buy and sell Bitcoin on their platform.

- Bitcoin currency exchange fees– if you are buying Bitcoin against the USD (BTCUSD) but depositing GBP into your Bitcoin wallet, there will be a fee for converting the GBP into USD. It is possible with some exchanges to buy Bitcoin against GBP where you do not need to convert Fiat currencies.

- Bitcoin price spread– this is the difference between the buy and sell prices. As with investing in stocks, there is always a spread between where people are prepared to buy and people are prepared to sell. The Bitcoin spread varies, depending on how active the market is (liquidity) and how much the price is moving (volatility), as well as which Bitcoin platform you are investing through.

You can compare cryptocurrency exchange costs here.

Investing platforms that offer Bitcoin

As buying BTC increases in popularity (The FCA estimate that 12% of UK investors have bought crypto), traditional investing platforms like IG, Interactive Brokers and eToro now let you buy Bitcoin on their platforms. This is usually in partnership with a specialist crypto provider, but the process is seamless and integrated into their normal investing platform, so you can see it when you login.

Investing platforms that offer Bitcoin are also regulated by the FCA for other things such as stocks, bonds, bank accounts and trading. By choosing a Bitcoin account that is attached to a regulated entity, you will be dealing with a provider who is responsible for treating clients fairly (although not directly for cryptocurrency investing).

Buying Bitcoin Stocks & ETFs

You can also invest in Bitcoin by buying a stock or ETF that is heavily exposed to the price of Bitcoin.

Most stocks that track the price of Bitcoin are US based including:

- Strategy (formerly Microstrategy, US:MSTR)

- iShares Bitcoin ETF (US:IBIT)

- Mara Holdings (US:MARA)

- Coinbase (US:COIN)

- Galaxy Holdings (TSX:GLXY)

You can read more about the best Bitcoin stocks & ETFs to buy here.

Bitcoin CFDs and derivatives

You can only buy Bitcoin as a CFD or financial spread bet in the UK if you are classified as a professional client, as the FCA has banned it for retail investors.

When using CFDs or placing spread bets, it is possible to lose more than your initial stake. This will be amplified if you use leverage. Don’t risk more money than you can afford to lose when you take a position. Placing stop loss orders, which automatically close down your position when Bitcoin hits a particular value, are an essential way to limit the risk that you face.

Bitcoin FAQ:

Here are some of the most frequently asked questions people ask before they invest in Bitcoin:

Bitcoin is a digital currency that is based on blockchain technology and can be sent from user to user on the global Bitcoin network without the need for intermediaries such as banks. It was launched in 2009 by Satoshi Nakamoto (a pseudonym) and designed to be an alternative to traditional fiat currencies.

Bitcoin works as a digital currency where a record of all transactions are kept on the block chain. Each Bitcoin is stored in a digital wallet where it can be spent or sent.

You can either mine Bitcoin or buy them through a cryptocurrency exchange platform.

Owning Bitcoin is not as safe as owning other currencies such as the USD, GBP or Euro. Bitcoin is an unregulated cryptocurrency, where investors do not get the same protection from regulators such as the FCA.

No, Bitcoin is not regulated by the FCA. However, the FCA is in the process of starting to regulated some cryptocurrency brokers and platforms in the UK.

Many Bitcoin adverts are fake. You should be extremely cautious of any advertisement advertising cryptocurrency. From Peter Jones to PSY, new scam adverts advertising get-rich-quick Bitcoin schemes are flooding the internet. Despite a global ban from Google on non-regulated brokers advertising derivatives products, they are still getting through. Amazingly, you see them in the header of the DailyMail and other mainstream media websites.

No, Martin Lewis, the money-saving-guru from Money Saving Expert very clearly states on his social media profile that he “doesn’t do ads”. In fact Martin Lewis recently sued Facebook because they failed to stop scammers using his image in scam ads for get-rich-quick Bitcoin schemes. Martin Lewis settled with Facebook for a £3m charitable donation in the end.

If you see an advert for Bitcoin investing, it may well be a scam as Google and Facebook have banned cryptocurrency advertising. If it looks like a scam, it’s a scam. And always check the FCA register for any broker you deal with.

Keep in mind too though that the cryptocurrency scammers make clone websites of real brokerages to scam you. So, double and triple-check any broker before sending money. A quick google search can save you from becoming a victim.

It is possible to make money investing in Bitcoin in the same respect that it is possible to make money investing in high-risk stocks. If you buy low, sell high, you will make money. But unlike investing in stocks where a company generates revenue and profits, Bitcoin has no underlying value so it is also possible to lose money very quickly by investing in Bitcoin.

Bitcoin is not illegal in the UK.

If you buy Bitcoin through a cryptocurrency exchange, they will have an option for you to sell it as well.

Never believe anyone who says they can make you rich or adopt trading as a career if you are a complete beginner. However, if you do want trading ideas, you can find news and analysis on Bitcoin here:

- Bloomberg

- Reuters

- TradingView provides excellent crypto charts and lots of users post trading ideas.

The current Bitcoin (CURRENCY:BTCGBP) price is £68,380.62413.

You cannot buy Bitcoin with PayPal at the moment in the UK. It’s worth pointing out that in the past, it has been possible to buy Bitcoin in the UK through PayPal. This used to be a really easy way to buy the crypto-asset.

However, right now, PayPal’s crypto purchasing service is temporarily paused while the company updates its system to comply with new UK regulations. So, at the moment, PayPal is not an option for those in the UK who are looking to buy the digital asset.

If you are buying Bitcoins, then you will require a Bitcoin address. This is a code to which the Bitcoins that you buy will be allocated. You can acquire an address by downloading a Bitcoin client to your computer or setting up an online wallet.

However, if you are happy to leave your Bitcion on an exchange you do not need a Bitcoin address.