To buy shares in Starbucks (NASDAQ:SBUX), you need a trading or share dealing account. Follow these three steps if you want to buy shares in Starbucks from the UK:

- Decide if you want to buy Starbucks shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

How much does it cost to buy Starbucks shares (NASDAQ:SBUX)?

Buying one NASDAQ:SBUX share costs $94.94. However, as well as the $94.94 cost of buying each share you will also have to pay any relevant tax, commission when you buy and sell shares, custody fees for holding your shares on your account and foreign exchange fees for converting GBP into USD. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

It’s also important to remember that share prices can move quickly, for example, the current NASDAQ:SBUX share price is $94.94 which is a change of 0.21 or 0.22% from the last closing price of 94.94 with 6,339,762 shares traded giving NASDAQ:SBUX a market capitalisation of $107,889,818,774. The most recent daily high has been 95.32 and daily low 94.14. The NASDAQ:SBUX share price 52 week high has been 117.46 and the 52 week low 71.55. Based on the most recent NASDAQ:SBUX share price opening of 94.94, the current NASDAQ:SBUX EPS (earnings per share) are 2.75 and the PE (price earnings ratio) is 34.51.

Pricing data automatically updates every 15 minutes

Starbucks share price FAQ (NASDAQ:SBUX):

The answers to our frequently asked questions by people interested in buying Starbucks shares about Starbucks’s share price are automatically updated every 15 minutes.

What is the live Starbucks share price?

The current Starbucks share price is $94.94

How much has Starbucks’s share price moved today?

Starbucks’s share price has moved $0.21 or 0.22% today.

How much was Starbucks’s share price yesterday?

Yesterday, Starbucks’s share price closed at $94.94

How many Starbucks shares are traded each day?

There were 6,339,762 shares traded in Starbucks yesterday.

What is Starbucks’s market capitalisation (market cap)?

Starbucks has market cap of $107,889,818,774

What has been Starbucks’s share price most recent daily high?

Starbucks’s most recent daily high has been $95.32

What has been Starbucks’s share price most recent daily low?

Starbucks’s most recent daily low has been $94.14

How high has the Starbucks share price been in the last year?

The Starbucks share price 52 week high has been $117.46

How low has the Starbucks share price been in the last year?

The Starbucks share price 52 week high has been $71.55

What is Starbucks’s earnings per share?

Starbucks’s current earnings per share (EPS) is 2.75

What is Starbucks’s price-earnings ratio (PE)?

Starbucks’s current price earnings ratio (PE) is 34.51

Is Starbucks [NASDAQ:SBUX] a good investment in the long term?

In the great hall of US food-chain stocks, three icons stood immortal on the table: McDonald’s, Coca-cola and Starbucks.

The rise of Starbucks is well-documented. From a single store in Seattle, it grew and grew into a coffee colossus. Every week, more than 33,000 Starbucks stores served 100 million customers globally. To many, Starbucks symbolises the modern American culture, a convenient meeting place or a place that serves chic drinks.

All this frantic expansion happened under the charismatic and entrepreneurial Howard Schultz, who has returned as ‘interim CEO’ recently.

And yes, success on the ground has translated into great financial success for shareholders. At the end of October, Starbucks was valued at around US$100 billion – one of the top 150 stocks in the world, ahead of Boeing, Blackrock or Diageo.

A quick look at its long-term price chart confirms Starbucks’ long-term growth story. It delivered Tesla-like returns over the past three decades.

- Related guide – is now a good time to buy Tesla shares (NASDAQ:TSLA)?

Note: Prices in the chart is not the actual historical level as SBUX had 6 stock splits in its history (all 2-for-1). The most recent split occurred in 2015.

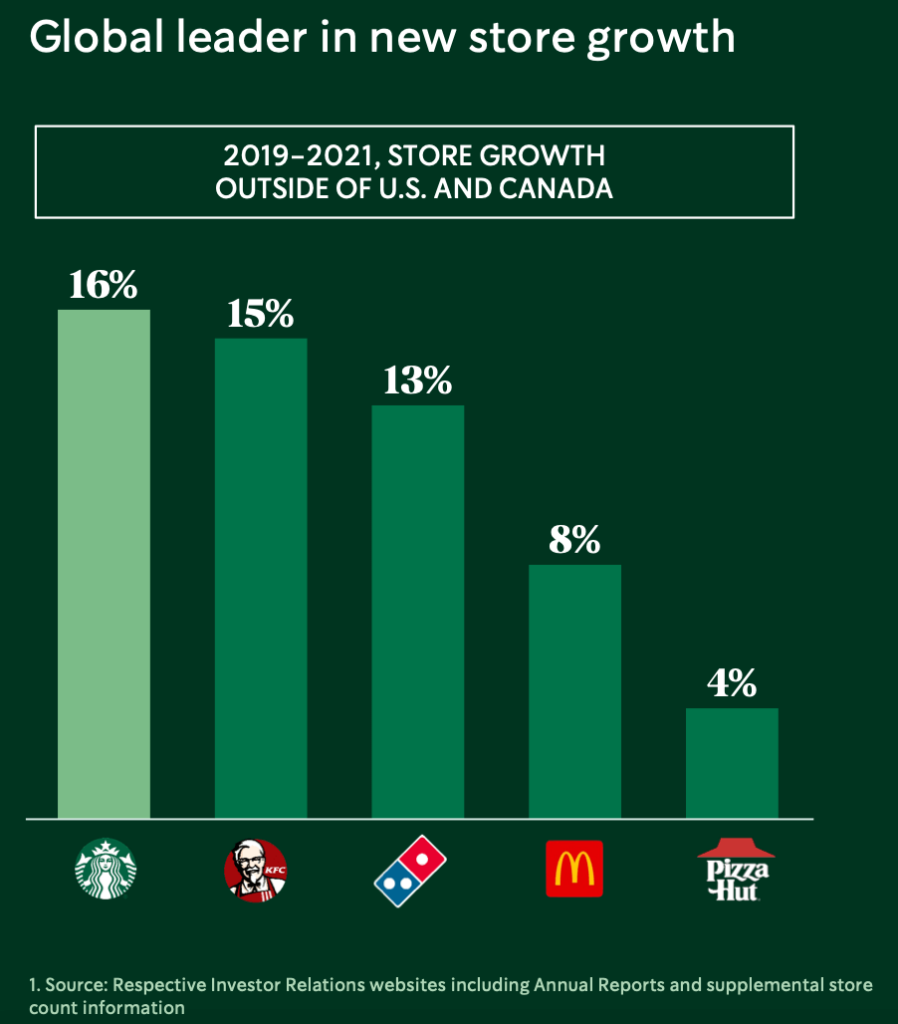

In summary, Starbucks has been a phenomenal success. The speciality coffee chain has developed into a well-honed operation and is well suited to take advantage of a further growth in coffee drinking habits among the expanding middle class. Moreover, Starbucks’ new store expansion is the highest among US fast-food chains.

The brand is exceptional and attracts devoted customers regularly. This should help maintain Starbucks’ competitive edge over the medium term.

When is the best time to buy Starbucks shares?

Like most other stocks, the best time to buy Starbucks shares is usually when there is ‘blood on the streets’.

Looking back at Starbucks’ share price, it had a few such declines (2007-09, 2020, and now). In the first two instances, the Nasdaq-listed stock rebounded as soon as the economic storm faded. Hence, based on this experience it is possible that we are entering into a potential buy zone for the stock as SBUX cratered this year. The market has downgraded Starbucks’ share price since January – from $115 to $70 – tracing a fall of nearly 40 percent.

Another opportunity to buy Starbucks’ stock is when the company misjudged its expansion and had to start focussing on profitability. Again, this relies on a meaningful share price correction and a successful management overhaul to bring the company back on track. Recently the interim CEO Howard criticised the previous management and said SBUX had ‘lost its way’.

In both cases, investors would have to buy against the trend. Some may not feel comfortable with this tactic as prices may continue to sink.

Is the Starbucks share price NASDAQ:SBUX overvalued or undervalued at the moment?

The stock market is a forward-looking machine. Very often, it overlooks the current levels. One example was Maersk, the global shipping giant. On Wednesday this week, it revealed record profits and yet its share price dropped markedly. Why? Because the company anticipates a ‘looming slowdown’.

In the same way, Starbucks’ share price now is dominated by macro concerns and a drop in earnings visibility. Back in September, the company expected its revenue to grow 10% annually for the next three years. Has this changed? Will the recent management overhaul bear fruits soon? All these will be revealed in today’s third-quarter results (3 Nov 2020).

Investors will be using the latest earning results to judge its SBUX’s future profitability.

Why has Starbucks’ share price (NASDAQ:SBUX) dropped recently?

Starbucks, like most other food and beverage companies, has had to contend with the global inflation problem. Some other problems that Starbucks had to address include:

- Rise in operating costs (wages, input costs) – which compress profit margins

- Unionisation of its stores (esp US)

- Stop-gap operations in China – due to the zero-covid policy. (Note: SBUX has 6,000 stores in the country)

- A fall in consumption due to economic weakness

- Return of interim CEO (Howard) – leading to a management and store overhaul (costing $450 million)

As such, the market dialled down expectations of the company’s profitability.

What is Starbucks’ share price prediction?

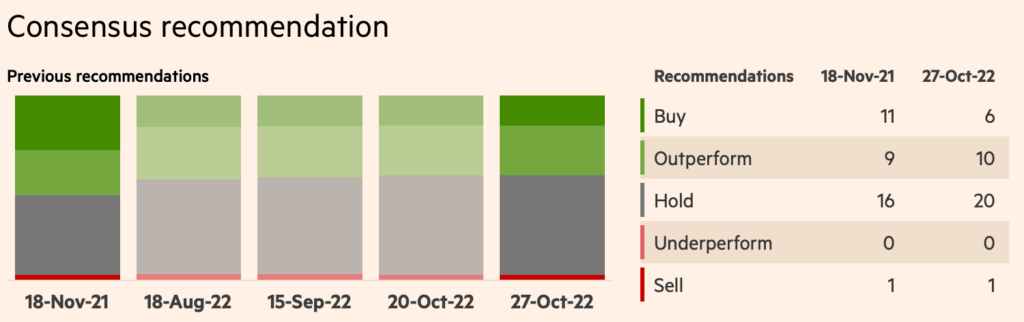

According to the Financial Times, Starbucks has 37 analysts following it, and 20 of them say ‘Hold’. This is not exactly a vouch of confidence on the beverage company (see below). Only six analysts are saying ‘Buy’.

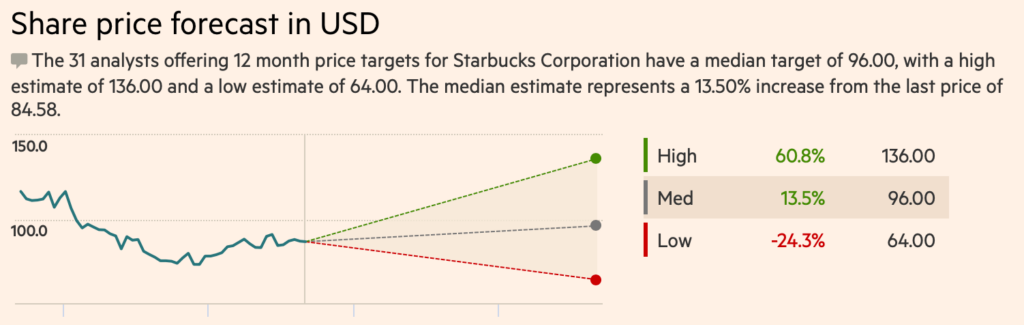

Meanwhile, the median price forecast of the SBUX’s share price is around $100 – 15-20% higher than the current share prices. Perhaps the analysts community are a tad too optimistic?

Source: Financial Times

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com